Federal Student Loan Refinancing: A Comprehensive Guide

Table of Contents

Understanding Federal Student Loan Refinancing

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan from a private lender. This is different from federal loan consolidation, which combines your existing federal loans into a single federal loan, usually without changing the interest rate. Refinancing your federal student loans means you're essentially taking out a new, private loan to pay off your existing federal debt.

- Refinancing replaces your existing federal loans with a new private loan. This means you'll have one monthly payment instead of potentially many.

- This new loan typically offers a lower interest rate and potentially more favorable repayment terms. A lower interest rate translates to substantial savings over the life of the loan.

- You lose federal loan benefits like income-driven repayment plans and potential forgiveness programs. This is a significant trade-off, so careful consideration is crucial.

Keywords: Federal student loan refinancing, private student loans, loan consolidation, interest rates, repayment terms, federal loan benefits.

Benefits of Refinancing Federal Student Loans

One of the primary benefits of refinancing federal student loans is the potential for significantly lower monthly payments. This can dramatically improve your cash flow and provide much-needed financial breathing room. Additionally, securing a lower interest rate can save you thousands of dollars over the life of your loan.

- Lower monthly payments can improve your cash flow. This allows you to allocate funds towards other financial goals, such as saving for a down payment on a house or investing.

- Reduced interest rates can save you thousands of dollars over the life of the loan. The interest savings can be substantial, especially over longer repayment periods.

- Potential for a shorter repayment term. While this may lead to higher monthly payments, it can result in paying off your loan faster and reducing the overall interest paid.

- Simplified repayment with a single monthly payment. Managing one payment instead of multiple is much more convenient.

Keywords: Lower monthly payments, lower interest rates, shorter repayment terms, save money, cash flow, student loan debt relief, student loan payment.

Drawbacks of Refinancing Federal Student Loans

While refinancing offers potential benefits, it's crucial to understand the drawbacks. The most significant disadvantage is the loss of federal student loan protections. These protections are valuable and shouldn't be taken lightly.

- Loss of federal student loan benefits (e.g., income-driven repayment, public service loan forgiveness). Income-driven repayment plans adjust your monthly payments based on your income, while public service loan forgiveness can forgive your debt after a certain number of qualifying payments. These are lost when you refinance.

- Higher interest rates are possible if your credit score is low. Lenders assess your creditworthiness, and a poor credit score can result in a higher interest rate than you might anticipate.

- Potential for penalties if you refinance and then experience financial hardship. Private lenders may not offer the same forbearance or deferment options as the federal government.

- Loss of access to federal loan forbearance and deferment options. These options provide temporary relief from payments during times of financial difficulty.

Keywords: Federal loan benefits, income-driven repayment, public service loan forgiveness, credit score, financial hardship, forbearance, deferment, private student loans, interest rate.

How to Choose the Right Federal Student Loan Refinancing Lender

Choosing the right lender is critical to securing the best rates and terms. Take your time, compare options thoroughly, and don't rush the decision.

- Check lenders' reputation and reviews. Read online reviews and check with the Better Business Bureau to assess the lender's trustworthiness.

- Compare interest rates, fees, and repayment terms from multiple lenders. Don't settle for the first offer you receive. Shop around and compare offers from several lenders.

- Understand the lender's eligibility requirements. Make sure you meet the lender's criteria before applying to avoid wasted time and effort.

- Read the fine print carefully before signing any documents. Understand all terms and conditions before committing to a loan.

Keywords: Student loan refinancing lenders, compare rates, best rates, fees, eligibility requirements, lender reviews, student loan refinancing options.

The Refinancing Process: A Step-by-Step Guide

Refinancing federal student loans involves several steps. Be prepared and organized to streamline the process.

- Check your credit score and report. A higher credit score typically qualifies you for better interest rates.

- Gather necessary documentation. This may include pay stubs, tax returns, and your student loan information.

- Compare lenders and choose one. Use online comparison tools and carefully review lender offerings.

- Complete the application process. Follow the lender's instructions carefully and provide all necessary information.

- Review and sign the loan documents. Thoroughly review the loan agreement before signing.

- Receive loan disbursement. Once approved, the lender will disburse the funds to pay off your existing federal loans.

Keywords: Application process, loan disbursement, credit report, documentation, student loan refinancing application, student loan refinancing process.

Conclusion

Federal student loan refinancing can be a powerful tool for managing your student loan debt, potentially leading to lower monthly payments and significant long-term savings. However, it's crucial to weigh the benefits against the potential loss of federal protections before making a decision. Carefully compare lenders, understand the terms, and ensure refinancing aligns with your financial goals. Make an informed choice about whether federal student loan refinancing is the right strategy for your unique situation. Don't hesitate to seek professional financial advice if you're unsure. Start exploring your federal student loan refinancing options today and take control of your student loan debt.

