Examining RTL Group's Progress In Streaming Profitability

Table of Contents

RTL Group's Streaming Strategy and Portfolio

RTL Group's streaming strategy centers around a diversified portfolio of platforms, each targeting specific audiences and geographic regions. Understanding this strategy is crucial to assessing their overall streaming profitability.

Key Streaming Services

RTL Group operates several key streaming services, each with its own unique content library and target audience:

-

RTL+: RTL+'s strength lies in its broad range of German-language content, including live TV channels, on-demand shows, and exclusive originals. It offers a compelling mix of established and new programming, attracting a large and diverse audience. Key features include personalized recommendations and seamless integration with other RTL Group services.

-

Videoland: Targeted at the Dutch market, Videoland boasts a significant library of popular Dutch and international content. Its focus on local programming gives it a strong competitive edge in the Netherlands. Videoland differentiates itself through exclusive content partnerships and a user-friendly interface.

-

Other Regional Platforms: RTL Group operates several other streaming platforms in various European countries, reflecting its pan-European reach. These platforms offer tailored content to local preferences, capitalizing on specific market opportunities. Further analysis of each platform's performance is needed to accurately assess overall RTL Group streaming profitability.

Content Acquisition and Production

RTL Group employs a multi-pronged approach to content acquisition, balancing original programming with licensed content and co-productions.

-

Original Programming: Significant investments in original productions, particularly German-language dramas, have proven successful in driving subscriber growth on RTL+. These exclusive series act as key differentiators, attracting and retaining subscribers.

-

Licensing Deals: Securing licenses for popular international shows complements the original programming, providing additional value to subscribers. However, the cost of licensing high-demand content can significantly impact profitability.

-

Co-productions: Collaborative ventures with other production companies help spread the risk and cost of production, while potentially accessing larger audiences and broader distribution. Strategic partnerships are crucial to maximizing the ROI of content investments.

The challenge for RTL Group lies in striking the right balance between investment in original programming and the acquisition of licensed content to optimize RTL Group streaming profitability.

Technological Infrastructure and User Experience

The success of any streaming platform depends heavily on a robust technological infrastructure and a positive user experience.

-

User Interface and App Functionality: Recent updates to the RTL+ app have improved navigation, search functionality, and overall streaming quality, contributing to increased user satisfaction. Continued investment in user interface and app functionality is essential for user retention and acquisition.

-

Device Compatibility: Ensuring seamless access across multiple devices (smart TVs, mobile devices, etc.) is crucial for user convenience and satisfaction. Broad device compatibility enhances the accessibility of the platform and contributes to a better user experience.

-

Platform Stability: Minimizing technical glitches and ensuring consistent streaming quality are paramount for user retention. Addressing any challenges related to platform stability is critical for maintaining subscriber satisfaction and enhancing the perception of RTL Group streaming profitability.

Financial Performance and Key Metrics

Analyzing key financial metrics is critical to understanding RTL Group's progress towards streaming profitability. While precise figures may vary and require further research, we can analyze the general trends and challenges.

Subscriber Growth and Acquisition Costs

While specific numbers for subscriber growth and customer acquisition costs (CAC) for each platform require further investigation, the overall trajectory of RTL Group's streaming subscriber base provides a critical indicator. Comparing growth rates to competitors will further illustrate their success. High CAC can significantly impact profitability and requires careful management.

Revenue Generation and Monetization Strategies

RTL Group employs a range of monetization strategies to generate revenue from its streaming services:

-

Subscription Fees: A tiered subscription model, offering both ad-supported and ad-free options, maximizes revenue by catering to diverse consumer preferences and budgets.

-

Advertising Revenue: Ad-supported tiers generate revenue from advertisements, although carefully managing ad frequency to avoid impacting the user experience is crucial.

-

Other Revenue Streams: Potential additional revenue streams could include partnerships, merchandising, and other forms of digital engagement.

Analyzing ARPU (Average Revenue Per User) and comparing it to competitors offers valuable insights into the effectiveness of RTL Group’s monetization strategies and their contribution to RTL Group streaming profitability.

Profitability and Path to Break-even

RTL Group's path to break-even in streaming hinges on several factors:

-

Content Costs: Managing content acquisition and production costs effectively is critical for profitability. This includes negotiating favorable licensing deals and optimizing production budgets.

-

Marketing Expenses: Reaching target audiences requires substantial marketing investment, which must be carefully managed to achieve a positive return on investment.

-

Technological Investments: Continuous investments in technology and infrastructure are necessary to maintain platform stability, enhance user experience, and compete effectively.

RTL Group's projected path to profitability will require continued subscriber growth, efficient cost management, and the successful implementation of their monetization strategies.

Conclusion

This examination of RTL Group's progress in streaming profitability reveals a complex picture. While significant investments in content and technology are driving subscriber growth, achieving sustainable profitability remains a key challenge. The success of RTL Group's streaming strategy hinges on factors such as continued subscriber acquisition, effective content monetization, and the ability to manage costs efficiently. To stay informed on RTL Group's ongoing performance and the evolution of their streaming strategy, continue monitoring their financial reports and industry news related to RTL Group streaming profitability. Further research into the competitive landscape and emerging trends in the streaming market will provide a more comprehensive understanding of RTL Group's position and future outlook.

