Epiroc ADR Programs: Deutsche Bank's Role As Depositary Bank

Table of Contents

What are American Depository Receipts (ADRs)?

American Depository Receipts (ADRs) are negotiable certificates representing ownership of shares in a foreign company. These shares are held by a depositary bank in the foreign company's home country, making it easier for US investors to buy and sell these shares on US stock exchanges. There are three levels of ADRs, each offering a different level of regulatory compliance and reporting requirements:

- Level 1 ADRs: These are the simplest form, traded over-the-counter (OTC) and typically don't require the same level of regulatory compliance as higher levels.

- Level 2 ADRs: These are listed on US exchanges like the NYSE or NASDAQ, and the issuing company must meet more stringent reporting requirements with the Securities and Exchange Commission (SEC).

- Level 3 ADRs: These are the most comprehensive, requiring full SEC registration and compliance. They are also listed on major US exchanges.

The advantages of investing in ADRs are significant:

- Simplified investment in foreign companies: ADRs make investing in international companies as easy as buying domestic stocks.

- Diversification opportunities: ADRs allow investors to diversify their portfolios beyond the US market, reducing overall risk.

- Liquidity: ADRs traded on US exchanges offer greater liquidity than directly investing in the foreign stock market.

- Currency risk management: While still subject to currency fluctuations, ADRs simplify the process compared to direct foreign investment.

Epiroc's ADR Program: A Closer Look

Epiroc, a leading productivity partner for the mining and infrastructure industries, offers its stock to US investors through an ADR program. This allows US investors to participate in Epiroc's success without the complexities of navigating international markets directly.

- Trading Symbol and Exchange Listing: You can find Epiroc ADRs traded on major US exchanges (check the relevant exchange website for the most up-to-date information).

- Buying and Selling Epiroc ADRs: The process is identical to buying and selling any other US-listed stock, making it convenient for investors. You can utilize your usual brokerage account.

- Key Features: Epiroc's ADR program provides US investors with seamless access to a global leader in its industry, simplifying participation in a growing market sector.

Deutsche Bank's Role as Depositary Bank for Epiroc ADRs

Deutsche Bank acts as the depositary bank for Epiroc's ADR program. This crucial role ensures the smooth functioning of the entire process. As a depositary bank, Deutsche Bank undertakes vital responsibilities, including:

- Facilitating transactions: Deutsche Bank manages the buying, selling, and settlement of Epiroc ADRs, streamlining the process for investors.

- Managing ADRs: They are responsible for the safekeeping and administration of the underlying shares represented by the ADRs.

- Ensuring ADR holder rights: They act as an intermediary to ensure that ADR holders have the same rights as direct shareholders in Epiroc.

- Regulatory Compliance: They help ensure compliance with all relevant regulations in both the US and the company's home country.

Understanding the Responsibilities of a Depositary Bank

The depositary bank's role is vital for ensuring investor confidence and the smooth functioning of ADR programs. Their responsibilities extend beyond simple record-keeping. They act as a crucial link between the foreign company, the US investors, and the regulatory authorities. This includes:

- Custodian of Shares: Securing the underlying shares held on behalf of ADR holders.

- Corporate Actions: Managing corporate actions such as dividends, stock splits, and mergers on behalf of ADR holders.

- Regulatory Compliance: Ensuring adherence to all relevant regulations in both the US and the company's home jurisdiction.

- Communication: Acting as a communication channel between the company and the ADR holders.

Conclusion

Investing in Epiroc ADRs offers US investors a compelling opportunity to gain exposure to a leading global company in the mining and infrastructure sector, benefiting from diversification and ease of access to international markets. Deutsche Bank’s role as the depositary bank ensures the smooth and efficient functioning of this process, providing confidence and security to investors. Learn more about investing in Epiroc ADRs and the advantages of this streamlined process facilitated by Deutsche Bank. Explore the opportunities today!

