Find The Best Tribal Loans With Guaranteed Approval For Bad Credit

Table of Contents

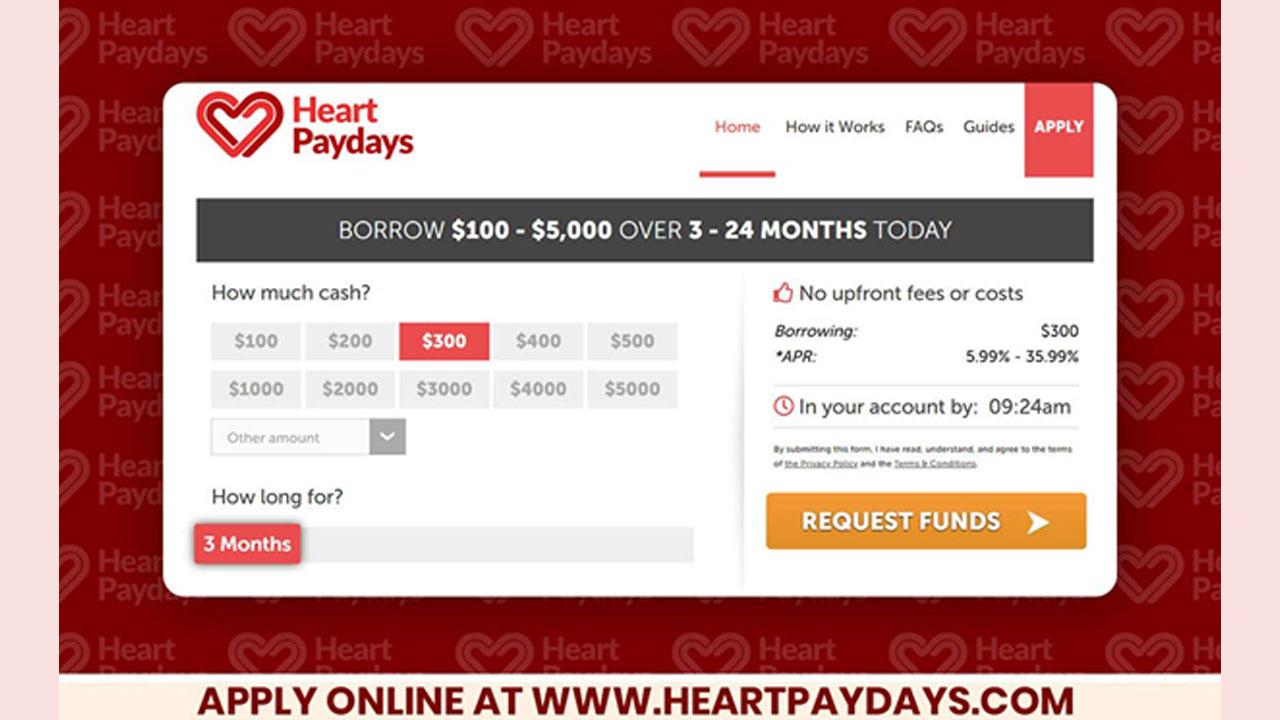

Understanding Tribal Loans and Guaranteed Approval

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders associated with Native American tribes. These tribes operate on sovereign land, allowing them to offer lending services that may differ from traditional banking regulations. This unique legal standing is often cited as a reason why tribal lenders might be more willing to approve applicants with bad credit than traditional banks or credit unions. However, it's crucial to understand the nuances and potential implications. They are often marketed as payday loans, online loans, or emergency loans.

The Concept of "Guaranteed Approval"

The term "guaranteed approval" for tribal loans (and other types of short-term loans) needs careful consideration. While some lenders advertise this, it doesn't imply automatic approval. What it usually means is that these lenders have a higher approval rate for individuals with bad credit compared to traditional financial institutions. This higher approval rate doesn't negate the need for responsible borrowing. Understanding your financial capacity and the terms of the loan remains critical before committing.

- Advantages of Tribal Loans: Potentially easier approval for bad credit, faster processing times, online application convenience.

- Disadvantages of Tribal Loans: Higher interest rates than traditional loans, shorter repayment periods, potential for higher overall costs if not managed carefully.