Featured Posts

-

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025

Nba Playoffs Knicks Vs Pistons Bet365 Bonus Code Nypbet And Betting Preview

May 17, 2025 -

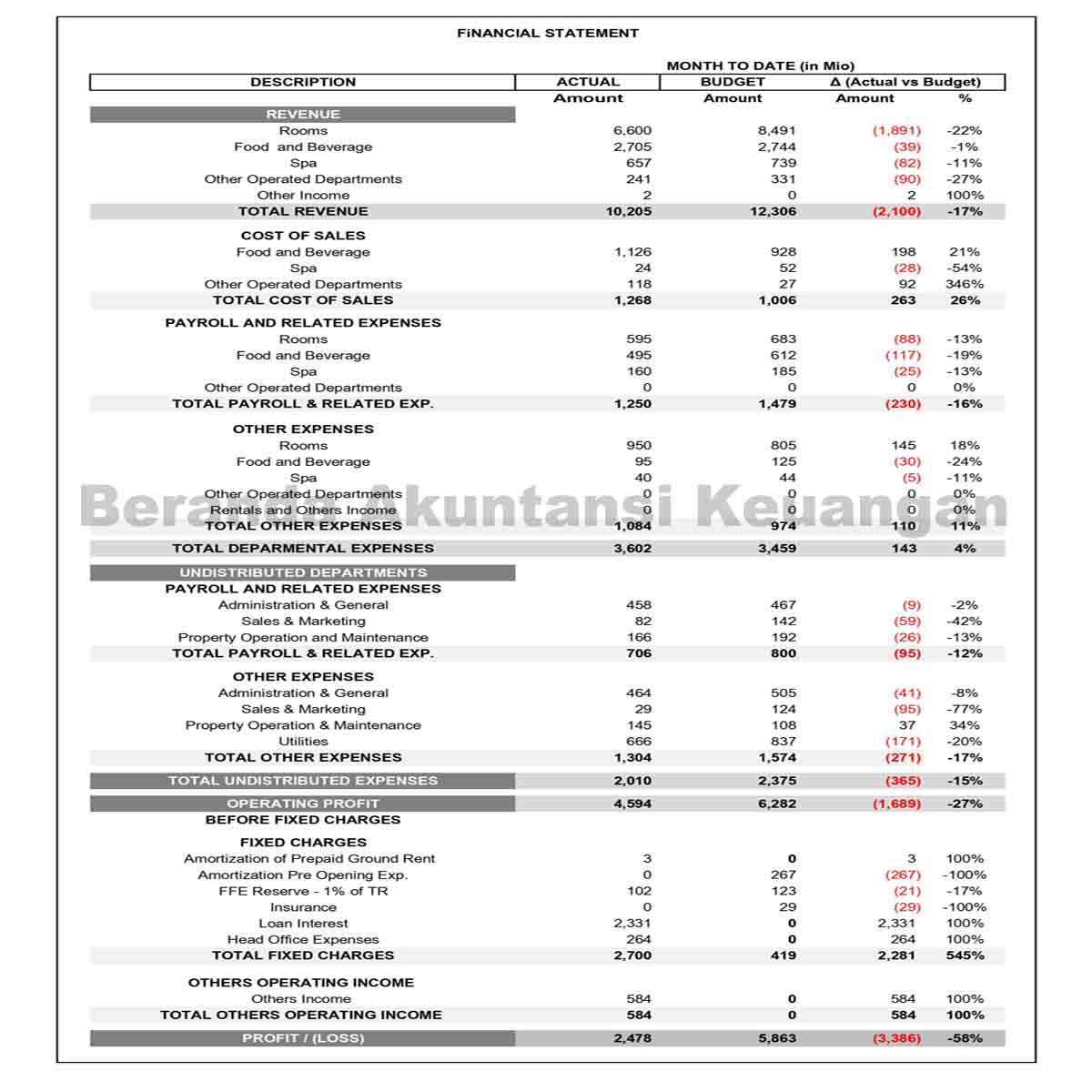

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025 -

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025

Luxury Real Estate A Recession Proof Investment For High Net Worth Individuals

May 17, 2025 -

Prestamos Estudiantiles Impagados El Departamento De Educacion Actua

May 17, 2025

Prestamos Estudiantiles Impagados El Departamento De Educacion Actua

May 17, 2025 -

Toronto Tempos Latest Announcements A Wnba Franchise On The Rise

May 17, 2025

Toronto Tempos Latest Announcements A Wnba Franchise On The Rise

May 17, 2025