Frankfurt Stock Exchange: DAX Ends Trading Below 24,000

Table of Contents

Factors Contributing to the DAX Decline

Geopolitical Uncertainty

Global events continue to cast a shadow over investor confidence. The ongoing war in Ukraine, coupled with escalating tensions between the US and China, fuels market volatility. These geopolitical factors create uncertainty about future economic growth and supply chains, impacting investor sentiment and leading to a sell-off in the DAX.

- Ukraine Conflict: The war's impact on energy prices and global supply chains is a major concern.

- US-China Relations: Trade disputes and technological rivalry between these economic giants contribute to instability.

- Other Geopolitical Risks: Emerging crises in other regions can also influence investor decisions and impact the DAX.

News sources like the Financial Times and Bloomberg constantly report on these events, and experts warn of their sustained impact on market sentiment.

Inflationary Pressures and Interest Rate Hikes

Rising inflation across the globe is forcing central banks, including the European Central Bank (ECB), to aggressively hike interest rates. This move, while aimed at curbing inflation, also increases borrowing costs for businesses, impacting investment and potentially slowing economic growth. Higher interest rates generally lead to lower stock valuations.

- Inflation Data: Recent inflation figures in Germany and the Eurozone remain stubbornly high, exceeding the ECB's target.

- ECB Interest Rate Decisions: The ECB's recent interest rate hikes are putting pressure on businesses and consumers.

- Impact on Stock Valuations: Higher discount rates due to increased interest rates lead to lower present values of future earnings, impacting stock prices.

Energy Crisis and its Impact on German Businesses

The energy crisis in Europe, particularly impacting Germany's energy-intensive industries, is significantly affecting corporate profits and investor confidence. High energy prices increase production costs, squeezing profit margins and impacting the bottom line of numerous German companies.

- Manufacturing Sector: The automotive and manufacturing sectors are heavily impacted by soaring energy costs.

- Corporate Earnings: Several DAX-listed companies have reported reduced profits or issued profit warnings due to high energy prices.

- Energy Price Volatility: Fluctuations in energy prices create additional uncertainty for businesses and investors.

Analysis of Key DAX Performers

Sector-Specific Performance

The DAX decline wasn't uniform across all sectors. While energy companies might initially benefit from higher prices, the overall negative sentiment overshadowed these gains. The automotive sector, heavily reliant on energy and impacted by supply chain disruptions, underperformed. Conversely, certain technology companies might show some resilience.

- Automotive Sector: Underperformed due to high energy costs and supply chain issues.

- Technology Sector: Showed mixed results, with some companies demonstrating relative strength.

- Financials Sector: Performance varies depending on the sub-sector and exposure to interest rate changes.

Investor Sentiment and Trading Volume

Investor sentiment is currently cautious, reflecting the uncertainties discussed above. Trading volume on the Frankfurt Stock Exchange might increase during periods of high volatility, as investors react to market news and adjust their portfolios. Analyzing trading volume gives insights into the intensity of market movements.

- Market Sentiment Indicators: Surveys and expert opinions suggest a prevailing sense of caution among investors.

- Trading Volume Analysis: Increased trading volume indicates higher activity and stronger reactions to market events.

- Analyst Ratings: Follow analyst ratings and recommendations to better understand the expectations and perspectives on different DAX companies.

Potential Implications and Future Outlook for the DAX

Short-Term Predictions

The DAX could experience further short-term volatility depending on the resolution of geopolitical tensions, inflation rates, and ECB policy decisions. Technical analysis might identify potential support and resistance levels, providing indications of short-term price movements. However, market predictions are inherently uncertain.

- Support and Resistance Levels: Technical analysts might identify levels where the DAX might find support or face resistance.

- Market Volatility: Expect continued volatility in the short term, influenced by incoming economic data and news.

- Disclaimer: Market predictions are subject to significant uncertainty and should not be considered financial advice.

Long-Term Outlook

The long-term prospects of the DAX are tied to the health of the German economy and the broader European Union. Factors such as successful energy diversification, technological innovation, and structural reforms can contribute to positive long-term growth. However, persistent inflation, geopolitical instability, and potential economic slowdowns pose risks.

- Economic Growth Forecasts: Consult economic forecasts from reputable institutions for insights into potential long-term growth.

- Structural Reforms: The implementation of structural reforms in Germany could positively influence the DAX's long-term performance.

- Technological Advancements: Technological progress and innovation offer potential growth opportunities for German companies.

DAX Below 24,000: What's Next?

In summary, the DAX closing below 24,000 reflects a confluence of factors, including geopolitical uncertainty, inflationary pressures, interest rate hikes, and the ongoing energy crisis. These factors have contributed to a cautious investor sentiment and increased market volatility. While the short-term outlook remains uncertain, the long-term prospects of the DAX depend on addressing these challenges and fostering sustainable economic growth. Stay tuned for further updates on the DAX and the Frankfurt Stock Exchange. Understanding the factors impacting the DAX index is crucial for informed investment strategies.

