FTC Challenges Microsoft's Activision Blizzard Acquisition: A Deep Dive

Table of Contents

The FTC's Antitrust Concerns

The FTC's antitrust lawsuit against the Microsoft-Activision Blizzard merger centers on concerns about the potential for stifled competition and reduced consumer choice within the gaming market. The commission argues that the merger would grant Microsoft undue monopoly power, harming both gamers and the broader industry.

- Exclusionary Practices: A primary concern is Microsoft's potential to make popular Activision Blizzard titles, like Call of Duty, exclusive to its Xbox ecosystem. This could lock out players on other platforms, like PlayStation, hindering competition and limiting consumer options.

- Pricing and Consumer Choice: The FTC also worries about the impact on pricing practices. With control over a vast library of games, Microsoft might leverage its market power to inflate prices or bundle games in ways that disadvantage consumers.

- Impact on Innovation: Reduced competition can stifle innovation. The merger could lead to less investment in new game development and a decrease in the variety of gaming experiences available to consumers.

The FTC's statement explicitly mentions concerns about "the elimination of competition" and Microsoft's potential to "foreclose rivals" in the market. These are powerful arguments underpinning their pursuit of an injunction to block the merger.

Microsoft's Defense Strategy

Microsoft vigorously defends its acquisition, arguing that the merger will ultimately benefit consumers and enhance competition in the broader gaming market. Their defense rests on several key pillars:

- Expanded Access: Microsoft claims that the merger will lead to wider access to Activision Blizzard games through various platforms, including Xbox Game Pass, benefiting a larger player base.

- Competitive Landscape: They emphasize the competitive nature of the gaming market, highlighting the existence of other major players like Sony, Nintendo, and various PC game developers. They argue their market share won't become dangerously dominant.

- Cloud Gaming Commitment: Microsoft stresses its commitment to bringing Activision Blizzard games to various cloud gaming platforms, further enhancing accessibility for consumers.

Microsoft's official statements repeatedly highlight the "consumer benefits" of the merger, emphasizing increased access and innovative game development as key outcomes.

The Impact on the Gaming Industry

The outcome of this legal battle will have profound and far-reaching consequences for the gaming industry. The short-term impacts could involve uncertainty in the market, potential delays in game releases, and fluctuating game prices. However, the long-term ramifications could be even more significant:

- Game Availability and Pricing: The merger's success or failure will significantly influence the availability and pricing of key game franchises. Exclusive deals and pricing strategies will likely be a focal point of future discussions.

- Power Dynamics: The balance of power between console manufacturers and game developers could shift dramatically depending on the outcome. This could impact future game development strategies and market entry for new players.

- Subscription Services: The future of subscription-based gaming services like Xbox Game Pass could be reshaped. The inclusion or exclusion of Activision Blizzard titles will directly impact the appeal and competitiveness of such services.

The broader implications extend beyond the immediate players, influencing future mergers and acquisitions within the video game market and setting precedents for regulatory approaches to tech consolidation.

Legal Precedents and Future Outlook

The FTC's challenge draws parallels to previous antitrust cases involving tech giants. The government's scrutiny of Microsoft's actions mirrors past investigations into the practices of other large companies aiming to consolidate market power. Examining the outcomes of similar cases provides crucial insight into the potential trajectory of the current lawsuit.

The legal process will likely be protracted, involving extensive discovery, witness testimonies, and court proceedings. The final outcome hinges on the court's interpretation of antitrust laws and its assessment of the evidence presented by both sides. A ruling against Microsoft could significantly impact future mergers and acquisitions in the tech industry, prompting greater regulatory scrutiny and potentially altering the consolidation patterns of the sector.

Conclusion: The Future of the FTC's Challenge to Microsoft's Activision Blizzard Acquisition

The FTC's challenge to Microsoft's Activision Blizzard acquisition presents a complex case with significant implications for the gaming industry and antitrust enforcement. The arguments for and against the merger highlight the tension between fostering innovation and preventing the formation of monopolies. The potential impact on game prices, availability, and innovation remains a key concern. The ultimate outcome of this legal battle will likely set a precedent for future mergers and acquisitions in the tech sector, shaping the competitive landscape for years to come. Stay informed about the ongoing legal battle and its implications for the future of the gaming industry, closely following updates on the Microsoft's Activision Blizzard acquisition and the FTC's challenge. The future of gaming may well depend on it.

