Frankfurt Equities: DAX's Continued Rise Pushes Towards New Record

Table of Contents

DAX Performance and Key Drivers

The DAX index has shown significant strength recently, climbing [insert specific percentage increase] in the last [insert time period]. This impressive performance brings it tantalizingly close to surpassing previous record highs. Several key economic factors contribute to this robust growth within the German and broader European equity markets.

-

Robust Corporate Earnings: Many leading DAX companies have reported exceptionally strong earnings, fueled by increased consumer spending and global demand. This positive trend underscores the health of the German economy and boosts investor confidence in the Frankfurt equities market.

-

Positive Economic Growth: Germany and the Eurozone are experiencing relatively healthy economic growth, albeit facing challenges. This positive macroeconomic environment provides a fertile ground for sustained growth in the stock market. Factors such as resilient industrial production and increased exports play a crucial role.

-

Easing Inflation Concerns: While inflation remains a concern globally, recent data suggests a gradual easing in inflationary pressures in Europe. This reduction in inflation uncertainty contributes to a more favorable investment climate, encouraging investors to allocate capital to Frankfurt equities.

-

Interest Rate Decisions: The European Central Bank's (ECB) interest rate decisions, while aimed at curbing inflation, have had a relatively measured impact on the DAX's performance. The market seems to have largely anticipated these moves.

-

Geopolitical Factors: While geopolitical instability always presents a risk, relative calm in certain key regions has contributed to a less volatile investment environment, allowing the DAX to maintain its upward trajectory.

Sector-Specific Performance within the Frankfurt Equities Market

The performance within the Frankfurt equities market isn't uniform. While the DAX as a whole is thriving, sector-specific performance reveals a nuanced picture.

-

Automotive Sector: This sector is performing strongly, driven by robust export demand and the ongoing growth of the electric vehicle (EV) market. German automotive giants are benefiting from increased global sales and investments in innovative technologies.

-

Technology Sector: The technology sector is another key driver of growth, fueled by ongoing digital transformation across industries and continued investment in research and development. Innovative German tech companies are attracting significant investment.

-

Financial Sector: The financial sector's performance is closely linked to interest rate decisions. While rising rates present challenges, they also create opportunities for increased lending and profitability, leading to mixed performance within this sector.

-

Underperforming Sectors: [Mention any underperforming sectors and their contributing factors – e.g., energy sector impacted by regulatory changes or specific market conditions].

Investor Sentiment and Future Outlook for Frankfurt Equities

Investor sentiment towards Frankfurt equities and the DAX is currently cautiously optimistic. While the market exhibits strength, potential risks remain.

-

Analyst Predictions: Many analysts predict continued growth for the DAX in the coming months, though the pace of growth may moderate. [Cite specific analyst predictions if available].

-

Potential Risks: The risk of a global recession, lingering inflation uncertainty, and geopolitical tensions remain potential headwinds that could impact the DAX's performance.

-

Investment Strategies: Given the current market conditions, a diversified investment strategy is recommended, balancing risk and potential return. Long-term investment strategies are generally favored in a market exhibiting sustained growth.

Conclusion

The DAX's impressive rise reflects a positive economic climate, strong corporate performance, and easing inflation concerns within the Frankfurt equities market. While risks persist, the overall outlook for Frankfurt equities remains favorable, with the potential for the DAX to reach new record highs. Different sectors exhibit varying levels of performance, underscoring the importance of sector-specific analysis for investment decisions.

Stay informed on the latest developments in Frankfurt Equities and the DAX to make informed investment decisions. For ongoing analysis and market insights, consult reputable financial news websites and investment research platforms. Track the exciting trajectory of the DAX and Frankfurt Equities for potential investment opportunities.

