Factors Contributing To The BigBear.ai (BBAI) Stock Fall In 2025

Table of Contents

Macroeconomic Factors Impacting BBAI Stock Performance

The overall economic climate significantly affects individual stock prices, and BBAI was not immune. A general market correction or recession can drag down even fundamentally strong companies. The technology sector, and particularly AI stocks like BBAI, are often more volatile than others.

Broader Market Downturn

A downturn in the broader market creates a negative sentiment that spills over into individual stocks.

- Increased interest rates impacting investor sentiment: Higher interest rates make borrowing more expensive, reducing corporate investment and dampening investor enthusiasm. This often leads to a sell-off in riskier assets, including technology stocks.

- Reduced investor risk appetite leading to sell-offs across sectors: Uncertainty in the economy prompts investors to shift from growth stocks, such as BBAI, to safer investments like bonds. This reduced risk appetite fuels a general sell-off.

- Global economic uncertainty impacting technology investments: Geopolitical tensions, inflation, and supply chain disruptions can create a climate of uncertainty, making investors hesitant to commit capital to technology ventures.

Sector-Specific Headwinds

The AI and technology sector is inherently volatile. Rapid technological advancements, intense competition, and evolving market demands create specific challenges.

- Increased competition within the AI market: The AI field is rapidly evolving, with numerous companies vying for market share. Increased competition can pressure profit margins and limit growth opportunities for established players like BBAI.

- Slowdown in AI-related government contracts or funding: Government budgets can fluctuate, impacting funding for AI initiatives. A reduction in government contracts can significantly affect revenue streams for companies reliant on this sector.

- Concerns over the sustainability of the AI sector's growth: Periodic concerns about the long-term viability of certain AI technologies or market saturation can trigger investor anxiety and sell-offs.

Company-Specific Challenges Affecting BBAI Stock Price

Internal factors within BigBear.ai also played a role in the 2025 stock decline. These challenges impacted investor confidence and negatively affected the BBAI share price.

Financial Performance

Poor financial results directly impact stock valuations. Missed expectations can severely erode investor trust.

- Missed earnings projections: Failing to meet projected revenue or earnings targets signals potential issues with the company's operational efficiency or market positioning.

- Increased operating expenses: Rising costs, without corresponding revenue growth, can squeeze profit margins and lead to lower profitability, impacting the stock price.

- Concerns about debt levels: High levels of debt can make a company vulnerable during economic downturns, increasing investor anxieties.

Management and Leadership

Leadership plays a crucial role in a company's success. Any instability or negative publicity related to management can harm investor confidence.

- Executive departures or changes in strategic direction: Sudden changes in leadership can create uncertainty, impacting investor trust and potentially leading to sell-offs.

- Negative media coverage or scandals: Negative publicity, whether related to ethical concerns, financial irregularities, or other issues, can damage the company's reputation and affect its stock price.

- Concerns about the effectiveness of the company's leadership: Investors constantly assess management's ability to execute its strategy. Concerns about leadership's competence can negatively impact stock performance.

Technological Challenges

In the fast-paced technology sector, failing to adapt or innovate can lead to competitive disadvantage.

- Delayed product launches or technological setbacks: Delays in product development or significant technical challenges can signal weaknesses in the company's R&D capabilities and negatively affect investor perception.

- Inability to compete effectively with rivals: Falling behind competitors in innovation or market penetration can lead to reduced market share and lower profitability.

- Dependence on outdated technologies: Relying on outdated technologies exposes the company to risks from more advanced solutions offered by competitors.

External Influences Affecting BBAI's Stock Trajectory

External factors beyond the company's direct control can also influence its stock price.

Geopolitical Events

Global events can have far-reaching impacts on market sentiment.

- International conflicts or trade wars: Geopolitical instability can disrupt supply chains, increase uncertainty, and lead to decreased investor confidence.

- Changes in government regulations: New regulations impacting the AI industry, such as data privacy laws, can significantly affect a company's operations and profitability.