- Crucial Note: Always compare multiple lenders and their offerings before applying for a tribal loan. Don't rush the process.

Finding Reputable Tribal Lenders

Identifying Legitimate Lenders

Navigating the world of online lenders requires vigilance. Thoroughly research any lender before applying for a tribal loan to avoid scams and predatory lending practices. Be wary of lenders making unrealistic promises or employing high-pressure sales tactics. Transparency in terms and conditions is paramount.

Online Resources and Reviews

Utilize reputable online resources and review platforms to compare lenders and assess their credibility. Reading customer reviews and testimonials can offer valuable insights into a lender's reputation and customer service.

- Trustworthy Resources: Check the Better Business Bureau (BBB) website, your state's attorney general website, and independent financial review sites.

- Identifying Scams: Look for unclear terms and conditions, hidden fees, aggressive sales tactics, and a lack of transparent contact information.

- Importance of Reviews: Negative reviews often highlight issues like hidden fees, difficulty contacting customer service, or aggressive debt collection practices.

Factors Affecting Approval for Tribal Loans with Bad Credit

Credit Score and History

While your credit score plays a role in the approval process, tribal lenders are often more lenient than traditional banks. However, a higher credit score will still generally improve your chances of approval and secure better loan terms. Having a positive credit history is always recommended.

Income and Employment Verification

Demonstrating a consistent income stream is crucial. Lenders need to be assured you can manage loan repayments. This usually requires providing proof of income, such as pay stubs or bank statements. Employment verification might also be necessary.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio represents the percentage of your monthly income dedicated to debt repayment. A lower DTI indicates a greater capacity to handle additional debt, increasing your chances of loan approval.

- Factors Increasing Approval Chances: Consistent income, low debt-to-income ratio, positive payment history (even on smaller accounts), and a co-signer (where available).

- Improving Creditworthiness: Pay bills on time, reduce existing debt, monitor your credit report regularly, and correct any errors.

- Accurate Information: Provide accurate and complete information on your application to avoid delays or rejection.

Comparing Tribal Loan Offers and Choosing the Best Option

Key Factors to Consider

Before accepting any tribal loan offer, meticulously compare various options. Consider factors such as the Annual Percentage Rate (APR), loan fees, loan term length, and repayment options.

Avoiding Predatory Lending Practices

Beware of excessively high interest rates and hidden fees. Predatory lenders often target vulnerable individuals with bad credit, trapping them in a cycle of debt. Understand all fees and charges upfront to avoid unexpected costs.

- Loan Offer Checklist: APR, loan amount, repayment schedule, total cost of the loan (including all fees and interest), and loan terms.

- Loan Agreement: Read the loan agreement carefully before signing. Don't hesitate to ask questions if anything is unclear.

- Budgeting: Create a realistic budget to ensure you can comfortably afford the monthly repayments without jeopardizing your other financial obligations.

Conclusion

Securing a tribal loan with purported "guaranteed approval" for bad credit requires careful planning and diligent research. Understanding the nature of tribal loans, identifying reputable lenders, considering factors affecting approval, and comparing loan offers are crucial steps. Remember, responsible borrowing is key. High interest rates can quickly escalate into unmanageable debt if not handled properly.

Don't let bad credit hold you back – find the best tribal loan for your needs today! Start your search for the right tribal loan now and take control of your finances. Remember to always prioritize responsible borrowing practices.

