European Futures Outperform US Futures: Swissquote Bank Analysis

Table of Contents

Macroeconomic Factors Favoring European Futures

Several macroeconomic factors contribute to the robust performance of European futures. The Eurozone's economic resilience and the evolving geopolitical landscape have played significant roles.

The Eurozone's Economic Resilience

The Eurozone has demonstrated stronger-than-expected economic growth compared to the US. This resilience is supported by various key economic indicators. Swissquote Bank's data highlights a consistently positive outlook for the Eurozone, contrasting with the more volatile situation in some parts of the US economy.

- Stronger-than-expected Q2 GDP growth in the Eurozone: Preliminary data suggests a solid expansion, surpassing initial forecasts. This growth demonstrates the underlying strength of the Eurozone economy.

- Resilience against global inflationary pressures: While inflation remains a concern globally, the Eurozone has shown greater resilience compared to the US, managing to curb price increases more effectively in certain sectors.

- Positive impact of EU recovery funds: The substantial financial aid disbursed through EU recovery programs has fueled investment and stimulated economic activity in several member states, contributing to the overall Eurozone growth.

Geopolitical Landscape and its Impact

The ongoing geopolitical situation, particularly the war in Ukraine, has significantly impacted both European and US markets. However, European markets have demonstrated a surprising ability to adapt more effectively.

- European energy diversification strategies: The EU's focus on diversifying its energy sources, reducing reliance on Russian gas, has created opportunities for growth in renewable energy sectors, mitigating the impact of geopolitical instability.

- Increased EU defense spending boosting certain sectors: The heightened geopolitical uncertainty has led to increased defense spending across Europe, benefiting related industries and further strengthening certain segments of the European market.

- Relative stability within the EU compared to global uncertainties: Despite external pressures, the EU has maintained relative internal stability, providing a more predictable investment environment compared to the more volatile global landscape.

Sector-Specific Performance Driving European Futures Gains

The outperformance of European futures is not solely attributable to macroeconomic factors. Specific sectors have significantly contributed to this positive trend.

Outperformance in Key European Sectors

Several key sectors within the European economy have demonstrated exceptional performance, driving the overall growth in European futures.

- Strong performance of renewable energy companies in Europe: The transition to cleaner energy sources has boosted the renewable energy sector, creating significant investment opportunities and driving growth.

- Growth in the European tech sector, driven by AI advancements: The European tech sector is experiencing a surge driven by advancements in Artificial Intelligence and related technologies, attracting significant investment and contributing to market strength.

