Eni Cuts Costs To Maintain Share Buyback Despite Lower Cash Flow

Table of Contents

Eni's Reduced Cash Flow: The Underlying Factors

Several factors have contributed to Eni's lower cash flow in recent times. These factors are complex and interconnected, reflecting the volatile nature of the global energy market and the ongoing energy transition.

-

Fluctuations in oil and gas prices: The energy market is notoriously susceptible to price swings. Periods of lower hydrocarbon prices directly impact Eni's revenue streams, making it harder to maintain the same level of cash flow. This volatility necessitates strategic planning and risk mitigation strategies.

-

Increased operating expenses: Global inflation has significantly impacted operating costs across various sectors, including the energy industry. Increased costs for labor, materials, and logistics put pressure on profit margins and consequently, cash flow.

-

Investment in renewable energy projects: Eni, like many other energy companies, is investing heavily in renewable energy sources as part of its transition to a more sustainable business model. These investments, while crucial for long-term growth, require significant upfront capital expenditure, temporarily impacting short-term cash flow.

-

Geopolitical uncertainties: Geopolitical instability in various regions affects Eni's production and sales. Sanctions, conflicts, and political risks can disrupt supply chains, impacting both revenue and operational efficiency.

In short:

- Lower hydrocarbon prices impacting revenue streams.

- Increased capital expenditure in the renewable energy transition.

- Geopolitical instability affecting production and sales.

- Impact of global inflation on operating costs.

Cost-Cutting Measures Implemented by Eni

To offset the reduced cash flow and maintain its commitment to the share buyback program, Eni has implemented a range of cost-cutting measures across its operations. These measures demonstrate a proactive approach to financial management and a commitment to efficiency.

-

Operational efficiency improvements: Eni has focused on streamlining its operational processes to reduce waste and improve productivity. This includes optimizing logistics, enhancing supply chain management, and implementing technological solutions to improve efficiency.

-

Optimization of capital expenditure: Eni has rigorously reviewed its capital expenditure projects, prioritizing those with the highest potential return on investment and delaying or canceling less profitable ventures.

-

Implementation of cost-saving initiatives across various departments: Cost-cutting measures have been implemented across all departments, focusing on areas such as administrative expenses, travel, and procurement.

-

Potential workforce adjustments: While not explicitly stated, companies often resort to workforce adjustments during periods of financial constraint. However, any such measures by Eni, if applicable, would likely be managed with sensitivity and consideration for employees.

Key cost-cutting strategies:

- Streamlining of operational processes for cost reduction.

- Review and optimization of capital expenditure projects.

- Implementation of cost-saving initiatives across various departments.

- Cautious and sensitive approach to workforce optimization (if applicable).

Maintaining the Share Buyback Program: Strategic Rationale

Despite the reduced cash flow, Eni's decision to maintain its share buyback program is a strategic one, driven by several key factors.

-

Signaling confidence in future growth: The continuation of the share buyback program signals Eni's confidence in its long-term growth prospects and its ability to generate future cash flow. This demonstrates a positive outlook to investors.

-

Enhancing shareholder value: Share buybacks are a common way for companies to return value to shareholders. By reducing the number of outstanding shares, Eni increases the earnings per share, potentially boosting the stock price and benefiting existing shareholders.

-

Optimizing capital allocation: Eni is strategically balancing its investment in growth opportunities with its commitment to returning value to shareholders. The share buyback represents a significant allocation of capital aimed at enhancing shareholder returns.

-

Attracting investors: A consistent share buyback program can attract investors who are seeking high dividend yield and share buyback opportunities, contributing to a stronger investor base.

Strategic reasons for maintaining the Eni share buyback:

- Demonstrates confidence in long-term growth prospects.

- Reinforces commitment to shareholder return strategies.

- Attracts investors seeking high dividend yield and share buyback opportunities.

- Optimizes capital allocation by balancing growth investments and shareholder returns.

Impact of the Share Buyback on Eni's Stock Price

The impact of Eni's share buyback program on its stock price is a complex issue, influenced by various market factors. While share buybacks can positively affect stock price in the long run by increasing earnings per share, short-term effects can vary. Further analysis is needed to determine the net impact, comparing Eni's performance to industry peers and considering the overall market conditions. Access to financial data and market analysis tools would be necessary for a comprehensive assessment.

- Short-term and long-term effects on stock valuation.

- Market reaction to the announcement of the cost-cutting measures and maintained buyback.

- Comparison to industry peers' stock performance.