Featured Posts

-

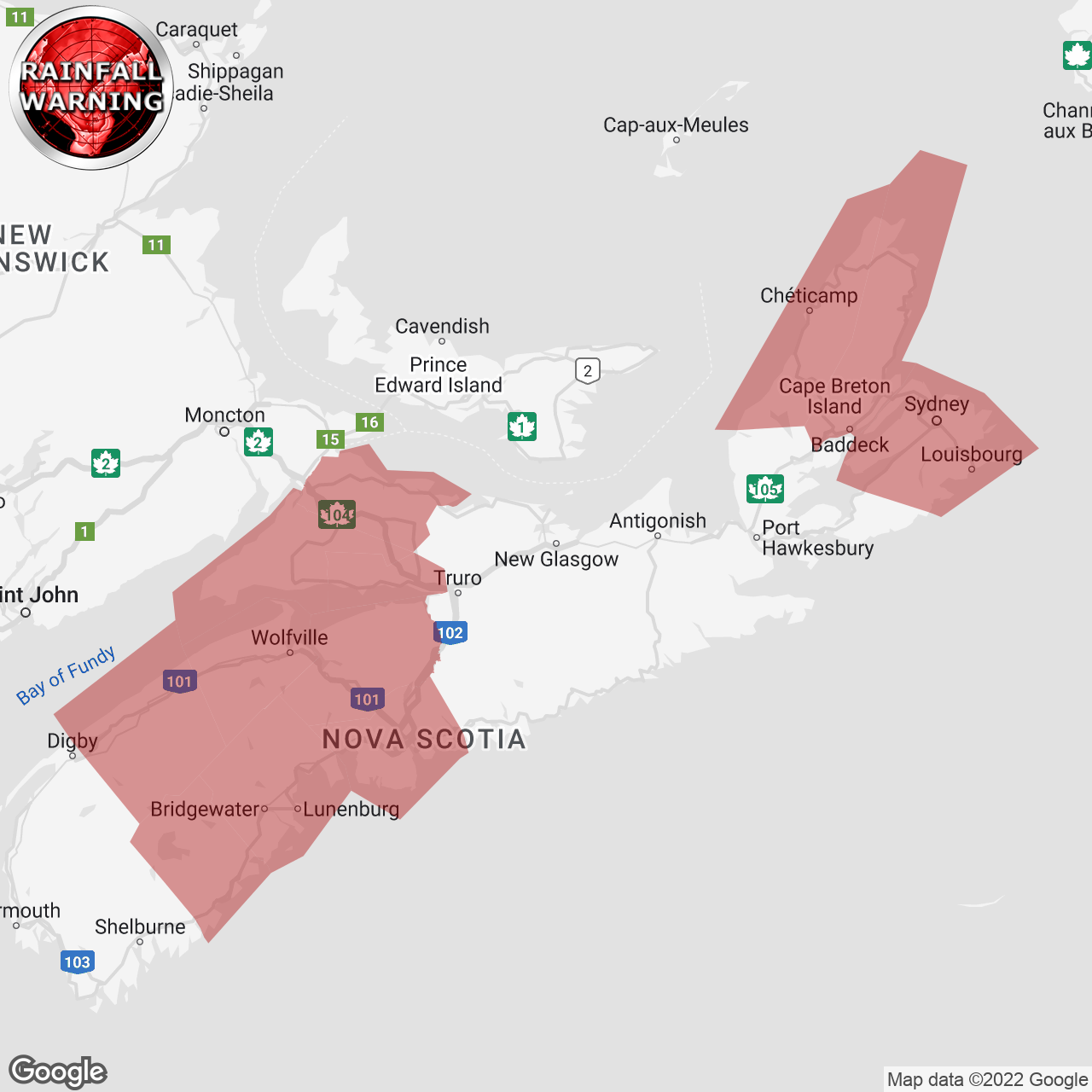

Urgent Flash Flood Warning Issued For Pennsylvania Heavy Rainfall Expected

May 25, 2025

Urgent Flash Flood Warning Issued For Pennsylvania Heavy Rainfall Expected

May 25, 2025 -

Yubileyniy Vecher Pamyati Sergeya Yurskogo

May 25, 2025

Yubileyniy Vecher Pamyati Sergeya Yurskogo

May 25, 2025 -

Republican Unity Under Pressure Trumps Role

May 25, 2025

Republican Unity Under Pressure Trumps Role

May 25, 2025 -

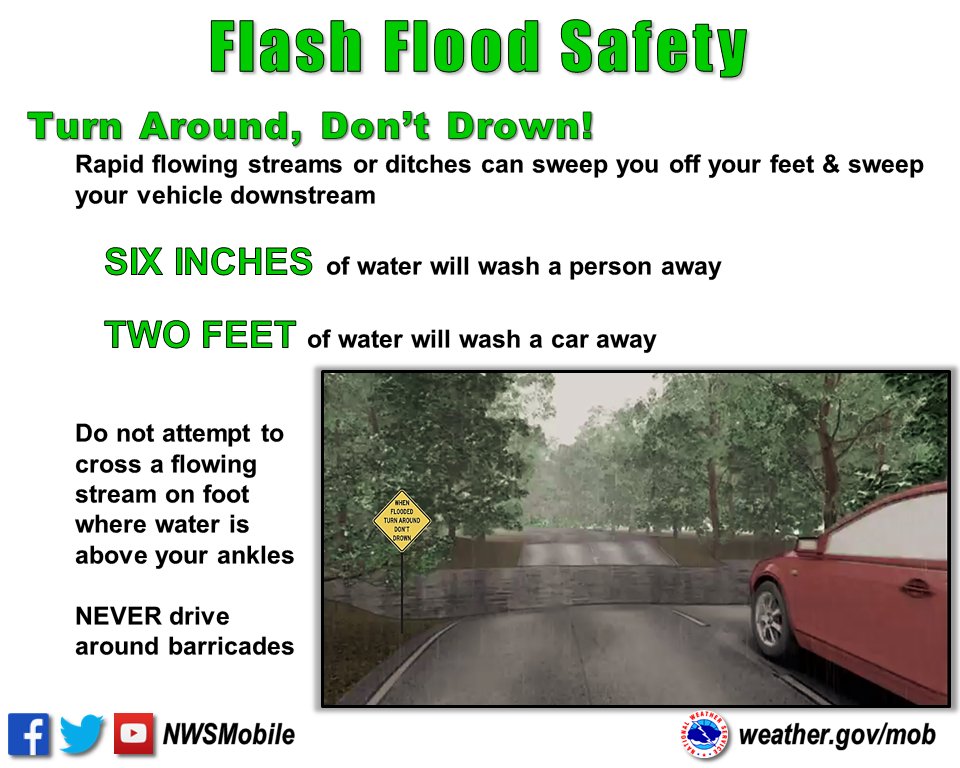

Flood Warning In Effect Essential Safety Precautions From Nws

May 25, 2025

Flood Warning In Effect Essential Safety Precautions From Nws

May 25, 2025 -

Demnas Gucci Debut And Kerings Recent Financial Performance

May 25, 2025

Demnas Gucci Debut And Kerings Recent Financial Performance

May 25, 2025