Financial Losses Of Tech Titans: Musk, Bezos, And Zuckerberg Post-2017

Table of Contents

Elon Musk's Financial Rollercoaster

Elon Musk's financial journey since 2017 has been nothing short of a rollercoaster. His net worth, largely tied to Tesla's stock performance, has seen dramatic swings, highlighting the inherent risks of heavily investing in volatile tech stocks.

Tesla Stock Volatility

Tesla's stock performance since 2017 has been a major driver of Musk's fluctuating net worth.

- 2018-2019: Experienced significant stock price drops amidst production challenges and controversies.

- 2020-2021: A meteoric rise fueled by strong sales and increasing investor confidence.

- 2022-Present: A period of considerable volatility, reflecting broader market trends and concerns about the company's valuation.

These fluctuations directly correlate with Musk's often controversial tweets, which have been known to impact Tesla's stock price dramatically. While some attribute his outspoken nature to his success, it's undeniably contributed to periods of significant financial loss for him personally. Estimates indicate a percentage loss in net worth reaching double-digits during these periods of decline.

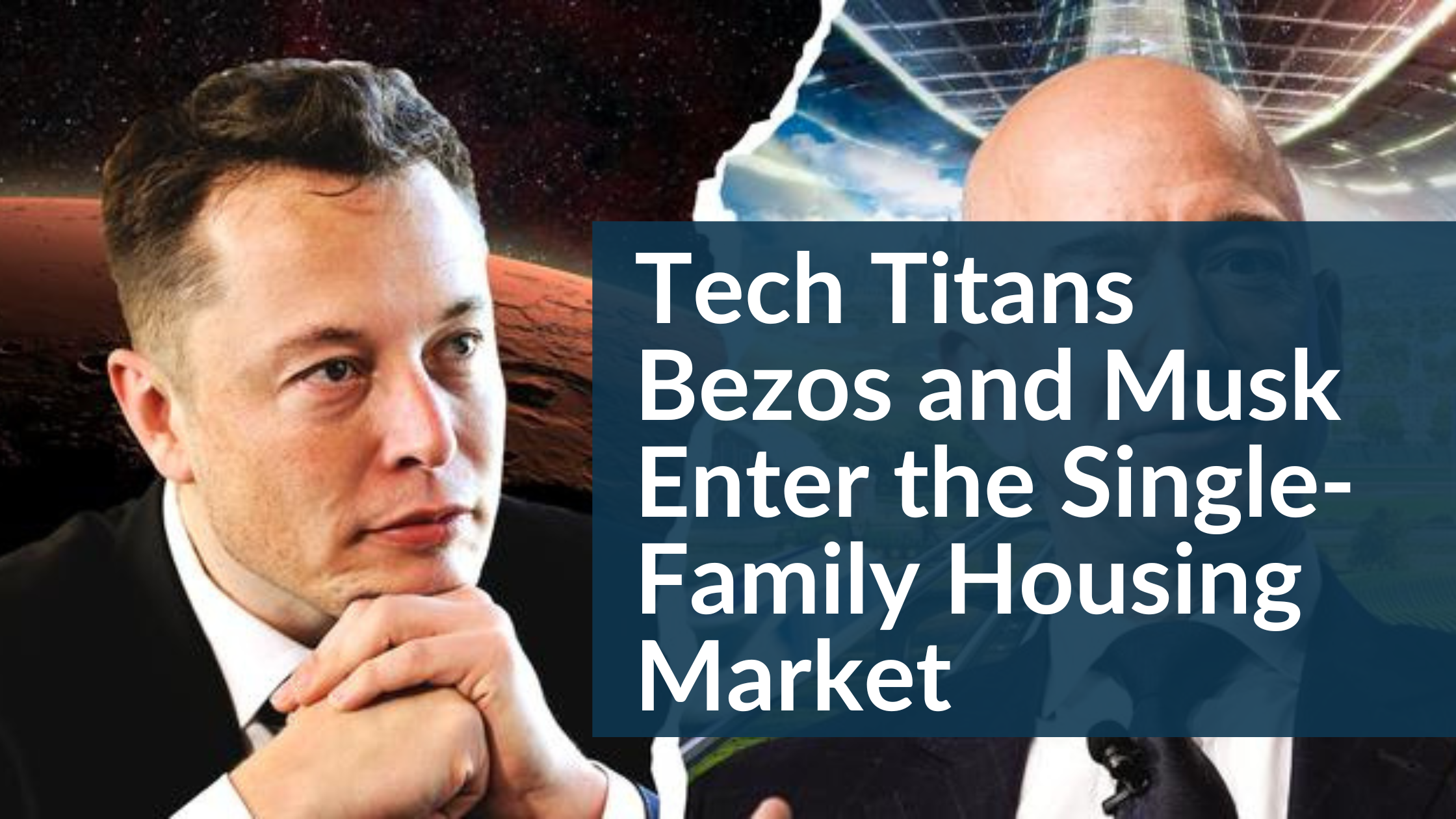

SpaceX Investments and Challenges

SpaceX, Musk's ambitious space exploration company, represents another significant aspect of his financial landscape. While SpaceX has secured lucrative contracts and achieved remarkable technological feats, its large-scale investments in reusable rockets and ambitious projects like Starship carry substantial financial risks.

- Massive investments in research and development represent significant ongoing costs.

- The ambitious nature of Starship, including potential launch failures, represents a financial burden.

- Future profitability relies heavily on continued government contracts and commercial space ventures.

Publicly available data on SpaceX's financials remains limited, making a precise assessment of its financial impact on Musk's overall net worth challenging.

