Finding Your Place In The Sun: A Guide To Overseas Property

Table of Contents

Researching Your Ideal Overseas Property Location

Finding the right location is the cornerstone of a successful overseas property purchase. This involves careful consideration of various factors to ensure your international property investment aligns with your lifestyle and financial goals.

Choosing the Right Country

Selecting the ideal country for your overseas property requires thorough research. Consider factors like:

- Climate: Do you prefer year-round sunshine or distinct seasons?

- Lifestyle: Are you seeking a bustling city life or a peaceful rural retreat?

- Cost of living: Compare expenses such as housing, groceries, healthcare, and transportation.

- Visa requirements: Understand the visa regulations for long-term stays or residency.

- Language barriers: Assess your language skills and the prevalence of English in your chosen location.

Here are some popular overseas property destinations to inspire your search:

- Spain: Known for its beautiful beaches, vibrant culture, and relatively affordable property prices. [Link to Spanish property portal]

- Portugal: Offers a relaxed lifestyle, stunning coastline, and attractive tax benefits for non-residents. [Link to Portuguese government website]

- Italy: A land of history, art, and delicious food, with properties ranging from charming villas to modern apartments. [Link to Italian real estate website]

- Thailand: A tropical paradise with affordable properties and a warm, welcoming culture. [Link to expat forum discussing Thailand property]

- Florida, USA: A popular choice for its warm climate, beautiful beaches, and strong rental market. [Link to Florida real estate listings]

These are just a few examples; the "best countries to buy property" depend entirely on your individual preferences and priorities. Researching different locations and exploring options for your "ideal location for overseas property" is crucial.

Finding the Perfect Property Type

The type of property you choose will significantly impact your lifestyle and investment potential. Let's explore some popular options:

- Villas: Offer privacy, space, and often come with gardens or pools. However, they require more maintenance.

- Apartments: Provide convenience and often lower maintenance costs. They might offer less privacy and outdoor space.

- Townhouses: A compromise between villas and apartments, offering a balance of privacy, space, and convenience.

- Land: Buying land overseas offers potential for building your dream home but requires significant planning and investment.

Consider factors like:

- Maintenance: How much time and money are you willing to dedicate to upkeep?

- Lifestyle suitability: Does the property type align with your preferred living style?

- Investment potential: What are the rental yields and potential for capital appreciation?

Choosing the right property type is key to ensuring a successful "overseas villa," "apartment abroad," or "buying land overseas" experience.

Understanding Local Market Conditions

Before making an offer, thoroughly research the local market conditions. This includes:

- Property prices: Analyze recent sales data to understand the average price per square meter.

- Market trends: Identify whether prices are rising, falling, or stable.

- Potential rental yields: Estimate the potential rental income if you plan to rent out your property.

Utilize resources such as:

- Online property portals: Explore international property listings and market data.

- Local real estate agents: They provide invaluable insights into local market conditions and can help you find suitable properties.

- Financial advisors: They can offer expert advice on investment strategies and financial planning for "international property investment."

Understanding "overseas property market trends" is critical for making informed investment decisions.

Navigating the Legal and Financial Aspects of Overseas Property Purchase

Purchasing "international property" involves navigating complex legal and financial procedures. Careful planning and professional guidance are essential.

Securing Financing for Overseas Property

Securing financing for an "overseas property mortgage" can be more challenging than domestic mortgages. Explore options like:

- International mortgages: Banks specializing in international lending offer mortgages for overseas properties.

- Personal loans: You might use a personal loan to supplement your down payment or cover additional costs.

- Cash purchases: Paying in cash eliminates the need for a mortgage but requires substantial upfront capital.

Important considerations include:

- Interest rates: Interest rates on international mortgages can vary significantly.

- Documentation: You'll need extensive documentation, including proof of income and creditworthiness.

- Currency exchange rates: Fluctuations in exchange rates can impact your overall costs. "Financing international property purchase" requires a thorough understanding of currency risk.

Understanding Legal Requirements and Due Diligence

Engage a solicitor or lawyer specializing in international property transactions. They will guide you through the legal process, including:

- Property surveys: Ensure the property is structurally sound and free from defects.

- Title checks: Verify that the seller has the legal right to sell the property.

- Purchase agreement: Review the purchase agreement carefully before signing.

Thorough "overseas property lawyer" and "international property due diligence" are critical steps to protect your investment. "Buying property abroad legally" requires attention to detail and professional expertise.

Tax Implications of Owning Overseas Property

Owning "overseas property" has tax implications in both your home country and the country where the property is located. Seek advice from a tax professional familiar with international tax laws regarding:

- Capital gains tax: This is payable when you sell the property.

- Property tax: This is an annual tax levied on the property's value.

- Other taxes: Depending on the country, other taxes may apply, such as inheritance tax or wealth tax.

Understanding "overseas property tax" and "international property tax implications" is crucial to avoid costly surprises.

Tips for a Smooth Overseas Property Transaction

Several strategies can ensure a smooth and successful overseas property purchase.

Working with Local Professionals

Working with experienced and reputable local professionals is vital:

- Overseas real estate agent: Choose an agent with a proven track record and local market expertise.

- Property lawyer: Find a lawyer specializing in international property transactions.

- Surveyor: Engage a qualified surveyor to assess the property's condition.

Verify their credentials and read reviews before engaging their services. Finding a "property lawyer abroad" or a reputable "overseas real estate agent" requires thorough research.

Understanding Cultural Differences

Be mindful of cultural differences in communication styles and business practices.

