Financial Assistance For Sustainable Practices In SMEs

Table of Contents

Government Grants and Subsidies for Green Initiatives

Governments at national and regional levels recognize the importance of supporting SMEs in their sustainability journey. Many offer substantial financial assistance through various grant programs and subsidies specifically designed for green initiatives. These SME sustainability grants often target specific areas like energy efficiency upgrades, waste reduction strategies, and the adoption of renewable energy sources.

- Types of Government Programs: These programs can vary widely, offering funding for everything from installing solar panels to implementing sustainable supply chain management. Some focus on specific industries, while others have broader eligibility criteria.

- Examples of Grant Programs: (Note: Specific examples would need to be tailored to the target region/country. For example, in the US, you might mention the Small Business Administration (SBA) grants or state-level programs. In the UK, you could highlight Innovate UK grants or regional development agency initiatives). Always check government websites for the most up-to-date information.

- Eligibility Criteria, Application Processes, and Funding Amounts: Eligibility criteria vary depending on the program, but often include factors like business size, industry, and the nature of the proposed sustainable project. Application processes typically involve submitting a detailed proposal outlining the project's goals, budget, and expected impact. Funding amounts can range from a few thousand to hundreds of thousands of dollars or pounds, depending on the program and the project’s scale.

- Relevant Government Websites and Resources: Regularly check your national and regional government websites for details on available green grants and government funding for sustainable business.

Low-Interest Loans and Green Financing Options

Securing funding for sustainable investments doesn't always rely solely on grants. Many financial institutions now offer green loans and other innovative financing options specifically designed for SMEs seeking to improve their environmental performance. These often come with lower interest rates than traditional business loans, reflecting the reduced risk associated with sustainable investments.

- Low-Interest Loans: These loans often have more favorable terms than standard business loans, making sustainable investments more financially accessible. Banks and other lenders are increasingly recognizing the long-term benefits of supporting green initiatives.

- Green Bonds and Other Innovative Financing Mechanisms: Green bonds are debt securities specifically issued to raise capital for climate-friendly projects. They’re becoming increasingly popular as a way for businesses to access significant funding for sustainable initiatives. Other innovative financing mechanisms, such as sustainable finance initiatives, are also emerging.

- Advantages and Disadvantages of Different Financing Options:

- Advantages: Lower interest rates, longer repayment periods, potential for tax benefits.

- Disadvantages: Still requires repayment, might require collateral, application processes can be complex.

Impact Investing and Venture Capital for Sustainability

The rise of ESG investing (Environmental, Social, and Governance) has opened doors for SMEs focused on sustainability. Impact investing and venture capital are increasingly targeting businesses with a strong commitment to environmental and social responsibility.

- Impact Investors and Venture Capitalists: These investors are not just looking for financial returns; they also seek positive social and environmental impact. This makes them particularly interested in businesses demonstrating clear sustainability goals and measurable results.

- Sustainable Initiatives that Attract Impact Investment: Businesses focusing on renewable energy, sustainable agriculture, waste reduction, and circular economy models are particularly attractive to impact investors.

Tax Incentives and Rebates for Sustainable Practices

Many governments offer substantial tax credits for sustainability and other tax incentives for green businesses to encourage the adoption of sustainable practices. These incentives can significantly reduce the upfront costs of implementing green technologies and strategies.

- Tax Breaks and Incentives: These can take many forms, including tax deductions for energy-efficient equipment, tax credits for renewable energy installations, and rebates for waste reduction programs.

- Examples of Tax Deductions or Credits: (Specific examples would need to be regionally tailored. Consult your local tax authority for details.)

- Reducing the Financial Burden: Sustainable business tax breaks can make a considerable difference in the overall cost of sustainability projects, making them more financially viable for SMEs.

Crowdfunding and Community Funding for Sustainable Projects

Crowdfunding presents a powerful alternative to traditional financing for sustainable initiatives. Platforms like Kickstarter and Indiegogo allow SMEs to raise capital directly from the public by appealing to consumers who share their values.

- Potential of Crowdfunding Platforms: Crowdfunding campaigns can generate excitement and build brand awareness while simultaneously raising funds. Successful campaigns often tap into a sense of community and shared purpose.

- Successful Examples: (Include examples of SMEs successfully using crowdfunding for sustainability projects.)

- Building a Compelling Crowdfunding Campaign: A successful campaign requires a clear and compelling narrative outlining the project's purpose, impact, and rewards for backers.

Conclusion: Securing Financial Assistance for Your Sustainable SME

Securing financial assistance for sustainable practices in SMEs is no longer a luxury; it's a necessity for long-term competitiveness and success. This article highlights various pathways to access funding, including government grants and subsidies, low-interest loans, tax incentives, impact investing, and crowdfunding. By exploring these options, SMEs can significantly reduce the financial barriers to implementing sustainable practices and contribute to a greener future while boosting their bottom line. Start exploring the available resources today by visiting your national or regional government websites dedicated to sustainable business funding or contacting a financial advisor specializing in green initiatives. Take the first step toward a more sustainable and profitable future for your SME.

