Forecasting Apple Stock (AAPL) Price: Important Levels To Consider

Table of Contents

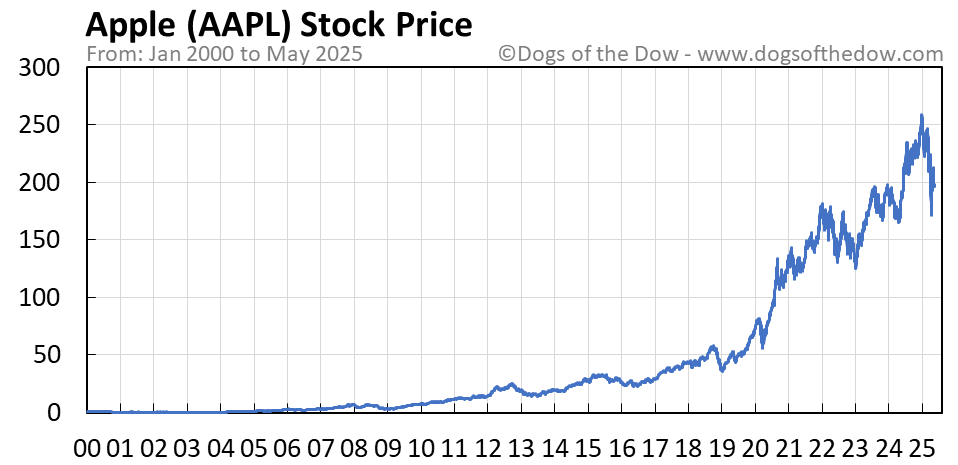

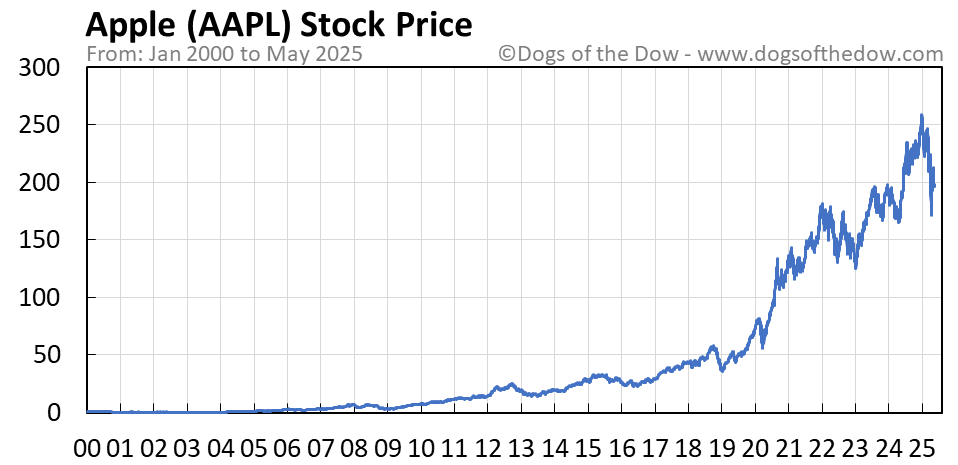

Technical Analysis for AAPL Stock Price Prediction

Technical analysis focuses on historical price and volume data to predict future price movements. For AAPL stock price forecasting, several indicators prove particularly useful.

-

Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. The 20-day, 50-day, and 200-day moving averages are commonly used. A bullish crossover (shorter-term MA crossing above a longer-term MA) can signal a potential uptrend, while a bearish crossover suggests a possible downtrend. For AAPL, observing how the price interacts with these moving averages can offer insights into short-term and long-term trends.

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often suggests the stock is overbought, potentially leading to a price correction. Conversely, an RSI below 30 may indicate an oversold condition, potentially signaling a bounce. Monitoring the RSI for AAPL can help identify potential turning points.

-

Moving Average Convergence Divergence (MACD): The MACD identifies changes in momentum by comparing two moving averages. A bullish signal occurs when the MACD line crosses above the signal line, potentially indicating an upward trend. A bearish signal occurs when the MACD line crosses below the signal line. Analyzing the MACD for AAPL can provide another layer of confirmation for potential trends.

