Financial Times: BP CEO's Plan To Double Company Value, UK Listing To Stay

Table of Contents

Key Pillars of BP's Value-Doubling Strategy

BP's CEO has outlined a three-pronged approach to doubling the company's value. This involves a significant restructuring and re-focus of the company's operations across its existing portfolio and ambitious expansion into new areas.

Increased Investment in Renewable Energy

A core element of BP's value-doubling strategy is a massive increase in its investment in renewable energy sources. This commitment to renewable energy investment forms a key part of BP's green energy strategy. The plan includes:

- Expanding renewable energy portfolio: BP aims to significantly expand its portfolio, focusing on solar, wind, and hydrogen power generation. This includes investments in both onshore and offshore wind farms, large-scale solar projects, and hydrogen production facilities.

- Strategic acquisitions and partnerships: To accelerate growth, BP plans to pursue strategic acquisitions of established renewable energy companies and form key partnerships with technology providers and developers. This will allow them to leverage existing expertise and infrastructure.

- Targeting specific markets: The company will target markets with high renewable energy potential and supportive government policies, ensuring optimal returns on investment. This geographically focused approach will allow for efficient resource allocation.

- Projected investment and returns: While specific figures haven't been publicly released, industry analysts predict billions of dollars will be invested in this area over the next decade, with projected returns expected to be substantial as renewable energy markets continue to grow.

Optimization of Oil and Gas Operations

While transitioning to renewable energy, BP acknowledges the continued importance of its oil and gas operations. Improving efficiency and cost-effectiveness in this sector is crucial to funding the renewable energy transition. Key aspects of BP's oil and gas efficiency strategy include:

- Reducing operational costs: The company plans to implement stringent cost-cutting measures across its existing oil and gas assets to improve profitability and free up capital for renewable energy investments.

- Technological advancements: Leveraging cutting-edge technologies such as enhanced oil recovery techniques and advanced analytics will help increase production efficiency and reduce environmental impact.

- Exploration of new reserves: BP will continue exploring for new, cost-effective oil and gas reserves, focusing on projects with lower environmental risk and high returns.

- Sustainable practices: A strong emphasis will be placed on responsible and sustainable oil and gas extraction practices, adhering to the highest environmental and safety standards. This aspect of BP's fossil fuel strategy is critical in maintaining a positive public image and investor confidence.

Capital Allocation and Shareholder Returns

Balancing investment in renewables with shareholder returns is a key challenge. BP plans to address this by:

- Dividend payouts: Maintaining a robust dividend policy will reassure existing shareholders and attract new investment.

- Share buyback programs: Repurchasing company shares will increase the value of remaining shares, benefiting existing shareholders.

- Addressing investor concerns: The company will proactively address investor concerns about the transition to renewable energy, emphasizing the long-term value creation potential of its strategy. Transparency and clear communication will be key. The impact on BP share price will be closely monitored as a measure of the success of the plan. A well-defined dividend policy will be important in maintaining investor confidence.

Maintaining the UK Listing

BP has reaffirmed its commitment to maintaining its primary listing on the London Stock Exchange. This decision highlights the importance of the UK market to BP's operations and investor base. Maintaining this UK energy market presence offers several advantages:

- Access to capital: The UK remains a significant financial centre, providing access to a wide range of investors and funding opportunities.

- Regulatory familiarity: Operating in a well-established regulatory environment minimizes uncertainty.

- Strong investor base: The UK boasts a sophisticated and substantial investor base for energy companies.

Market Reaction and Analyst Opinions

The market's initial reaction to BP's plan has been mixed. Some analysts express optimism about the long-term potential of the strategy, while others highlight the significant challenges involved in transitioning to a low-carbon future. BP stock performance will be a key indicator of success. The analysis of energy market analysis is key in understanding the prospects for this plan. The comparison to competitor strategies from other major energy companies provides further context.

The success of the plan will depend on several factors, including:

- The speed of technological advancements in renewable energy.

- The overall stability and growth of the global energy market.

- The success of BP's operational efficiencies.

- Government policies and regulations relating to both fossil fuels and renewable energy.

Conclusion

This article details BP CEO's ambitious plan to double the company's value, a strategy predicated on increased renewable energy investment, optimized oil and gas operations, and a strong commitment to shareholder returns while maintaining its significant UK listing. The success of this strategy hinges on navigating the complexities of the energy transition and maintaining investor confidence.

