Finding The Real Safe Bet: A Practical Guide To Low-Risk Investments

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific low-risk investment options, it's crucial to understand your risk tolerance. This involves considering both your investment goals and your comfort level with potential market fluctuations.

Defining Your Investment Goals

What are you saving for? Retirement? A down payment on a house? A child's education? Understanding your timeline directly impacts your risk tolerance.

- Short-term goals (less than 5 years): These require a higher emphasis on capital preservation and liquidity. You'll likely want to prioritize low-risk investments with easy access to your funds.

- Medium-term goals (5-10 years): You have more flexibility to consider investments with slightly higher potential returns, but still maintaining a focus on minimizing risk.

- Long-term goals (10+ years): A longer time horizon allows for a potentially greater allocation to investments with moderate risk, as you have more time to recover from any short-term market downturns.

Knowing your time horizon allows you to choose investments aligned with your needs. For instance, investing in long-term bonds for a short-term goal might not be suitable due to potential penalties for early withdrawal.

Assessing Your Comfort Level

How much fluctuation in your investment's value can you comfortably handle? Honest self-assessment is crucial for successful investing.

- Conservative investors: Prefer minimal risk and prioritize capital preservation above all else. They are comfortable with lower returns in exchange for greater security.

- Moderate investors: Balance risk and return, accepting some market fluctuations in pursuit of higher growth potential.

- Aggressive investors: Have a higher tolerance for risk and are willing to accept greater volatility in exchange for potentially higher returns.

Understanding your risk profile is critical to selecting investments that align with your emotional and financial capabilities. A conservative investor might find the volatility of the stock market unsettling, while an aggressive investor might find low-risk options too restrictive.

Exploring Low-Risk Investment Options

Several investment options offer a relatively low risk profile, each with its own set of advantages and disadvantages.

High-Yield Savings Accounts and Money Market Accounts

These are considered among the safest investment options, offering FDIC insurance (up to $250,000 per depositor, per insured bank) and easy access to your funds.

- Liquidity: You can withdraw your money at any time without penalty.

- FDIC insurance: Provides protection against bank failure.

- Low returns: Interest rates are typically lower than other investment options.

High-yield savings accounts and money market accounts are ideal for emergency funds and short-term savings goals where preserving capital and easy access are paramount.

Certificates of Deposit (CDs)

CDs are fixed-term deposits that offer a predetermined interest rate for a specific period.

- Fixed interest rate: Provides certainty about your returns.

- Limited liquidity: Early withdrawal usually incurs penalties.

- Higher returns than savings accounts: Generally offer better returns than savings accounts, but the rate is fixed for the term.

CDs are suitable for short- to medium-term goals where you can lock in a rate for a specific period without needing immediate access to your funds.

Government Bonds

Government bonds are considered one of the safest investments due to the backing of the government.

- Low risk: The risk of default is minimal.

- Relatively low returns: Returns are generally lower than those of higher-risk investments.

- Diversification benefits: They can contribute to a diversified investment portfolio.

Treasury bills, notes, and bonds offer varying maturities and interest rates, allowing you to choose options that fit your timeline and risk tolerance.

Diversified Mutual Funds and ETFs Focused on Low-Volatility Strategies

These funds spread risk across multiple assets, mitigating potential losses.

- Professional management: Benefit from the expertise of professional fund managers.

- Diversification: Reduces risk by investing in a variety of assets.

- Lower volatility than individual stocks: Tend to be less volatile than investing in individual stocks.

Look for funds specifically designed for conservative investors, often labeled as "low-volatility" or "conservative allocation" funds.

Tips for Successful Low-Risk Investing

Even with low-risk investments, employing smart strategies enhances your success.

Diversify Your Portfolio

Don't put all your eggs in one basket. Spread your investments across different asset classes, even within the low-risk category.

- Reduce overall risk: Diversification mitigates the impact of any single investment underperforming.

- Mitigate potential losses: Helps cushion against losses in one area by having gains in another.

Regularly Review and Rebalance

Market conditions change, so periodically review your portfolio and adjust your asset allocation as needed.

- Maintain your desired asset allocation: Regular rebalancing ensures your portfolio stays aligned with your risk tolerance and goals.

- Adapt to changing circumstances: Allows you to respond to market shifts and opportunities.

Seek Professional Advice

A financial advisor can help you create a personalized investment strategy based on your goals and risk tolerance.

- Personalized guidance: Receive tailored advice based on your unique circumstances.

- Objective perspective: Gain an unbiased view of your investment options.

- Access to expertise: Benefit from the knowledge and experience of a financial professional.

Conclusion

Finding the "real safe bet" in investments means understanding your risk tolerance and choosing options that align with your financial goals. By exploring low-risk investment vehicles like high-yield savings accounts, CDs, government bonds, and diversified low-volatility funds, you can build a solid foundation for your financial future. Remember to diversify, regularly review your portfolio, and consider seeking professional advice to make informed decisions. Start planning your low-risk investment strategy today!

Featured Posts

-

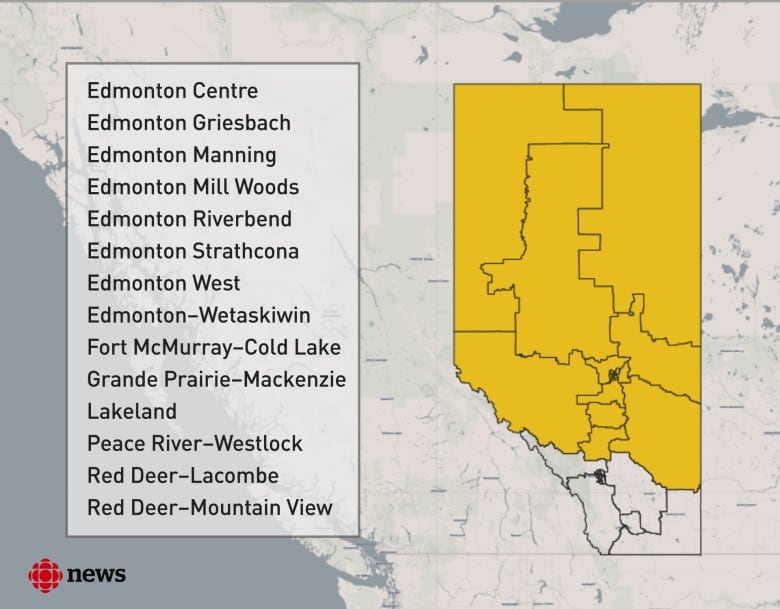

Greater Edmontons New Federal Ridings A Voters Guide

May 10, 2025

Greater Edmontons New Federal Ridings A Voters Guide

May 10, 2025 -

Uy Scuti Release Date Tease Young Thugs New Album

May 10, 2025

Uy Scuti Release Date Tease Young Thugs New Album

May 10, 2025 -

King Protiv Maska Skandal Na Platforme X

May 10, 2025

King Protiv Maska Skandal Na Platforme X

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Statements

May 10, 2025

The Transgender Military Ban Unpacking Trumps Statements

May 10, 2025 -

Nyt Strands Wednesday April 9 Game 402 Complete Solution Guide

May 10, 2025

Nyt Strands Wednesday April 9 Game 402 Complete Solution Guide

May 10, 2025