Euronext Amsterdam Sees 8% Stock Increase Following US Tariff Delay

Table of Contents

The Impact of the US Tariff Delay on Euronext Amsterdam

The delay in implementing the proposed US tariffs, initially targeting specific European sectors, created a wave of relief across several businesses listed on Euronext Amsterdam. These tariffs, had they been enacted, threatened to disrupt trade relations and negatively impact the profitability of numerous companies heavily involved in transatlantic commerce. The delay, however, significantly reduced uncertainty for businesses reliant on US trade.

- Reduced uncertainty for businesses trading with the US: The postponement eliminated the immediate threat of increased import costs and trade barriers, allowing companies to better plan for the future.

- Improved investor confidence leading to increased investment: The positive news fueled investor confidence, leading to increased investment in companies listed on Euronext Amsterdam. This influx of capital directly contributed to the rise in stock prices.

- Positive impact on specific sectors (e.g., technology, manufacturing): Sectors like technology and manufacturing, heavily reliant on US markets, experienced particularly strong gains as the threat of tariffs diminished.

- Potential for increased export opportunities: The delay opened doors to potentially increased export opportunities to the US, boosting the outlook for many Euronext Amsterdam-listed businesses.

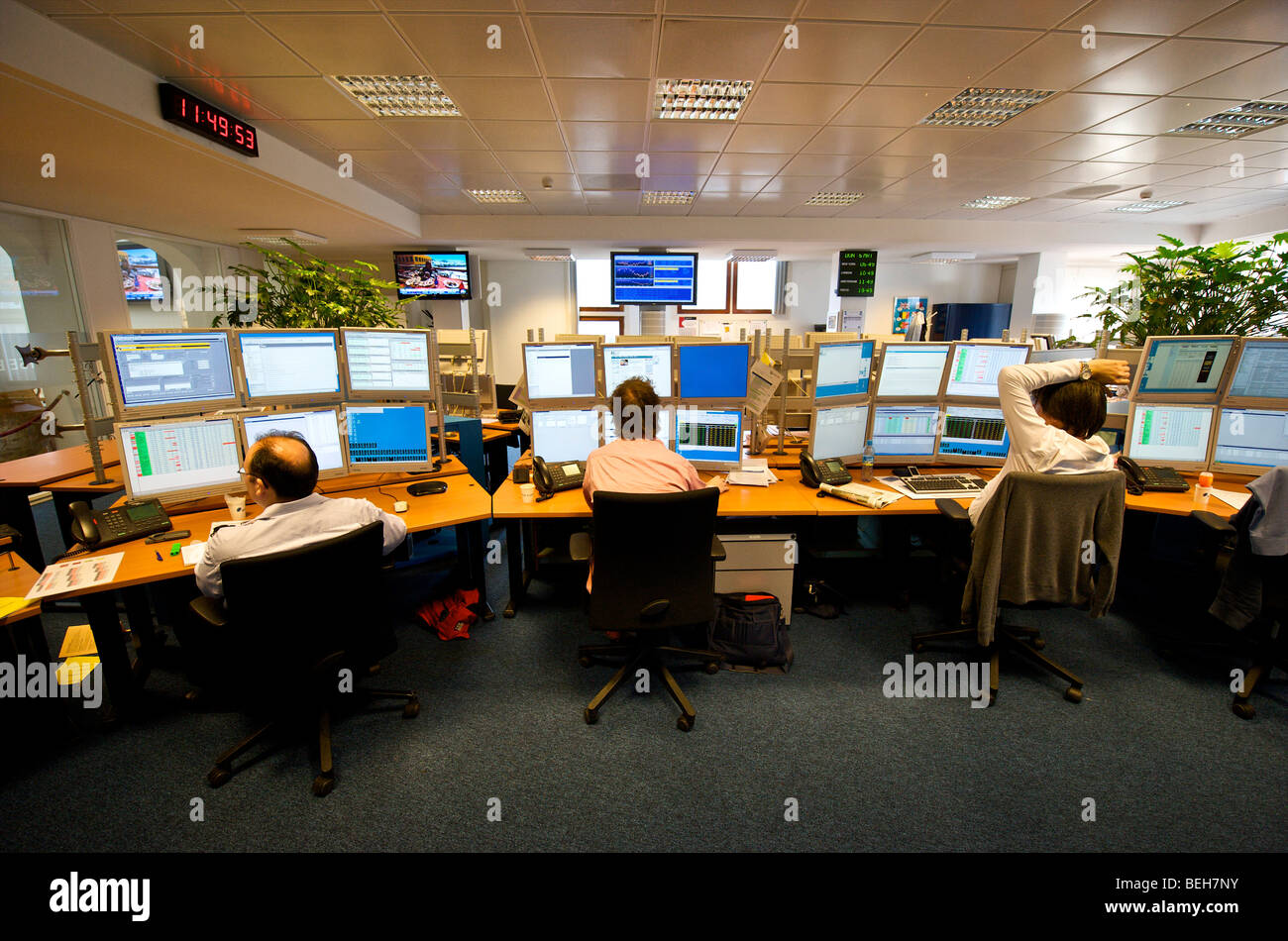

Analysis of Stock Performance on Euronext Amsterdam

The 8% increase on Euronext Amsterdam wasn't a uniform surge; it occurred over a period of [Insert timeframe, e.g., three trading days], with trading volume significantly exceeding the average for the preceding weeks. Companies heavily involved in US trade saw the most significant gains.

- Comparison of performance before and after the tariff delay announcement: A clear upward trend is visible in the stock prices of many companies following the announcement. [Insert chart or graph visualizing stock market movement here].

- Mention specific companies that showed significant stock growth: [Insert examples of companies with notable stock increases and their percentage gains]. This illustrates the targeted nature of the positive impact.

- Specific data on the 8% increase – timeframe, volume, and affected companies: [Provide detailed data, citing sources where possible].

Investor Sentiment and Market Reactions

The news of the tariff delay triggered a palpable shift in investor sentiment. Previously cautious, investors became more optimistic about the prospects of Euronext Amsterdam-listed companies. Financial analysts weighed in, reinforcing this positive outlook.

