European Stock Market Update: Tariff Hopes And LVMH's Decline

Table of Contents

Tariff Hopes and Trade Tensions

Easing of Trade Disputes

Positive news regarding potential tariff reductions between major economic blocs injected a dose of optimism into the European stock market. This led to a short-term surge in specific sectors, particularly those heavily reliant on international trade.

- Negotiations between the EU and the US showed signs of progress, leading to expectations of reduced trade barriers and a more positive outlook for transatlantic commerce. This is crucial for the European Union’s economy, which is heavily reliant on trade with the US.

- This positive sentiment significantly impacted sectors heavily reliant on international trade, such as automobiles, technology, and agricultural products. Companies in these sectors saw their stock prices rise on the prospect of increased sales and reduced production costs.

- However, significant uncertainty remains. Any agreements are subject to further ratification processes and the ever-present risk of future disputes. The path towards lasting trade stability remains fraught with challenges. This cautious optimism needs to be carefully considered by investors.

Lingering Trade Uncertainty

Despite the optimistic headlines, significant uncertainties persist regarding future trade policies and the potential for renewed trade conflicts. This ongoing uncertainty continues to impact investor confidence and fuel market volatility within the European stock market.

- Geopolitical risks and unpredictable policy shifts continue to pose challenges. The ever-changing global political landscape creates a volatile environment for investors, impacting the stability of the European stock market.

- Investors remain cautious, seeking clearer signals on the future trajectory of trade relations. They are carefully evaluating potential risks before committing capital, leading to a period of wait-and-see sentiment.

- This uncertainty is impacting investment decisions and creating market volatility. The fluctuating nature of the market makes long-term planning and investment strategy more challenging for investors in the European stock market.

LVMH's Decline and its Implications

Factors Contributing to LVMH's Stock Drop

The significant decline in LVMH's stock price is a key indicator of potential issues within the luxury goods sector and raises broader concerns about the overall economic health. Several factors contributed to this decrease.

- Concerns about slowing growth in key markets like China impacted investor confidence. The slowdown in the Chinese economy, a major market for luxury goods, triggered fears of reduced consumer spending.

- Shifting consumer spending habits and increased competition in the luxury sector played a significant role. The increasing preference for experiences over material possessions and the rise of new competitors are impacting traditional luxury brands.

- The overall economic slowdown and potential recessionary fears also contributed to the negative sentiment. Global economic uncertainty fuels a risk-averse environment, leading to investors seeking safer investments.

Ripple Effect on the Broader Market

LVMH's decline didn't stay contained within the luxury goods sector; it sent a wave of uncertainty throughout the broader European market, raising concerns about its overall resilience.

- Investors are closely monitoring other luxury brands for similar trends. The performance of LVMH serves as a barometer for the entire luxury goods sector, prompting careful observation of its competitors.

- This event highlights the interconnectedness of different sectors within the European stock market. The performance of one key player can have a significant knock-on effect on the entire market.

- The decline could be an indicator of broader economic slowdowns affecting consumer spending. It serves as a potential warning sign for investors, suggesting a potential weakening in consumer confidence across the board.

Conclusion

This week's European stock market activity showcased a tug-of-war between positive tariff developments and the negative impact of LVMH's decline. While hopes for reduced trade tensions provided a temporary reprieve, uncertainties linger. The performance of key companies like LVMH continues to heavily influence overall market sentiment. Investors need to closely monitor developments in both trade negotiations and the luxury goods sector to gain a clearer picture of the European stock market's future trajectory. Stay informed on the latest European stock market updates to make well-informed investment decisions and navigate this complex landscape successfully. Understanding the nuances of the European stock market is crucial for effective portfolio management.

Featured Posts

-

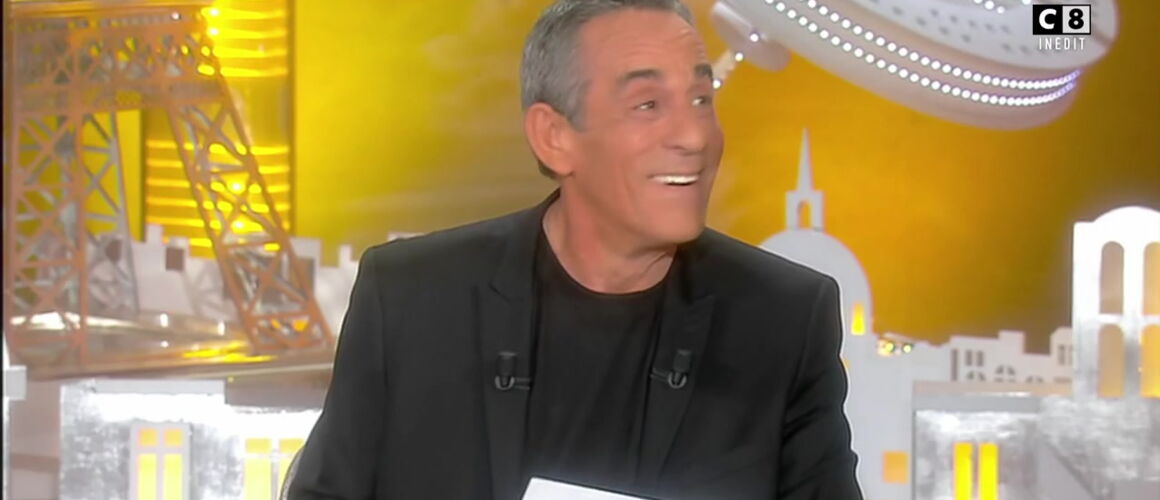

Laurent Baffie Thierry Ardisson Defend Ses Blagues Controversees

May 25, 2025

Laurent Baffie Thierry Ardisson Defend Ses Blagues Controversees

May 25, 2025 -

Relx Ai Als Motor Voor Groei En Winstgevendheid Zelfs In Een Zwakke Economie

May 25, 2025

Relx Ai Als Motor Voor Groei En Winstgevendheid Zelfs In Een Zwakke Economie

May 25, 2025 -

Demnas Gucci Debut And Kerings Recent Financial Performance

May 25, 2025

Demnas Gucci Debut And Kerings Recent Financial Performance

May 25, 2025 -

The Dreyfus Affair A Renewed Push For Justice In The French Parliament

May 25, 2025

The Dreyfus Affair A Renewed Push For Justice In The French Parliament

May 25, 2025 -

Annie Kilners Social Media Activity After Kyle Walker Incident

May 25, 2025

Annie Kilners Social Media Activity After Kyle Walker Incident

May 25, 2025