Financial Mistakes Women Should Avoid

Table of Contents

Underestimating the Importance of Retirement Planning

The gender retirement gap is a significant concern, stemming from various factors that disproportionately affect women. Proactive retirement planning is not just important; it's essential for a comfortable and secure future.

The Gender Retirement Gap:

The disparity in retirement savings between men and women is substantial. Several factors contribute to this gap:

- Lower lifetime earnings: The persistent gender pay gap means women often earn less than their male counterparts over their careers, leading to less money available for savings.

- Career breaks for childcare: Many women take time off work to raise children, impacting their earning potential and reducing their contributions to retirement savings.

- Longer lifespans: Women generally live longer than men, meaning their retirement savings need to last longer.

To bridge this gap, women must prioritize retirement planning early and aggressively. Utilize tools like retirement calculators and investment apps to project your needs and track your progress. Maximize employer-sponsored retirement plans like 401(k)s, taking full advantage of employer matching contributions – it's essentially free money! Consider exploring Roth IRAs and traditional IRAs to further boost your retirement savings.

Ignoring Debt Management

High levels of debt can significantly hinder financial progress, preventing women from saving and investing for the future. Effective debt management is crucial for long-term financial health.

High-Interest Debt Traps:

Credit card debt and payday loans carry exorbitant interest rates that can quickly spiral out of control. Employ strategies like the debt snowball method (paying off smallest debts first for motivation) or the debt avalanche method (paying off highest-interest debts first for cost savings) to tackle your debts systematically.

- Strategies for debt consolidation: Explore options to consolidate high-interest debts into lower-interest loans.

- Budgeting tips to reduce spending: Create a detailed budget to identify areas where you can cut expenses and allocate more funds towards debt repayment.

- Importance of creating a debt repayment plan: Develop a realistic plan, outlining how much you'll pay each month and when you expect to be debt-free. Consider seeking assistance from credit counseling services.

Student Loan Repayment Strategies:

Student loans can significantly impact long-term financial goals. Explore different repayment options to manage your debt effectively:

- Consolidating student loans: Combining multiple loans into a single loan can simplify repayment and potentially lower your interest rate.

- Refinancing options: Refinancing your student loans might secure a lower interest rate, saving you money over time.

- Strategies to accelerate repayment: Explore ways to increase your monthly payments to pay off your loans faster.

Remember, resources for credit counseling and debt management are available; don't hesitate to seek professional help.

Neglecting Financial Literacy and Education

A lack of financial knowledge can lead to costly mistakes. Empowering yourself with financial literacy is an essential step toward securing your financial future.

Understanding Basic Financial Concepts:

Mastering fundamental financial concepts is crucial for making informed decisions.

- Resources for financial education: Utilize numerous free and paid resources like online courses, books, workshops, and podcasts dedicated to financial literacy.

- Seeking professional financial advice: Don't hesitate to seek professional guidance from a financial advisor, particularly when dealing with complex financial matters like investment strategies or estate planning.

The Power of Investing:

Investing is a powerful tool for wealth creation, particularly in the long term.

- Different investment options: Explore diverse investment options, including mutual funds, index funds, and ETFs (Exchange Traded Funds), understanding the associated risks and potential returns.

- Risk tolerance: Determine your risk tolerance before investing – how much volatility are you comfortable with?

- Diversification: Diversify your investment portfolio to mitigate risk by spreading your investments across different asset classes.

Start investing early and consistently to benefit from the power of compounding.

Failing to Plan for Emergencies

Life throws unexpected curveballs. Having a financial safety net is crucial to navigating unforeseen circumstances without derailing your long-term financial goals.

Building an Emergency Fund:

Aim to build an emergency fund covering 3-6 months of living expenses.

- Strategies for saving money: Identify areas to cut expenses and automate savings to consistently build your emergency fund.

- Automating savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

Insurance Coverage:

Adequate insurance coverage protects you from significant financial losses.

- Reviewing insurance policies regularly: Regularly review your health, life, and disability insurance policies to ensure they meet your current needs.

- Understanding coverage: Understand your policy details, including coverage limits and exclusions.

- Adjusting policies as needed: Adjust your insurance coverage as your life circumstances change (marriage, children, career changes).

