Ethereum's Bullish Trend: Analysis Of Recent Accumulation And Price Movement

Table of Contents

On-Chain Data Suggesting Accumulation

On-chain data provides valuable insights into the behavior of Ethereum holders and can be a powerful indicator of future price movements. Several key metrics point towards significant accumulation and reduced selling pressure, supporting Ethereum's bullish trend.

Increased ETH Supply Held on Exchanges

A decreasing amount of ETH held on cryptocurrency exchanges is a strong signal of reduced selling pressure and potential accumulation by long-term holders. These holders are less likely to sell their ETH in the near term, providing support for the price.

- Glassnode data shows a significant decrease in exchange reserves over the past three months, suggesting a reduction in selling pressure and increased accumulation.

- CoinMetrics data corroborates this trend, showing a consistent outflow of ETH from exchanges to private wallets.

- This reduction in exchange supply indicates that fewer ETH are readily available for sale, potentially leading to price appreciation as demand increases.

Growing Number of Large ETH Holders (Whales)

The increase in the number of addresses holding significant amounts of ETH (often referred to as "whales") is another positive indicator for Ethereum's bullish trend. Whale accumulation often signals strong confidence in the asset's long-term value.

- Data from WhaleStats shows a notable increase in the number of addresses holding over 10,000 ETH in recent weeks.

- This accumulation by large holders suggests they anticipate future price appreciation, creating a robust support level for the price.

- Whale activity often precedes significant price movements, adding credence to the bullish outlook.

Increased Activity on DeFi Platforms

The flourishing decentralized finance (DeFi) ecosystem built on Ethereum is another crucial factor driving demand and price. Increased activity on DeFi platforms directly translates to higher demand for ETH.

- Total Value Locked (TVL) in Ethereum-based DeFi protocols continues to rise, demonstrating growing adoption and usage.

- Popular protocols like Uniswap, Aave, and Compound have seen record-breaking transaction volumes, fueling ETH demand.

- This increased usage within the DeFi ecosystem strengthens Ethereum's overall value proposition and further supports the bullish trend.

Technical Analysis Supporting a Bullish Trend

Technical analysis, based on price charts and indicators, offers another perspective on Ethereum's bullish trend. Several key indicators point towards sustained upward momentum.

Price Breakout from Key Resistance Levels

Ethereum has recently broken out from several key resistance levels, suggesting a strong bullish momentum. Overcoming these resistance points signifies a significant shift in market sentiment.

- Charts show a clear breakout above the [insert specific price level] resistance level, confirming the strength of the bullish trend.

- This breakout was accompanied by increased trading volume, further validating the move.

- The successful breach of these resistance levels indicates a potential continuation of the upward price movement.

Positive Momentum Indicators

Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages all point towards positive momentum for Ethereum.

- The RSI is currently above [insert value], indicating overbought conditions but also suggesting strong bullish momentum.

- The MACD shows a clear bullish crossover, signaling a potential continuation of the upward trend.

- Moving averages are aligned in a bullish configuration, supporting the positive momentum.

Volume Confirmation

High trading volume during price increases confirms the strength and legitimacy of the bullish trend. Significant volume during breakouts suggests strong buying pressure.

- Breakouts from key resistance levels were accompanied by exceptionally high trading volumes, indicating strong conviction from buyers.

- This confirms that the price increase isn't merely driven by speculation but rather by strong underlying demand.

- Sustained high volume during upward price movements supports the sustainability of Ethereum's bullish trend.

Potential Catalysts for Continued Bullish Movement

Several factors could further catalyze Ethereum's bullish movement and solidify its upward trend.

Ethereum 2.0 Development Updates

The ongoing development of Ethereum 2.0 and its anticipated features are major catalysts for continued bullish sentiment. These upgrades promise to enhance scalability, security, and efficiency.

- Significant progress is being made on the Ethereum 2.0 roadmap, with key milestones already achieved.

- The anticipated improvements will attract more developers and users, increasing demand for ETH.

- The rollout of Ethereum 2.0 is expected to significantly boost the value and adoption of the Ethereum network.

Increasing Institutional Adoption

Growing involvement from institutional investors is injecting significant capital into the Ethereum market, providing a strong foundation for the continued bullish trend.

- Several major financial institutions have announced investments in Ethereum, indicating growing acceptance and legitimacy.

- This institutional adoption brings greater stability and liquidity to the market, further supporting the price.

- The inflow of institutional capital often signals a maturing market and strengthens the long-term prospects for price appreciation.

Growing DeFi Ecosystem

The continuously expanding DeFi ecosystem built on Ethereum is another key catalyst driving ETH demand. The growth of DeFi applications creates a strong foundation for Ethereum's long-term value.

