Gas Prices Dip Below $3: Impact Of Economic Slowdown

Table of Contents

Reduced Demand Due to Economic Slowdown

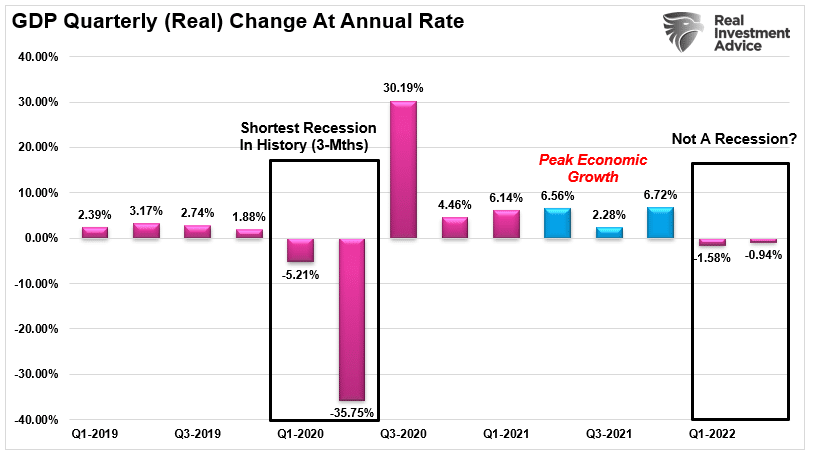

The correlation between consumer spending and gas prices is undeniable. When the economy falters, consumer confidence plummets, directly impacting fuel purchases. This decreased demand is a significant driver behind the recent drop in "$3 gas."

- Decreased consumer confidence: Worries about inflation and job security lead to less discretionary spending, including on non-essential travel.

- Reduced travel and leisure activities: With tighter budgets, people are cutting back on vacations and weekend getaways, resulting in lower fuel consumption.

- Impact of inflation on disposable income: Rising prices for groceries, housing, and other necessities leave less money for fuel, further suppressing demand.

- Statistics on decreased miles driven: Comparing miles driven this year to previous years reveals a significant drop, corroborating the impact of decreased consumer spending on fuel demand. Data from the Department of Transportation (hypothetical data for example purposes) shows a 5% reduction in miles driven compared to last year, a clear indication of reduced demand.