- Negotiation: Negotiating strategies may differ from your home country.

- Timeframes: Be patient, as processes can take longer than you're used to.

- Communication: Use clear and concise communication, and be respectful of local customs.

Navigating "cultural considerations when buying property abroad" contributes significantly to a smooth transaction. Learning about "international property buying tips" related to cultural nuances can be extremely valuable.

Protecting Your Investment

Once you've purchased your property, protect your investment through:

- Overseas property insurance: Secure comprehensive insurance coverage to protect against unforeseen events.

- Maintenance: Regular maintenance will help preserve the value of your property.

- Long-term management: Consider hiring a property management company if you plan to rent it out or are unable to manage it yourself.

Protecting your "international property investment" requires proactive measures to mitigate risks and preserve value.

Conclusion: Finding Your Dream Overseas Property

Buying overseas property is an exciting but complex undertaking. This guide has highlighted key steps, from researching potential locations and understanding legal requirements to securing financing and protecting your investment. Remember, thorough research, professional advice, and cultural sensitivity are key to a smooth and successful transaction. Owning "overseas property" offers significant lifestyle improvements, potentially lucrative investment opportunities, and the chance to create lasting memories. Start your search today and find your dream overseas property now! Embrace the opportunity to find your perfect "place in the sun."

Featured Posts

-

Real Madrids Ambitious Transfer Plans After Mbappes Arsenal Dud

May 19, 2025

Real Madrids Ambitious Transfer Plans After Mbappes Arsenal Dud

May 19, 2025 -

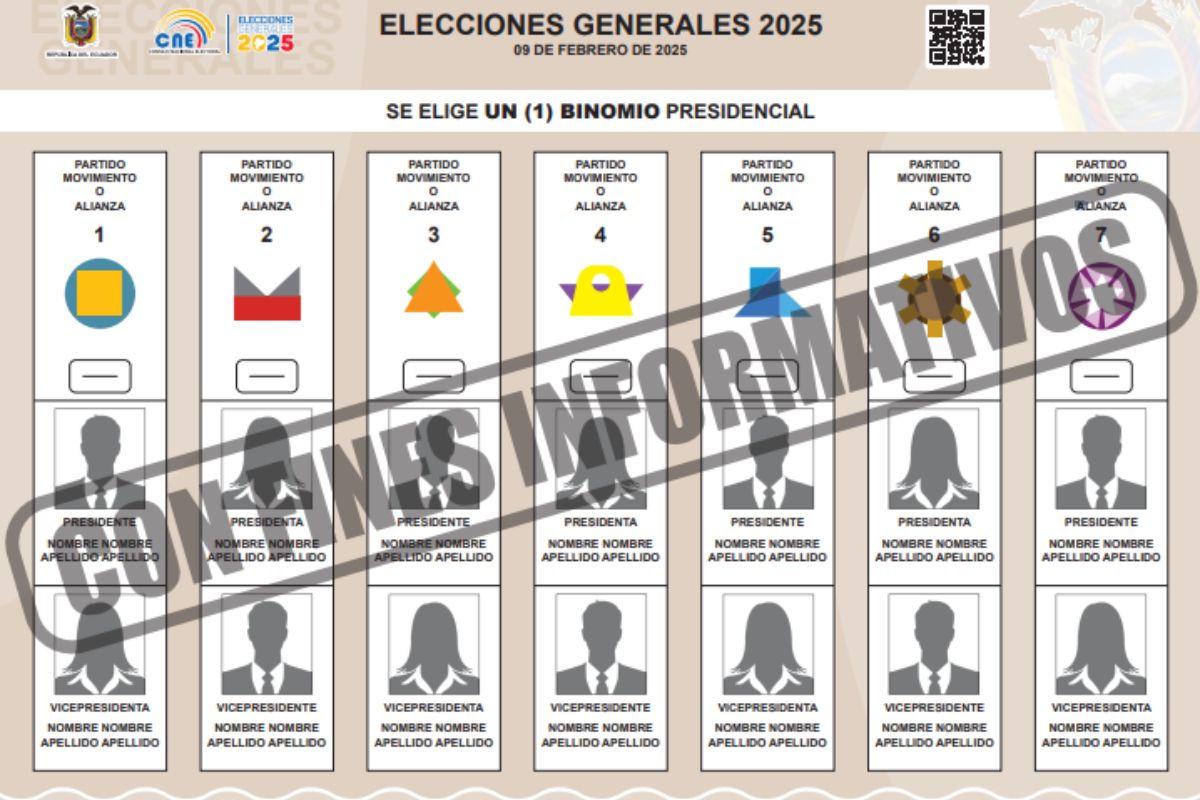

Elecciones Primarias 2025 El Cne Analiza 18 Solicitudes De Nulidad

May 19, 2025

Elecciones Primarias 2025 El Cne Analiza 18 Solicitudes De Nulidad

May 19, 2025 -

Problemy Justyny Steczkowskiej Przed Eurowizja

May 19, 2025

Problemy Justyny Steczkowskiej Przed Eurowizja

May 19, 2025 -

Haalands Hat Trick Powers Norway Past Moldova In World Cup Qualifier

May 19, 2025

Haalands Hat Trick Powers Norway Past Moldova In World Cup Qualifier

May 19, 2025 -

Ubers Kalanick A Costly Mistake The Project Strategy Name Decision

May 19, 2025

Ubers Kalanick A Costly Mistake The Project Strategy Name Decision

May 19, 2025