Ethereum Price Analysis: Wyckoff Accumulation And The Path To $2,700

Table of Contents

Understanding Wyckoff Accumulation in Ethereum

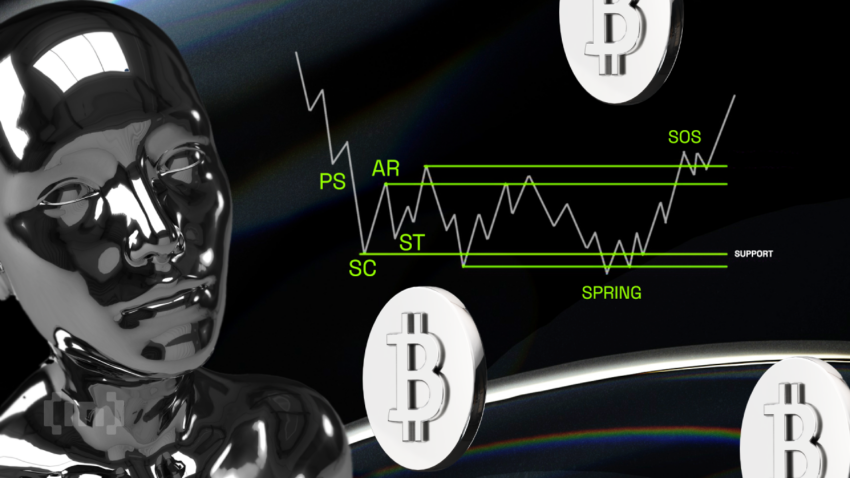

The Wyckoff method is a technical analysis technique that identifies market manipulation and accumulation phases before significant price moves. It focuses on understanding the behavior of large market players (smart money) and their impact on price and volume. Applying the Wyckoff method to Ethereum helps us identify potential accumulation phases that could precede a substantial price increase.

The key phases of Wyckoff accumulation include:

- Preliminary Supply (PS): This phase shows the initial distribution of the asset by large holders. In Ethereum, we might observe this as a period of slightly declining price with increasing volume.

- Sign of Weakness (SOW): A test of the support level, showing weakness in the selling pressure. Volume often decreases during this phase.

- Sign of Strength (SOS): A strong upward move after the SOW, indicating buying pressure. Volume typically increases here.

- Test: A retest of the previous support, confirming the accumulation. Volume usually remains relatively low.

- Markup: This is the final phase where the price accelerates upwards as smart money begins to distribute their holdings.

[Insert Chart Illustrating Wyckoff Phases in Ethereum Price History Here]

Typical Characteristics of Wyckoff Accumulation:

- Low volume relative to price fluctuations.

- Sideways or slightly downward trending price action.

- Occasional sharp price spikes followed by pullbacks.

- Gradual increase in buying pressure.

Technical Indicators Supporting the $2,700 Ethereum Price Target

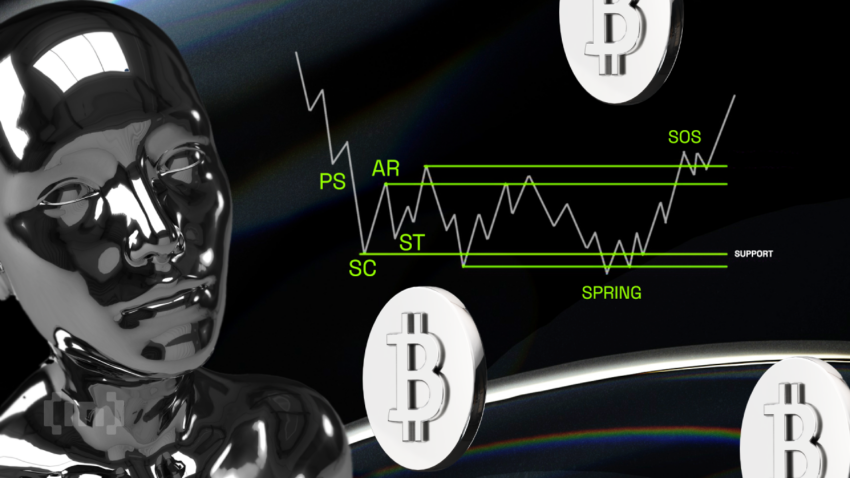

Several technical indicators support the bullish outlook suggested by the Wyckoff accumulation pattern.

