Ethereum Weekly Chart Shows Buy Signal: Potential Rebound?

Table of Contents

Technical Analysis of the Ethereum Weekly Chart

Identifying the Buy Signal

The Ethereum weekly chart is exhibiting several indicators that could signal a potential rebound. Key among these are:

-

Bullish Engulfing Candle: A recent bullish engulfing candle suggests a shift in market sentiment. This pattern, where a larger green candle completely engulfs the preceding red candle, often indicates a potential reversal from a downtrend. (Image of chart highlighting the bullish engulfing candle would be inserted here)

-

Breakout from Significant Support: The price has recently broken out from a key support level around $[Support Level Price]. This suggests strong buying pressure overcoming selling pressure. (Image of chart highlighting the support level breakout would be inserted here)

-

Moving Average Crossover: The 50-day moving average has crossed above the 200-day moving average, a classic bullish signal known as a "golden cross." This indicates a potential shift from a bearish trend to a bullish one. (Image of chart highlighting the moving average crossover would be inserted here)

-

RSI Divergence: The Relative Strength Index (RSI) is showing a bullish divergence. While the price made lower lows, the RSI formed higher lows, suggesting weakening bearish momentum and potential for a price reversal. (Image of chart highlighting the RSI divergence would be inserted here)

Potential resistance levels lie around $[Resistance Level Price 1] and $[Resistance Level Price 2]. The price's ability to break through these levels will be crucial in determining the strength and extent of the potential rebound.

Volume Confirmation

The importance of volume cannot be overstated. A strong buy signal is validated by increased trading volume accompanying the price increase.

-

High Volume During Bullish Candle: The bullish engulfing candle was accompanied by significantly higher volume than the preceding candles, confirming the strength of the buying pressure. (Image showing volume data alongside the price chart would be inserted here)

-

Increased Trading Volume Post-Breakout: The breakout from the support level was also supported by a noticeable surge in trading volume, further strengthening the bullish signal. This indicates conviction behind the price movement.

Increased trading volume is a crucial validation of the potential rebound, suggesting a significant number of investors are participating in the price increase.

Macroeconomic Factors Influencing Ethereum's Price

Overall Crypto Market Sentiment

The broader cryptocurrency market sentiment significantly influences Ethereum's price. Ethereum, often considered the second-largest cryptocurrency, tends to exhibit a strong correlation with Bitcoin's price action.

-

Bitcoin's Price Action: Recent positive movements in Bitcoin's price often lead to positive sentiment across the entire crypto market, including Ethereum.

-

Overall Market Recovery Signs: Positive news regarding regulatory clarity, institutional adoption, or technological advancements can boost market sentiment, benefiting Ethereum.

-

Significant Market Events: Major crypto conferences, regulatory announcements, and technological upgrades all play a vital role in shaping market sentiment and thus, Ethereum's price. (Links to reputable sources for market data would be inserted here)

Regulatory Developments

Regulatory developments worldwide significantly impact the cryptocurrency market. Positive regulatory clarity can boost investor confidence, while negative news can lead to price drops.

-

Specific Regulations and Potential Effects: [Mention specific regulatory developments, their potential positive or negative impacts on Ethereum, and provide links to relevant news articles or official statements].

-

Ongoing Regulatory Scrutiny: It's crucial to stay updated on regulatory news as it can influence the Ethereum price significantly, potentially impacting the potential rebound.

Potential Rebound Targets and Risks

Price Targets Based on Technical Analysis

Based on the technical analysis, potential price targets for Ethereum's rebound could be:

-

Short-Term Target: $[Short-Term Price Target] based on the resistance levels identified.

-

Medium-Term Target: $[Medium-Term Price Target] if the price breaks through initial resistance and holds above the support level.

(Disclaimer: These are merely potential targets based on technical analysis. Crypto prices are extremely volatile, and these predictions are not financial advice.)

Risk Assessment

Investing in cryptocurrencies, including Ethereum, involves significant risk.

-

Market Volatility: Ethereum's price is known for its high volatility. Unexpected market movements can quickly negate any bullish signals.

-

Regulatory Uncertainty: Changes in regulations can have a profound and immediate impact on the price.

-

Technological Risks: Unexpected bugs or vulnerabilities in the Ethereum network can lead to price drops.

-

Security Risks: Smart contract vulnerabilities and hacks can negatively impact the value of ETH.

Effective risk management strategies, such as diversification and setting stop-loss orders, are essential.

Conclusion

The Ethereum weekly chart presents a potential buy signal, indicated by a bullish engulfing candle, breakout from support, a golden cross, and RSI divergence. The increased trading volume further strengthens this signal. However, positive macroeconomic factors, including overall market sentiment and regulatory developments, are also crucial considerations. While potential price targets exist based on technical analysis, significant risks, including market volatility and regulatory uncertainty, must be carefully evaluated. Before investing in Ethereum, it's crucial to conduct thorough research, understand these risks, and consult a financial advisor. Remember to only invest what you can afford to lose. Learn more about interpreting Ethereum's weekly chart and understanding potential buy signals to make informed investment decisions.