Featured Posts

-

The Impact Of Brexit On Uk Luxury Exports To The Eu

May 20, 2025

The Impact Of Brexit On Uk Luxury Exports To The Eu

May 20, 2025 -

Fenerbahce Eist Actie Na Tadic Incident Met Ajax

May 20, 2025

Fenerbahce Eist Actie Na Tadic Incident Met Ajax

May 20, 2025 -

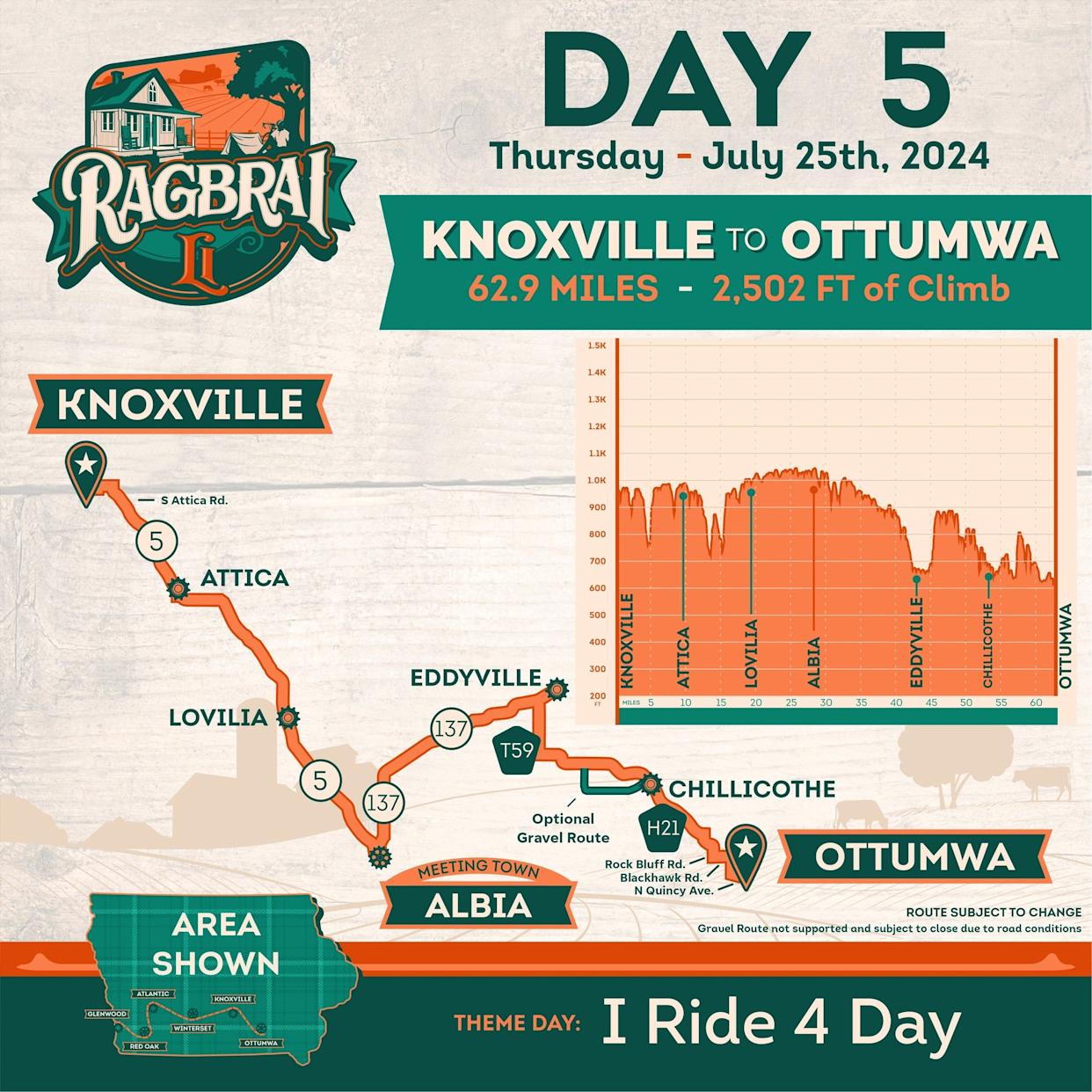

Ragbrai And Daily Rides Scott Savilles Enduring Love Of Cycling

May 20, 2025

Ragbrai And Daily Rides Scott Savilles Enduring Love Of Cycling

May 20, 2025 -

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025

Prokrisi Kroyz Azoyl O Giakoymakis Ston Teliko Champions League

May 20, 2025 -

Solo Travel The Rise Of The Independent Explorer

May 20, 2025

Solo Travel The Rise Of The Independent Explorer

May 20, 2025