Featured Posts

-

Buy Your Pakistan Super League 10 Tickets Today

May 08, 2025

Buy Your Pakistan Super League 10 Tickets Today

May 08, 2025 -

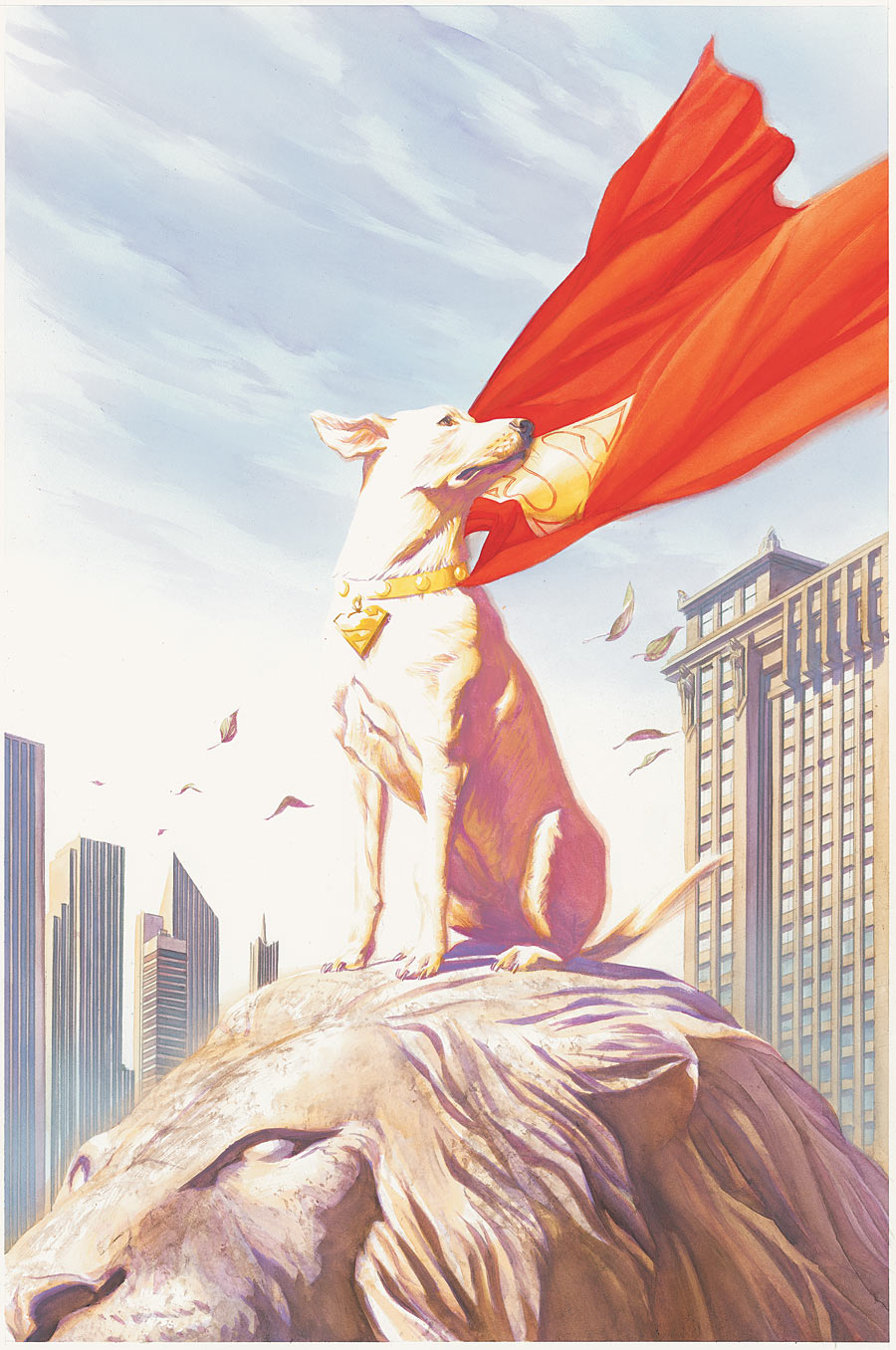

Krypto The Superdog Takes Center Stage In New Superman Preview

May 08, 2025

Krypto The Superdog Takes Center Stage In New Superman Preview

May 08, 2025 -

Cute Krypto Moments In New Superman Film Footage

May 08, 2025

Cute Krypto Moments In New Superman Film Footage

May 08, 2025 -

Ethereums Steady Price Upward Momentum Ahead

May 08, 2025

Ethereums Steady Price Upward Momentum Ahead

May 08, 2025 -

3 Strong Indicators Of A Princess Leia Cameo In The Upcoming Star Wars Tv Series

May 08, 2025

3 Strong Indicators Of A Princess Leia Cameo In The Upcoming Star Wars Tv Series

May 08, 2025