Five Key Charts To Watch In Global Commodity Markets This Week

Table of Contents

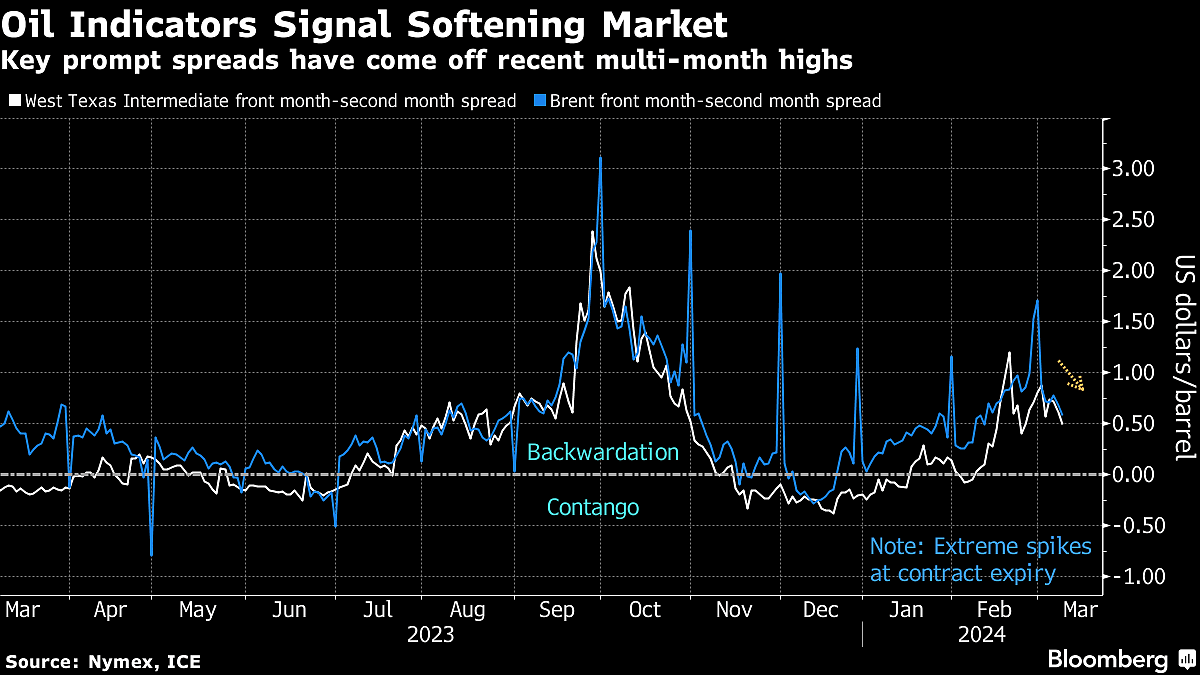

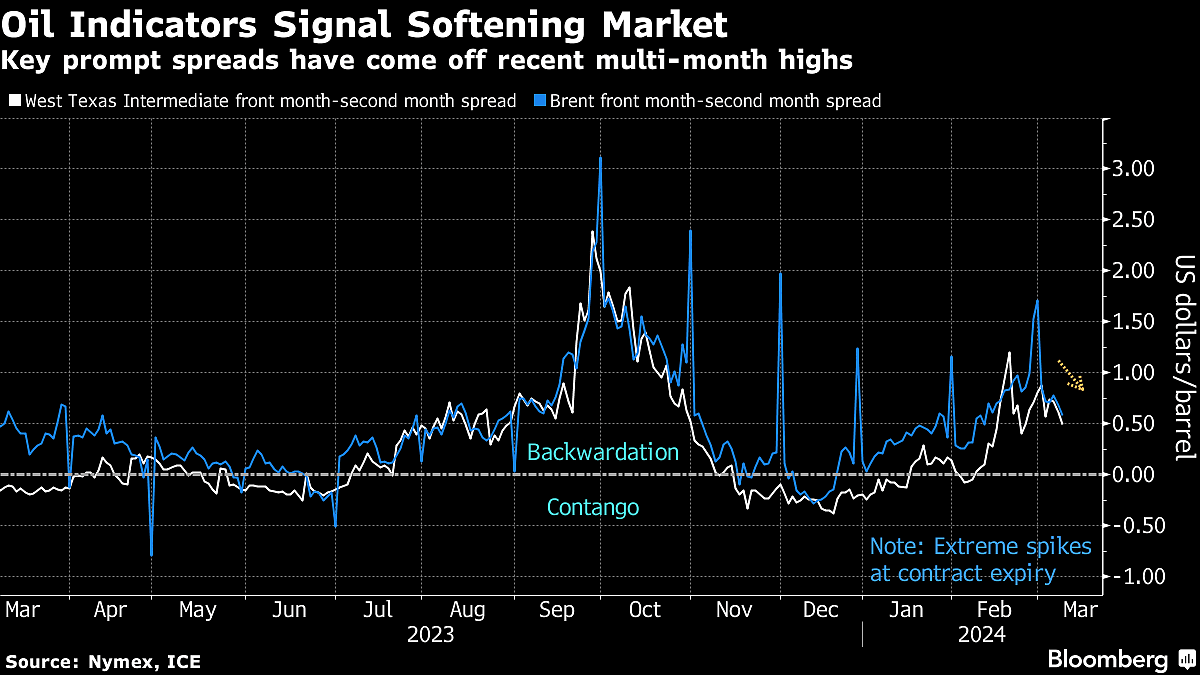

1. Crude Oil Price Chart: OPEC+ Production and Geopolitical Risks

Analyzing the crude oil price chart is paramount this week. The interplay of OPEC+ production decisions, geopolitical instability, and global demand significantly impacts prices. Key factors to watch include the daily and weekly price movements of Brent and WTI crude oil, two key benchmarks.

- OPEC+ Influence: The decisions made by the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) directly affect global oil supply. Any unexpected changes to production quotas can trigger significant price swings. Monitor announcements closely.

- Geopolitical Instability: The ongoing Russia-Ukraine conflict continues to create uncertainty in the energy market. Sanctions on Russian oil exports, a major global producer, disrupt supply chains and contribute to price volatility. The impact of these sanctions is crucial to watch.

- Global Demand: Global oil demand is another critical factor. Economic growth in major economies significantly influences consumption, which in turn affects prices. Rising demand, coupled with supply constraints, typically pushes prices upward.

- Strategic Petroleum Reserves: The release or withholding of strategic petroleum reserves by major consuming nations can also have a significant impact on the crude oil price, providing a buffer against sharp price increases or exacerbating shortages.

Keywords: Crude oil price, OPEC+, geopolitical risk, Brent crude, WTI, oil demand, energy crisis, supply chain disruption.

2. Natural Gas Price Chart: European Supply and Storage Levels

