Fluctuations In Elon Musk's Net Worth: A US Economic Perspective

Table of Contents

The Impact of Tesla's Stock Performance

Elon Musk's net worth is intrinsically linked to Tesla's financial performance. The electric vehicle (EV) manufacturer's stock price directly influences his wealth, creating a fascinating correlation between the two.

Correlation between Tesla stock and Musk's wealth

- Tesla's stock performance over the past 5 years: A look at Tesla's stock chart reveals periods of explosive growth interspersed with significant corrections. In 2020, for example, the stock price soared, dramatically increasing Musk's net worth. Conversely, market downturns have directly impacted his wealth. Analyzing this volatility provides valuable insights into the market's perception of Tesla and its impact on Musk's fortune.

- Market sentiment, news cycles, and investor confidence: Positive news, such as successful product launches (like the Cybertruck unveiling) or advancements in battery technology, generally boost investor confidence and drive up Tesla's stock price, enriching Musk. Conversely, negative news, including production delays, regulatory challenges, or controversial tweets from Musk himself, can lead to significant stock price declines and decrease his net worth.

- The role of short-selling: Tesla has been a target for short-sellers, betting against the stock's success. Periods of heavy short-selling can create increased volatility, impacting both the stock price and Musk's net worth. Covering these short positions, when the stock price rises, can further amplify upward movements.

Tesla's market capitalization and its reflection on the US economy

Tesla's market capitalization is not merely a reflection of a single company's success; it's a powerful indicator of broader trends in the US economy.

- Tesla as a bellwether for the EV market: Tesla's success has spurred competition and significant investment in the US electric vehicle sector, influencing the valuations and strategies of established automakers. Its market leadership signals the growing acceptance and demand for electric vehicles.

- Correlation with broader US tech sector investments: Tesla's performance reflects the overall investor sentiment towards the US tech sector. Periods of high investor confidence in technology generally benefit Tesla's stock price and subsequently Musk's wealth.

- Impact on job creation and economic growth: Tesla's manufacturing facilities and expansion plans in the US contribute significantly to job creation and economic growth, specifically within the renewable energy and automotive sectors. This positive economic contribution further reinforces the importance of understanding Tesla's impact.

Influence of SpaceX and Other Ventures

Beyond Tesla, Elon Musk's net worth benefits from the success of SpaceX and his other ventures, highlighting the power of diversification.

SpaceX's contributions to Musk's net worth and the US space industry

SpaceX's achievements in commercial spaceflight have significantly boosted Musk's wealth while also invigorating the US space industry.

- Contracts with NASA and other organizations: SpaceX's lucrative contracts with NASA for cargo resupply missions to the International Space Station and astronaut transportation services have contributed substantially to its valuation and, consequently, to Musk's net worth.

- Impact on the US space industry's global competitiveness: SpaceX's innovations in reusable rockets and cost-effective space travel have increased the US's global competitiveness in the commercial space sector. This has helped attract further investments into the American space industry.

- Future growth areas: SpaceX's ambitious plans for Mars colonization and its growing satellite internet constellation (Starlink) represent significant potential for future revenue growth and a further increase in Musk's net worth.

Diversification of investments and their effect on overall net worth

Musk's investments in Neuralink (brain-computer interface technology) and The Boring Company (infrastructure and tunnel construction) demonstrate a diversification strategy that mitigates risk.

- Potential of Neuralink and The Boring Company: These ventures represent long-term growth opportunities with the potential to significantly increase Musk’s net worth in the future. Their success could further solidify his position as one of the world's wealthiest individuals.

- Risk mitigation through diversification: Diversifying across various sectors helps to reduce the overall volatility of his net worth. This strategy reduces the impact of downturns in any single sector.

- Comparison with other high-net-worth individuals: Musk's diversification strategy can be compared to that of other successful entrepreneurs and investors in the US, offering valuable insights into effective wealth management.

Macroeconomic Factors and Their Influence

Broader macroeconomic factors significantly influence market sentiment and, consequently, Elon Musk's net worth.

Impact of interest rates, inflation, and economic recessions

Economic indicators like interest rates, inflation, and recessionary periods impact investor confidence and market valuations.

- Impact of rising interest rates and inflation: Increased interest rates and inflation can negatively impact investor confidence, leading to lower stock valuations, including for Tesla and SpaceX, consequently reducing Musk's net worth.

