FIU: ₹5.45 Crore Penalty On Paytm Payments Bank For Money Laundering

Table of Contents

Details of the FIU Penalty on Paytm Payments Bank

The FIU, India's central agency for receiving, processing, and disseminating financial intelligence, imposed a ₹5.45 crore penalty on Paytm Payments Bank on [Insert Date of Penalty]. The penalty stems from alleged violations related to Know Your Customer (KYC) norms and the processing of suspicious transactions. While the exact details of the violations remain partially undisclosed, it's understood that the FIU's investigation uncovered significant shortcomings in Paytm Payments Bank's AML compliance procedures.

- Penalty Amount: ₹5.45 Crore

- Date of Imposition: [Insert Date]

- Specific Violations: Alleged breaches of KYC norms and processing of suspicious transactions. This likely includes failures to properly identify and verify customer identities, and insufficient monitoring of potentially illicit transactions.

- Official Statements: [Insert details of any official statements released by Paytm Payments Bank or the FIU regarding the penalty. Include links to official sources if available]. Keywords: FIU India, Paytm Penalty, Money Laundering Investigation, KYC Violations

The Allegations of Money Laundering Against Paytm Payments Bank

The allegations against Paytm Payments Bank center around facilitating potentially illicit financial transactions. While specifics remain limited due to ongoing investigations and confidentiality, the FIU's action suggests a significant volume of suspicious activities were identified. This could include:

- Nature of Alleged Activities: [Describe the nature of alleged money laundering activities, e.g., facilitating transactions linked to shell companies, processing funds from known illicit sources, etc. Be factual and avoid speculation].

- Examples of Suspicious Transactions: [If publicly available, provide specific examples of suspicious transactions. Focus on the patterns and types of transactions rather than specific account details to protect privacy].

- Scale and Scope: The scale and scope of the alleged offences are currently under investigation, but the substantial penalty suggests a significant breach of AML regulations.

- Investigation Process: The FIU's investigation involved a thorough review of Paytm Payments Bank's transaction records, KYC documentation, and internal compliance procedures. [Add details about the duration of the investigation and methodologies used, if available]. Keywords: Suspicious Transactions, Financial Crimes, Anti-Money Laundering, Paytm Investigation

Impact of the Penalty on Paytm Payments Bank and the Fintech Industry

The ₹5.45 crore penalty will undoubtedly have a significant impact on Paytm Payments Bank, both financially and reputationally.

- Financial Impact: The penalty represents a substantial financial loss and could affect the company's profitability and future investments.

- Reputational Damage: The allegations of money laundering severely damage Paytm Payments Bank's brand image and erode customer trust. This could lead to customer churn and difficulties attracting new users.

- Influence on Regulatory Oversight: This case sets a precedent for stricter regulatory oversight of fintech companies in India. Other fintech firms will likely face increased scrutiny and pressure to enhance their AML and KYC compliance.

- Changes in Compliance Procedures: The industry may witness a widespread overhaul of KYC/AML compliance procedures, with a greater emphasis on robust monitoring systems, enhanced due diligence, and regular audits. Keywords: Fintech Regulations, Reputational Risk, AML Compliance, KYC Compliance, Indian Fintech Industry

Reactions and Responses to the Penalty

Paytm Payments Bank [Insert statement from Paytm Payments Bank regarding the penalty and any actions they are taking to rectify the situation. Include links to official sources if available]. Industry experts and analysts have expressed varied reactions, with some highlighting the need for stricter regulatory frameworks and others emphasizing the importance of robust internal controls within fintech companies. [Include quotes or summaries of reactions from key industry figures and analysts]. Keywords: Paytm Response, Industry Reactions, Expert Opinions

Conclusion: Understanding the Implications of the FIU Penalty on Paytm Payments Bank

The ₹5.45 crore penalty imposed on Paytm Payments Bank by the FIU underscores the seriousness with which India is addressing money laundering within its financial sector. The alleged KYC and AML violations highlight the critical need for robust compliance measures within all financial institutions, particularly in the rapidly growing fintech space. This case serves as a strong warning to other fintech companies to prioritize compliance and invest in robust anti-money laundering measures. Stay updated on the latest developments concerning the Paytm Payments Bank money laundering case and the importance of robust anti-money laundering measures in the Indian fintech industry. The implications of this case will likely shape the future regulatory landscape for fintech in India and reinforce the importance of KYC and AML compliance for all financial institutions operating within the country.

