European Stock Market Reaction To Trump's Auto Tariff Comments

Table of Contents

Immediate Market Impact of Trump's Auto Tariff Announcement

The immediate reaction to Trump's auto tariff threats was a sharp sell-off in major European stock market indices. The announcement triggered a wave of panic selling, significantly increasing market volatility. The FTSE 100, DAX, and CAC 40 all experienced substantial drops within hours of the news breaking. This stock market crash-like behavior highlighted the intense sensitivity of European markets to trade policy uncertainty.

- Percentage drops: The FTSE 100 fell by approximately X%, the DAX by Y%, and the CAC 40 by Z% (replace X, Y, and Z with actual percentage drops from a relevant historical event). These immediate drops reflected a significant loss of investor confidence.

- Heavily impacted companies: Automotive manufacturers like Volkswagen, BMW, and Daimler experienced particularly sharp declines, reflecting the direct exposure of these companies to potential tariffs. Parts suppliers also suffered significant losses, highlighting the vulnerability of the entire automotive supply chain.

- Increased trading volume: Trading volumes spiked dramatically, indicating heightened investor anxiety and a rush to offload assets perceived as being at high risk from the trade war.

Sector-Specific Analysis: Automotive and Related Industries

The automotive sector and its associated industries bore the brunt of the negative impact from Trump's auto tariff comments. The potential for significant tariffs on European cars exported to the US created a palpable sense of crisis within the industry. The consequences could extend far beyond the major car manufacturers.

- Impact on specific manufacturers: Volkswagen, BMW, and Daimler, major exporters to the US market, faced immediate and substantial share price drops. The potential for reduced sales and decreased profitability prompted concerns about job security and future investments.

- Ripple effect on related industries: The automotive sector's extensive supply chain means the impact extended to steel and aluminum producers, as well as other related industries supplying parts and components. These companies also witnessed a decline in their stock prices.

- Potential relocation of production: The threat of tariffs could incentivize European automakers to consider relocating production facilities or shifting supply chains to countries outside of the EU, potentially impacting jobs and economic growth within the EU.

The Broader Economic Implications for the European Union

The impact of Trump's auto tariff comments extends far beyond the automotive sector, posing significant challenges to the overall European Union economy. The potential for a broader trade war creates considerable uncertainty and risk.

- Impact on EU GDP growth: The potential for reduced exports, decreased investment, and disrupted supply chains could significantly impact the EU's GDP growth, leading to slower economic expansion.

- Retaliatory tariffs: The EU has the potential to retaliate with its own tariffs on US goods, escalating the trade war and further damaging global economic growth. The impact of retaliatory tariffs could be felt across various sectors.

- Long-term implications for trade relations: The incident underscores the fragility of EU-US trade relations, raising concerns about the long-term stability and predictability of the global trading system.

Investor Sentiment and Future Outlook

Following the tariff announcement, investor sentiment plummeted, reflecting increased uncertainty and risk aversion. The threat of a prolonged trade conflict significantly impacted investor confidence.

- Changes in investor sentiment: Market data indicated a sharp decline in investor confidence, with risk-off sentiment dominating market behavior.

- Hedging strategies: Investors are likely to adopt hedging strategies to mitigate potential losses associated with European stock market exposure. Diversification is key.

- Long-term implications for European economic growth: The long-term impact will depend on the resolution of the trade dispute. A protracted trade war could significantly hinder European economic growth.

Conclusion

Trump's auto tariff comments had a significant and immediate impact on the European stock market, particularly affecting the automotive sector and creating broader economic uncertainty. The increased market volatility and decline in investor confidence underscore the risks associated with escalating trade tensions. The potential for a full-blown trade war poses severe threats to European economic growth.

Call to Action: Stay informed about the evolving situation regarding European stock market reactions to Trump's auto tariffs and their variants. Regularly monitor market news and expert analysis to make informed investment decisions in this volatile climate. Consider diversifying your portfolio to mitigate risks associated with potential trade wars and effectively manage your investments in this uncertain environment.