The European natural gas market remains highly volatile. This week, keep a close watch on European natural gas storage levels, pipeline flows from Russia, and the influence of weather patterns.

- European Gas Storage: Storage levels in key European countries are crucial indicators of winter preparedness. Low storage levels combined with reduced Russian supply can lead to price spikes, especially during cold weather.

- Russian Gas Supply: The flow of Russian gas through pipelines to Europe remains a major uncertainty. Any further reductions or complete shutdowns could severely impact gas prices and energy security across the continent.

- LNG Imports: The role of liquefied natural gas (LNG) imports in compensating for reduced pipeline gas from Russia is growing. Increased LNG imports can help mitigate price increases, but their availability and cost remain important factors.

- Weather Impact: Unusually cold or warm weather directly affects natural gas demand. A harsh winter can quickly deplete storage and push prices higher, while warmer than expected temperatures can ease pressure on prices.

Keywords: Natural gas price, European gas storage, Russian gas supply, LNG imports, winter weather, energy security, gas price volatility.

3. Metal Prices Chart: Supply Chain Disruptions and Inflationary Pressures

The prices of key industrial metals like copper and aluminum are closely tied to global supply chains and inflationary pressures. Monitoring this chart provides insights into the health of the manufacturing sector and broader economic trends.

- Supply Chain Bottlenecks: Ongoing supply chain disruptions continue to impact the availability of industrial metals. Bottlenecks in transportation, production, and raw material sourcing can drive up prices.

