Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Analyzing Gibraltar Industries' Recent Performance (ROCK Stock)

Revenue Growth and Trends:

Gibraltar Industries' revenue growth has been a key area of focus for investors. Examining recent quarterly and yearly figures reveals important trends. For example, (insert recent quarterly revenue figures and percentage change year-over-year). This growth can be further analyzed by segment. Specifically, (mention strong performing segments and their growth rates, citing source if possible). Key contracts or partnerships have also contributed to revenue, such as (mention any significant deals). Analyzing these trends, along with charts visualizing the data, is crucial for understanding the Gibraltar Industries revenue trajectory. Keywords: Gibraltar Industries revenue, ROCK stock performance, quarterly earnings.

- Q[Insert Quarter] 2024 Revenue: [Insert Data]

- YoY Revenue Growth: [Insert Data]

- Key Segment Growth Drivers: [List key segments and growth rates]

- Significant Contracts/Partnerships: [List and briefly describe]

Profitability and Margins:

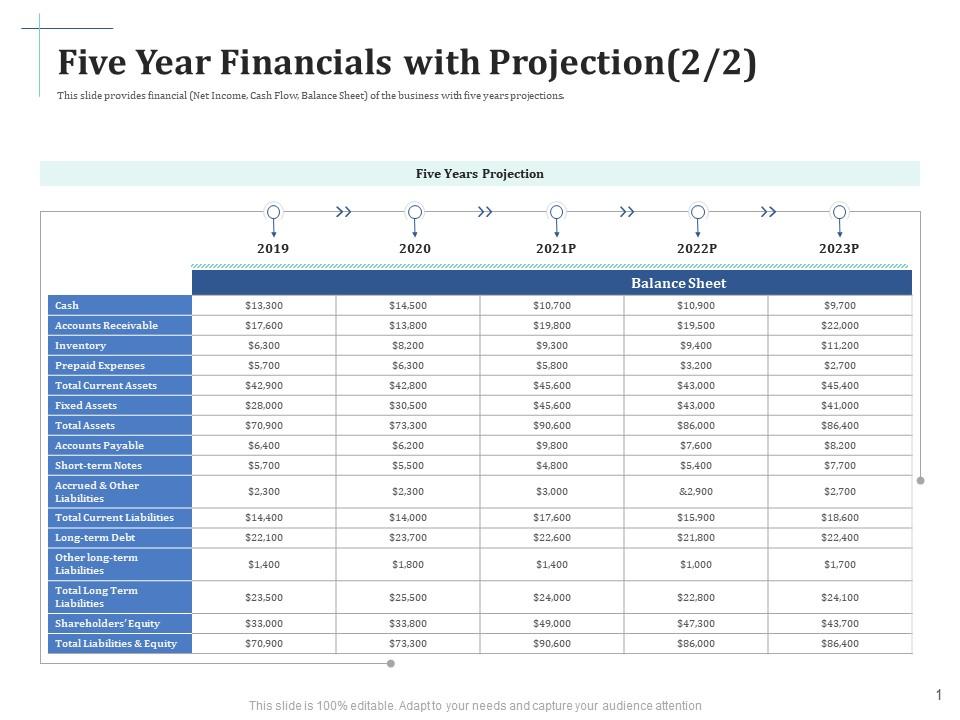

Profitability is a critical aspect of Gibraltar Industries' (ROCK) financial health. Analyzing gross profit margins, operating margins, and net income provides insight into the company's efficiency and pricing power. (Insert data on margins and net income, comparing to previous quarters and highlighting any trends). The impact of raw material costs and supply chain disruptions should also be considered. (Discuss how these factors affected margins and profitability, referencing specific data if available). Keywords: Gibraltar Industries profitability, ROCK margins, net income.

- Gross Profit Margin: [Insert Data and Trend]

- Operating Margin: [Insert Data and Trend]

- Net Income: [Insert Data and Trend]

- Impact of Raw Material Costs: [Analysis and Data]

Key Financial Metrics to Watch:

Beyond revenue and margins, several key financial metrics will provide a clearer picture of Gibraltar Industries’ (ROCK) financial health. Earnings per share (EPS) is a crucial indicator of profitability on a per-share basis. (Insert anticipated EPS and compare to previous quarters). The debt-to-equity ratio will reveal the company's financial leverage (Insert data and analysis). Finally, free cash flow, which represents cash generated from operations, less capital expenditures, is a critical indicator of the company's ability to generate cash. (Insert data and analysis). Comparing these metrics to previous quarters and industry averages will offer valuable context. Keywords: Gibraltar Industries EPS, ROCK financial metrics, free cash flow.