Featured Posts

-

Merrill Back Campusano To El Paso Padres Pregame Update

May 15, 2025

Merrill Back Campusano To El Paso Padres Pregame Update

May 15, 2025 -

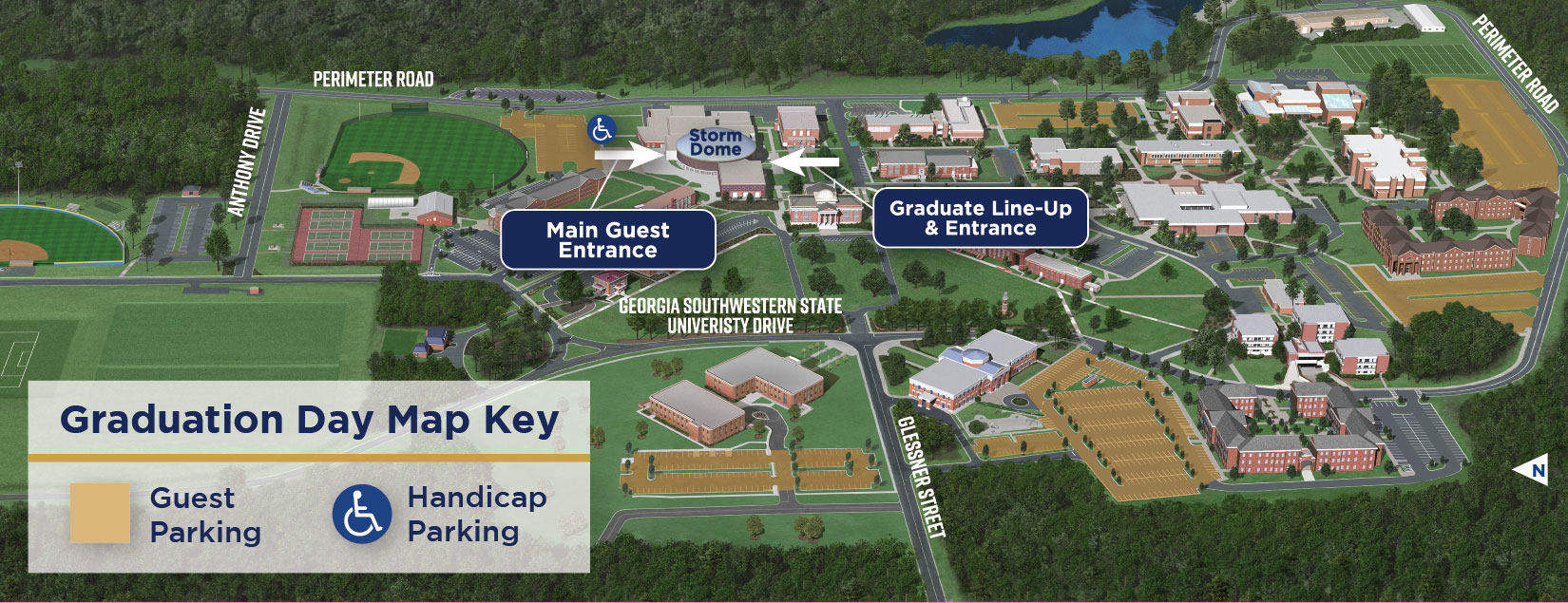

Individual In Custody Gsw Campus Safe All Clear

May 15, 2025

Individual In Custody Gsw Campus Safe All Clear

May 15, 2025 -

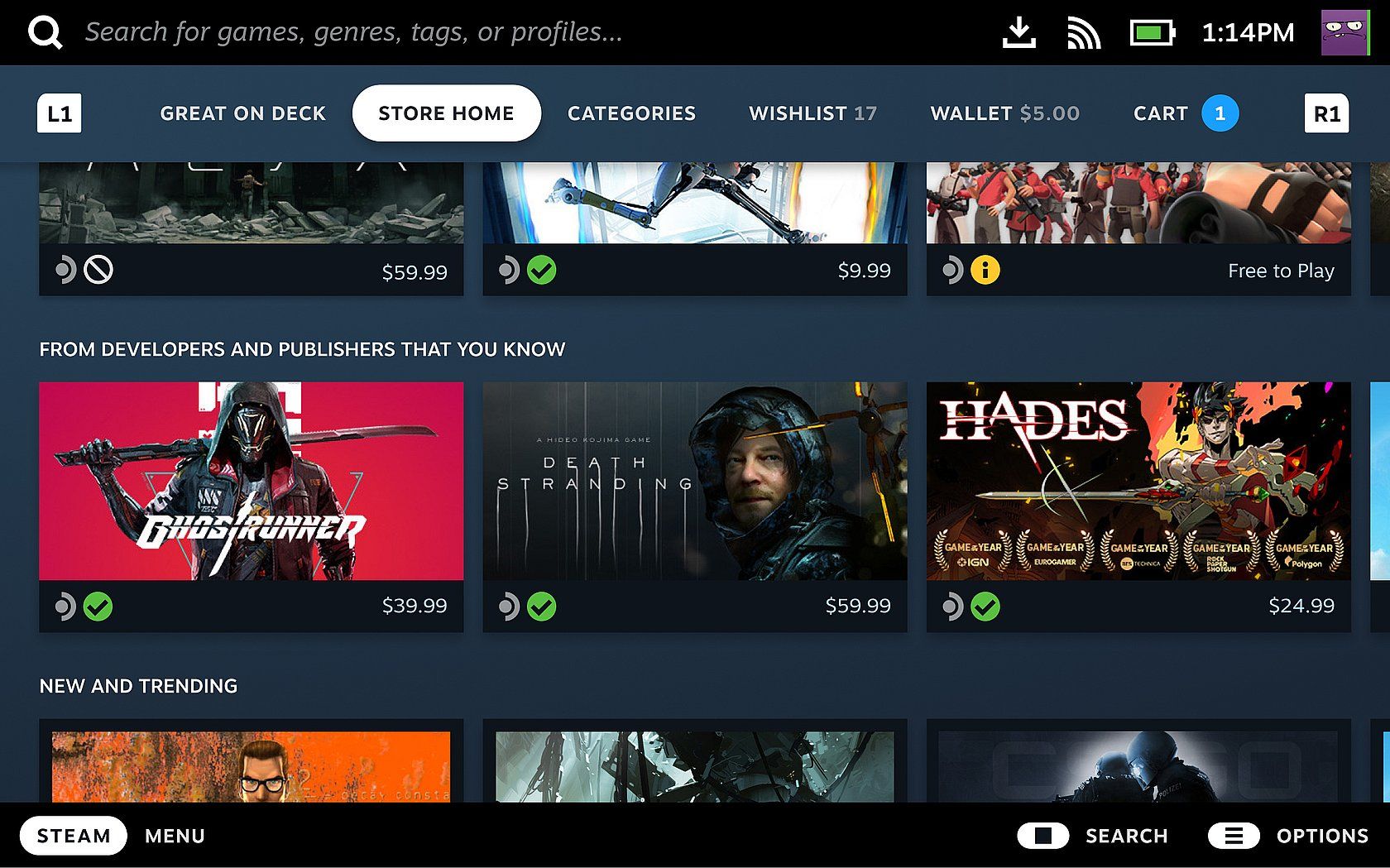

Enhanced Ps 1 Gaming Exploring The New Steam Deck Verified Titles

May 15, 2025

Enhanced Ps 1 Gaming Exploring The New Steam Deck Verified Titles

May 15, 2025 -

Vont Weekend A Photo Journey April 4 6 2025

May 15, 2025

Vont Weekend A Photo Journey April 4 6 2025

May 15, 2025 -

The Forgotten Base Exploring The U S Nuclear Facility Under Greenlands Ice

May 15, 2025

The Forgotten Base Exploring The U S Nuclear Facility Under Greenlands Ice

May 15, 2025