FTC To Appeal Microsoft-Activision Merger Ruling

Table of Contents

The FTC's Concerns Regarding the Microsoft-Activision Merger

The FTC's primary argument against the Microsoft-Activision merger centers on its potential to stifle competition and harm consumers. Their concerns stem from the significant market power Microsoft would gain by acquiring Activision Blizzard, a company boasting hugely popular franchises like Call of Duty, Candy Crush, and World of Warcraft.

- Anti-competitive practices regarding Call of Duty and other Activision Blizzard franchises: The FTC argues that Microsoft could leverage its ownership of Activision Blizzard to make Call of Duty and other key titles exclusive to Xbox consoles or its Game Pass subscription service, effectively locking out competitors like PlayStation and Nintendo. This could harm gamers by limiting their choices and potentially increasing prices.

- Potential for reduced competition and higher prices for gamers: By consolidating market share, the merger could reduce competition, allowing Microsoft to increase prices for games, subscriptions, and other gaming-related services. This would ultimately hurt consumers’ wallets.

- Concerns about Microsoft's market dominance in the gaming console and cloud gaming sectors: The FTC worries that the merger would further cement Microsoft's already substantial dominance in the gaming console market and its growing influence in the burgeoning cloud gaming sector. This lack of competition could stifle innovation and limit consumer choice.

- Discussion of the FTC's previous actions against mergers in the tech industry: The FTC’s actions reflect a broader trend of increased scrutiny towards large tech mergers and acquisitions, highlighting their commitment to preserving competition and preventing anti-competitive practices. This isn't their first rodeo; they have a history of challenging mergers they deem detrimental to the market.

You can find more information on the FTC's position in their official press releases and statements [link to relevant FTC resources]. Keywords like antitrust, competition, gaming industry, and market dominance are central to their arguments.

Microsoft's Response to the FTC's Appeal

Microsoft has strongly refuted the FTC's claims, arguing that the merger will benefit gamers and promote competition. They have presented counter-arguments designed to address the FTC's concerns.

- Highlighting any concessions Microsoft has offered to address FTC concerns: Microsoft has offered various concessions, such as long-term agreements to keep Call of Duty available on PlayStation consoles. These commitments are aimed at demonstrating their willingness to address competition concerns.

- Mention any legal arguments used by Microsoft in their defense: Microsoft has employed a robust legal strategy to defend the merger, leveraging legal arguments centered on the benefits of the deal and challenging the FTC's claims on multiple grounds.

- Discuss Microsoft's commitment to maintaining fair competition in the gaming market: Microsoft has repeatedly emphasized its commitment to a fair and competitive gaming market, even after the merger. Their statements aim to reassure regulators and gamers alike.

Microsoft's official statements and press releases [link to relevant Microsoft resources] detail their position on this matter further. Keywords such as Microsoft defense, legal challenge, gaming competition, and cloud gaming are key in understanding their perspective.

Potential Outcomes of the FTC Appeal and its Impact on the Gaming Industry

The FTC's appeal could have several outcomes, each with significant ramifications for the gaming landscape:

- Successful appeal by the FTC resulting in the blocking of the merger: This would represent a major victory for the FTC and could set a significant precedent for future tech mergers. It would also likely mean a considerable delay, if not an end, to the Microsoft-Activision deal.

- Microsoft winning the appeal, allowing the merger to proceed: This would allow the merger to move forward, potentially reshaping the gaming industry's competitive dynamics. The impact would be significant, depending on Microsoft's subsequent actions.

- Negotiated settlement between Microsoft and the FTC: A negotiated settlement could involve Microsoft making further concessions to address the FTC's concerns. This outcome would likely lead to a modified version of the merger, potentially with some conditions attached.

The impact of each scenario on game prices, availability, competition, and innovation would be substantial. Industry analysts and legal experts [link to relevant expert analysis] offer diverse perspectives on these potential outcomes. Keywords like merger implications, gaming future, antitrust lawsuit, and market analysis are crucial for understanding the broader implications.

Conclusion: The Future of the Microsoft-Activision Merger Remains Uncertain

The FTC's appeal of the Microsoft-Activision merger represents a critical juncture for the gaming industry. The core arguments presented by both sides – the FTC's concerns about anti-competitive practices and Microsoft's commitment to fair competition – highlight the complex issues at stake. The potential impacts on game prices, accessibility, and the overall competitive landscape are significant and far-reaching. The outcome of this appeal will have lasting implications for gamers worldwide. Stay informed about this ongoing legal battle by following news from reliable sources and keeping an eye on official statements from the FTC and Microsoft regarding the Microsoft Activision deal, the Activision Blizzard merger, and the FTC antitrust lawsuit. The future of gaming may depend on it.

Featured Posts

-

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025 -

Ghidul Investitorului Cele Mai Profitabile Depozite Bancare In Martie 2024

Apr 23, 2025

Ghidul Investitorului Cele Mai Profitabile Depozite Bancare In Martie 2024

Apr 23, 2025 -

Nine Home Runs Judges Three Yankees Set New Team Record In 2025 Opener

Apr 23, 2025

Nine Home Runs Judges Three Yankees Set New Team Record In 2025 Opener

Apr 23, 2025 -

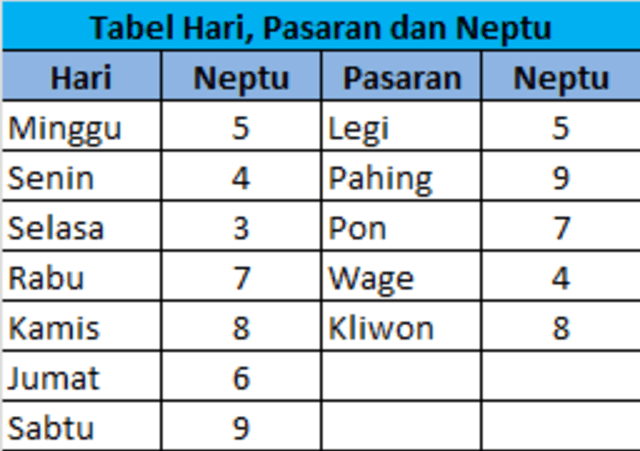

Ramalan Pernikahan Weton Senin Legi Dan Rabu Pon Menurut Primbon Jawa

Apr 23, 2025

Ramalan Pernikahan Weton Senin Legi Dan Rabu Pon Menurut Primbon Jawa

Apr 23, 2025 -

Aldhhb Alywm Asearh Fy Alsaght Bed Akhr Ankhfad

Apr 23, 2025

Aldhhb Alywm Asearh Fy Alsaght Bed Akhr Ankhfad

Apr 23, 2025