Twitter Acquisition and its Financial Fallout

The acquisition of Twitter (now X) in 2022 represents a pivotal moment in Musk's financial history. The hefty acquisition cost, coupled with ongoing operational expenses and debt incurred, significantly impacted his personal finances.

- The purchase price alone placed a considerable strain on his resources.

- Subsequent layoffs and restructuring efforts, while intended to improve profitability, faced criticism.

- The high debt incurred to fund the acquisition presents long-term financial implications.

Analysts estimate the Twitter acquisition alone resulted in a substantial reduction in Musk's overall net worth.

Jeff Bezos' Post-Amazon Diversification

Jeff Bezos, after stepping down as CEO of Amazon, has pursued a strategy of diversification. While Amazon’s stock performance has largely remained positive, his personal investments outside the e-commerce giant have yielded mixed results, impacting his overall net worth.

Amazon Stock Performance and Diversification Strategy

Amazon's stock performance post-2017 has been generally positive, but not without periods of correction. Bezos' diversification into Blue Origin and other ventures has influenced his overall wealth, although the extent remains largely unknown due to a lack of transparent reporting on the financial performance of Blue Origin.

- Amazon stock has outperformed many other tech companies but experienced periods of fluctuation.

- Bezos' diversification into Blue Origin, real estate, and other ventures represents a strategic move away from total reliance on Amazon's success.

- The profitability of his investments outside Amazon varies significantly, making it difficult to determine their exact impact.

Blue Origin's Financial Landscape

Blue Origin, Bezos' space exploration company, represents a significant financial undertaking with uncertain long-term returns.

- The high costs associated with space exploration are a well-known factor.

- The development of reusable launch vehicles represents a long-term investment with high initial costs.

- The return on investment depends significantly on securing future contracts and successful commercial space missions.

The limited public information on Blue Origin's financial status makes a complete assessment of its influence on Bezos's net worth difficult.

Mark Zuckerberg's Metamorphosis and Financial Shifts

Mark Zuckerberg's financial story since 2017 is largely defined by Meta's (formerly Facebook) stock performance and its significant investment in the Metaverse.

Meta's Stock Price Decline and the Metaverse Bet

Meta's stock price has experienced a significant decline since 2021, largely attributed to the substantial investment in the Metaverse and increasing competition in the social media space. This directly impacts Zuckerberg's net worth.

- The massive investment in the Metaverse has yet to deliver substantial returns, impacting profitability.

- Changing market sentiment and regulatory concerns have affected Meta's overall valuation.

- Increased competition from other social media platforms has put pressure on Meta's user growth and advertising revenue.

Data on Meta's stock price decline clearly shows a significant impact on Zuckerberg's net worth.

Other Meta Investments and Ventures

Beyond the Metaverse, Meta continues to invest in various projects and acquisitions. While some have proven successful, others have faced setbacks, contributing to the overall financial picture.

- Investments in augmented reality (AR) and virtual reality (VR) technologies continue.

- Acquisitions and internal development of new technologies are ongoing.

- The financial success of these ventures will play a crucial role in shaping Meta's, and Zuckerberg's, future financial standing.

Conclusion

This analysis of the financial trajectories of Elon Musk, Jeff Bezos, and Mark Zuckerberg since 2017 reveals a complex picture of significant market fluctuations, high-risk ventures, and the inherent volatility of the tech industry. While all three have experienced substantial financial losses in various aspects of their business empires, their resilience and continued investment in innovative projects underscore their enduring influence on the global technological landscape. These financial losses, while substantial, don't diminish their impact on the tech world.

Call to Action: Want to stay updated on the financial fortunes of these tech titans and other influential figures? Subscribe to our newsletter for regular insights on the financial losses and gains of leading tech personalities and stay informed on the ever-evolving world of tech investments. Learn more about the financial losses of tech giants!

Featured Posts

-

Aoc Vs Fox News A Breakdown Of The Recent Trump Criticism

May 10, 2025

Aoc Vs Fox News A Breakdown Of The Recent Trump Criticism

May 10, 2025 -

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025

Transznemu No Letartoztatasa Floridaban Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025 -

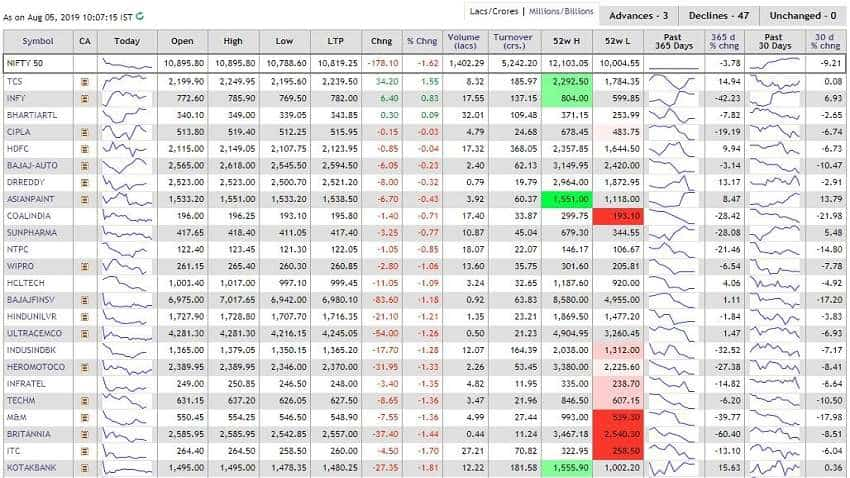

600 Sensex Nifty

May 10, 2025

600 Sensex Nifty

May 10, 2025 -

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025 -

Young Thug Addresses Not Like U Name Drop Following Prison Release

May 10, 2025

Young Thug Addresses Not Like U Name Drop Following Prison Release

May 10, 2025