Financial Fallout: The IMF's Assessment Of Trump's Trade War

Table of Contents

The IMF's Criticism of the Trump Trade War

The IMF consistently criticized the Trump administration's trade policies, highlighting their detrimental effects on global economic stability and multilateral trade cooperation.

Increased Trade Tensions and Protectionism

The IMF expressed deep concern over the escalating trade tensions and the rise of protectionist measures. The imposition of tariffs, often met with retaliatory measures from affected countries, created a climate of uncertainty and instability.

- Examples: The 25% tariff on steel and aluminum imports, tariffs on hundreds of billions of dollars worth of Chinese goods, and subsequent retaliatory tariffs from China significantly disrupted global supply chains.

- Impact: This disruption led to increased production costs, reduced consumer choice, and a decline in investor confidence, impacting global trade significantly. IMF reports consistently showed a negative correlation between increased tariffs and global trade volume.

Negative Impact on Global Growth

The IMF's assessments consistently showed that the trade war significantly hampered global economic growth. Reduced trade flows, coupled with increased uncertainty, led to a contraction in global GDP growth.

- GDP Projections: The IMF's World Economic Outlook reports repeatedly downgraded global GDP growth projections due to the trade war's negative impact. For instance, [cite specific IMF report and data points].

- Reduced Investment and Spending: The uncertainty created by the trade war discouraged both business investment and consumer spending, further dampening economic activity. Charts illustrating this decline in investment and consumer confidence can be found in [cite source].

Damage to Multilateral Trade Agreements

The Trump administration's actions severely undermined the multilateral trading system and weakened institutions like the World Trade Organization (WTO).

- WTO Challenges: The frequent use of unilateral tariffs and the undermining of the WTO's dispute settlement system significantly eroded trust in the rules-based international trade order. [Cite specific examples and reports].

- Erosion of Global Governance: The trade war demonstrated a retreat from multilateralism, creating a precedent for other countries to pursue protectionist policies, potentially leading to a further fragmentation of global trade.

Specific Sectors Affected by the Trade War Fallout

The impact of the Trump trade war was felt across various sectors, with some experiencing more significant repercussions than others.

Agriculture

The agricultural sector was particularly hard hit, with farmers and exporters facing substantial losses due to retaliatory tariffs imposed by trading partners.

- Specific Examples: Soybean farmers in the US faced significant losses due to Chinese tariffs. [Cite data on export volume and price changes]. Similar impacts were seen in other agricultural products and regions.

- Impact on Farmers' Incomes: The decline in export markets and reduced prices significantly impacted farmers' incomes, leading to financial hardship and job losses in rural communities.