- EPS (Earnings Per Share): [Insert Data and Analysis]

- Debt-to-Equity Ratio: [Insert Data and Analysis]

- Free Cash Flow: [Insert Data and Analysis]

Factors Influencing Gibraltar Industries' (ROCK) Next Earnings Report

Market Conditions and Industry Outlook:

The building products market significantly impacts Gibraltar Industries' performance. Current market conditions, including housing starts, construction spending, and overall economic growth, will play a crucial role in the company's next earnings report. (Analyze current market conditions and their potential impact on ROCK, citing relevant economic indicators and reports). Identifying headwinds (e.g., rising interest rates, material shortages) and tailwinds (e.g., increased infrastructure spending, housing market recovery) is crucial for accurate forecasting. Keywords: Building products market, construction industry outlook, ROCK stock forecast.

- Housing Starts: [Data and Analysis]

- Construction Spending: [Data and Analysis]

- Economic Indicators: [Data and Analysis of relevant indicators]

Company-Specific Factors:

Internal factors also significantly influence Gibraltar Industries’ (ROCK) performance. Recent strategic initiatives, such as new product launches, acquisitions, or expansion projects, can have a substantial impact on the upcoming earnings report. (Discuss any significant company announcements or developments). Analyze the potential impact of these factors, considering both opportunities and challenges. (Identify potential risks, such as supply chain disruptions or competitive pressures). Keywords: Gibraltar Industries strategy, ROCK acquisitions, company outlook.

- New Product Launches: [Description and potential impact]

- Acquisitions or Partnerships: [Description and potential impact]

- Ongoing Projects: [Description and potential impact]

- Potential Risks: [Identify and analyze key risks]

Analyst Expectations and Price Targets:

Financial analysts offer valuable insights into the anticipated performance of Gibraltar Industries (ROCK). (Summarize consensus EPS estimates and price targets from reputable analysts). Explain the implications of meeting or exceeding these expectations for the ROCK stock price. Discuss the range of price targets and the factors driving these projections. Keywords: ROCK stock price target, analyst estimates, Gibraltar Industries forecast.

- Consensus EPS Estimate: [Insert Data and Source]

- Price Target Range: [Insert Data and Source]

- Implications of Meeting/Exceeding Expectations: [Analysis]

Conclusion: Preparing for the Gibraltar Industries (ROCK) Earnings Announcement

This preview of Gibraltar Industries (ROCK) earnings highlights the key factors influencing the upcoming report. Analyzing recent performance, market conditions, and company-specific factors provides a clearer picture of the potential outcomes. While there are potential upsides from strong revenue growth and strategic initiatives, investors should also consider potential headwinds, such as market volatility and rising input costs. The earnings announcement will significantly impact the ROCK stock price, making it a critical event for investors. Stay tuned for our post-earnings analysis of Gibraltar Industries (ROCK)! For more in-depth information, visit the Gibraltar Industries investor relations page. Remember to stay informed and monitor the Gibraltar Industries (ROCK) Earnings announcement for crucial updates.

Featured Posts

-

Bar Roma Toronto A Blog To Review And Guide

May 13, 2025

Bar Roma Toronto A Blog To Review And Guide

May 13, 2025 -

Efl Highlights A Comprehensive Review Of The Weeks Matches

May 13, 2025

Efl Highlights A Comprehensive Review Of The Weeks Matches

May 13, 2025 -

Doom Dark Ages Limited Edition Xbox Controllers And Wraps Now Available

May 13, 2025

Doom Dark Ages Limited Edition Xbox Controllers And Wraps Now Available

May 13, 2025 -

Rebuilding Raptors 7th Best Odds In Nba Draft Lottery

May 13, 2025

Rebuilding Raptors 7th Best Odds In Nba Draft Lottery

May 13, 2025 -

Nba Tankathon Fueling Miami Heat Fans Through The Off Season

May 13, 2025

Nba Tankathon Fueling Miami Heat Fans Through The Off Season

May 13, 2025

Latest Posts

-

Inter Miamis 1 0 Win Over Crew Sets Attendance Record In Cleveland

May 13, 2025

Inter Miamis 1 0 Win Over Crew Sets Attendance Record In Cleveland

May 13, 2025 -

Record Crowd Sees Inter Miami Edge Columbus Crew 1 0

May 13, 2025

Record Crowd Sees Inter Miami Edge Columbus Crew 1 0

May 13, 2025 -

Inter Miami Defeats Columbus Crew 1 0 Before Record Crowd

May 13, 2025

Inter Miami Defeats Columbus Crew 1 0 Before Record Crowd

May 13, 2025 -

Delhis Kanika House A Significant Site In Indian Constitutional History

May 13, 2025

Delhis Kanika House A Significant Site In Indian Constitutional History

May 13, 2025 -

Pliants 40 M Series B Investment Expanding B2 B Payment Capabilities

May 13, 2025

Pliants 40 M Series B Investment Expanding B2 B Payment Capabilities

May 13, 2025