Featured Posts

-

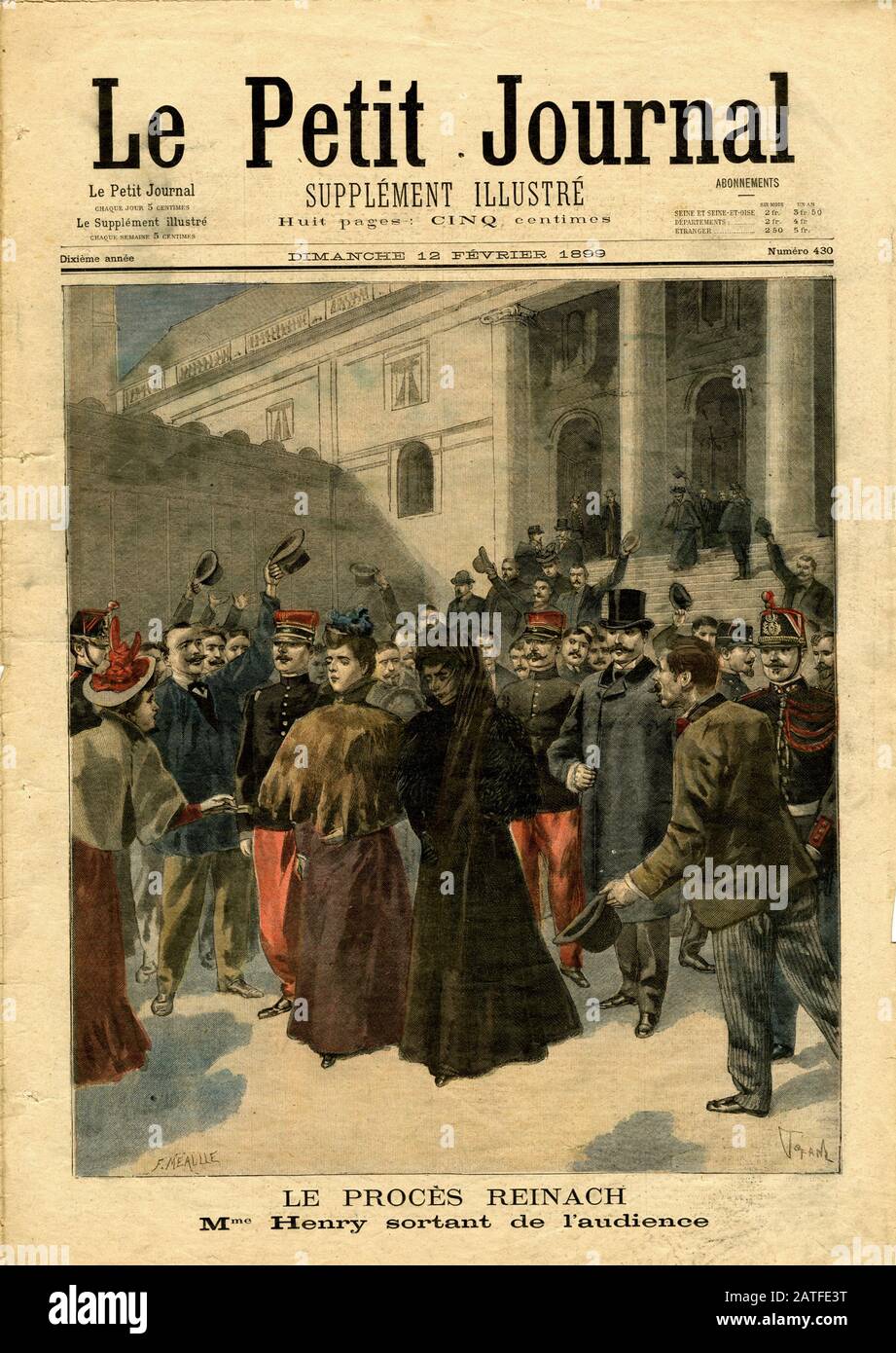

Dreyfus Affair Posthumous Promotion Proposed By French Parliament

May 25, 2025

Dreyfus Affair Posthumous Promotion Proposed By French Parliament

May 25, 2025 -

Joy Crookes Releases New Song I Know You D Kill Details And Release Date

May 25, 2025

Joy Crookes Releases New Song I Know You D Kill Details And Release Date

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Major Loss Down 11 Since Wednesday

May 25, 2025 -

Ocean Gate Titan The Sound Of Implosion In Newly Released Footage

May 25, 2025

Ocean Gate Titan The Sound Of Implosion In Newly Released Footage

May 25, 2025 -

Retour Du Ces Unveiled En Europe Amsterdam Devoile Les Dernieres Innovations Technologiques

May 25, 2025

Retour Du Ces Unveiled En Europe Amsterdam Devoile Les Dernieres Innovations Technologiques

May 25, 2025