FTC Challenges Microsoft's Activision Acquisition: A Legal Battle

Table of Contents

The FTC's Case Against the Merger

The FTC's core argument centers on antitrust concerns and the potential for market monopolization. Keywords: Antitrust concerns, market monopolization, Call of Duty, game exclusivity, competition reduction. The commission believes the merger would significantly reduce competition, particularly within the console gaming market. This concern is largely fueled by the potential for Microsoft to make popular Activision Blizzard titles, such as Call of Duty, exclusive to its Xbox ecosystem.

-

Stifling Competition: The FTC argues that removing Call of Duty from competitors' platforms like PlayStation would give Microsoft an unfair advantage, potentially harming Sony and other players in the market. This exclusivity could drive players towards the Xbox ecosystem, lessening competition and potentially harming innovation.

-

Control over Distribution and Pricing: The FTC alleges that the merged entity would gain excessive control over game distribution channels and pricing, leading to higher prices and less choice for consumers. The acquisition could also limit the ability of smaller developers to compete effectively.

-

Evidence Presented: The FTC's case rests on a significant body of evidence, including detailed market share analysis, expert testimony from economists and industry analysts, and potentially, internal documents obtained through discovery. This evidence aims to demonstrate the anti-competitive nature of the proposed merger.

-

Seeking to Block the Merger: Ultimately, the FTC is seeking to completely block the Microsoft-Activision Blizzard merger, arguing that it violates existing antitrust laws designed to protect competition and prevent monopolies.

Microsoft's Defense Strategy

Microsoft counters the FTC's claims with a robust defense strategy emphasizing the benefits for consumers and the promotion of competition. Keywords: Competition benefits, cloud gaming, consumer choice, Xbox Game Pass, innovation. Their central argument revolves around the idea that the merger will actually increase competition and benefit consumers through expanded access to games.

-

Xbox Game Pass Expansion: Microsoft highlights the role of Xbox Game Pass, its game subscription service. They contend that adding Activision Blizzard's extensive catalog to Game Pass will significantly expand consumer choice and affordability, making games more accessible to a wider audience.

-

Cloud Gaming Innovation: Microsoft emphasizes its commitment to cloud gaming technology and argues that the acquisition will accelerate innovation in this rapidly growing sector. They believe combining Activision Blizzard's expertise with Microsoft's cloud infrastructure will benefit gamers and drive competition in cloud-based gaming services.

-

Call of Duty's Continued Availability: A crucial point in Microsoft's defense is its repeated pledge to maintain Call of Duty's availability on competing platforms, including PlayStation. They argue this commitment directly counters the FTC's concerns about exclusivity.

-

Increased Competition and Choice: Microsoft’s overarching defense rests on the claim that the merger will ultimately lead to increased competition and consumer choice, directly contradicting the FTC's allegations. Their legal team presents economic models and arguments to support this assertion.

Global Regulatory Scrutiny

The FTC's challenge isn't an isolated incident; the Microsoft-Activision Blizzard merger is facing intense scrutiny from competition authorities worldwide. Keywords: International competition authorities, European Union, UK CMA, regulatory approvals, global impact. This highlights the international scope and complexity of the antitrust challenge.

-

UK CMA and European Union Concerns: The UK's Competition and Markets Authority (CMA) and the European Union have also expressed significant concerns about the merger, raising similar antitrust issues to those highlighted by the FTC.

-

Varying Regulatory Perspectives: While the core concerns are similar across jurisdictions, the specific interpretations and approaches of different regulatory bodies might vary, leading to potentially diverse outcomes.

-

Interconnected Decisions: The decision in one jurisdiction is likely to influence the decisions of others. A ruling against the merger in one major market could create significant pressure on other regulatory bodies to follow suit.

Potential Outcomes and Implications

The outcome of the FTC lawsuit carries significant weight, setting a legal precedent for future mergers and acquisitions within the gaming industry. Keywords: Legal precedent, market share, future acquisitions, gaming industry regulation. The implications extend far beyond this specific deal.