- Inflationary Pressures: Metal prices are often correlated with broader inflation rates. High inflation typically increases the cost of raw materials, including metals, fueling further price increases.

- Manufacturing PMI: The manufacturing Purchasing Managers' Index (PMI) offers a leading indicator of manufacturing activity. Strong PMI readings generally suggest increased demand for industrial metals, pushing prices higher.

- Specific Metal Prices: Keep a close eye on the price movements of specific metals such as copper, aluminum, and nickel, as their prices are influenced by unique supply and demand dynamics.

Keywords: Copper price, aluminum price, metal prices, supply chain bottlenecks, inflation, manufacturing PMI, industrial metals, commodity inflation.

4. Agricultural Commodity Price Chart: Weather Patterns and Global Food Security

Agricultural commodity prices are highly sensitive to weather patterns and global food security concerns. Extreme weather events can significantly impact crop yields and prices.

- Weather Events: Droughts, floods, and other extreme weather events are major factors influencing crop production and therefore prices. Monitor weather forecasts in key agricultural regions.

- Global Food Security: Global food security concerns play a critical role in determining prices. Any disruptions to supply chains, political instability, or export restrictions can exacerbate food price inflation.

- Major Commodity Prices: Track the prices of major agricultural commodities such as wheat, corn, and soybeans, as these are crucial for global food supplies.

- Harvest Yields: Actual harvest yields play a critical role in determining the supply available and thus prices. Lower than expected yields due to adverse weather or other factors can result in significant price increases.

Keywords: Wheat price, corn price, soybean price, agricultural commodity prices, drought, flood, food security, global food prices, harvest yields.

5. Precious Metals Price Chart: Safe-Haven Demand and Interest Rates

Precious metals like gold and silver are often considered safe-haven assets. Their price movements are influenced by factors such as safe-haven demand, interest rate movements, and the overall macroeconomic environment.

- Safe-Haven Demand: During times of economic uncertainty or geopolitical instability, investors often flock to precious metals as a store of value, driving up demand and prices.

- Interest Rates: Rising interest rates typically put downward pressure on precious metal prices as they increase the opportunity cost of holding non-interest-bearing assets like gold.

- Inflation Hedge: Precious metals are often seen as an inflation hedge. High inflation can increase demand for gold and silver as investors seek to protect their purchasing power.

- Macroeconomic Environment: The overall health of the global economy plays a significant role in determining the demand for precious metals and thus their prices.

Keywords: Gold price, silver price, precious metals, safe-haven asset, interest rates, inflation hedge, macroeconomic environment, precious metal investment.

Conclusion

This week’s global commodity market is characterized by a complex interplay of factors. By carefully monitoring these five key charts – Crude Oil Prices, Natural Gas Prices, Metal Prices, Agricultural Commodity Prices, and Precious Metals Prices – investors and market participants can gain valuable insights into the direction of prices and make more informed decisions. Staying informed about these crucial indicators is essential for navigating the complexities of global commodity markets. Keep checking back for regular updates on these key charts to stay ahead in the dynamic world of commodity trading. Don't miss out – keep watching these key charts for global commodity market analysis!

Featured Posts

-

Sabrina Carpenter Teams Up With Fun Size Castmate For Unexpected Snl Appearance

May 06, 2025

Sabrina Carpenter Teams Up With Fun Size Castmate For Unexpected Snl Appearance

May 06, 2025 -

Spike Lee Honored With Gift From Jimmy Butler After Game Win

May 06, 2025

Spike Lee Honored With Gift From Jimmy Butler After Game Win

May 06, 2025 -

Cara Menonton Live Streaming Timnas U20 Indonesia Vs Yaman 18 30 Wib

May 06, 2025

Cara Menonton Live Streaming Timnas U20 Indonesia Vs Yaman 18 30 Wib

May 06, 2025 -

Did Trumps Tariffs Help Us Manufacturers An Analysis

May 06, 2025

Did Trumps Tariffs Help Us Manufacturers An Analysis

May 06, 2025 -

Obtaining Sabrina Carpenter Skins In Fortnite The Ultimate Guide

May 06, 2025

Obtaining Sabrina Carpenter Skins In Fortnite The Ultimate Guide

May 06, 2025