FTC's Appeal Could Halt Microsoft's Activision Blizzard Acquisition

Table of Contents

H2: The FTC's Arguments Against the Acquisition

The FTC's primary argument centers around the potential for anti-competitive practices stemming from the merger. They believe the acquisition would grant Microsoft undue market power, harming consumers in the long run.

H3: Concerns about Competition

The FTC argues that Microsoft's control over Activision Blizzard's vast portfolio of games, including the immensely popular Call of Duty franchise, would stifle competition.

- Bullet Point: Microsoft could leverage its control of Call of Duty to exclude competitors like Sony PlayStation from accessing the game, potentially giving Xbox a significant advantage. This could harm PlayStation's market share and negatively impact gamers who prefer that console.

- Bullet Point: The merger could lead to higher prices for games and subscriptions, reducing consumer choice and limiting innovation within the gaming industry. The absence of competition can result in less incentive for price reductions and improved game quality.

- Bullet Point: The FTC highlights the potential for Microsoft to leverage its market power to favor its own gaming platforms and services, potentially disadvantaging other cloud gaming providers and ultimately limiting consumer access to a diverse range of gaming experiences.

H3: Market Domination and Anti-competitive Practices

The FTC's core concern is the creation of a dominant market player capable of manipulating prices, limiting choice, and stifling innovation.

- Bullet Point: The FTC's analysis of the gaming market suggests that the acquisition would significantly increase Microsoft's market share, potentially leading to a monopolistic situation. The analysis includes detailed market share data and projections for future market conditions.

- Bullet Point: The FTC points to Microsoft's history of acquisitions, arguing that this deal represents a continuation of a pattern aimed at consolidating market power. They highlight how prior mergers have impacted competition in the relevant markets.

- Bullet Point: The FTC proposed various remedies to mitigate the competitive concerns, including structural remedies such as divesting certain assets or behavioral remedies like licensing agreements. These remedies were rejected by Microsoft.

H2: Microsoft's Defense and Proposed Concessions

Microsoft has strongly defended the acquisition, arguing that it will benefit gamers and increase competition.

H3: Microsoft's Counterarguments

Microsoft counters the FTC's claims by emphasizing the benefits of the merger for consumers.

- Bullet Point: Microsoft has pledged to continue releasing Call of Duty on PlayStation consoles for an extended period, addressing concerns about exclusivity. They've offered long-term contractual commitments to this effect.

- Bullet Point: Microsoft disputes the FTC's market definition, arguing that the gaming market is more diverse and competitive than the FTC suggests. They present alternative data and analysis to support their view.

- Bullet Point: Microsoft argues that the acquisition will lead to increased investment in game development, resulting in more and better games for consumers. They claim enhanced resources and technological synergies will benefit gamers.

H3: Concessions Offered to Regulators

In an attempt to appease regulators, Microsoft has offered significant concessions.

- Bullet Point: Microsoft has proposed 10-year licensing agreements for Call of Duty on PlayStation, ensuring continued availability. The details of these agreements, including pricing and terms, have been submitted to regulators.

- Bullet Point: The effectiveness of these concessions in addressing the FTC's concerns remains debatable. The FTC has expressed doubts, citing potential future limitations and changes in the market.

- Bullet Point: These concessions are being compared to similar concessions offered in other major merger cases. Analyzing these precedents will provide insight into the potential success of Microsoft's approach.

H2: The Appeal Process and Potential Outcomes

The FTC's appeal is a complex legal process with multiple potential outcomes.

H3: The FTC's Appeal and its Trajectory

The appeal process is expected to be lengthy and complex, involving various stages of legal proceedings.

- Bullet Point: The appeal will likely involve briefing, oral arguments, and potential further legal challenges. The process could extend for several months or even years.

- Bullet Point: Predicting a precise timeline is difficult due to the complexity of antitrust litigation. However, experts offer various potential timelines based on similar cases.

- Bullet Point: The FTC’s likelihood of success is uncertain, dependent on the strength of their arguments and the court’s interpretation of the law and the evidence. Legal analysts offer differing predictions on the outcome.

