Financial Hardship: Practical Steps To Manage Lack Of Funds

Table of Contents

Creating a Realistic Budget

Effective money management begins with a solid understanding of your finances. This involves carefully tracking your spending, identifying essential versus non-essential expenses, and setting achievable financial goals.

Tracking Your Spending

Monitoring your income and expenses is crucial for identifying areas of overspending. You can use several methods:

- Budgeting Apps: Mint, YNAB (You Need A Budget), and Personal Capital offer automated tracking and insightful reports.

- Spreadsheets: Excel or Google Sheets allow for customized tracking and analysis of your financial data.

- Journals: A simple notebook can be effective for manually tracking income and expenses.

Categorize your expenses (housing, food, transportation, utilities, entertainment, etc.) to gain a clear picture of where your money is going. This detailed analysis will highlight areas where you can potentially reduce spending.

Identifying Essential vs. Non-Essential Expenses

Distinguishing between needs and wants is key to effective budgeting.

- Essential Expenses: These are necessary for survival and well-being, such as rent/mortgage, utilities, groceries, transportation, and healthcare.

- Non-Essential Expenses: These are discretionary spending, like dining out, entertainment, subscriptions, and luxury items.

Strategies for cutting back on non-essentials include:

- Reducing dining out: Cook at home more frequently.

- Cutting subscriptions: Cancel unused streaming services or memberships.

- Finding cheaper alternatives: Explore less expensive options for entertainment and shopping.

Setting Realistic Financial Goals

Setting both short-term and long-term financial goals provides direction and motivation.

- Short-Term Goals (within 1 year): Paying off a credit card, building an emergency fund, saving for a vacation.

- Long-Term Goals (more than 1 year): Saving for a down payment on a house, paying off student loans, investing for retirement.

Exploring Options for Increasing Income

Increasing your income can significantly alleviate financial hardship. Consider these options:

Seeking Additional Employment

Supplementing your current income with part-time work can make a substantial difference.

- Part-Time Jobs: Explore opportunities in retail, customer service, or hospitality.

- Freelance Work: Offer your skills (writing, editing, design, programming) on platforms like Upwork or Fiverr.

- Gig Economy Opportunities: Drive for ride-sharing services, deliver food, or participate in other on-demand work.

Websites like Indeed, LinkedIn, and Monster can help you find extra work opportunities. Negotiate your rates effectively and maximize your earnings by focusing on high-demand skills.

Negotiating a Raise or Promotion

If you're employed, consider negotiating a raise or promotion.

- Highlight accomplishments: Document your contributions and successes within your current role.

- Research industry standards: Understand the average salary for similar roles in your area.

- Prepare a compelling case: Clearly articulate your value to the company and justify your request.

Selling Unused Assets

Decluttering your home and selling unwanted items can generate extra cash.

- Online Marketplaces: eBay, Craigslist, Facebook Marketplace, and OfferUp are popular platforms for selling used goods.

- Consignment Shops: Consider consignment shops for clothing, furniture, or electronics.

Pricing your items competitively is crucial for attracting buyers. Research comparable listings to determine fair market value.

Managing Existing Debt

Effectively managing existing debt is vital for overcoming financial hardship.

Contacting Creditors

Communicating with your creditors is crucial. You may be able to negotiate:

- Payment Plans: Work with creditors to establish a more manageable payment schedule.

- Debt Consolidation: Combine multiple debts into a single loan with potentially lower interest rates.

Understand your rights as a debtor and explore all available options. Debt consolidation can simplify payments but may not always be the best solution; carefully consider the terms and conditions.

Prioritizing Debt Payments

Prioritize high-interest debt to minimize long-term costs. Two common methods are:

- Avalanche Method: Pay off the debt with the highest interest rate first, regardless of balance.

- Snowball Method: Pay off the debt with the smallest balance first, regardless of interest rate, to build momentum and motivation.

Consider the pros and cons of each method and choose the one best suited to your circumstances.

Avoiding Further Debt

Prevent accumulating more debt by:

- Creating a debt repayment plan: Establish a clear plan to systematically eliminate your debt.

- Building good credit habits: Pay bills on time, keep credit utilization low, and avoid unnecessary borrowing.

Seeking Financial Assistance

Numerous resources can provide financial assistance during periods of hardship.

Government Programs and Benefits

Several government programs offer financial aid to those in need. Eligibility requirements vary; research programs specific to your location.

- Food Stamps (SNAP): Provides food assistance to low-income individuals and families.

- Housing Assistance: Programs like Section 8 provide rental assistance.

- Unemployment Benefits: Provides temporary financial support to those who have lost their jobs.

Research government websites and local resources to find relevant programs and understand the application process.

Non-Profit Organizations and Charities

Local non-profit organizations and charities often provide financial assistance. Search online for organizations in your area or contact local community centers for referrals.

Credit Counseling Services

Credit counseling agencies offer professional guidance on debt management, budgeting, and financial literacy. They can help you create a realistic budget, negotiate with creditors, and develop a plan for long-term financial stability. Ensure you choose a reputable agency.