Featured Posts

-

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025

2024 Philips Annual General Meeting What You Need To Know

May 24, 2025 -

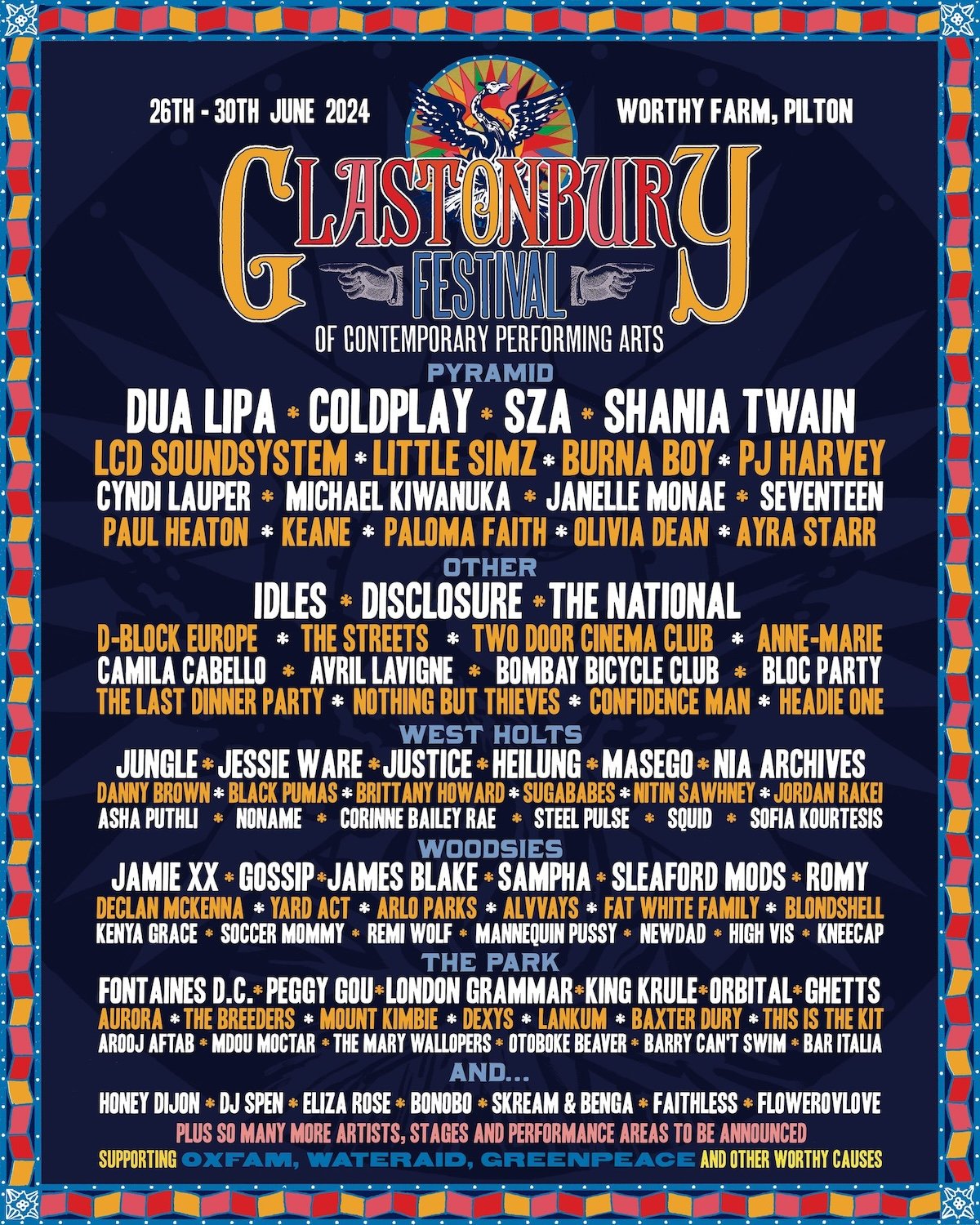

Leaked Glastonbury 2025 Lineup Official Artists And Where To Buy Tickets

May 24, 2025

Leaked Glastonbury 2025 Lineup Official Artists And Where To Buy Tickets

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Ela Mshjeyn

May 24, 2025 -

Escape To The Country The Benefits Of Countryside Living

May 24, 2025

Escape To The Country The Benefits Of Countryside Living

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025