Financial Times: BP CEO's Plan To Double Company Value, No US Stock Market Switch

Table of Contents

The Core Pillars of BP's Growth Strategy

BP's plan to double its value rests on three interconnected pillars: an accelerated energy transition, enhanced operational efficiency and cost reduction, and strategic acquisitions and partnerships.

Accelerated Energy Transition

BP is aggressively pursuing a shift towards renewable energy sources. This involves significant investments in various green energy sectors.

- Massive Investments in Renewables: BP is committing billions to solar, wind, and other renewable energy projects globally. These investments represent a strategic shift away from fossil fuels and towards a more sustainable energy future.

- Ambitious Renewable Energy Capacity Targets: The company has set ambitious targets for its renewable energy capacity, aiming for substantial growth within the next decade. This commitment underscores their seriousness about becoming a major player in the green energy market.

- Profitability and Long-Term Value: While the transition presents challenges, BP believes that investment in renewable energy, green energy, and sustainable energy is crucial for long-term profitability and increased ESG investing appeal, ultimately boosting its long-term value.

Operational Efficiency and Cost Reduction

Streamlining operations and cutting costs are vital to maximizing profitability. BP plans to achieve this through several initiatives:

- Workforce Optimization: The company is implementing strategies to optimize its workforce, improving efficiency and reducing labor costs.

- Technology Adoption: Investing in advanced technologies to automate processes and improve efficiency across various operations is a key component of this strategy.

- Impact on Profitability Margins: These cost optimization measures are projected to significantly improve efficiency gains and bolster operational excellence, leading to higher profitability margins.

Strategic Acquisitions and Partnerships

Strategic M&A activity and forging strategic partnerships will play a crucial role in BP’s growth.

- Targeted Acquisitions: BP is actively seeking acquisitions of companies that complement its existing portfolio and enhance its capabilities in renewable energy and other growth areas.

- Synergistic Effects: The rationale behind each acquisition is to create synergies that lead to significant value creation, contributing to the overall goal of doubling the company's value. These growth through acquisition strategies are key to the plan's success.

Why No US Stock Market Listing?

BP’s decision to remain listed on the London Stock Exchange (LSE), rather than switching to the NYSE or NASDAQ, is a strategic choice.

Analyzing the Reasons for Staying on the London Stock Exchange

Several factors likely influenced this decision:

- Favorable Regulatory Environment: The LSE may offer a more favorable regulatory environment compared to US exchanges.

- Existing Investor Base: BP already has a well-established investor base on the LSE, making a switch unnecessary and potentially disruptive.

- Potential Disadvantages of a US Listing: The complexities and costs associated with a US stock market listing, including stricter regulatory requirements, may outweigh the perceived benefits. The current regulatory environment and the nature of its investor relations likely played a significant role in the decision.

Potential Challenges and Risks to BP's Plan

Despite the ambitious plan, several challenges and risks could hinder BP's progress.

Geopolitical Uncertainty and Market Volatility

The global energy market is highly volatile and subject to significant geopolitical risk.

- Energy Price Volatility: Fluctuations in energy prices pose a substantial risk to BP's profitability and its ability to achieve its ambitious goals.

- Political Instability: Political instability in key regions could disrupt operations and negatively impact the company's performance.

- Risk Management: BP will need robust risk management strategies to mitigate these risks effectively.

Competition in the Renewable Energy Sector

The renewable energy competition is fierce.

- Key Competitors: BP faces intense competition from other major energy companies and numerous smaller players in the renewable energy sector.

- Competitive Advantage: BP's success will depend on its ability to maintain a competitive advantage through innovation, strategic partnerships, and efficient operations to secure its desired market share.

Conclusion: BP's Bold Vision for the Future – Doubling Company Value

BP's CEO has set a bold vision: to double the company's value without relocating to the US stock market. This ambitious plan hinges on three key strategies: accelerating the energy transition, improving operational efficiency and cutting costs, and undertaking strategic acquisitions. While the potential rewards are significant, the plan faces considerable challenges, including geopolitical uncertainty and intense competition in the renewable energy sector. Stay tuned to see how BP's ambitious plan to double its company value unfolds! Follow the developments of BP’s groundbreaking strategy to achieve a doubled company valuation.

Featured Posts

-

The Return Of Dexter A Resurrected Villain Wins Over Fans

May 22, 2025

The Return Of Dexter A Resurrected Villain Wins Over Fans

May 22, 2025 -

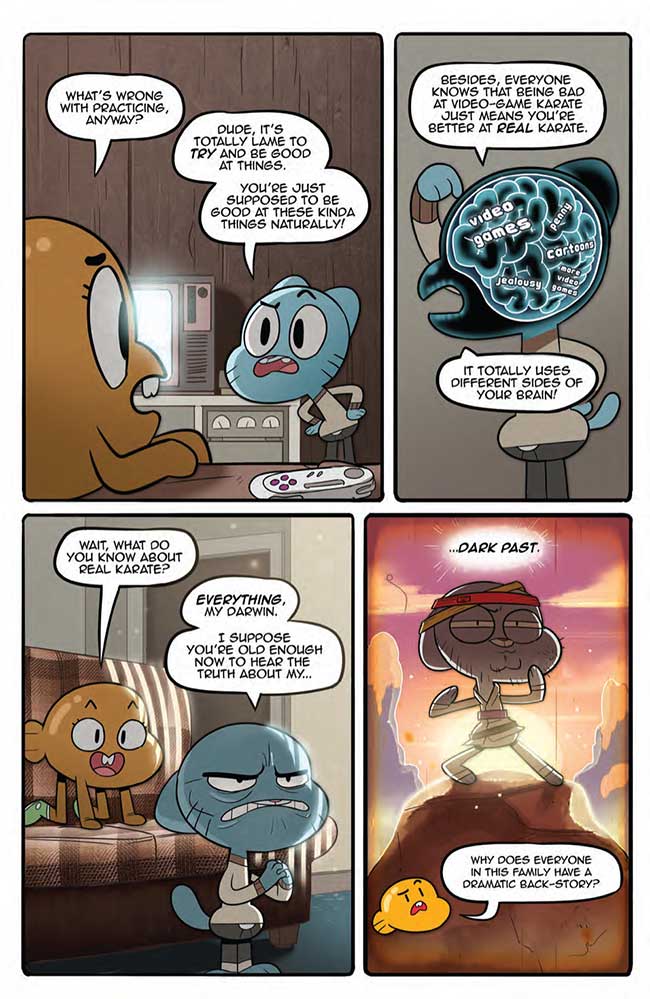

The World Of Gumball Gets Even Stranger A Sneak Peek

May 22, 2025

The World Of Gumball Gets Even Stranger A Sneak Peek

May 22, 2025 -

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Kartels Restrictions A Police Source Explains Why

May 22, 2025

Kartels Restrictions A Police Source Explains Why

May 22, 2025 -

Pivdenniy Mist Remont Analiz Proektu Ta Zaluchenikh Resursiv

May 22, 2025

Pivdenniy Mist Remont Analiz Proektu Ta Zaluchenikh Resursiv

May 22, 2025