H3: Possible Scenarios and Their Implications

Several outcomes are possible, each with significant implications for the gaming industry.

- Bullet Point: Scenario 1: FTC Wins: The acquisition is blocked, potentially setting a precedent for future large-scale mergers in the gaming industry and other sectors. Microsoft may need to reconsider its expansion strategy.

- Bullet Point: Scenario 2: FTC Loses: The acquisition proceeds as planned, potentially leading to increased market concentration and raising concerns about future anti-competitive behavior.

- Bullet Point: Scenario 3: Negotiated Settlement: A compromise may be reached, perhaps involving further concessions from Microsoft to address the FTC's concerns. This could involve modified licensing agreements or other restrictions.

3. Conclusion:

The FTC's appeal against Microsoft's acquisition of Activision Blizzard is a landmark case with far-reaching implications for the gaming industry. The outcome will significantly shape the competitive landscape and influence future mergers and acquisitions in the sector. The uncertainty surrounding the deal highlights the growing importance of regulatory scrutiny in the tech industry and underscores the need for careful consideration of potential anti-competitive effects of large-scale mergers. Stay informed about developments regarding the FTC’s appeal and the Microsoft Activision Blizzard acquisition to understand its impact on the gaming industry. Closely monitoring the progress of this appeal and its eventual outcome is crucial for understanding the future of the gaming industry.