Featured Posts

-

The Future Of Cyberpunk Cd Projekt Reds Roadmap

May 30, 2025

The Future Of Cyberpunk Cd Projekt Reds Roadmap

May 30, 2025 -

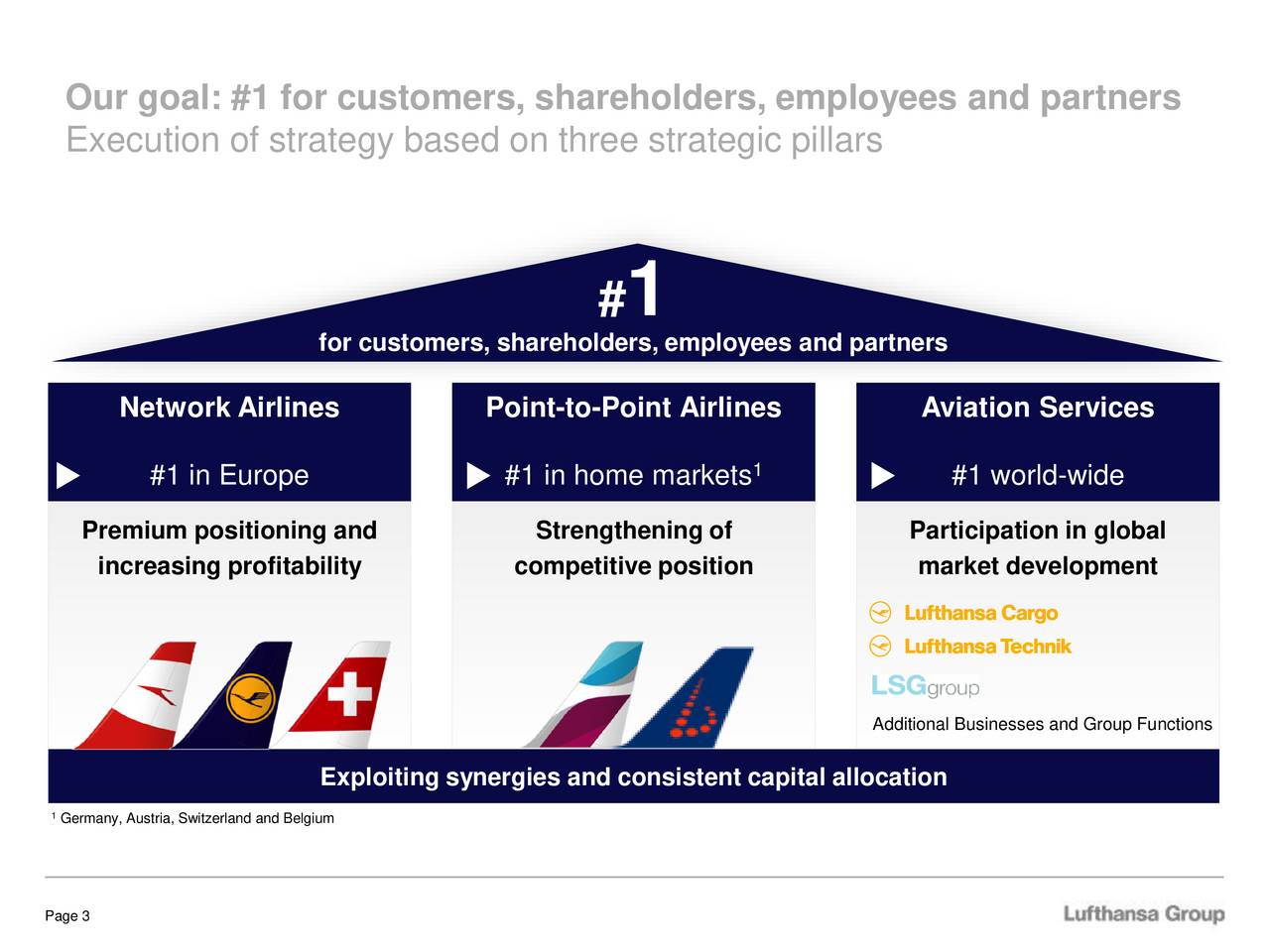

Recent Drop In Us Measles Cases Whats Behind The Improvement

May 30, 2025

Recent Drop In Us Measles Cases Whats Behind The Improvement

May 30, 2025 -

Noticias De Ticketmaster Incidencias Y Caidas Del 8 De Abril Grupo Milenio

May 30, 2025

Noticias De Ticketmaster Incidencias Y Caidas Del 8 De Abril Grupo Milenio

May 30, 2025 -

Dara O Briains Voice Of Reason A Comedians Perspective

May 30, 2025

Dara O Briains Voice Of Reason A Comedians Perspective

May 30, 2025 -

Southeast Asia Solar Market How Trump Tariffs Affect Indian Exporters

May 30, 2025

Southeast Asia Solar Market How Trump Tariffs Affect Indian Exporters

May 30, 2025