European Stock Market Outlook: Strategists Shift From Optimism Amidst Trump's Trade War

Table of Contents

Weakening Economic Indicators and their Impact on European Stocks

Recent economic data releases paint a concerning picture for the European Union. Major economies like Germany, France, and the UK are showing signs of slowing growth, impacting investor confidence and the overall European stock market outlook. Key indicators are flashing warning signs. GDP growth is decelerating across the board, inflation remains stubbornly low in many countries, and consumer confidence is dwindling. This combination suggests a potential economic slowdown, a significant threat to the performance of European equities.

- Declining Manufacturing PMI: The Purchasing Managers' Index (PMI) for manufacturing, a key indicator of industrial activity, has been steadily declining in several major European economies, signaling a contraction in the manufacturing sector. This directly impacts employment and investment, further dampening economic growth.

- Slowing Consumer Spending: Weakening consumer confidence translates into reduced spending, a crucial element of economic growth. Uncertainty about the future, coupled with potential job losses in struggling sectors, is causing consumers to tighten their belts, impacting businesses reliant on consumer demand.

- Increased Uncertainty Impacting Business Investment: The prevailing economic uncertainty is discouraging businesses from investing in expansion and new projects. This hesitancy contributes to slower job creation and overall economic stagnation, further impacting the European stock market outlook negatively.

The Escalating Trade War and its Effect on European Businesses

Trump's trade policies, characterized by tariffs and trade disputes, are having a tangible and detrimental impact on European businesses, particularly those heavily reliant on exports. Sectors like automobiles and aerospace, key players in the European economy, are bearing the brunt of these trade tensions. The imposition of tariffs increases costs for European exporters, making their products less competitive in global markets. This leads to reduced profits and, in some cases, job losses.

- Increased Costs for European Exporters: Tariffs imposed by the US significantly increase the cost of exporting goods to the American market, eroding profit margins for European businesses and reducing their competitiveness.

- Reduced Competitiveness in Global Markets: The trade war creates a climate of uncertainty and instability, making it harder for European companies to plan for the future and compete effectively in international markets.

- Potential for Retaliatory Tariffs from the EU: The EU's response to US tariffs could lead to retaliatory measures, escalating the trade war and further harming European businesses and the European equity market outlook. This cycle of protectionism creates significant risks for investors.