- Geopolitical risks affecting global investment: Concerns about global stability can lead to investors withdrawing from riskier assets, including technology stocks.

Regulatory Scrutiny

The AI sector is subject to increasing regulatory scrutiny. Compliance issues or legal challenges can negatively affect stock performance.

- Data privacy concerns and regulatory compliance: Companies must navigate complex data privacy regulations, and failures to comply can result in significant penalties and damage investor confidence.

- Antitrust investigations or legal challenges: Investigations into potential monopolistic practices or legal disputes can severely impact a company’s reputation and stock price.

- Changes in data security regulations: Evolving data security regulations require constant adaptation and investment, and failure to comply can lead to significant financial and reputational damage.

Conclusion

The decline in BigBear.ai (BBAI) stock price in 2025 was likely a confluence of macroeconomic factors, company-specific challenges, and external influences. Understanding these interwoven factors is crucial for investors considering future investments in BBAI and other AI stocks. By carefully analyzing market trends, company performance, and potential risks, investors can make more informed decisions about their portfolio. For a more detailed analysis of the BigBear.ai (BBAI) stock and its future prospects, continue researching the company’s financials and market positioning. Stay informed about the factors affecting the BBAI stock price and make well-informed investment decisions.

Featured Posts

-

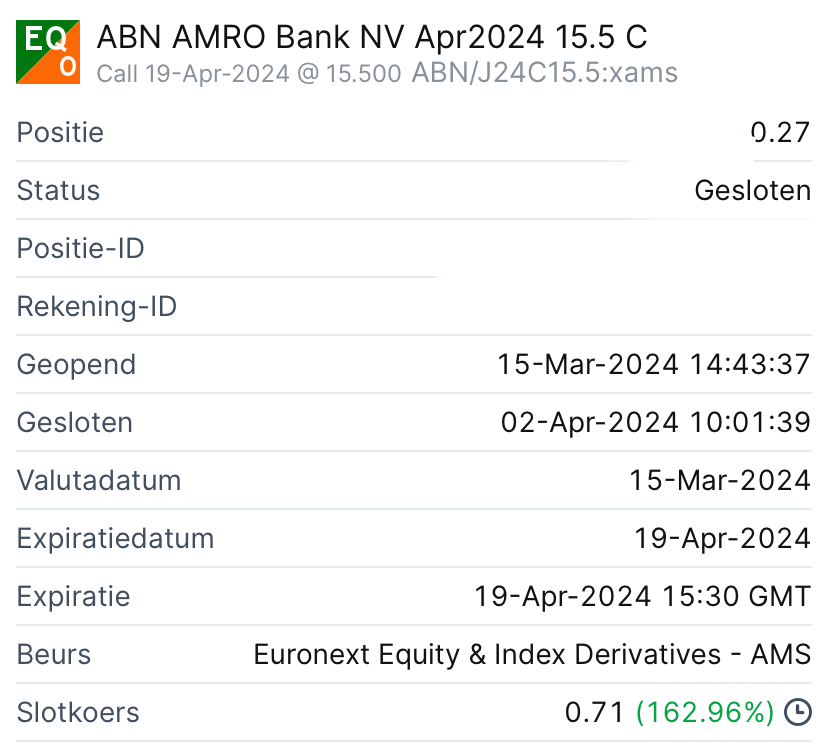

Uw Gids Voor Het Abn Amro Kamerbrief Certificaten Verkoopprogramma

May 21, 2025

Uw Gids Voor Het Abn Amro Kamerbrief Certificaten Verkoopprogramma

May 21, 2025 -

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025

Record Breaking Run Fastest Crossing Of Australia On Foot

May 21, 2025 -

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingssector Door Goedkope Arbeidsmigranten

May 21, 2025 -

Abn Amro Import Van Voedingsmiddelen Naar De Vs Gehalveerd Door Heffingen

May 21, 2025

Abn Amro Import Van Voedingsmiddelen Naar De Vs Gehalveerd Door Heffingen

May 21, 2025 -

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 21, 2025