-

Chart Patterns: Identifying chart patterns like head and shoulders, double tops/bottoms, and triangles can help anticipate price reversals or continuations. These patterns, when observed in AAPL's historical price charts, can provide valuable signals.

-

Support and Resistance Levels: These are price levels where the stock price has historically struggled to break through. Support levels act as a floor, while resistance levels act as a ceiling. Identifying these levels on AAPL's chart is crucial for forecasting potential price movements. For example, a previous high might act as a resistance level, and a previous low might act as support.

Fundamental Analysis of Apple's Stock (AAPL)

Fundamental analysis assesses the intrinsic value of a company by examining its financial statements and other qualitative factors. For AAPL, this involves:

-

Financial Metrics: Analyzing key metrics like revenue growth, earnings per share (EPS), profit margins, and debt-to-equity ratio is crucial. Strong revenue growth, increasing EPS, and healthy profit margins generally suggest a healthy and growing company, positively impacting the AAPL stock price.

-

Product Releases and Innovation: Apple's continuous innovation with products like iPhones, iPads, Macs, and wearables is a significant driver of its financial performance. New product releases and updates directly impact revenue and investor sentiment, influencing the AAPL stock price.

-

Market Share and Competitive Landscape: Analyzing Apple's market share in various sectors (smartphones, wearables, etc.) and assessing its competitive landscape (Samsung, Google, etc.) provides insights into its long-term growth potential and its ability to maintain its market position.

-

Industry Trends: Understanding broader industry trends (e.g., the growth of the mobile market, the rise of artificial intelligence) is essential for evaluating AAPL's long-term prospects.

Analyzing these factors helps determine if the current AAPL stock price accurately reflects the company's intrinsic value.

Key Support and Resistance Levels for AAPL Stock

Identifying key support and resistance levels for AAPL stock involves examining historical price data. These levels often represent psychological barriers for traders and investors.

-

Historical Support and Resistance: Past price action can reveal consistent levels where the stock has found support or encountered resistance. These levels can act as potential turning points in the future.

-

Psychological Levels: Round numbers (e.g., $150, $175, $200) often act as significant support or resistance levels due to their psychological importance to traders.

Understanding these levels can help anticipate potential price reversals or breakouts.

Risks and Considerations When Forecasting Apple Stock (AAPL)

Stock price forecasting, even for a seemingly stable company like Apple, is inherently uncertain.

-

Unforeseen Events: Economic downturns, supply chain disruptions, geopolitical events, and unexpected technological shifts can significantly impact AAPL stock prices.

-

Limitations of Analysis: Both technical and fundamental analysis have limitations. No method guarantees accurate predictions.

-

Diversification and Risk Management: Diversifying your investment portfolio and employing appropriate risk management strategies are crucial to mitigating potential losses.

Conclusion: Mastering Apple Stock (AAPL) Price Forecasting: Your Next Steps

Forecasting AAPL stock price effectively involves combining technical and fundamental analysis to identify key support and resistance levels. However, it's critical to acknowledge the inherent uncertainties and risks involved. This article provides a framework for your own AAPL stock price forecasting. Remember to conduct thorough research, utilize reliable financial resources, and continuously monitor the market for changes. Successful Apple stock (AAPL) price forecasting is an ongoing process that requires adaptation and a well-defined risk management strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Carolina Country Music Fest 2025 Tickets Gone

May 25, 2025

Carolina Country Music Fest 2025 Tickets Gone

May 25, 2025 -

The 2009 Brawn Jenson Buttons Formula 1 Masterpiece

May 25, 2025

The 2009 Brawn Jenson Buttons Formula 1 Masterpiece

May 25, 2025 -

Adios A Eddie Jordan Ultima Hora En El Mundo Del Motor

May 25, 2025

Adios A Eddie Jordan Ultima Hora En El Mundo Del Motor

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value Nav

May 25, 2025 -

Porsche Cayenne 2025 A Comprehensive Look At Its Interior And Exterior Design

May 25, 2025

Porsche Cayenne 2025 A Comprehensive Look At Its Interior And Exterior Design

May 25, 2025