- Relative Strength Index (RSI): A reading below 30 often indicates oversold conditions, which could signal a potential reversal and price increase. We're looking for a bounce from oversold territory.

- Moving Average Convergence Divergence (MACD): A bullish crossover (MACD line crossing above the signal line) can confirm a change in momentum from bearish to bullish.

- Moving Averages (e.g., 50-day and 200-day): A bullish crossover of the shorter-term moving average (50-day) above the longer-term moving average (200-day) often suggests a strong upward trend.

[Insert Chart Showing Relevant Technical Indicators Here]

Key Signals Supporting a Bullish Outlook:

- RSI showing signs of bottoming out.

- MACD displaying a bullish crossover.

- 50-day moving average crossing above the 200-day moving average.

On-Chain Metrics: Confirming Accumulation

On-chain data provides further evidence of potential accumulation.

- Exchange Balances: A decrease in Ethereum held on exchanges suggests that investors are moving their coins to cold storage, indicating a bullish sentiment.

- Active Addresses: An increase in the number of active Ethereum addresses signifies growing network activity and participation.

- Transaction Volume: Sustained transaction volume even during periods of sideways price action could hint at underlying accumulation.

Key On-Chain Metrics and Implications:

- Decreasing exchange balances imply reduced selling pressure.

- Increasing active addresses suggest growing user adoption and network strength.

- High transaction volume despite price consolidation strengthens the accumulation thesis.

Potential Risks and Challenges to Reaching $2,700

Despite the bullish signals, several factors could hinder Ethereum's price rise to $2,700.

- Regulatory Uncertainty: Changes in cryptocurrency regulations could negatively impact the market.

- Macroeconomic Conditions: Global economic factors and inflation can influence investor sentiment.

- Competition from other cryptocurrencies: The emergence of competing blockchains could affect Ethereum's dominance.

Key Risks and Potential Downsides:

- Regulatory crackdowns could trigger a sharp price correction.

- Negative macroeconomic news could lead to a market-wide downturn.

- Competition from other Layer-1 blockchains might limit Ethereum's growth.

Trading Strategies Based on Wyckoff Accumulation in Ethereum

Investors can utilize several trading strategies based on the Wyckoff method.

- Entry Point: Look for a confirmation of the SOS phase (Sign of Strength), potentially near support levels identified by technical analysis.

- Stop-Loss Order: Place a stop-loss order below a significant support level to protect against potential losses.

- Take-Profit Order: Set a take-profit order based on your risk tolerance and price targets, potentially near resistance levels or Fibonacci retracement levels.

Clear, Concise Trading Strategies:

- Identify support and resistance levels using technical analysis.

- Monitor volume and price action for confirmation of the Wyckoff phases.

- Implement risk management strategies to protect your capital.

Conclusion: Ethereum Price Prediction: Is $2,700 Realistic Based on Wyckoff Accumulation?

Our Ethereum price analysis suggests that a move to $2,700 is possible, based on the observed Wyckoff accumulation pattern, supported by technical indicators and on-chain metrics. However, regulatory uncertainty, macroeconomic conditions, and competition remain key risks. While the indicators point towards a potential bullish trend, it’s crucial to remember that the cryptocurrency market is inherently volatile.

Start your Ethereum investment journey today, but always conduct your own thorough research and consider your risk tolerance before investing. Learn more about Wyckoff accumulation and Ethereum price predictions to make informed decisions. Analyze Ethereum's price with your chosen tools and strategies, keeping a watchful eye on the market’s ever-changing dynamics.

Featured Posts

-

Dont Miss It Superman And Krypto Team Up In Next Weeks Special

May 08, 2025

Dont Miss It Superman And Krypto Team Up In Next Weeks Special

May 08, 2025 -

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025 -

Auto Analyst Claims Gm Leveraged Us Tariffs To Decrease Canadian Activities

May 08, 2025

Auto Analyst Claims Gm Leveraged Us Tariffs To Decrease Canadian Activities

May 08, 2025 -

Enhancing Crime Control Through Targeted Directives

May 08, 2025

Enhancing Crime Control Through Targeted Directives

May 08, 2025 -

Thunders Williams Points To Exceptional Team Leadership

May 08, 2025

Thunders Williams Points To Exceptional Team Leadership

May 08, 2025