-

Future Mergers and Acquisitions: A ruling against Microsoft could significantly chill future mergers and acquisitions in the gaming sector, increasing the difficulty for large companies to consolidate market share.

-

Impact on Microsoft's Ambitions: A failed acquisition would represent a significant setback for Microsoft's ambitions to become a major player in the gaming industry, potentially altering its long-term strategy.

-

Increased Regulatory Scrutiny: Regardless of the outcome, this case is likely to lead to increased regulatory scrutiny of large technology company acquisitions, particularly in the gaming and entertainment sectors.

Conclusion

The FTC's challenge to Microsoft's acquisition of Activision Blizzard represents a pivotal legal battle with far-reaching consequences for the gaming industry. The arguments presented by both sides highlight the complex interplay between competition, innovation, and consumer welfare. The outcome will not only affect the fate of this specific merger but also shape future regulations and industry practices. Staying informed about the developments in this Microsoft Activision acquisition legal case is crucial for anyone interested in the future of the gaming landscape. Follow the ongoing updates to understand the evolving dynamics of this landmark FTC challenge.

Featured Posts

-

Candidatos A Diputado Por Rescate Y Transformacion En Cortes Un Analisis De Sus Plataformas

May 19, 2025

Candidatos A Diputado Por Rescate Y Transformacion En Cortes Un Analisis De Sus Plataformas

May 19, 2025 -

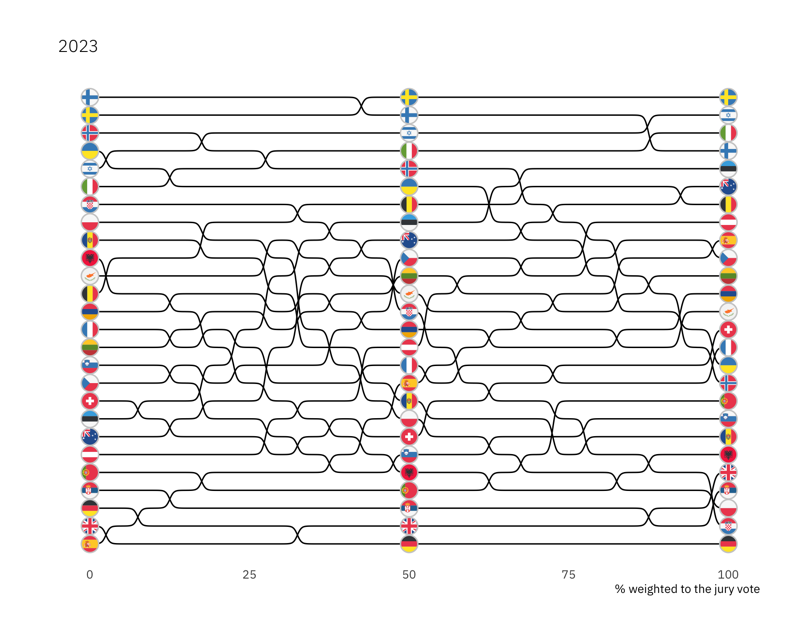

Eurovision Voting Explained From Jury To Televote

May 19, 2025

Eurovision Voting Explained From Jury To Televote

May 19, 2025 -

Analysis Of The Uks 19th Place Finish At Eurovision 2025

May 19, 2025

Analysis Of The Uks 19th Place Finish At Eurovision 2025

May 19, 2025 -

Virginia Tech Basketball Coach Mike Youngs Plans Ahead

May 19, 2025

Virginia Tech Basketball Coach Mike Youngs Plans Ahead

May 19, 2025 -

North Carolina Tar Heels Athletic Events Summary March 3 9

May 19, 2025

North Carolina Tar Heels Athletic Events Summary March 3 9

May 19, 2025