Finding The Real Safe Bet: How To Minimize Risk And Maximize Returns

Table of Contents

1. Understanding Your Risk Tolerance:

Before diving into specific investment strategies, it's crucial to understand your own risk tolerance. This isn't about being fearless or overly cautious; it's about honestly assessing your comfort level with potential losses.

Assessing Your Personal Financial Situation:

To accurately determine your risk tolerance, you need a clear picture of your current financial health. Consider these factors:

- Current income: Your stable income stream impacts how much risk you can afford to take.

- Savings: The size of your emergency fund influences your ability to weather potential market downturns.

- Debts: High levels of debt can limit your risk-taking capacity.

- Financial goals (short-term, long-term): Your goals—like buying a house, retirement planning, or funding your child's education—will influence your investment timeline and risk tolerance.

- Time horizon for investment: Longer time horizons generally allow for greater risk-taking, as there's more time to recover from potential losses.

Honest self-assessment is paramount. Don't overestimate your risk tolerance. Online risk tolerance quizzes can be helpful starting points, but professional advice is often beneficial for complex situations. [Link to a reputable risk tolerance quiz].

Different Risk Profiles:

Investors generally fall into one of these categories:

- Conservative: These investors prioritize capital preservation over high growth, preferring low-risk investments with modest returns.

- Moderate: These investors seek a balance between risk and reward, accepting moderate levels of risk for potentially higher returns.

- Aggressive: These investors are comfortable with higher levels of risk in pursuit of substantial returns, often investing in more volatile assets.

Understanding your risk profile is crucial in selecting appropriate investments. An aggressive investor might allocate a larger portion of their portfolio to stocks, while a conservative investor might favor bonds and fixed-income securities.

2. Diversification: Spreading Your Investments:

Diversification is a cornerstone of risk management. It involves spreading your investments across various asset classes, geographic regions, and sectors to reduce the impact of any single investment's poor performance.

The Power of Diversification:

Diversification isn't just about owning multiple stocks; it's a strategic approach to minimize risk. If one investment underperforms, others may offset those losses.

- Diversifying across asset classes: Consider a mix of stocks, bonds, real estate, and potentially alternative investments like commodities or precious metals.

- Geographical diversification: Investing in companies and assets from different countries reduces exposure to country-specific risks.

- Sector diversification: Spreading investments across various sectors (technology, healthcare, energy, etc.) protects against sector-specific downturns.

Asset Allocation Strategies:

Your asset allocation strategy will depend on your risk tolerance and investment goals.

- Conservative portfolio: A higher percentage of bonds and low-risk investments.

- Moderate portfolio: A balanced mix of stocks and bonds.

- Aggressive portfolio: A higher percentage of stocks and potentially alternative investments.

Regular rebalancing is crucial to maintain your desired asset allocation. As market values fluctuate, your portfolio may drift from its target allocation. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to bring your portfolio back to its optimal balance.

3. Due Diligence and Research:

Thorough research is essential before committing to any investment. Don't rely solely on marketing materials or tips from friends.

Researching Investment Opportunities:

Before investing your hard-earned money, take the time to thoroughly investigate each opportunity.

- Analyze financial statements: Understand a company's financial health by examining its income statement, balance sheet, and cash flow statement.

- Understand market trends: Stay informed about market conditions and economic factors that may impact your investments.

- Seek independent verification: Don't rely solely on information from the company itself. Consult independent sources like financial news outlets and analyst reports.

Identifying Red Flags:

Be wary of any investment opportunity that exhibits these red flags:

- High-yield promises with little to no risk: If it sounds too good to be true, it probably is.

- Lack of transparency: Avoid investments where the details are unclear or hidden.

- Pressure to invest quickly: Legitimate investment opportunities rarely involve high-pressure sales tactics.

Avoid scams and fraudulent schemes by doing your homework and only investing in reputable entities.

4. Seeking Professional Advice:

While this article provides valuable insights, seeking professional guidance can be incredibly beneficial.

When to Consult a Financial Advisor:

Consider professional help in these situations:

- Complex financial situations: If you have a complicated financial picture, a financial advisor can provide tailored solutions.

- Lack of investment knowledge: If you're new to investing, a financial advisor can help you navigate the complexities of the market.

- Large investment amounts: For significant investments, professional guidance is prudent.

The Value of Expertise:

A financial advisor can provide personalized support, helping you develop a comprehensive investment strategy that aligns with your risk tolerance and goals. They offer valuable expertise in managing risk and maximizing returns.

Conclusion:

Finding the real safe bet isn't about eliminating risk entirely; it's about intelligently managing it. By understanding your risk tolerance, diversifying your investments, conducting thorough research, and seeking professional advice when needed, you can significantly increase your chances of achieving your financial goals while minimizing potential losses. Start by honestly assessing your risk tolerance and begin building a diversified investment portfolio tailored to your needs. Schedule a consultation with a financial advisor to discuss your options or delve deeper into relevant investment strategies to start finding your own real safe bet today.

Featured Posts

-

Section 230 And Banned Chemicals Impact On E Bay Listings

May 09, 2025

Section 230 And Banned Chemicals Impact On E Bay Listings

May 09, 2025 -

Bundesliga 2 Cologne Overtakes Hamburg After Matchday 27

May 09, 2025

Bundesliga 2 Cologne Overtakes Hamburg After Matchday 27

May 09, 2025 -

How Did Donald Trumps First 100 Days Influence Elon Musks Wealth

May 09, 2025

How Did Donald Trumps First 100 Days Influence Elon Musks Wealth

May 09, 2025 -

Nhs Trust Chiefs Cooperation With Nottingham Attack Investigation

May 09, 2025

Nhs Trust Chiefs Cooperation With Nottingham Attack Investigation

May 09, 2025 -

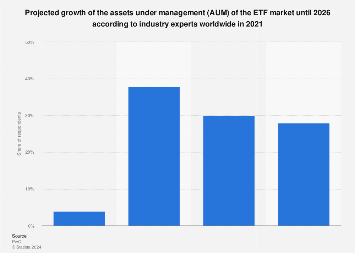

Billionaires Favorite Etf Projected 110 Growth By 2025

May 09, 2025

Billionaires Favorite Etf Projected 110 Growth By 2025

May 09, 2025