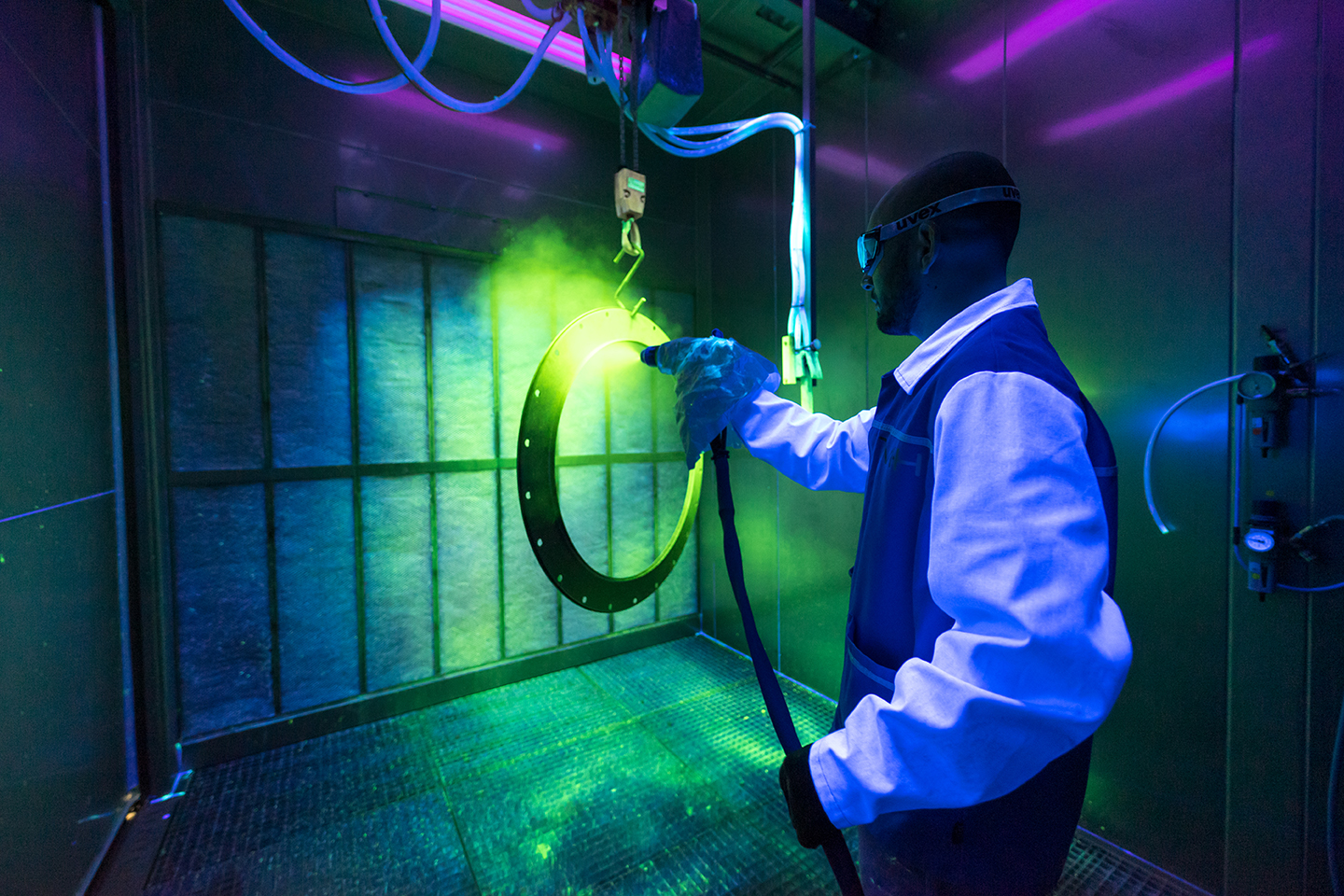

Manufacturing

The manufacturing sector also suffered considerably, experiencing disruptions to supply chains and reduced competitiveness.

- Supply Chain Disruptions: Tariffs and retaliatory measures led to significant delays and increased costs in global supply chains, impacting production schedules and profitability.

- Job Losses: The trade war contributed to job losses in specific manufacturing sectors, particularly those heavily reliant on international trade. [Cite data on manufacturing job losses in affected countries]. Charts illustrating this decline can be found in [cite source].

Technology

The technology sector was not immune to the effects of the trade war, with trade restrictions impacting the production and sale of semiconductors and other vital technology products.

- Impact on Semiconductors: Trade tensions between the US and China, particularly concerning semiconductors, disrupted global supply chains and raised concerns about technological innovation. [Cite specific examples and industry reports].

- Consequences for Innovation: Increased costs and uncertainties associated with the trade war hampered investment in research and development, potentially hindering technological advancement.

Long-Term Economic Consequences of the Trump Trade War

The Trump trade war's effects extend beyond the immediate economic impact, creating lasting consequences for global trade and economic stability.

Uncertainty and Investor Sentiment

The unpredictable nature of the trade war created significant uncertainty in global markets, negatively affecting investor confidence.

- Stock Market Fluctuations: The imposition of tariffs and retaliatory measures often led to significant fluctuations in global stock markets, reflecting investor anxieties. [Cite data on market volatility].

- Foreign Direct Investment (FDI) Flows: Uncertainty surrounding trade policies discouraged foreign direct investment, impacting long-term economic growth prospects. [Cite data on FDI flows before and during the trade war].

Potential for Future Trade Conflicts

The Trump trade war's legacy includes increased trade protectionism and a heightened risk of future trade conflicts.

- Increased Protectionism: The trade war set a precedent, potentially emboldening other countries to adopt protectionist measures, exacerbating global trade tensions.

- Escalation of Trade Conflicts: The experience of the Trump trade war demonstrated the potential for seemingly minor trade disputes to escalate into broader and more damaging conflicts. [Discuss potential future trade conflicts based on current geopolitical tensions].

Conclusion

The IMF's assessment of the Trump trade war's financial fallout paints a clear picture of significant negative consequences for the global economy. Decreased global growth, damage to international trade institutions, and negative impacts across multiple sectors, from agriculture to technology, underscore the severe repercussions of protectionist trade policies. The uncertainty and the potential for future trade conflicts add to the long-term economic risks. Understand the lasting effects of the Trump trade war by delving deeper into the IMF's assessment of the impact of this period. Learn more about the IMF's analysis of financial fallout from protectionist trade policies by exploring their publications and reports available on their website [link to IMF website].

Featured Posts

-

Broadcoms Proposed V Mware Price Hike An Extreme Cost Increase For At And T

Apr 23, 2025

Broadcoms Proposed V Mware Price Hike An Extreme Cost Increase For At And T

Apr 23, 2025 -

Mtabet Asear Aldhhb Ser Sbykt 10 Jramat Fy Swq Alsaght Alathnyn 17 2 2025

Apr 23, 2025

Mtabet Asear Aldhhb Ser Sbykt 10 Jramat Fy Swq Alsaght Alathnyn 17 2 2025

Apr 23, 2025 -

Cortes Stellar Performance Fuels Yankees Win Extends Reds Losing Streak

Apr 23, 2025

Cortes Stellar Performance Fuels Yankees Win Extends Reds Losing Streak

Apr 23, 2025 -

Bu Aksamki Diziler 17 Subat Pazartesi Televizyon Programi

Apr 23, 2025

Bu Aksamki Diziler 17 Subat Pazartesi Televizyon Programi

Apr 23, 2025 -

Pascal Boulanger Le Role De La Fpi Dans Le Secteur Immobilier Francais

Apr 23, 2025

Pascal Boulanger Le Role De La Fpi Dans Le Secteur Immobilier Francais

Apr 23, 2025