Gibraltar Industries Earnings Preview: Key Financial Metrics To Watch

Table of Contents

Revenue Growth and Breakdown

Analyzing Gibraltar Industries' revenue is crucial for understanding its overall health. We'll examine both overall revenue growth and a breakdown by segment.

Analyzing Overall Revenue

The year-over-year (YoY) revenue growth is a primary indicator of Gibraltar Industries' success. Investors should compare this growth to previous quarters and analyst expectations. Factors influencing revenue include market demand for infrastructure and building products, pricing strategies implemented by the company, and the success of new product introductions. A strong YoY increase suggests robust market demand and effective business strategies. Conversely, a decline may signal weakening market conditions or internal challenges.

- YoY revenue comparison: Direct comparison of current quarter revenue against the same quarter of the previous year.

- Breakdown of revenue by product segment: Analyzing revenue contributions from infrastructure, building products, and renewable energy segments provides insights into the performance of each sector. Identifying high-growth areas is critical.

- Impact of macroeconomic factors on revenue: External influences like inflation, interest rates, and overall economic growth significantly impact revenue. Analyzing these factors provides context to the reported numbers.

- Analysis of sales growth in key geographic markets: Understanding regional performance is essential. Strong growth in certain regions may offset weaker performance in others.

Profitability and Margins

Profitability is another crucial metric for assessing Gibraltar Industries' financial health. We'll analyze gross profit margin, operating income, and net income.

Gross Profit Margin Analysis

The gross profit margin reveals the profitability of Gibraltar Industries' core operations after accounting for direct costs. Changes in this margin reflect shifts in raw material costs, manufacturing efficiency improvements, and pricing power. A shrinking margin may suggest rising input costs or price competition, while an expanding margin indicates better cost control or successful pricing strategies.

Operating Income and Net Income

Operating income shows profitability before interest and taxes, offering insights into the efficiency of the company's operations. Net income, the final profit after all expenses, represents the actual profit available to shareholders. Comparing these figures to previous quarters and analyst expectations is crucial for assessing performance. Significant deviations may warrant further investigation.

- Gross profit margin trends and drivers: Identifying the factors driving changes in gross profit margin is essential for understanding the company's performance.

- Operating income and net income analysis: A detailed comparison of these figures across different periods reveals the trend in profitability.

- Impact of cost-cutting measures: Evaluating the effects of cost reduction initiatives on profitability.

- Explanation of any discrepancies between expected and actual profitability: Identifying the reasons for any discrepancies between predicted and actual profitability is important for understanding future performance.