Conclusion

Eni's decision to maintain its share buyback program despite facing lower cash flow demonstrates a strong commitment to shareholder value. The implemented cost-cutting measures highlight the company's proactive approach to financial management, allowing it to navigate a challenging environment while delivering on its promises to investors. While the long-term impact of this strategy on the Eni share buyback remains to be seen, the company's actions underscore its belief in its future performance and its dedication to rewarding its shareholders.

Call to Action: Stay informed about Eni's ongoing efforts to manage its cash flow and its commitment to its Eni share buyback program by following our updates and subscribing to our newsletter. Learn more about Eni's investor relations strategy and its share buyback program by visiting their official website.

Featured Posts

-

Anzac Bridge Crash Causes Major Delays Truck And Car Collision

Apr 25, 2025

Anzac Bridge Crash Causes Major Delays Truck And Car Collision

Apr 25, 2025 -

How Election Promises Lead To Budget Deficits An Economic Analysis

Apr 25, 2025

How Election Promises Lead To Budget Deficits An Economic Analysis

Apr 25, 2025 -

Walton Goggins Unexpected Style Evolution The Rise Of The Fluoro Speedo

Apr 25, 2025

Walton Goggins Unexpected Style Evolution The Rise Of The Fluoro Speedo

Apr 25, 2025 -

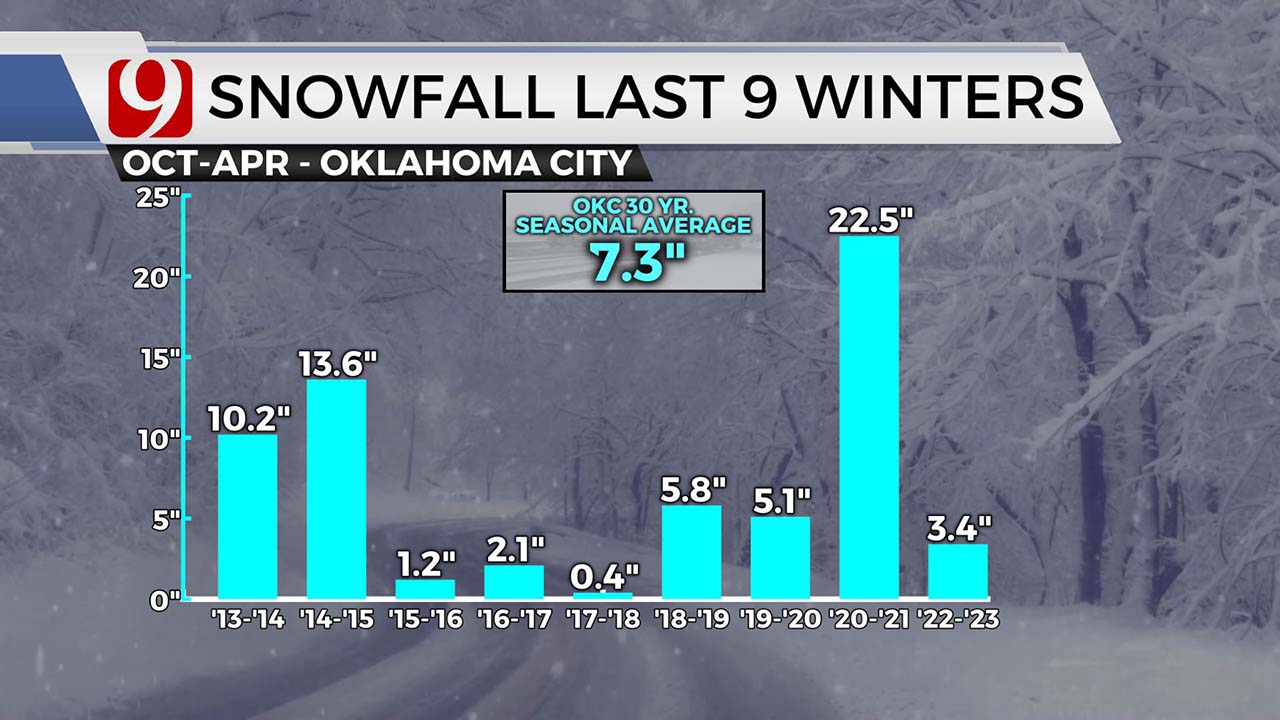

Okc Winter Weather Digital Exclusive Forecast From David Payne

Apr 25, 2025

Okc Winter Weather Digital Exclusive Forecast From David Payne

Apr 25, 2025 -

Meteorologist Arrested Sexual Extortion Charges Filed

Apr 25, 2025

Meteorologist Arrested Sexual Extortion Charges Filed

Apr 25, 2025