Fuji Media Shakeup: Dalton Partners With Murakami-Affiliated Investor

Table of Contents

Dalton Investments' Strategic Move into Fuji Media

Dalton Investments, a prominent investment firm known for its active and often transformative approach to portfolio companies, has made a significant move by investing in Fuji Media. Their investment strategy is characterized by identifying undervalued assets and implementing strategies designed to unlock significant shareholder value. While Dalton's history includes both notable successes and strategic retreats, their entry into the Japanese media market through Fuji Media represents a bold and potentially impactful decision. The motivations behind this investment are likely multifaceted:

- Undervalued Assets: Fuji Media, despite its prominent position, may have been perceived by Dalton as undervalued relative to its potential.

- Strategic Positioning: Investment in Fuji Media could represent a strategic foothold for Dalton in the lucrative Japanese media market, opening doors to future opportunities.

- Long-Term Growth Potential: Dalton likely sees significant long-term growth potential in Fuji Media, potentially through restructuring and strategic initiatives.

Dalton's strategy likely includes:

- Acquisition of a substantial shareholding: Securing a significant stake to exert influence on corporate decisions.

- Potential board representation: Aiming to secure board seats to directly influence Fuji Media's strategic direction.

- Long-term investment goals: A commitment to a long-term investment horizon to allow for significant changes to take effect.

The Murakami-Affiliated Investor's Influence

The partnership with a Murakami-affiliated investor adds another layer of complexity and potential impact to this Fuji Media shakeup. While the specific investor remains partially undisclosed, their association with Yoshiaki Murakami, a well-known activist investor in Japan, hints at a potentially aggressive and transformative strategy. Murakami's history is marked by successful shareholder activism, often leading to significant corporate governance changes. The synergy between Dalton and this Murakami-affiliated investor could be considerable, with aligned goals focusing on:

- Shareholder Value Enhancement: Both parties likely aim to maximize shareholder returns through increased efficiency and strategic initiatives.

- Corporate Governance Reform: The partnership could push for improved corporate governance practices within Fuji Media.

- Potential for Program Changes: The investor's influence could potentially lead to significant changes in Fuji Media's programming strategy.

The investor's likely objectives include:

- Increased profitability: Implementing strategies to improve Fuji Media's financial performance.

- Strategic alliances: Exploring partnerships to expand Fuji Media's reach and market share.

- Modernization: Updating Fuji Media's technology and infrastructure to enhance its competitiveness.

Potential Implications for Fuji Media and the Broader Media Landscape

This Fuji Media shakeup has significant implications, potentially impacting various aspects of the company and the broader Japanese media landscape:

- Programming and Content Strategy: Expect potential shifts in programming genres, with a likely focus on increased profitability and audience engagement.

- Competition: The changes within Fuji Media could significantly alter the competitive dynamics within the Japanese media market.

- Employment and Company Culture: Restructuring efforts could impact employment levels and the overall company culture.

- Future of Japanese Media Conglomerates: This event may set a precedent for other media companies facing similar pressures for modernization and increased shareholder value.

Potential scenarios include:

- Increased focus on popular genres: Prioritizing programming with proven success to maximize viewership and advertising revenue.

- Changes in management and executive positions: Restructuring could lead to significant changes in leadership.

- Potential mergers or acquisitions: The shakeup may pave the way for strategic mergers or acquisitions within the media sector.

- Shifts in advertising strategy: Changes in programming could necessitate adjustments to advertising strategies.

Regulatory Scrutiny and Future Outlook

The regulatory environment surrounding media ownership in Japan will play a crucial role in shaping the outcome of this Fuji Media shakeup. Potential regulatory hurdles and challenges faced by Dalton and the Murakami-affiliated investor include:

- Antitrust regulations: Concerns regarding potential monopolies or anti-competitive practices.

- Media ownership limits: Regulations governing foreign ownership and influence within the Japanese media sector.

- Public opinion and political pressure: Potential backlash from public opinion or political pressure.

Regulatory concerns include:

- Compliance with broadcasting regulations: Ensuring adherence to all broadcasting standards and guidelines.

- Transparency requirements: Meeting strict requirements for transparency in financial dealings.

- Potential for investigations: Exposure to regulatory scrutiny and potential investigations.

