From $TRUMP Short To White House Dinner: One Trader's Story

Table of Contents

The Risky Bet: Initial $TRUMP Short Position

The 2016 US Presidential election was a period of intense market volatility. Many analysts were skeptical of Donald Trump's candidacy, and our trader, let's call him Alex, was among them. This led him to take a daring $TRUMP short position, betting against assets he believed would decline if Trump won.

Market Sentiment and the Decision

Alex's decision to short Trump-related assets wasn't based on mere speculation. He meticulously analyzed market sentiment, economic forecasts, and Trump's policy proposals. He identified several potential downsides to a Trump presidency that he felt the market was underestimating.

- Market analysis: Polling data indicating low probability of a Trump victory, analyses predicting negative economic consequences of certain Trump policies, and perceived market instability under a Trump administration.

- Specific assets shorted: Alex diversified his short position across various assets, including specific stocks sensitive to trade policy changes, and futures contracts tied to indices.

- Risk assessment: While acknowledging the inherent risks, Alex believed the potential rewards outweighed the potential losses, based on his analysis of the market and the perceived political climate. He knew shorting a high-profile candidate like Trump carried significant political risk.

Managing the $TRUMP Short: Hedging and Risk Mitigation

Shorting any asset involves risk, but shorting something as politically charged as Trump-related assets significantly amplified the potential for losses. Alex employed several risk mitigation strategies:

- Hedging techniques: He used options contracts to hedge against unexpected market movements, attempting to limit potential losses if the market reacted favorably to Trump.

- Stop-loss orders: Protective stop-loss orders were implemented to automatically close the short position if the price of the shorted assets moved against his prediction.

- Diversification: His short position was spread across multiple assets to prevent catastrophic losses from a single adverse event.

- Portfolio adjustments: Alex regularly monitored the market and made adjustments to his portfolio based on new information and shifting market sentiment. This involved re-evaluating his $TRUMP short position and adjusting his hedges accordingly.

The Unexpected Turn: Election Night and its Aftermath

Election night brought a shock: Donald Trump won. The immediate market reaction was a sharp and unexpected surge in many sectors Alex had shorted.

Election Results and Market Reaction

The election results sent shockwaves through global financial markets. The assets Alex had shorted experienced significant price increases, putting his $TRUMP short position at considerable risk.

- Market volatility: The market experienced extreme volatility in the days following the election, reflecting the uncertainty about the new administration's policies.

- Price movements of affected assets: Many assets initially dropped, but then rebounded sharply, illustrating the unpredictable nature of shorting politically sensitive investments.

- Trader's emotional response: Alex, like many, was surprised and initially concerned about the implications for his portfolio. He experienced a range of emotions, from anxiety to a sense of disbelief.

Damage Control and Re-evaluation

Faced with significant losses, Alex had to act quickly. He chose to cover a portion of his short position to limit further damage.

- Decision to hold or cover the short position: The decision was made to cut losses on some positions while maintaining a smaller, more hedged position on other assets to observe the market's long-term reaction.

- Adjustments to the trading strategy: Alex realized his initial market analysis had underestimated the resilience of the market to political surprises. He adapted his trading strategy to better account for unpredictable events.

- Lessons learned: The experience highlighted the crucial importance of risk management, diversification, and the unpredictable influence of political events on the market.

From Trader to White House Guest: An Unlikely Turn of Events

This is where the story takes a truly unexpected turn. Months later, Alex received an invitation to a White House event.

The Connection and the Invitation

The connection wasn't directly related to his $TRUMP short position. Through a series of chance encounters and professional networking events, Alex formed a connection with someone involved in the Trump administration who was impressed by his financial expertise.

- Nature of the connection: The connection was entirely unrelated to Alex's trading activities; it developed through a common professional acquaintance.

- Details about the invitation: While specific details remain private, the invitation was to a significant event, demonstrating the surprising trajectory of his life after the election.

- The trader's reaction: Alex was obviously surprised and honored by the invitation, demonstrating the unpredictable nature of life's events.

Reflections on the Journey

Looking back, Alex's journey is a testament to the unpredictable nature of both the market and life itself.

- Key takeaways from the experience: The experience underscored the importance of risk management, market analysis, diversification, and recognizing that unforeseen political events can heavily influence market performance.

- Insights gained about market volatility: Alex learned about the importance of adapting to new information, recognizing personal biases, and adjusting strategies accordingly.

- Insights gained about political influence and risk management: He gained a better understanding of the critical role that political factors play in market volatility and the need for careful risk assessment when trading politically charged assets.

Conclusion

Alex's journey from a high-risk $TRUMP short position to an unlikely White House dinner is a remarkable example of how unexpected events can shape our lives. His story highlights the crucial role of risk management, the unpredictable nature of market volatility, and the significant influence of political events on financial markets. He learned to adapt, re-evaluate, and ultimately, navigate the complexities of trading and life’s surprising turns.

Have you ever taken a bold trading position with unexpected results? Share your story in the comments below! Learn more about navigating the risks of shorting high-profile assets like $TRUMP, and share your insights!

Featured Posts

-

Bayern Munich And Jonathan Tah Concrete Negotiations Begin

May 29, 2025

Bayern Munich And Jonathan Tah Concrete Negotiations Begin

May 29, 2025 -

Air Jordan June 2025 Release Calendar And More

May 29, 2025

Air Jordan June 2025 Release Calendar And More

May 29, 2025 -

Will These Beloved Characters Return In Stranger Things Season 5

May 29, 2025

Will These Beloved Characters Return In Stranger Things Season 5

May 29, 2025 -

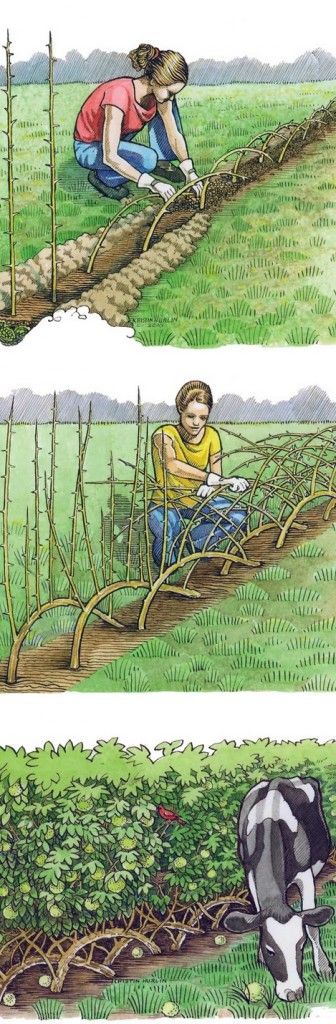

The Ultimate Guide To Building A Living Fence

May 29, 2025

The Ultimate Guide To Building A Living Fence

May 29, 2025 -

Ipa I Kritiki Toy Ilon Mask Sto Megalo Omorfo Nomosxedio Kai I Apoxorisi Toy

May 29, 2025

Ipa I Kritiki Toy Ilon Mask Sto Megalo Omorfo Nomosxedio Kai I Apoxorisi Toy

May 29, 2025