Featured Posts

-

Dodgers Offseason Analysis Key Acquisitions And Departures

May 15, 2025

Dodgers Offseason Analysis Key Acquisitions And Departures

May 15, 2025 -

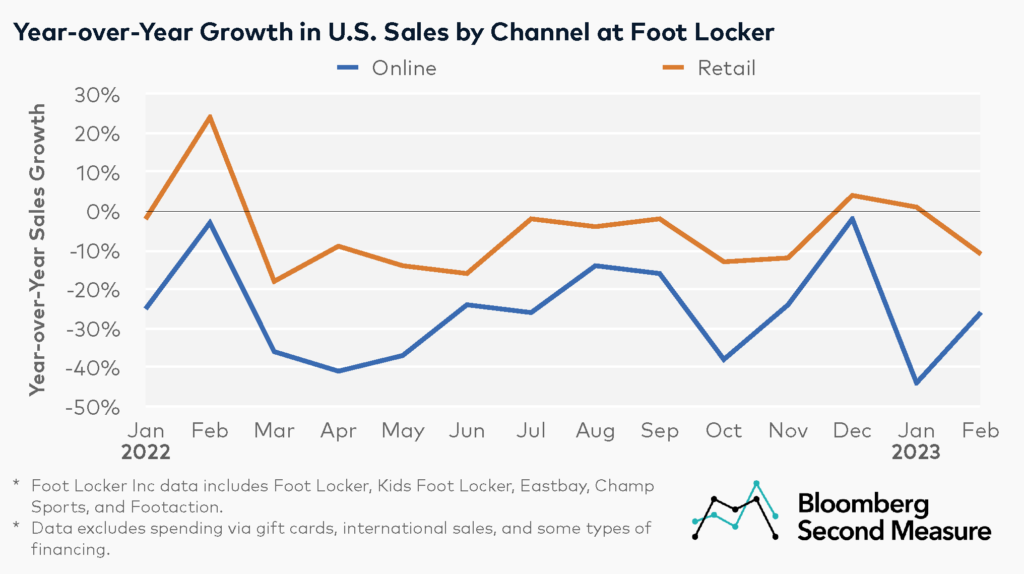

Foot Lockers Results Signal Nikes Resurgence According To Analysts

May 15, 2025

Foot Lockers Results Signal Nikes Resurgence According To Analysts

May 15, 2025 -

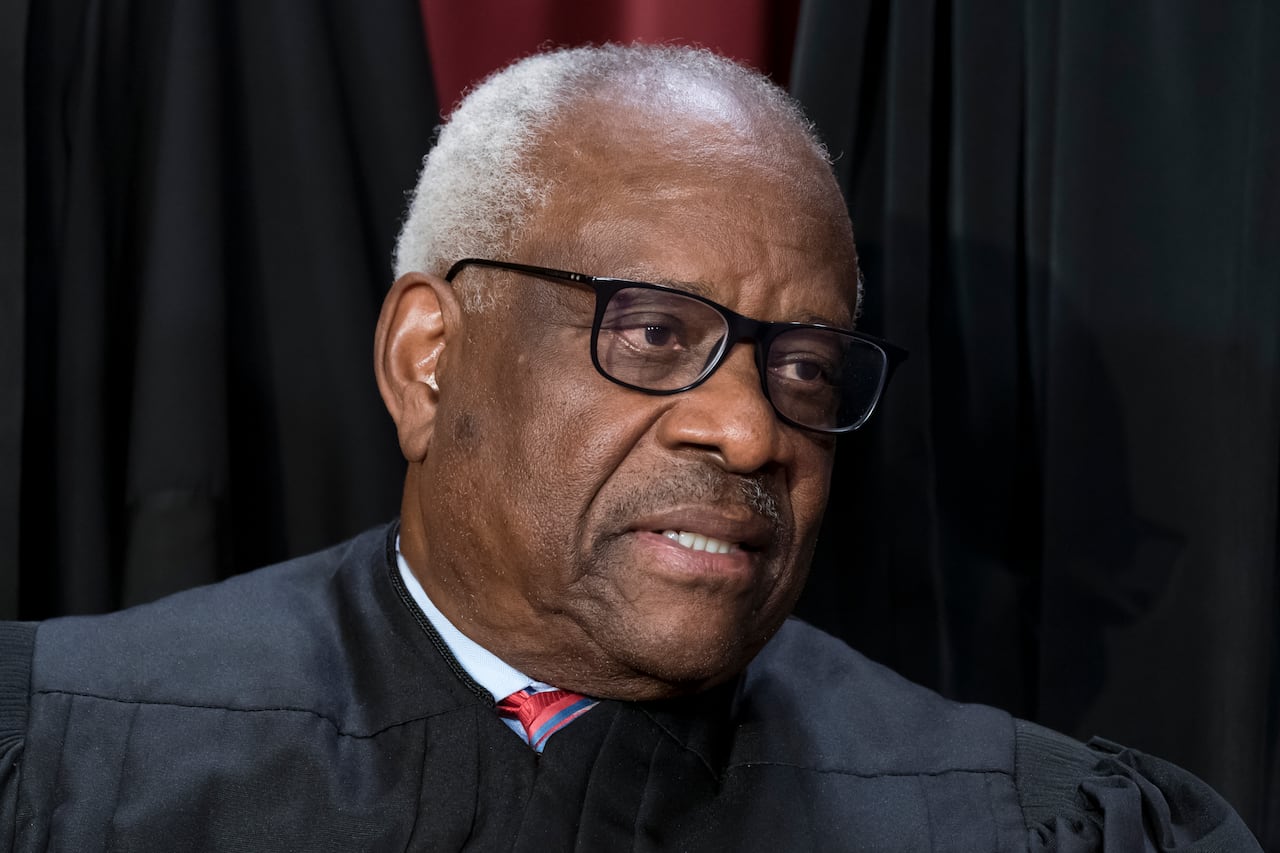

Analyzing The Gop Mega Bill Key Provisions And Expected Opposition

May 15, 2025

Analyzing The Gop Mega Bill Key Provisions And Expected Opposition

May 15, 2025 -

Paddy Pimblett Ufc 314 40 Pound Weight Increase Revealed

May 15, 2025

Paddy Pimblett Ufc 314 40 Pound Weight Increase Revealed

May 15, 2025 -

The Jalen Brunson Injury A Detailed Look At The Knicks Point Guard Situation

May 15, 2025

The Jalen Brunson Injury A Detailed Look At The Knicks Point Guard Situation

May 15, 2025