Featured Posts

-

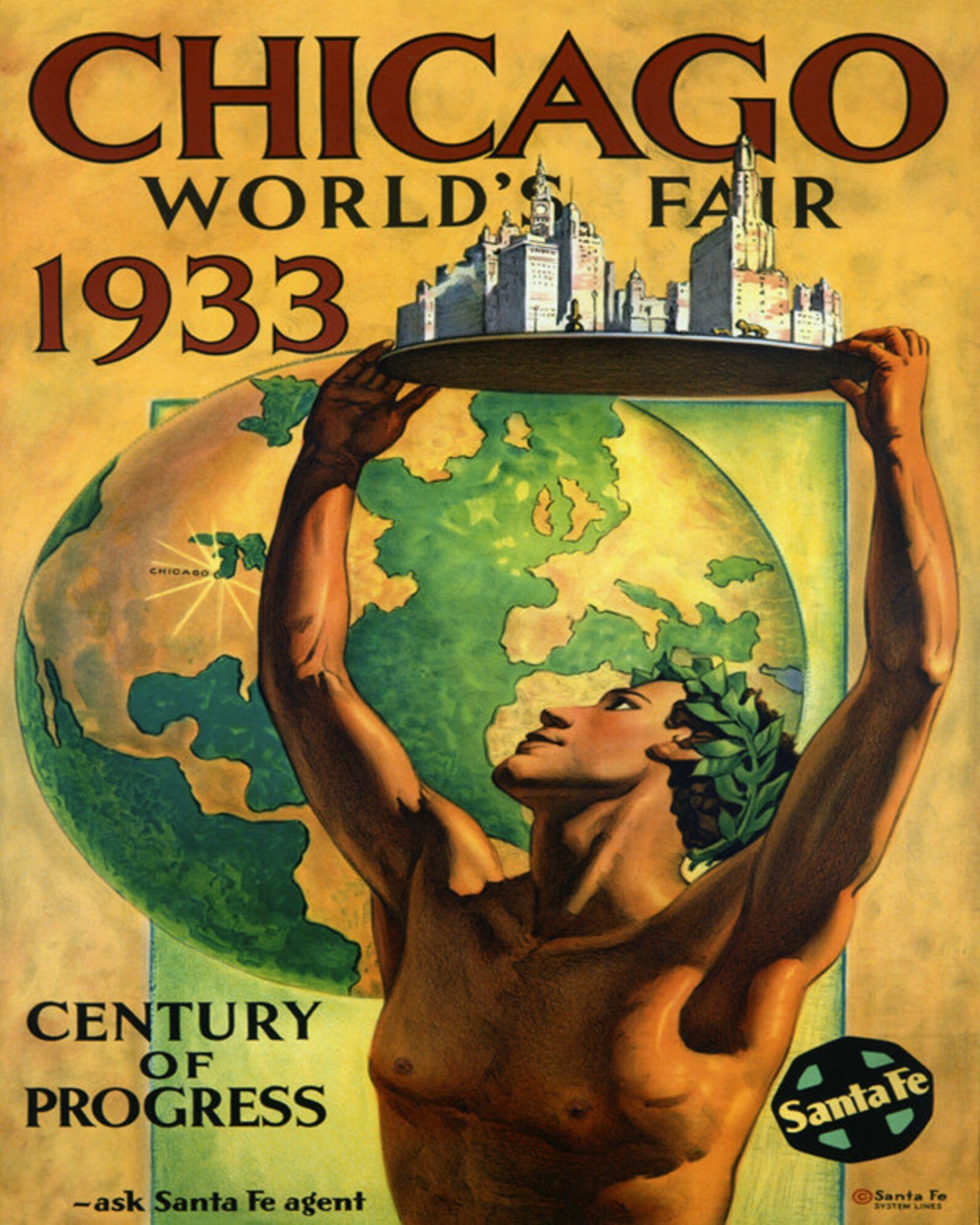

Century Of Progress A Look Back At Chicagos 1933 Worlds Fair

May 28, 2025

Century Of Progress A Look Back At Chicagos 1933 Worlds Fair

May 28, 2025 -

The Factors Behind Chicagos Unexpected Crime Decrease

May 28, 2025

The Factors Behind Chicagos Unexpected Crime Decrease

May 28, 2025 -

Danimarkali Tuerk Taraftar Ronaldo Ya Fenerbahce Teklifi Goenderdi

May 28, 2025

Danimarkali Tuerk Taraftar Ronaldo Ya Fenerbahce Teklifi Goenderdi

May 28, 2025 -

Padres Leadoff Hitter Fernando Tatis Jr Returns

May 28, 2025

Padres Leadoff Hitter Fernando Tatis Jr Returns

May 28, 2025 -

Bon Plan Samsung Galaxy S25 Ultra 1 To 5 Etoiles A 1294 90 E 13

May 28, 2025

Bon Plan Samsung Galaxy S25 Ultra 1 To 5 Etoiles A 1294 90 E 13

May 28, 2025