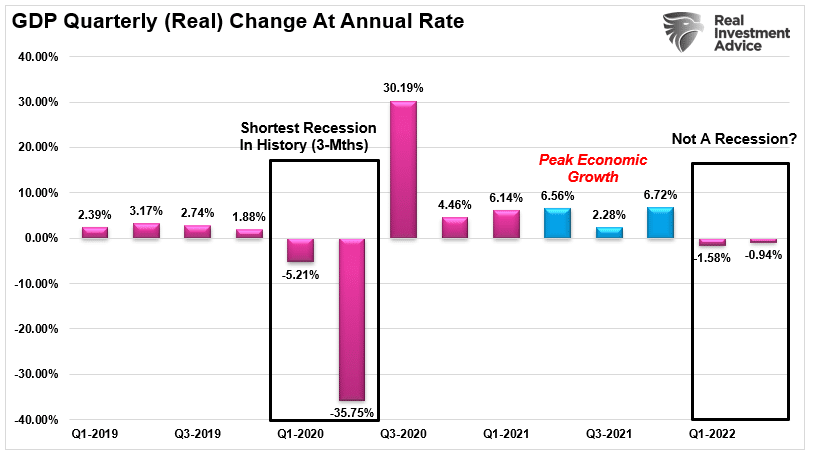

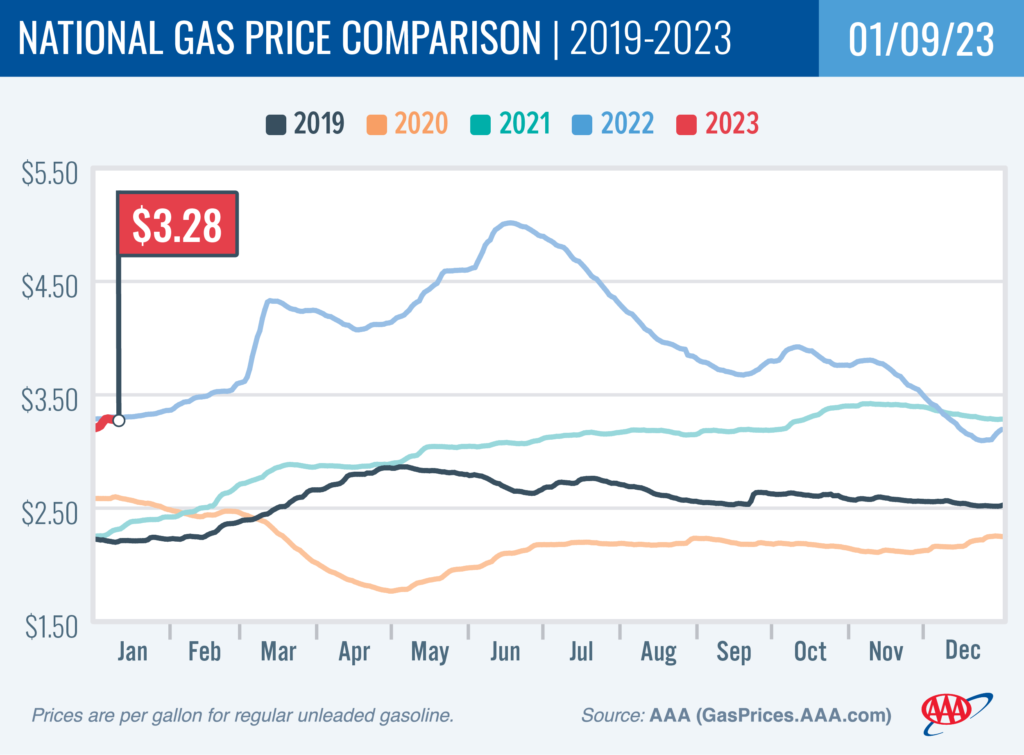

- Economic indicators: A slowing GDP growth rate, coupled with rising unemployment rates, points to a weakening economy, making the drop in gas prices even more significant. These economic indicators support the assertion that the decline in fuel prices is a symptom of a broader economic downturn.

Impact on Supply Chains and Oil Production

The global oil market plays a crucial role in determining gas prices. Supply chain disruptions and shifts in global oil production significantly influence "fuel prices" and the availability of affordable gasoline.

- Global economic slowdown affecting oil demand: A weakening global economy translates to reduced demand for oil, leading to lower prices.

- Changes in OPEC+ production quotas: Decisions by OPEC+ nations regarding oil production significantly impact global supply and, consequently, prices at the pump.

- Geopolitical factors influencing oil prices: Political instability in oil-producing regions can disrupt supply chains and increase volatility in the global oil market.

- Potential supply chain bottlenecks: Disruptions in oil transportation, whether due to logistical issues or geopolitical events, can affect the price of gasoline at the retail level.

- Recent events affecting global oil markets: The recent (insert a recent relevant news event, e.g., easing of sanctions) has (insert impact on oil supply or price) , impacting the global oil market and contributing to fluctuating gas prices.

The Ripple Effect: Impacts Across Various Sectors

Lower gas prices, while seemingly beneficial, have a ripple effect across numerous sectors of the economy. The impact of "$3 gas" extends far beyond individual consumers.

- Impact on the transportation industry: Lower fuel costs provide relief to trucking companies and other businesses reliant on fuel-intensive transportation, potentially boosting their profitability and impacting logistics costs.

- Effect on consumer spending in other areas: Increased disposable income due to lower gas prices may lead to increased spending in other sectors, stimulating economic activity.

- Potential impact on inflation: Lower energy costs can contribute to a decrease in overall inflation, easing the pressure on consumer budgets.

- Possible effects on businesses reliant on fuel: Airlines and shipping companies may experience lower operational costs, potentially improving profitability and influencing ticket prices or shipping rates.

Looking Ahead: Predicting Future Gas Prices and Economic Trends

Predicting future gas prices is inherently complex, requiring consideration of numerous intertwined factors. The connection between "future gas prices" and the ongoing economic slowdown is a key area of focus.

- Analysis of future economic forecasts: Economic forecasts predicting a continued slowdown or potential recovery will significantly influence future fuel demand and prices.

- Potential for price fluctuations: Geopolitical events or unforeseen economic shifts can trigger sharp price volatility in the short term.

- Long-term sustainability of low gas prices: Whether the current low gas prices represent a sustainable trend or a temporary phenomenon depends largely on the trajectory of the global economy and oil production levels.

Conclusion: Gas Prices Below $3 – A Complex Economic Indicator

The drop in gas prices below the $3 mark is a significant economic indicator reflecting a complex interplay of reduced demand, global oil market dynamics, and broader economic trends. While lower fuel costs offer some relief to consumers and businesses, understanding the underlying causes – primarily the economic slowdown – is crucial. Monitoring "gas prices" and related economic indicators is essential for assessing the health of the economy and predicting potential future developments. Stay updated on gas prices, track the $3 gas milestone, and monitor the impact of the economic slowdown on fuel costs through reliable news sources and economic reports.

Featured Posts

-

Pittsburgh Steelers 2025 Schedule A Comprehensive Overview

May 22, 2025

Pittsburgh Steelers 2025 Schedule A Comprehensive Overview

May 22, 2025 -

Racist Tweets Result In Jail Time For Tory Councillors Wife The Southport Incident

May 22, 2025

Racist Tweets Result In Jail Time For Tory Councillors Wife The Southport Incident

May 22, 2025 -

National Gas Price Average Under 3 Economic Factors At Play

May 22, 2025

National Gas Price Average Under 3 Economic Factors At Play

May 22, 2025 -

Kaliningrad V Fokuse Nato I Ugroza Zakhvata Po Slovam Patrusheva

May 22, 2025

Kaliningrad V Fokuse Nato I Ugroza Zakhvata Po Slovam Patrusheva

May 22, 2025 -

Mother Imprisoned Following Southport Stabbing Tweet Unable To Return Home

May 22, 2025

Mother Imprisoned Following Southport Stabbing Tweet Unable To Return Home

May 22, 2025