Conclusion

By understanding and avoiding these common financial mistakes women should avoid, you can significantly improve your financial well-being. Proactive retirement planning, effective debt management, continuous financial education, and comprehensive emergency preparedness are all cornerstones of a secure financial future. Take control of your finances today. Create a budget, explore investment options, and seek professional financial advice when needed. Empower yourself to build a brighter, more financially secure tomorrow. Don't let these common financial mistakes women should avoid define your future – take charge and build the wealth you deserve!

Featured Posts

-

Novi Sanktsiyi Lindsi Grem Zaklikaye Do Tisku Na Rosiyu

May 22, 2025

Novi Sanktsiyi Lindsi Grem Zaklikaye Do Tisku Na Rosiyu

May 22, 2025 -

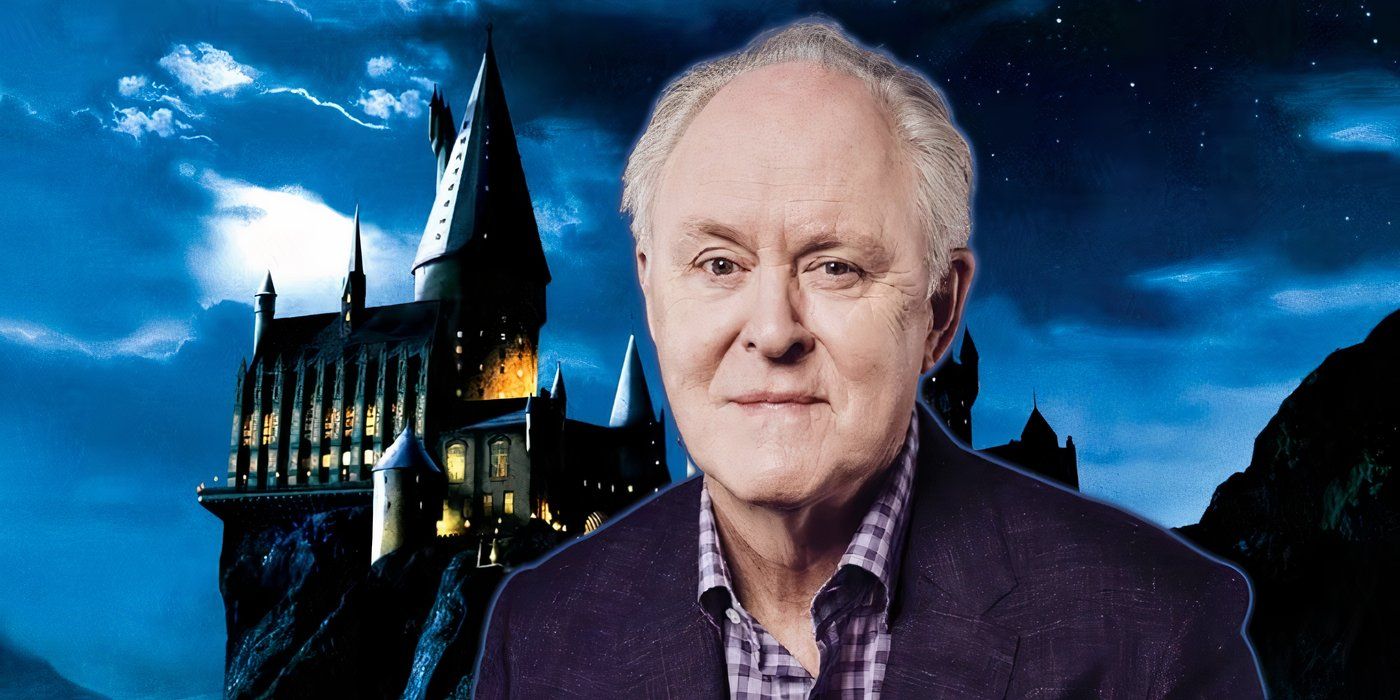

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits

May 22, 2025

Dexter Resurrection De Terugkeer Van John Lithgow En Jimmy Smits

May 22, 2025 -

Philadelphia Fuel Prices Average Up 6 Cents Further Increases Predicted

May 22, 2025

Philadelphia Fuel Prices Average Up 6 Cents Further Increases Predicted

May 22, 2025 -

Accident Involving Box Truck Causes Route 581 Closure

May 22, 2025

Accident Involving Box Truck Causes Route 581 Closure

May 22, 2025 -

Southern French Alps Weather Impact Of Recent Storms And Late Snow

May 22, 2025

Southern French Alps Weather Impact Of Recent Storms And Late Snow

May 22, 2025