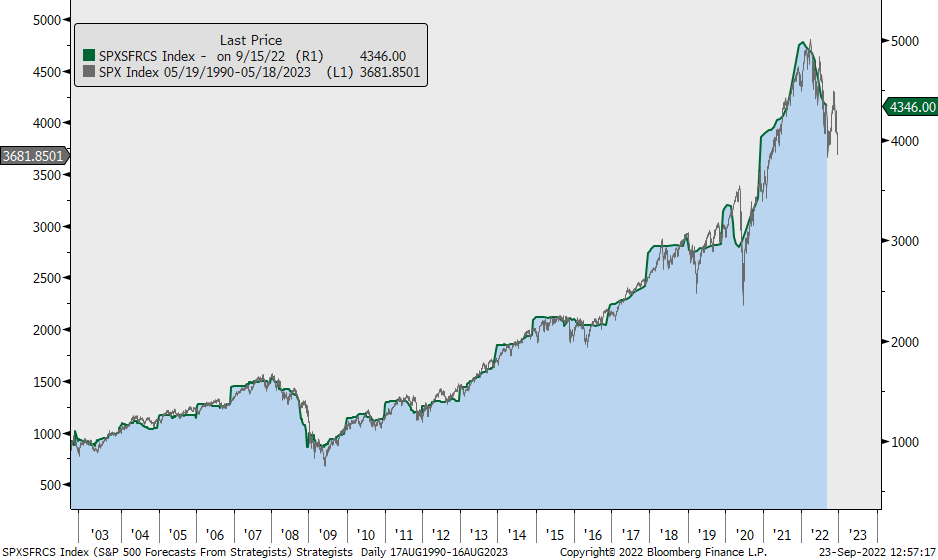

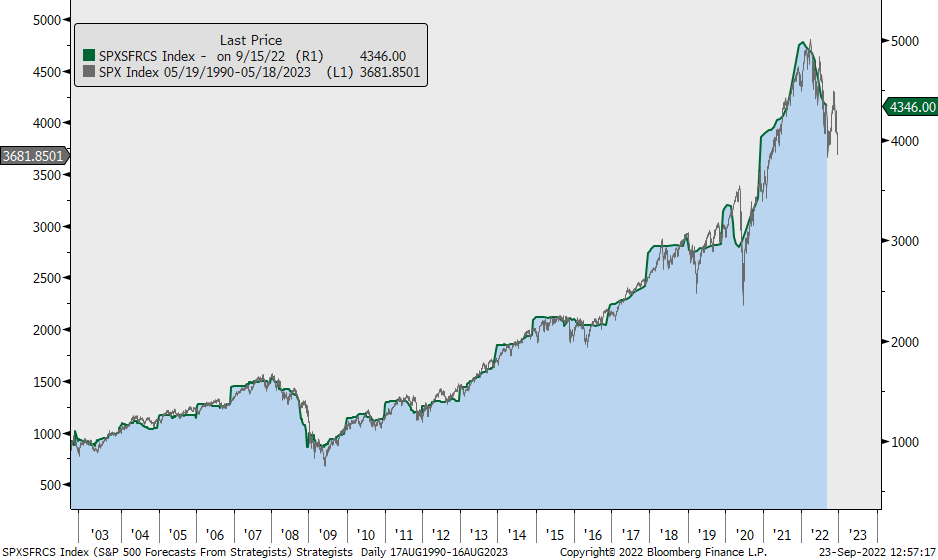

Shifting Strategist Sentiment: From Bullish to Bearish

The previously optimistic forecasts for the European stock market are being revised downward by leading financial analysts and investment banks. This shift from bullish to bearish sentiment reflects the growing concerns surrounding the economic slowdown and the ongoing trade war uncertainty. Geopolitical risks, including Brexit and rising tensions in various regions, are further exacerbating the situation.

- Lowered Earnings Expectations for European Companies: Analysts are reducing their profit forecasts for European companies, reflecting the negative impact of slowing growth and trade tensions. This directly affects stock valuations and investor confidence.

- Increased Volatility in the Stock Market: The uncertain environment is leading to increased volatility in the European stock market, creating a riskier investment landscape.

- Shift Towards More Defensive Investment Strategies: Many investors are moving away from riskier assets and shifting towards more defensive investment strategies, such as investing in bonds or less volatile sectors.

Potential Investment Strategies in a Challenging Market

Navigating the current challenging market requires a cautious and strategic approach. Investors need to carefully assess the risks and adjust their portfolios accordingly. Diversification is crucial to mitigate the impact of potential economic downturns.

- Diversify Across Different Sectors and Geographies: Reducing reliance on any single sector or geographic region can minimize exposure to sector-specific shocks.

- Consider Investing in Defensive Stocks (e.g., Consumer Staples): Defensive stocks, representing companies providing essential goods and services, are often less sensitive to economic downturns.

- Explore Alternative Investments (e.g., Bonds, Real Estate): Diversifying into asset classes like bonds and real estate can provide a degree of stability during periods of market uncertainty.

Conclusion:

The European stock market outlook has dimmed considerably, primarily due to weakening economic data and the disruptive effects of the ongoing trade war. The shift in sentiment among market strategists from bullish to bearish underscores the need for a cautious and strategic investment approach. Investors must carefully assess the risks, diversify their portfolios, and consider defensive investment strategies to navigate this challenging environment. Staying informed about the evolving European stock market analysis and seeking professional financial advice before making any investment decisions is paramount. A thorough understanding of the European equity market outlook and a well-defined European investment strategy are crucial in mitigating potential losses and capitalizing on emerging opportunities within this dynamic market.

Featured Posts

-

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025 -

Order I Ll Have What Shes Having By Chelsea Handler Online Today

Apr 26, 2025

Order I Ll Have What Shes Having By Chelsea Handler Online Today

Apr 26, 2025 -

Jorgenson Secures Back To Back Paris Nice Wins

Apr 26, 2025

Jorgenson Secures Back To Back Paris Nice Wins

Apr 26, 2025 -

Nyt Spelling Bee Solutions February 5th Puzzle 339 Hints And Answers

Apr 26, 2025

Nyt Spelling Bee Solutions February 5th Puzzle 339 Hints And Answers

Apr 26, 2025

Latest Posts

-

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025

Bangkok Post The Fight For Transgender Equality Continues

May 10, 2025 -

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025

Discussions On Transgender Equality Intensify Bangkok Post Reports

May 10, 2025 -

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025

Experiences Of Transgender Individuals Under Trumps Executive Orders

May 10, 2025 -

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025

The Impact Of Trumps Presidency On Transgender Rights

May 10, 2025