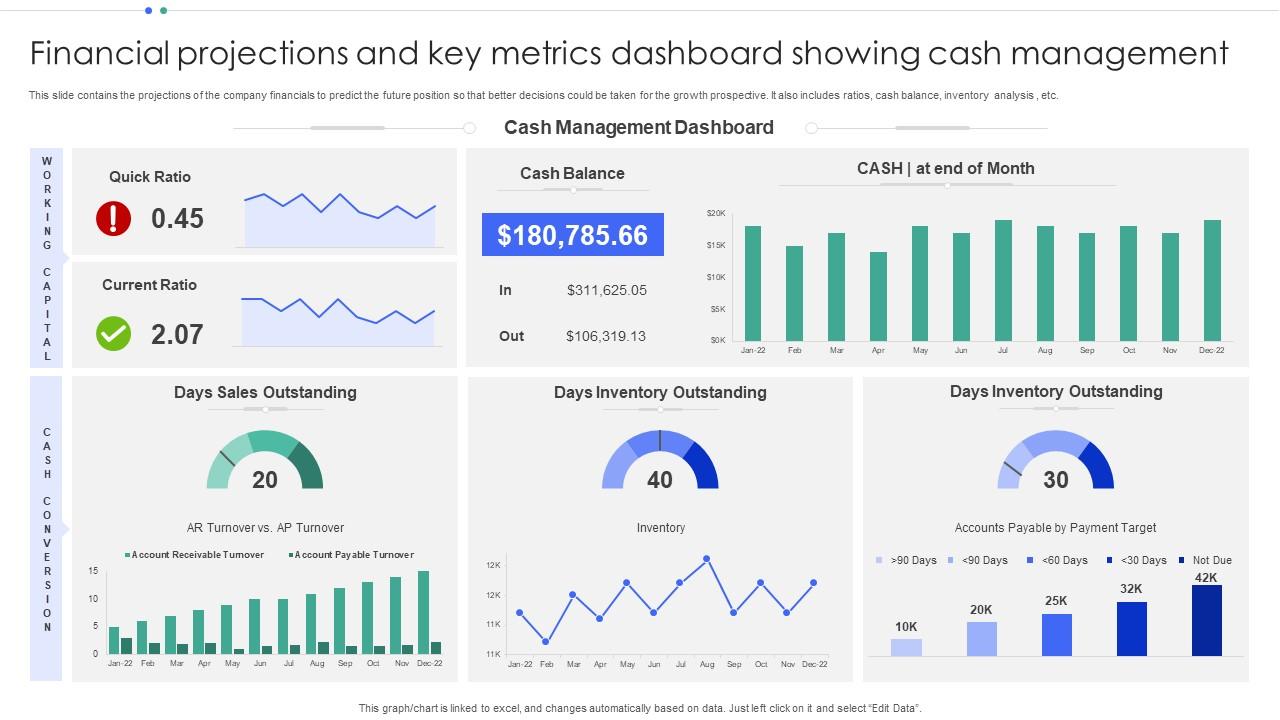

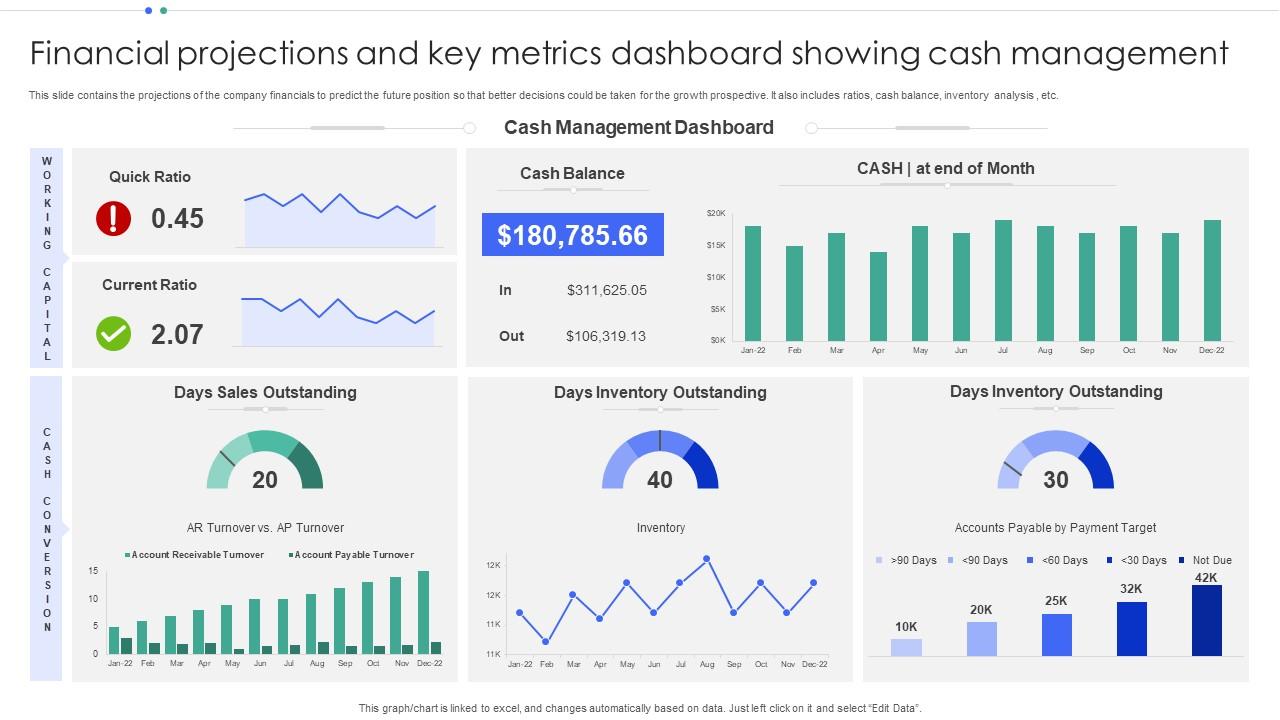

Key Financial Ratios

Analyzing key financial ratios offers a comprehensive view of Gibraltar Industries' financial health and risk profile.