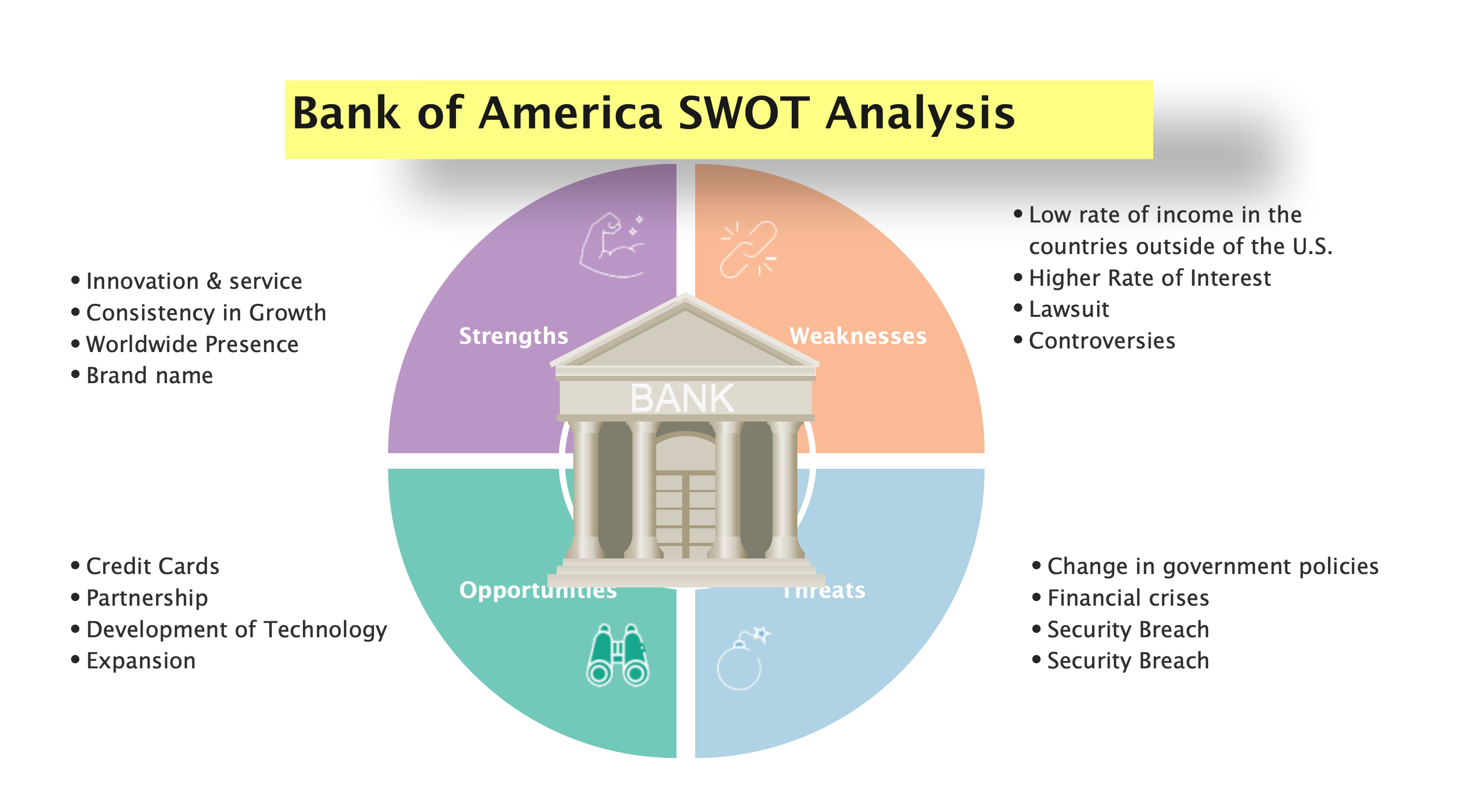

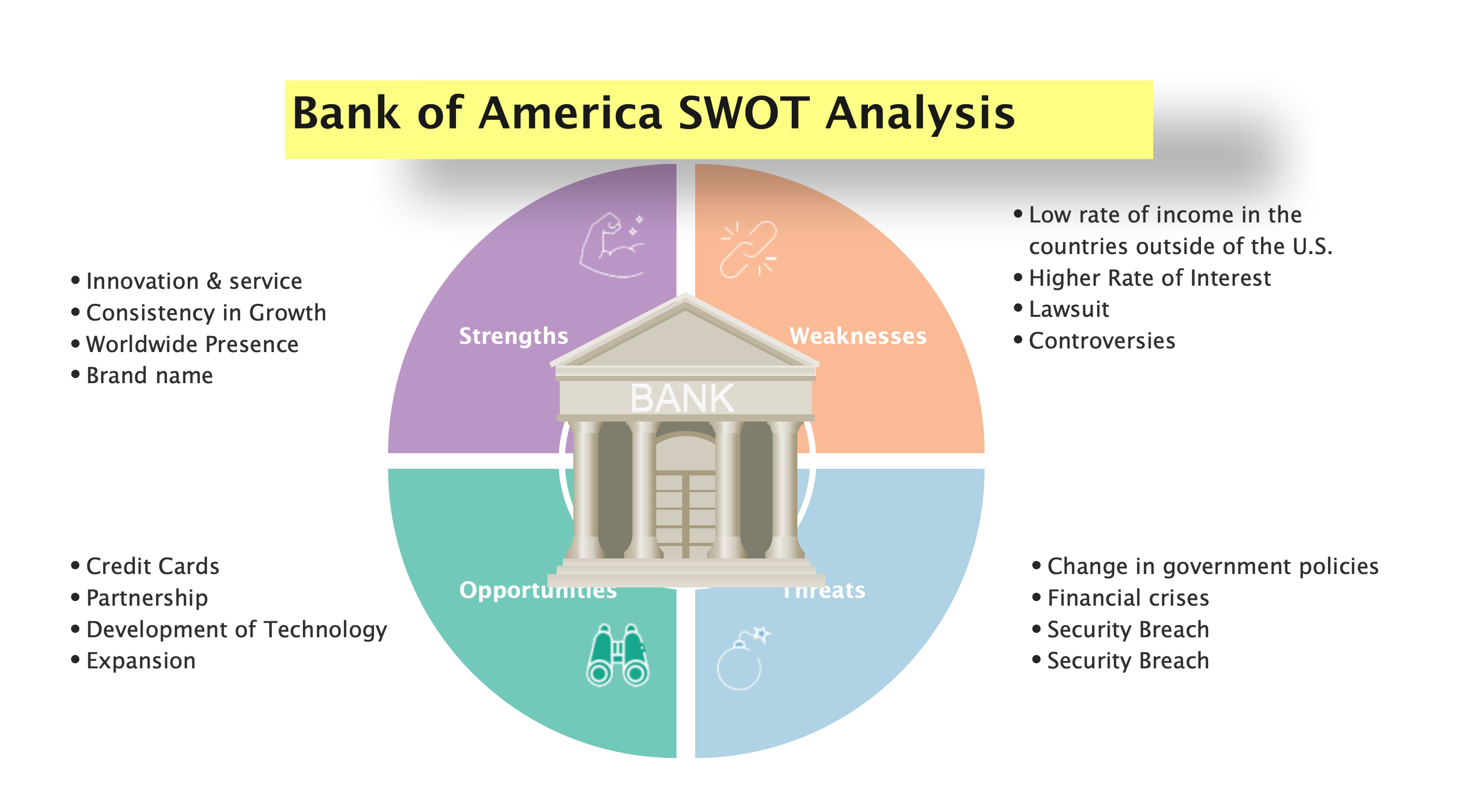

- Resilience of the European banking sector compared to US counterparts: While facing challenges, the European banking sector has shown remarkable resilience compared to some of its US counterparts.

Comparative Analysis of US and European Market Sectors

A direct comparison between analogous sectors in the US and Europe reveals considerable differences in performance. While the US market has experienced volatility, certain sectors in Europe have displayed more consistent growth. (Charts and graphs visualizing this comparison, sourced from Swissquote Bank data, would be included here).

- Comparison of energy sector performance (US vs. Europe): The European energy sector, particularly renewable energy, has outperformed its US counterpart due to factors like government support and increased demand.

- Technology sector comparison (US vs. Europe): While the US tech sector remains dominant globally, certain niche areas within the European tech sector have demonstrated remarkable growth.

- Financial sector comparison (US vs. Europe): The European financial sector has shown relatively stronger resilience compared to the US in the face of macroeconomic headwinds.

Swissquote Bank's Analysis and Methodology

Swissquote Bank's analysis provides valuable insights into the outperformance of European futures. Their methodology and predictions are crucial for understanding this trend.

Data Sources and Methodology Used

Swissquote Bank's analysis relies on a robust methodology using diverse data sources for comprehensive assessment.

- Data sources used (e.g., market indices, company reports): The bank uses a wide range of reputable data sources, ensuring the reliability of their analysis.

- Specific methodologies used for analysis and prediction: Swissquote Bank employs sophisticated quantitative and qualitative methods for its market analysis, providing a comprehensive approach. [Link to Swissquote Bank's methodology report].

- Transparency and limitations of the analysis: The bank maintains transparency regarding the limitations of its analysis, acknowledging potential biases and uncertainties.

Swissquote Bank's Predictions and Outlook