Featured Posts

-

Eurovision Song Contest 2025 Where And When Will The Show Take Place

May 19, 2025

Eurovision Song Contest 2025 Where And When Will The Show Take Place

May 19, 2025 -

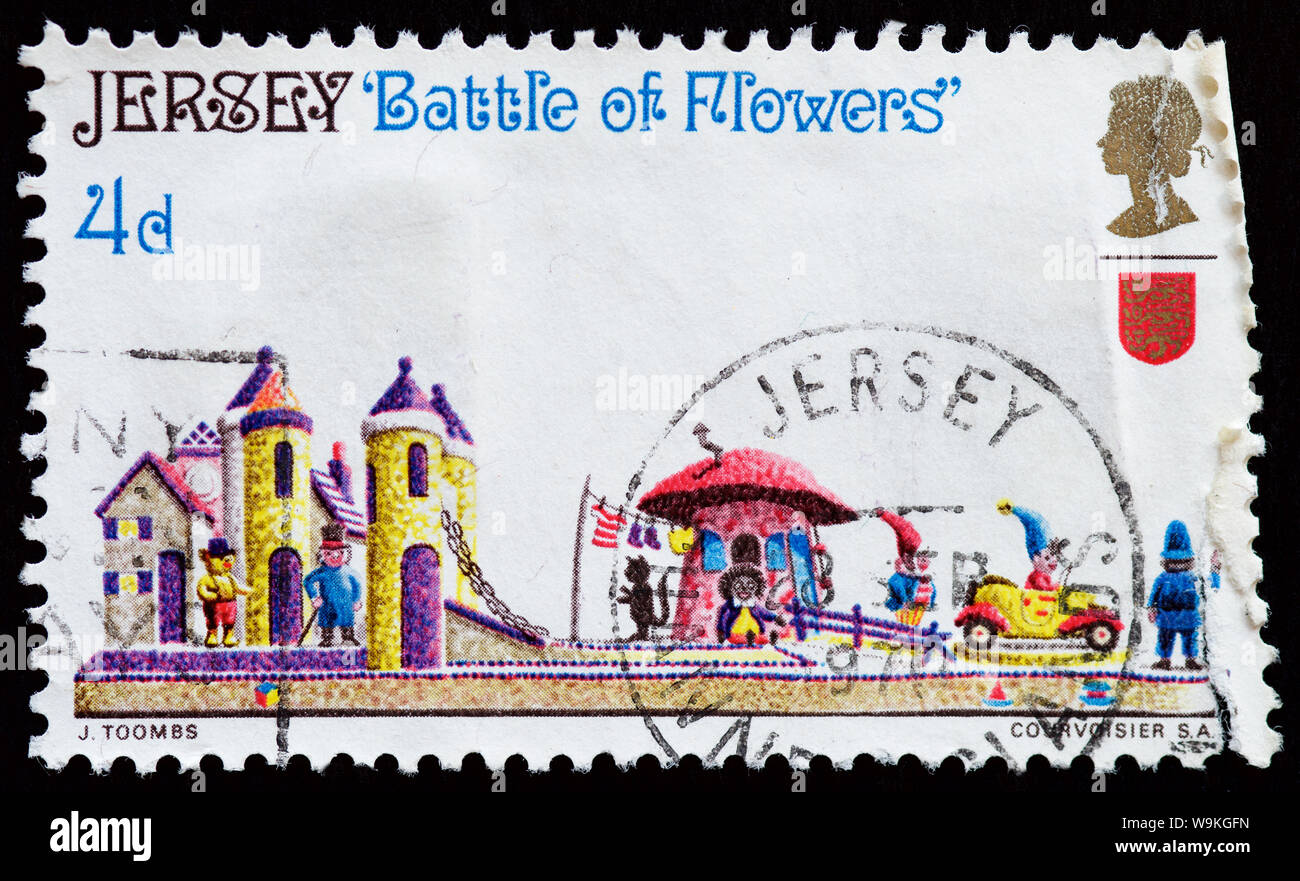

A Determined Effort Preserving The Jersey Battle Of Flowers Tradition

May 19, 2025

A Determined Effort Preserving The Jersey Battle Of Flowers Tradition

May 19, 2025 -

Tonawanda Worker Faces Charges For Providing Drugs To Colleague

May 19, 2025

Tonawanda Worker Faces Charges For Providing Drugs To Colleague

May 19, 2025 -

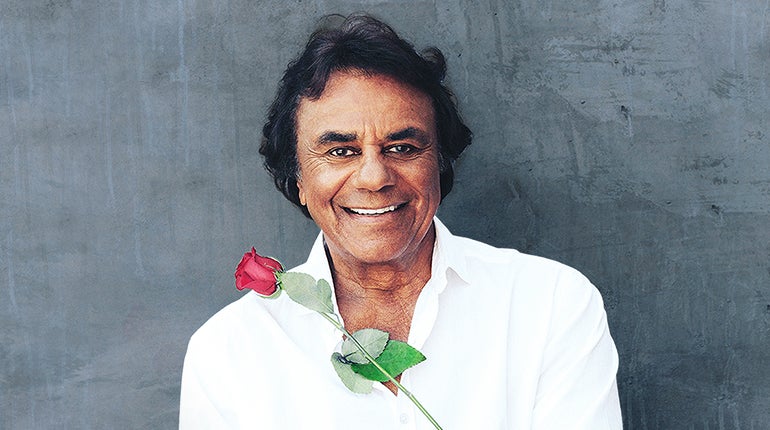

End Of An Era Johnny Mathis Retires From Live Concerts

May 19, 2025

End Of An Era Johnny Mathis Retires From Live Concerts

May 19, 2025 -

Eurovision 2025 Luca Haennis Role Revealed

May 19, 2025

Eurovision 2025 Luca Haennis Role Revealed

May 19, 2025