- Quotes from financial analysts on the impact of the tariff delay: "[Insert quotes from reputable financial analysts, properly cited]".

- Mention any news articles or reports that supported the analysis: "[Cite relevant news articles and reports]".

- Discuss the overall market trend and its correlation with the Euronext Amsterdam increase: The Euronext Amsterdam increase was largely independent of broader market trends, highlighting the specific impact of the US tariff delay.

Long-Term Implications for Euronext Amsterdam

While the 8% stock increase is encouraging, its long-term sustainability depends on various factors. The current geopolitical climate and ongoing economic uncertainty remain key considerations.

- Potential for further growth or correction in the market: Continued positive news regarding trade relations could fuel further growth. However, a reversal in the tariff situation could lead to a market correction.

- Discussion of ongoing geopolitical and economic factors that might influence the market: Factors such as Brexit, global economic slowdown, and any further trade disputes could influence the performance of Euronext Amsterdam.

- Prediction of future market trends based on current analysis: [Offer a cautious prediction based on the analysis, avoiding definitive statements].

Conclusion: Euronext Amsterdam's Future Following the US Tariff Delay

The 8% stock increase on Euronext Amsterdam following the US tariff delay represents a significant positive development, driven by improved investor confidence and reduced uncertainty for businesses trading with the US. The analysis highlights the specific impact of the tariff delay and the positive market reaction. However, the long-term implications remain subject to various geopolitical and economic factors. To monitor the Euronext Amsterdam market and track Euronext Amsterdam stocks closely, stay updated on Euronext Amsterdam news from reputable financial sources. Keep an eye on future developments to understand the sustainability of this positive trend.

Featured Posts

-

Los Mejores Vestidos Del Baile De La Rosa 2025 Carolina De Monaco Y Alexandra De Hannover

May 25, 2025

Los Mejores Vestidos Del Baile De La Rosa 2025 Carolina De Monaco Y Alexandra De Hannover

May 25, 2025 -

Ferstapen Mercedes To Mellon Tis Synergasias

May 25, 2025

Ferstapen Mercedes To Mellon Tis Synergasias

May 25, 2025 -

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025 -

Humoriste Transformiste Zize Soiree 100 Marseillaise A Graveson Le 4 Avril

May 25, 2025

Humoriste Transformiste Zize Soiree 100 Marseillaise A Graveson Le 4 Avril

May 25, 2025 -

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Zirok

May 25, 2025

10 Rokiv Peremog Yevrobachennya Doli Ta Kar Yeri Zirok

May 25, 2025