Predicting the future trajectory of Fuji Media is challenging, but this shakeup signals a period of significant change. The partnership between Dalton and the Murakami-affiliated investor is likely to lead to a more commercially-driven approach, potentially involving significant restructuring and strategic repositioning.

Conclusion: The Future of Fuji Media Post-Shakeup

The partnership between Dalton Investments and the Murakami-affiliated investor represents a pivotal moment in Fuji Media's history. The potential for significant changes in programming, management, and overall corporate strategy is substantial. This Fuji Media shakeup will undoubtedly reshape the competitive landscape of the Japanese media industry and set a precedent for future corporate transformations within the sector. The implications extend beyond Fuji Media itself, influencing the broader dynamics of the Japanese media market. Stay updated on the unfolding developments related to this Fuji Media shakeup and the partnership between Dalton Investments and the Murakami-affiliated investor. Share your thoughts and predictions in the comments below!

Featured Posts

-

Rayquaza Ex Arrives In Pokemon Tcg Pocket 6 Month Anniversary Event Details

May 29, 2025

Rayquaza Ex Arrives In Pokemon Tcg Pocket 6 Month Anniversary Event Details

May 29, 2025 -

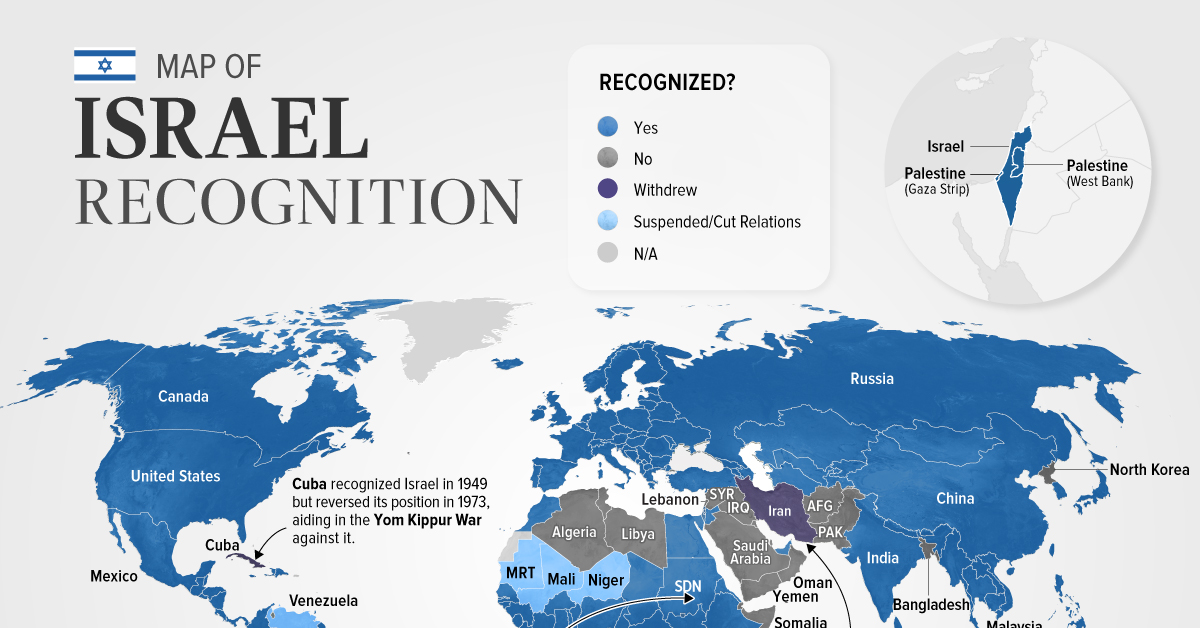

Palestine Recognition Key To Indonesia Israel Relations

May 29, 2025

Palestine Recognition Key To Indonesia Israel Relations

May 29, 2025 -

La Influencia De Toni Kroos En Fede Valverde

May 29, 2025

La Influencia De Toni Kroos En Fede Valverde

May 29, 2025 -

Kelly Smiths Outburst Accusations In Joshlin Disappearance Case

May 29, 2025

Kelly Smiths Outburst Accusations In Joshlin Disappearance Case

May 29, 2025 -

France To Seize Phones Crackdown On Drug Trafficking And Use

May 29, 2025

France To Seize Phones Crackdown On Drug Trafficking And Use

May 29, 2025