Featured Posts

-

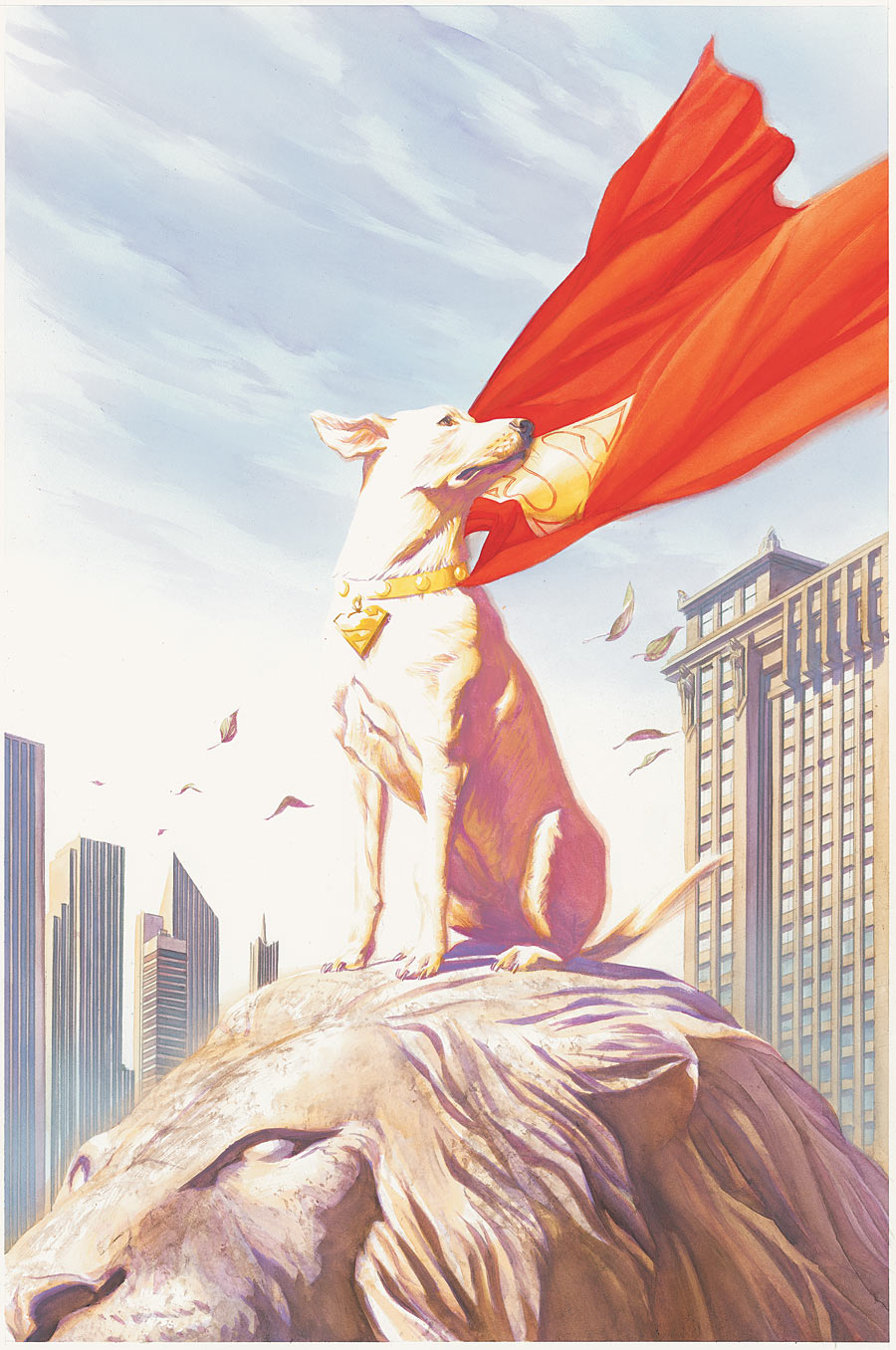

Cute Krypto Moments In New Superman Film Footage

May 08, 2025

Cute Krypto Moments In New Superman Film Footage

May 08, 2025 -

Pnjab Myn Pwlys Afsran Ky Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Mtathr

May 08, 2025

Pnjab Myn Pwlys Afsran Ky Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Mtathr

May 08, 2025 -

April 9th Lotto Draw Winning Numbers And Jackpot

May 08, 2025

April 9th Lotto Draw Winning Numbers And Jackpot

May 08, 2025 -

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025 -

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025

Izjava Pavla Grbovica Komentar Na Predloge Prelazne Vlade

May 08, 2025