Conclusion

Managing financial hardship requires a multifaceted approach. By creating a realistic budget, exploring options to increase income, effectively managing existing debt, and seeking available assistance, you can regain control of your finances and build a path towards financial stability. Remember, proactive steps and maintaining a positive attitude are essential. Start managing your financial hardship today by taking the first step: creating a budget, exploring additional income streams, or contacting a credit counselor. Take control of your finances and begin your journey to financial stability. Remember to utilize the resources listed above to find the support you need.

Featured Posts

-

Market Analysis Core Weave Inc Crwv Stock Performance On Tuesday

May 22, 2025

Market Analysis Core Weave Inc Crwv Stock Performance On Tuesday

May 22, 2025 -

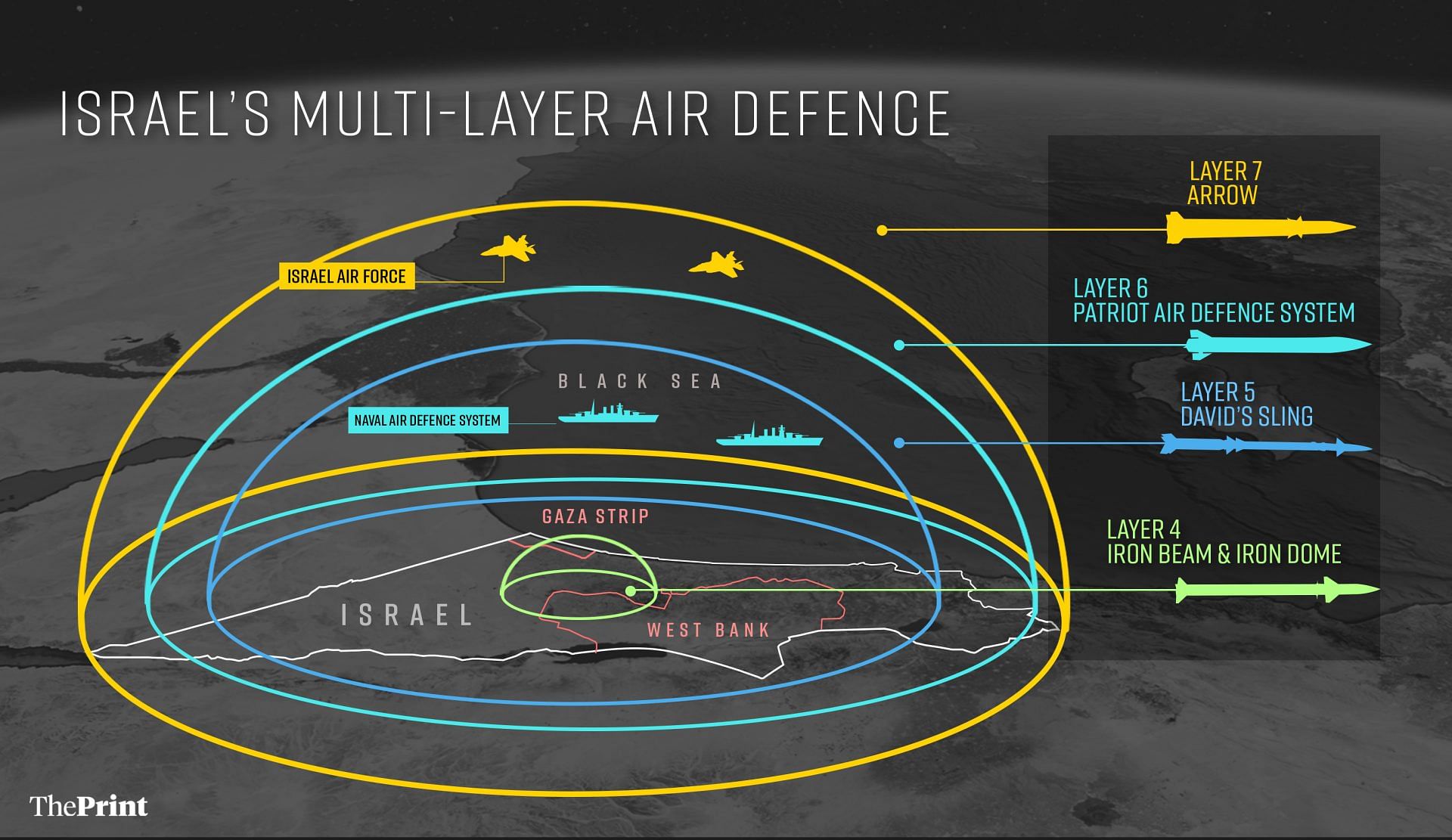

Trumps Golden Dome A Realistic Missile Defense Strategy

May 22, 2025

Trumps Golden Dome A Realistic Missile Defense Strategy

May 22, 2025 -

New Shows On Teletoon Pinata Smashling And Jellystone Arrive This Spring

May 22, 2025

New Shows On Teletoon Pinata Smashling And Jellystone Arrive This Spring

May 22, 2025 -

The Monetization Of Streaming Implications For Content Creation And Viewer Experience

May 22, 2025

The Monetization Of Streaming Implications For Content Creation And Viewer Experience

May 22, 2025 -

Shpani A Go Osvoi Tronot Vo Ln Khrvatska Porazena So Penali

May 22, 2025

Shpani A Go Osvoi Tronot Vo Ln Khrvatska Porazena So Penali

May 22, 2025