Ethereum Price Prediction: $2,700 On The Horizon As Wyckoff Accumulation Concludes?

Table of Contents

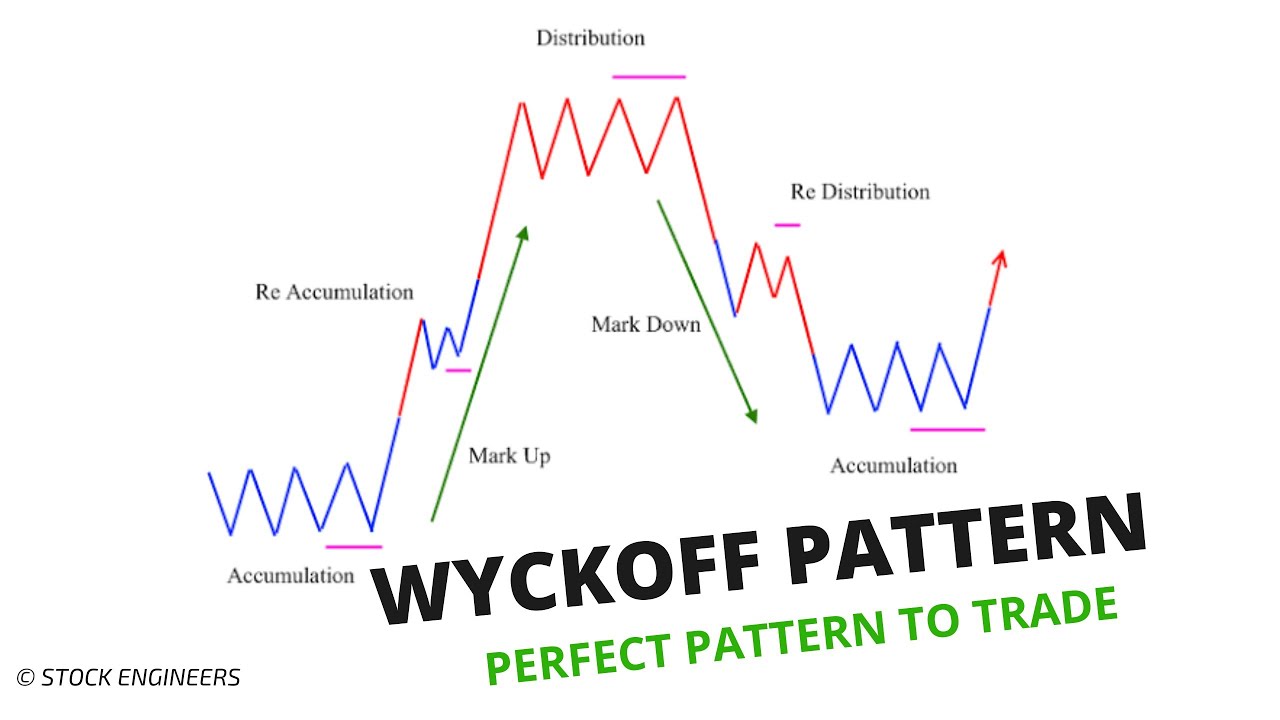

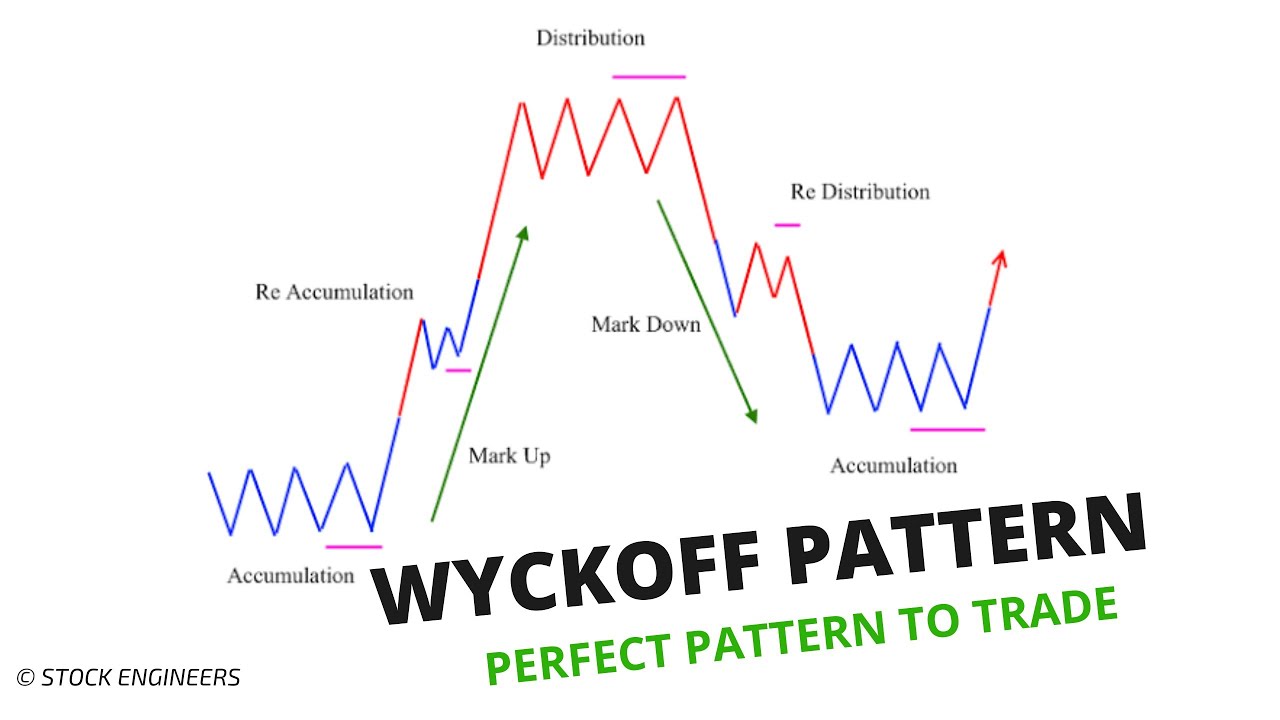

Understanding the Wyckoff Accumulation Pattern in Ethereum

What is Wyckoff Accumulation?

The Wyckoff method is a technical analysis technique used to identify periods of market manipulation where large players accumulate assets before a significant price increase. It focuses on identifying specific phases of price action and volume, revealing the hidden intentions of market makers. Unlike simple technical indicators, Wyckoff emphasizes the psychology of market participants, providing a more nuanced understanding of price movements. Think of it as detecting subtle clues left behind by "whales" accumulating ETH before a potential price breakout. (Include a chart example here showing a classic Wyckoff Accumulation pattern)

Identifying Key Phases of Wyckoff Accumulation in ETH:

The Wyckoff method identifies several key phases:

- Upthrusts and Tests: These are sharp upward movements followed by a pullback. These serve as tests of the market’s willingness to sell at higher prices. In the context of Ethereum, we might see a sudden surge in ETH price, followed by a correction, indicating that sellers are still present but are becoming less aggressive.

- Signs of Accumulation: This phase is characterized by relatively low price volatility and increasing trading volume. This suggests that buyers are absorbing the available supply without driving the price drastically higher. We might observe higher volume on upward price movements than on downward movements in the Ethereum chart during this phase.

- Spring: The spring is a final, deliberate, downward price move designed to shake out the remaining weak holders. This often involves a lower volume than the preceding accumulation phase, indicating a lack of true selling pressure. For Ethereum, a spring might look like a sudden dip in price just before the expected breakout.

- Sign of Strength (SOS): This signifies the end of the accumulation phase. A strong upward move with increased volume confirms the buyers' dominance and signals the potential for a significant price increase. An SOS in Ethereum would likely be accompanied by a considerable increase in trading volume and a decisive break above a crucial resistance level.

