Falling Stocks Reflect Growing Anxiety Over US Budget

Table of Contents

Debt Ceiling Debate and Market Volatility

The ongoing debt ceiling debate is a primary source of market volatility. The US government's ability to borrow money is directly tied to the debt ceiling, and failure to raise it could lead to a series of potentially disastrous consequences.

- Potential government shutdown scenarios and their market consequences: A government shutdown would disrupt essential services, impacting consumer confidence and potentially triggering a sharp market correction.

- Impact on US Treasury yields and borrowing costs: Uncertainty surrounding the debt ceiling increases the perceived risk of US Treasury bonds, leading to higher yields and increased borrowing costs for the government and businesses.

- Credit rating implications for the US and global markets: A failure to raise the debt ceiling could lead to a downgrade of the US credit rating, impacting investor confidence globally and potentially triggering a broader market sell-off.

- Examples of past debt ceiling crises and their effects on stock markets: Past debt ceiling standoffs have resulted in increased market volatility and negative impacts on stock prices, highlighting the potential for severe consequences.

The complexity of the debt ceiling debate stems from disagreements between political parties regarding spending levels and priorities. These disagreements translate directly into market uncertainty, fueling risk aversion amongst investors. Recent market reactions to debt ceiling headlines, often characterized by sharp drops followed by partial rebounds, exemplify this volatility. The lack of a clear resolution further exacerbates the anxiety driving the stock market downturn.

Government Spending and Inflationary Pressures

The relationship between government spending and inflation is a crucial element of the current market anxiety. Increased government spending, particularly when coupled with supply chain constraints, can fuel inflationary pressures.

- Impact of increased government spending on inflation rates: Increased government spending, without corresponding increases in productivity, can lead to higher demand and increased prices, thus driving inflation.

- Federal Reserve responses to inflationary pressures and their effect on interest rates: The Federal Reserve typically responds to rising inflation by raising interest rates, potentially slowing economic growth and impacting corporate profits.

- The impact of inflation on corporate earnings and stock valuations: High inflation erodes corporate profit margins, leading to lower earnings and reduced stock valuations. Companies struggle to pass increased costs to consumers, putting pressure on their bottom lines.

- How investors are adjusting their portfolios in response to inflation concerns: Investors are seeking assets that can hedge against inflation, such as commodities, inflation-protected securities, and real estate.

The interplay between government spending, inflation, and interest rate hikes is a significant driver of investor sentiment. Sectors particularly vulnerable to inflationary pressures, such as consumer staples and discretionary spending, are experiencing disproportionately negative impacts.

Political Uncertainty and Investor Sentiment

Political uncertainty plays a considerable role in shaping investor behavior and stock market performance. The current political climate is characterized by deep partisan divides, making it challenging to reach consensus on critical policy decisions.

- The impact of political gridlock on market confidence: Political gridlock creates uncertainty, hindering long-term economic planning and investment decisions.

- How partisan divides affect long-term economic planning and investment decisions: The inability to agree on fiscal policy creates a volatile and unpredictable environment for businesses and investors.

- The role of media coverage and public opinion in shaping market reactions: Media coverage of political events significantly impacts investor sentiment, often amplifying uncertainty and fear.

- Strategies for investors to navigate political uncertainty: Diversification, hedging strategies, and a long-term investment horizon are crucial during times of political uncertainty.

Political instability and a lack of clear policy direction contribute to market volatility. The "wait-and-see" approach adopted by many investors during periods of political uncertainty further exacerbates the downward pressure on stock prices.

Alternative Investment Strategies During Times of US Budget Concerns

Given the current climate of US budget concerns, investors should consider diversifying their portfolios to mitigate risks.

- Diversification into different asset classes (e.g., bonds, real estate): Diversifying across various asset classes can help reduce overall portfolio volatility and protect against losses in any single sector.

- Investing in inflation-protected securities: These securities offer protection against the erosive effects of inflation, providing a safer haven during periods of economic uncertainty.

- Exploring international markets to reduce dependence on the US economy: Investing in international markets can help reduce the impact of US-specific economic risks.

- Focus on value investing to find undervalued companies: Value investing strategies can identify companies whose stock prices may be trading below their intrinsic worth, offering potential for long-term growth.

By adopting a proactive approach and diversifying their investments, investors can potentially weather the current storm of US budget concerns more effectively.

Conclusion

The falling stock market is inextricably linked to growing anxiety over US budget concerns. The debt ceiling debate, inflationary pressures fueled by government spending, and pervasive political uncertainty all contribute to a volatile and unpredictable investment environment. Understanding the interplay between these factors is crucial for making informed investment decisions and managing risk. Staying informed about the evolving US budget situation and its impact on the economy is paramount. By monitoring developments closely and adjusting your investment strategy accordingly, you can navigate this period of US budget concerns more effectively.

Featured Posts

-

Julianne Moores Siren A First Look At Netflixs Dark Comedy

May 23, 2025

Julianne Moores Siren A First Look At Netflixs Dark Comedy

May 23, 2025 -

Londons Royal Albert Hall To Host Grand Ole Oprys First International Broadcast

May 23, 2025

Londons Royal Albert Hall To Host Grand Ole Oprys First International Broadcast

May 23, 2025 -

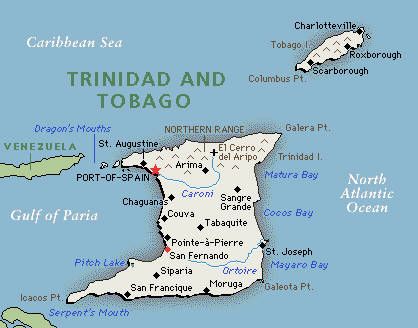

Trinidad And Tobago Trip Dancehall Artists Acceptance Of Visit Restrictions Amidst Kartels Support

May 23, 2025

Trinidad And Tobago Trip Dancehall Artists Acceptance Of Visit Restrictions Amidst Kartels Support

May 23, 2025 -

Tour De France Returns To Uk Edinburgh To Host 2027 Grand Depart

May 23, 2025

Tour De France Returns To Uk Edinburgh To Host 2027 Grand Depart

May 23, 2025 -

Cannes Underground Ticket Market How Much Does Access Really Cost

May 23, 2025

Cannes Underground Ticket Market How Much Does Access Really Cost

May 23, 2025

Latest Posts

-

Cambios En Daco Senado Aprueba A Valerie Rodriguez Como Nueva Secretaria

May 23, 2025

Cambios En Daco Senado Aprueba A Valerie Rodriguez Como Nueva Secretaria

May 23, 2025 -

Valerie Rodriguez Confirmada Como Secretaria De Daco Por El Senado

May 23, 2025

Valerie Rodriguez Confirmada Como Secretaria De Daco Por El Senado

May 23, 2025 -

Rodriguez Erazo Designada Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025

Rodriguez Erazo Designada Secretaria Del Departamento De Asuntos Del Consumidor

May 23, 2025 -

Cambios En El Daco Valerie Rodriguez Erazo En La Secretaria

May 23, 2025

Cambios En El Daco Valerie Rodriguez Erazo En La Secretaria

May 23, 2025 -

Senado Confirma A Valerie Rodriguez Como Secretaria De Daco Un Nuevo Capitulo Para El Consumidor Puertorriqueno

May 23, 2025

Senado Confirma A Valerie Rodriguez Como Secretaria De Daco Un Nuevo Capitulo Para El Consumidor Puertorriqueno

May 23, 2025