Call to Action: Stay informed about the progress of BP's ambitious plan to double its company value. Follow our updates for further insights into the development of BP’s strategy and its impact on the global energy market. Learn more about BP CEO's plan to double company value and its implications.

Featured Posts

-

The Unfolding Drama Walliams And Cowells Britains Got Talent Conflict

May 21, 2025

The Unfolding Drama Walliams And Cowells Britains Got Talent Conflict

May 21, 2025 -

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025 -

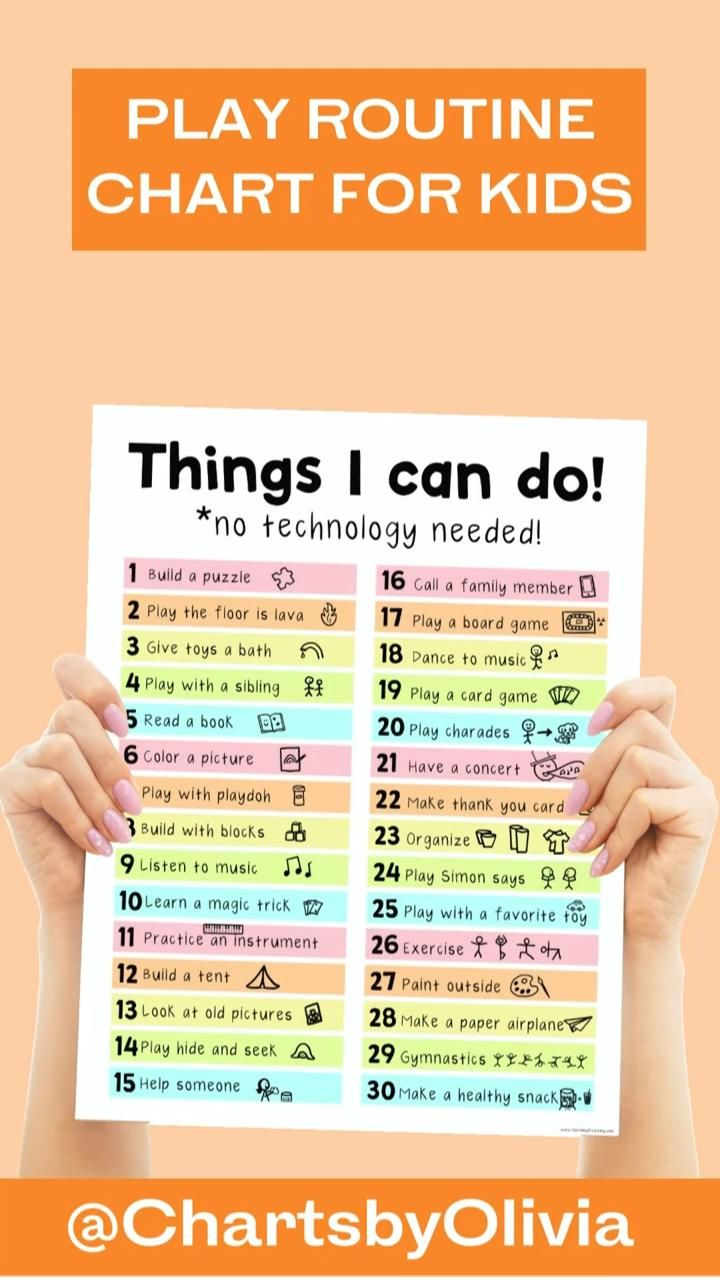

Your Guide To A Successful Screen Free Week With Kids

May 21, 2025

Your Guide To A Successful Screen Free Week With Kids

May 21, 2025 -

Experience Vybz Kartel Live Historic New York City Performance

May 21, 2025

Experience Vybz Kartel Live Historic New York City Performance

May 21, 2025 -

The Original Sin Finale And Dexters Biggest Regret Debra Morgan

May 21, 2025

The Original Sin Finale And Dexters Biggest Regret Debra Morgan

May 21, 2025

Latest Posts

-

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025 -

Antiques Roadshow Couple Arrested After Shocking National Treasure Appraisal

May 21, 2025

Antiques Roadshow Couple Arrested After Shocking National Treasure Appraisal

May 21, 2025 -

Couple Arrested Following Antiques Roadshow Episode

May 21, 2025

Couple Arrested Following Antiques Roadshow Episode

May 21, 2025