- Potential impact of a recession: During an economic recession, investors tend to become more risk-averse, potentially leading to a decline in the valuation of growth stocks like Tesla, affecting Musk's wealth.

- Influence of government policies and regulations: Government regulations and policies, particularly those related to environmental protection and technology, can influence Tesla's operations and profitability, and indirectly affect Musk's net worth.

Geopolitical events and their influence on the market

Global events exert significant influence on market stability and investor confidence.

- Geopolitical instability's impact on Tesla and SpaceX: Global instability can lead to market uncertainty and volatility, affecting the valuations of Tesla and SpaceX and, subsequently, Musk's net worth.

- Impact of supply chain disruptions: Supply chain disruptions caused by geopolitical events can hamper Tesla's production and impact its profitability, affecting Musk’s net worth.

- Influence of international trade relations: International trade relations and tariffs can affect Tesla's global operations and profitability, further influencing Musk's overall net worth.

Conclusion

The fluctuations in Elon Musk's net worth serve as a powerful lens through which to view the dynamism and interconnectedness of the US economy. His success, inextricably linked to the performance of Tesla and SpaceX, reflects broader trends in technology, innovation, and global market forces. Understanding these intricate relationships is key to navigating the complexities of the modern financial landscape. To stay informed about the continued impact of Elon Musk's net worth on the US economy, follow leading financial news sources and continue to research the interdependencies between innovation and economic growth. By monitoring Elon Musk's net worth and its influencing factors, you can gain valuable insights into the future trajectory of American business and investment.

Featured Posts

-

Is The Monkey The Worst Stephen King Movie Of 2025 A Critical Analysis

May 10, 2025

Is The Monkey The Worst Stephen King Movie Of 2025 A Critical Analysis

May 10, 2025 -

How Harry Styles Reacted To A Bad Snl Impression Of Himself

May 10, 2025

How Harry Styles Reacted To A Bad Snl Impression Of Himself

May 10, 2025 -

Indiana High School Athletic Association Bans Transgender Girls After Trump Order

May 10, 2025

Indiana High School Athletic Association Bans Transgender Girls After Trump Order

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025

Indian Stock Market Update Sensex Nifty Close Higher Despite Ultra Tech Fall

May 10, 2025 -

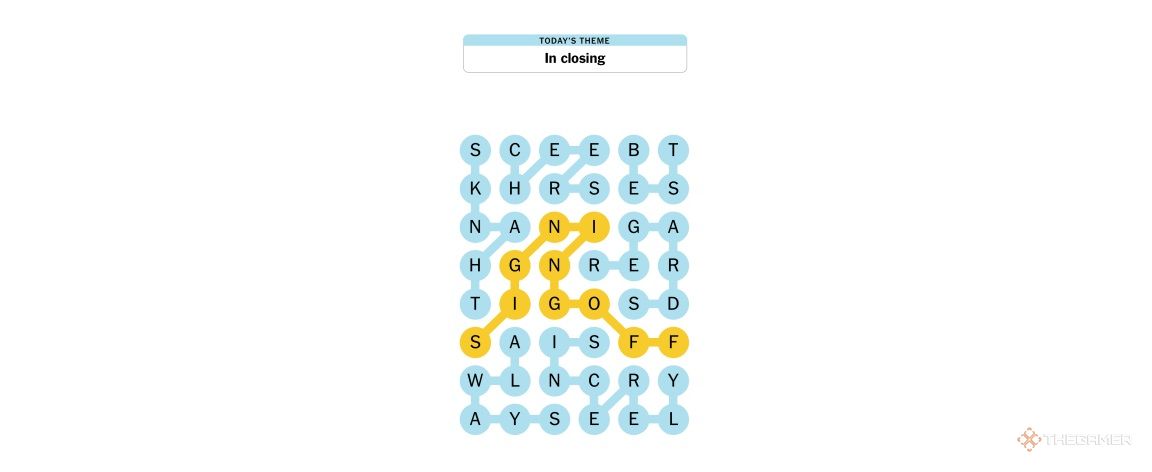

Nyt Strands April 6 2025 Complete Crossword Puzzle Guide

May 10, 2025

Nyt Strands April 6 2025 Complete Crossword Puzzle Guide

May 10, 2025