G-7 To Debate Lowering De Minimis Tariffs On Chinese Imports

Table of Contents

Current De Minimis Tariff Levels and Their Impact

Currently, each G7 country maintains its own de minimis value—the value below which imported goods are exempt from tariffs. These thresholds vary considerably, influencing import costs and the competitiveness of businesses. For instance, the United States currently has a relatively low de minimis value for many products imported from China, while some European nations have higher thresholds.

This existing system significantly impacts small businesses and online retailers importing goods from China. Lower thresholds mean smaller shipments incur tariffs, increasing costs and potentially hindering competitiveness against larger importers.

- Examples of current tariff rates and their effects on import costs: A small business importing $100 worth of goods from China might face significant tariff burdens if the de minimis value is low, making the products less competitive in their domestic market. Higher de minimis values allow for more cost-effective imports.

- Statistics on the volume of goods currently benefiting from the de minimis exemption: A substantial volume of goods, particularly low-value items sold through e-commerce platforms, currently benefits from this exemption. Data from relevant trade organizations would quantify the extent of this exemption.

- Case studies illustrating the challenges faced by importers under the existing system: Real-world examples of businesses struggling due to fluctuating or complex de minimis regulations highlight the need for clarity and consistency.

Arguments for Lowering De Minimis Tariffs

Proponents of lowering the de minimis tariff threshold argue it would unlock several key benefits:

- Increased competition and lower prices for consumers: Reducing tariffs on smaller imports could lead to a broader selection of goods at potentially lower prices for consumers.

- Stimulated growth for small and medium-sized enterprises (SMEs): Lower import costs would benefit small businesses that rely on importing goods from China, fostering economic growth and innovation.

- Enhanced efficiency in cross-border e-commerce: A simplified tariff system could streamline the import process for online retailers, making cross-border e-commerce more efficient.

- Potential for increased trade volume between China and G7 nations: Lower barriers to trade could stimulate economic activity and strengthen trade relationships between these major economic powers.

Arguments Against Lowering De Minimis Tariffs

Conversely, there are significant concerns about the potential negative consequences of lowering de minimis tariffs:

- Risk of increased competition for domestic businesses: Domestic businesses might struggle to compete with cheaper imports, potentially leading to job losses and economic disruption in certain sectors.

- Concerns about potential job losses in certain sectors: Industries that produce similar goods to those imported from China may experience significant challenges and job losses.

- Potential loss of government revenue from tariffs: Lowering the threshold would reduce tariff revenue for governments, potentially impacting public services and budgets.

- Challenges in enforcing regulations and combating smuggling: Lower tariffs might increase the incentive for smuggling and make it more difficult to enforce trade regulations.

Potential Consequences of the Decision

The G7's decision will have far-reaching consequences, both short-term and long-term:

- Impact on consumer spending and inflation: Lower prices could stimulate consumer spending, but increased imports could also impact domestic production and potentially influence inflation.

- Changes in the competitive landscape for various industries: Some industries might thrive, while others may struggle to compete with the influx of cheaper imports.

- Shifting trade patterns between China and G7 countries: The decision could fundamentally alter the balance of trade between China and the G7 nations.

- Potential for trade disputes and retaliatory measures: Changes to trade policy could trigger retaliatory measures from China or other trading partners, leading to further trade disputes.

Alternatives and Mitigation Strategies

Instead of a blanket reduction in de minimis tariffs, alternative approaches could be considered:

- Strengthening domestic industries through targeted support programs: Governments could invest in domestic industries to enhance their competitiveness and mitigate the impact of increased imports.

- Implementing stricter regulations to combat unfair trade practices: Focusing on addressing issues like dumping and intellectual property theft could level the playing field for domestic businesses.

- Exploring alternative trade agreements with China: Negotiating new trade agreements could help to address specific trade imbalances and reduce reliance on tariffs.

- Focusing on specific product categories for tariff adjustments: Targeted adjustments to de minimis values for specific products, rather than a blanket change, could minimize negative consequences.

Conclusion

The G7's debate on lowering de minimis tariffs on Chinese imports is a complex issue with significant implications for global trade. While reducing tariffs may offer benefits like lower prices for consumers, concerns about the impact on domestic industries and government revenue remain. A careful assessment of all potential consequences and the implementation of appropriate mitigation strategies are crucial.

Call to Action: Stay informed about the G7's final decision regarding de minimis tariffs on Chinese imports and its impact on your business. Follow our updates for further analysis on de minimis tariffs and their effects on global trade. Understanding the implications of changes to de minimis import tariffs is crucial for navigating the evolving landscape of international trade.