- New DeFi protocols and applications are constantly emerging, expanding the utility and adoption of ETH.

- The innovative nature of DeFi attracts more users and developers, further enhancing Ethereum's value proposition.

- The continued growth of DeFi will undoubtedly drive higher demand for ETH, supporting the bullish trend.

Conclusion: Ethereum's Bullish Outlook and Future Price Predictions

Our analysis of on-chain data, technical indicators, and potential catalysts strongly suggests a bullish outlook for Ethereum. The combination of increased accumulation, positive price action, and significant upcoming developments paints a compelling picture of continued upward momentum. Key takeaways include decreased exchange reserves, positive technical indicators, whale accumulation, and the ongoing development of Ethereum 2.0. While this analysis points to a strong bullish trend for Ethereum, it's crucial to conduct your own thorough research before making any investment decisions. Stay informed about Ethereum's progress and consider adding ETH to your portfolio based on your risk tolerance and investment strategy. Remember, understanding Ethereum's bullish potential requires diligent research and careful consideration of your individual investment goals.

Featured Posts

-

Bitcoin Rally Analyst Spots Potential Start Zone May 6 Chart Analysis

May 08, 2025

Bitcoin Rally Analyst Spots Potential Start Zone May 6 Chart Analysis

May 08, 2025 -

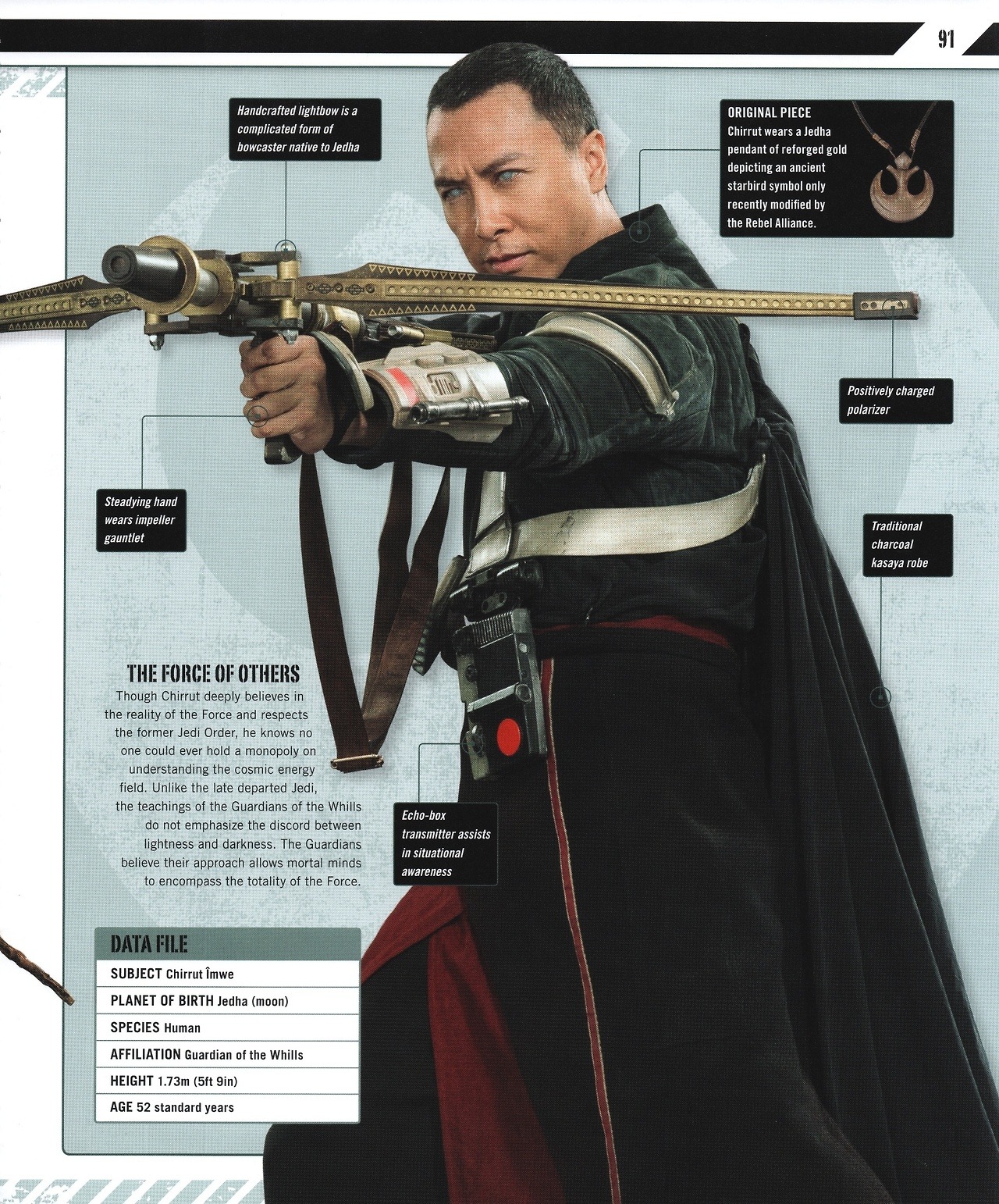

Rogue One Star Weighs In On Beloved Character

May 08, 2025

Rogue One Star Weighs In On Beloved Character

May 08, 2025 -

Agjenti Rrefen E Verteta Pas Transferimit 222 Milione Euro Te Neymar Te Psg

May 08, 2025

Agjenti Rrefen E Verteta Pas Transferimit 222 Milione Euro Te Neymar Te Psg

May 08, 2025 -

Breaking Bread With Scholars Fostering Collaboration And Intellectual Growth

May 08, 2025

Breaking Bread With Scholars Fostering Collaboration And Intellectual Growth

May 08, 2025 -

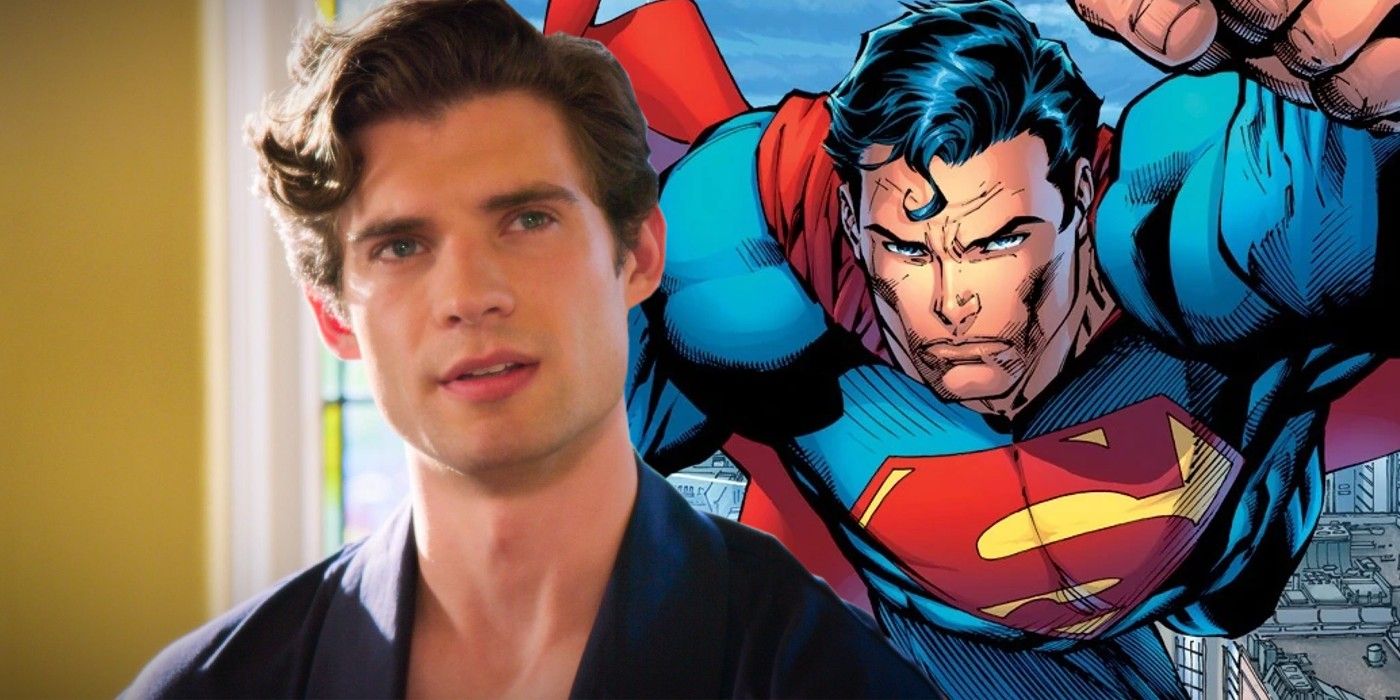

New Superman Movie 5 Minute Preview Showcases Krypto

May 08, 2025

New Superman Movie 5 Minute Preview Showcases Krypto

May 08, 2025