Swissquote Bank's outlook on European futures is cautiously optimistic.

- Short-term outlook for European futures: The bank anticipates continued strong performance in the short term, driven by the factors discussed above.

- Long-term outlook for European futures: The long-term outlook remains positive, contingent on various macroeconomic and geopolitical factors.

- Potential risks and uncertainties: The bank acknowledges potential risks and uncertainties, such as global economic slowdowns or unexpected geopolitical events.

Conclusion

In summary, European futures have shown significant outperformance compared to US futures, driven by robust macroeconomic factors, sector-specific growth, and adaptive responses to geopolitical challenges, all highlighted by Swissquote Bank's comprehensive analysis. The resilience of the Eurozone, the strategic adjustments within key sectors, and the bank's insightful predictions paint a picture of a dynamic and promising landscape for European markets.

Call to Action: Stay informed on the dynamic landscape of European futures. Follow Swissquote Bank's analysis for further insights into European and US market trends and make informed investment decisions based on their expert analysis of European futures. Learn more about investment opportunities in European futures and other market insights at [link to Swissquote Bank].

Featured Posts

-

Renowned Singer To Give Final Performance Amidst Memory Challenges

May 19, 2025

Renowned Singer To Give Final Performance Amidst Memory Challenges

May 19, 2025 -

Gensek Oon Sozyvaet Neformalnye Peregovory Po Kipru V Zheneve

May 19, 2025

Gensek Oon Sozyvaet Neformalnye Peregovory Po Kipru V Zheneve

May 19, 2025 -

Chateau Diy Projects Transform Your Home With Elegant Diy Designs

May 19, 2025

Chateau Diy Projects Transform Your Home With Elegant Diy Designs

May 19, 2025 -

Analysi Tis Thesis Toy L Tzoymi Gia To Kypriako Kateynasmos Anti Afairesis Simaias

May 19, 2025

Analysi Tis Thesis Toy L Tzoymi Gia To Kypriako Kateynasmos Anti Afairesis Simaias

May 19, 2025 -

Home Loss For Orlando City Against Philadelphia Union

May 19, 2025

Home Loss For Orlando City Against Philadelphia Union

May 19, 2025