Featured Posts

-

Julianne Moore Stars In Siren Trailer 1 Review Dark Comedy Series

May 23, 2025

Julianne Moore Stars In Siren Trailer 1 Review Dark Comedy Series

May 23, 2025 -

James Wiltshire 10 Years Capturing The Stories Of The Border Mail

May 23, 2025

James Wiltshire 10 Years Capturing The Stories Of The Border Mail

May 23, 2025 -

Successfully Negotiating A Final Job Offer Tips And Strategies

May 23, 2025

Successfully Negotiating A Final Job Offer Tips And Strategies

May 23, 2025 -

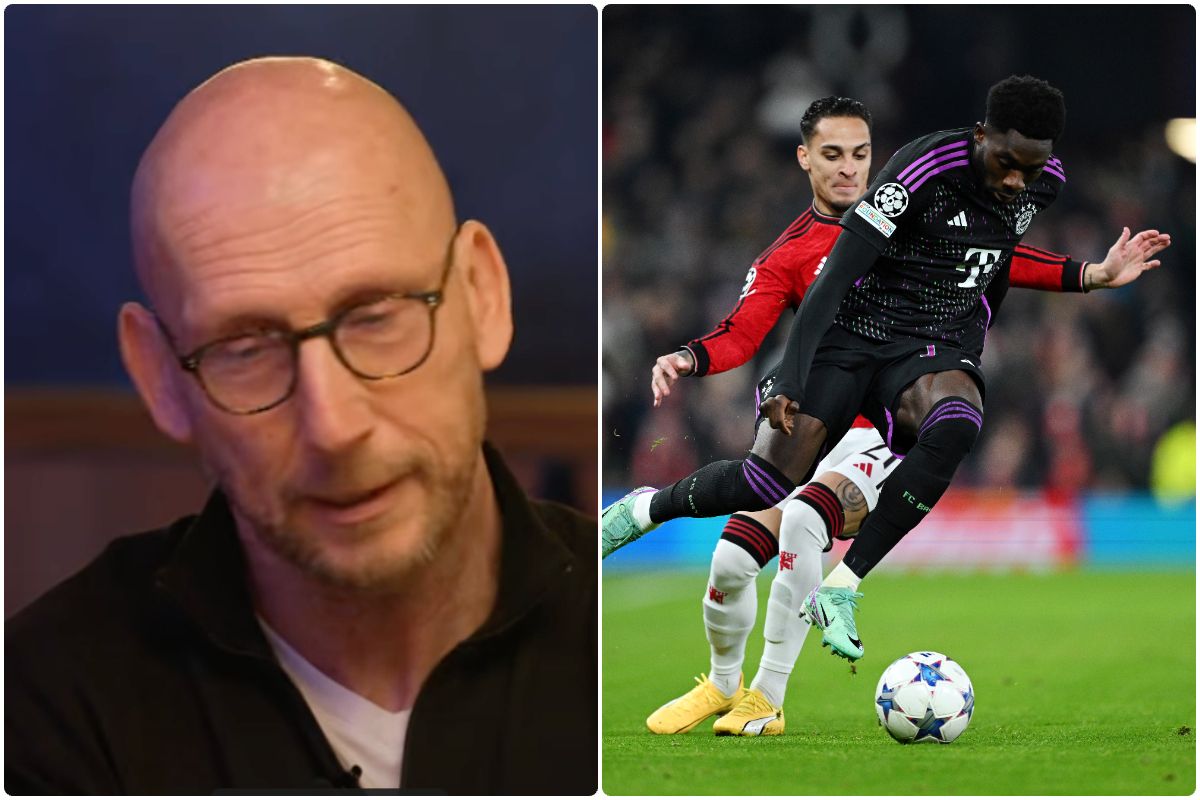

Jaap Stam Criticises Man Uniteds Expensive Ten Hag Gamble

May 23, 2025

Jaap Stam Criticises Man Uniteds Expensive Ten Hag Gamble

May 23, 2025 -

Shpani A Slavi Pobeda Nad Khrvatska Vo Finaleto Na Ln

May 23, 2025

Shpani A Slavi Pobeda Nad Khrvatska Vo Finaleto Na Ln

May 23, 2025

Latest Posts

-

The Jonas Brothers Joe Jonas His Reaction To A Couples Argument

May 23, 2025

The Jonas Brothers Joe Jonas His Reaction To A Couples Argument

May 23, 2025 -

Couple Fights Over Joe Jonas His Hilarious Response

May 23, 2025

Couple Fights Over Joe Jonas His Hilarious Response

May 23, 2025 -

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025 -

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025 -

The Last Rodeo Featuring Neal Mc Donough

May 23, 2025

The Last Rodeo Featuring Neal Mc Donough

May 23, 2025