Analyzing the Current ETH Chart Through a Wyckoff Lens:

(Include a current Ethereum price chart here with clearly marked annotations showing potential Wyckoff phases. Highlight specific price points, volume changes, and timeframes. Discuss the evidence supporting the idea that an accumulation phase is nearing completion. For example, point out specific upthrusts, tests, and the potential spring.) Based on this analysis, the current chart shows strong evidence suggesting we are approaching, or are currently in, the SOS phase of a Wyckoff Accumulation.

Factors Contributing to a Potential Ethereum Price Surge to $2,700

Ethereum's Growing Ecosystem:

Ethereum's price is significantly influenced by the growth and adoption of its ecosystem. Several factors point towards continued growth:

- DeFi Boom: Decentralized finance (DeFi) continues to flourish on Ethereum, driving demand for ETH.

- NFT Market Expansion: Non-fungible tokens (NFTs) remain popular, creating further demand for Ethereum's network.

- Enterprise Adoption: Increasing numbers of businesses are exploring and adopting Ethereum for various applications, boosting its utility and price.

Upcoming Ethereum Upgrades:

Planned upgrades, such as the Shanghai upgrade, which enables withdrawals of staked ETH, are poised to positively impact the Ethereum price. These upgrades enhance scalability, security, and overall efficiency, making the network more attractive for users and developers.

Macroeconomic Factors and their Influence on ETH Price:

The broader economic climate plays a vital role. A positive economic outlook could increase risk appetite, potentially benefiting Ethereum’s price. Conversely, negative economic news may lead to investors seeking safer assets, impacting the price negatively.

Institutional Investment in Ethereum:

Growing institutional interest in Ethereum, with large firms accumulating ETH, is a bullish signal. This institutional adoption brings stability and legitimacy to the cryptocurrency, potentially driving price appreciation.

Potential Risks and Challenges to the $2,700 Ethereum Price Prediction

Market Volatility and Unexpected Events:

The cryptocurrency market is notoriously volatile. Unexpected events, such as regulatory crackdowns or major security breaches, could negatively impact the Ethereum price.

Regulatory Uncertainty:

Unclear or unfavorable regulatory environments pose a significant risk. Changes in regulations could stifle growth and negatively affect the price of ETH.

Competition from Other Cryptocurrencies:

Competition from other cryptocurrencies, offering similar functionalities or better performance, could limit Ethereum's growth and price appreciation.

Conclusion: Ethereum Price Prediction: Is $2,700 Achievable?

This analysis suggests that the completion of a Wyckoff Accumulation pattern, coupled with the positive developments within the Ethereum ecosystem and growing institutional interest, could propel the Ethereum price towards $2,700. However, it's crucial to acknowledge the inherent volatility of the cryptocurrency market and the potential risks associated with this Ethereum price prediction. Regulatory uncertainty and competition from other cryptocurrencies remain significant challenges. While this Ethereum price prediction points to exciting potential, always conduct thorough research and consult with financial advisors before making any investment decisions related to Ethereum. Remember, this is not financial advice; it is an analysis based on technical and fundamental factors. Continue your own research into ETH price and Ethereum price prediction models to make informed decisions about your cryptocurrency investments.

Featured Posts

-

El Emotivo Gesto De Erick Pulgar Hacia Los Aficionados Del Flamengo

May 08, 2025

El Emotivo Gesto De Erick Pulgar Hacia Los Aficionados Del Flamengo

May 08, 2025 -

Liga De Quito Iguala Ante Flamengo Analisis Del Encuentro De Libertadores

May 08, 2025

Liga De Quito Iguala Ante Flamengo Analisis Del Encuentro De Libertadores

May 08, 2025 -

Bitcoin In Son Durumu Guencel Fiyat Ve Trendler

May 08, 2025

Bitcoin In Son Durumu Guencel Fiyat Ve Trendler

May 08, 2025 -

Bobi Marjanovic I Neobican Ritual Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Bobi Marjanovic I Neobican Ritual Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025 -

Andor Season 2 A Rogue One Star Reveals A Star Wars Rewriting

May 08, 2025

Andor Season 2 A Rogue One Star Reveals A Star Wars Rewriting

May 08, 2025