Debt-to-Equity Ratio

This ratio reveals the proportion of Gibraltar Industries' financing from debt compared to equity. A high ratio suggests higher financial leverage and potentially greater risk. Conversely, a lower ratio indicates lower financial risk.

Return on Equity (ROE)

ROE measures the return generated on shareholder investments. A higher ROE indicates better management in utilizing shareholder equity to generate profits.

Cash Flow from Operations

This metric reflects Gibraltar Industries' ability to generate cash from its core business operations. Strong cash flow is crucial for sustaining growth, paying down debt, and returning value to shareholders.

- Interpretation of key financial ratios: Understanding the implications of each ratio (debt-to-equity, ROE, cash flow from operations, current ratio) provides insights into the company's financial position.

- Comparison of ratios to industry benchmarks: Comparing Gibraltar Industries' ratios to those of its competitors offers a relative assessment of its financial health.

- Potential implications of the financial ratios for future investment decisions: Analyzing these ratios can help investors make informed decisions about investing in Gibraltar Industries.

Guidance and Outlook

Management's guidance and analyst consensus offer valuable insights into Gibraltar Industries' future prospects.

Management's Expectations

The company's guidance for future quarters reflects its internal assessment of market conditions, operational capabilities, and expected financial performance. Analyzing this guidance reveals management's expectations for revenue, earnings, and other key metrics.

Analyst Consensus

Financial analysts provide their own estimates of Gibraltar Industries' future performance. Comparing management's guidance to the consensus provides a valuable perspective on market expectations. Significant differences may indicate either overly optimistic or pessimistic market sentiment.

- Summary of management's expectations for future revenue and earnings: Understanding management's outlook for future financial performance.

- Comparison to analyst consensus estimates: Comparing the company's outlook to the collective view of financial analysts.

- Potential risks and opportunities affecting future performance: Identifying potential challenges and opportunities impacting future financial results.

Conclusion

Thoroughly analyzing these key financial metrics will provide a comprehensive understanding of Gibraltar Industries' performance and help investors make informed decisions. Keep an eye on revenue growth, profitability margins, key financial ratios, and management's outlook for a complete picture. Remember to conduct your own thorough research before making any investment decisions regarding Gibraltar Industries earnings and future stock performance. Stay informed and keep track of the Gibraltar Industries earnings preview to make optimal investment choices based on the revealed financial metrics. Understanding these aspects of the Gibraltar Industries earnings preview is crucial for informed investment strategies.

Featured Posts

-

Aryn Sabalenka And Coco Gauff Avoid Upsets Advance In Rome

May 13, 2025

Aryn Sabalenka And Coco Gauff Avoid Upsets Advance In Rome

May 13, 2025 -

Sabalenka Advances To Italian Open Round Of 32 Match Highlights

May 13, 2025

Sabalenka Advances To Italian Open Round Of 32 Match Highlights

May 13, 2025 -

How Well Do You Know The Nba Draft Lottery Winners Since 2000

May 13, 2025

How Well Do You Know The Nba Draft Lottery Winners Since 2000

May 13, 2025 -

Aryna Sabalenkas Victory Propels Her To Italian Open Round Of 32

May 13, 2025

Aryna Sabalenkas Victory Propels Her To Italian Open Round Of 32

May 13, 2025 -

Exploring Kanika House B R Ambedkars Legacy In Delhis Historical Bungalow

May 13, 2025

Exploring Kanika House B R Ambedkars Legacy In Delhis Historical Bungalow

May 13, 2025