Global Financial Risk: The IMF On Trump's Trade Policies

Table of Contents

Increased Trade Tensions and their Impact

The Trump administration's trade policies significantly escalated global trade tensions, leading to a period often described as a "trade war." This section explores the specific disputes and their consequences.

Escalation of Trade Wars

The administration initiated several high-profile trade disputes, most notably the imposition of tariffs on steel and aluminum imports, impacting numerous countries. The trade war with China, marked by escalating tariffs on billions of dollars worth of goods, was particularly impactful.

- Specific Tariffs: Tariffs targeted various sectors, including steel, aluminum, automobiles, and consumer goods. These ranged from 10% to 25%, significantly increasing import costs.

- Retaliatory Measures: Other countries responded with their own retaliatory tariffs, creating a cycle of escalating trade tensions and harming global trade flows. China, the European Union, and other nations imposed counter-tariffs on US goods.

- Global Supply Chain Disruption: The trade war disrupted global supply chains, forcing businesses to re-evaluate sourcing strategies and leading to increased production costs and delays. This particularly affected manufacturing and technology sectors. Keywords: Trade war, tariffs, protectionism, trade disputes, global supply chain disruption.

Uncertainty and Investor Confidence

The unpredictable nature of Trump's trade policies significantly undermined investor confidence. The frequent announcements of new tariffs and trade restrictions created uncertainty, making it difficult for businesses to plan for the future.

- Impact on Foreign Direct Investment (FDI): Uncertainty discouraged foreign direct investment (FDI), as businesses hesitated to commit capital to projects in environments with volatile trade policies.

- Stock Market Volatility: Stock markets experienced increased volatility as investors reacted to the news of new trade measures and the potential economic consequences.

- Decreased Business Investment: Businesses reduced investment in expansion and innovation due to the uncertainty surrounding future trade costs and access to markets. Keywords: Investor confidence, FDI, market volatility, business investment, economic uncertainty.

IMF's Warnings and Predictions

The IMF consistently issued warnings about the negative economic consequences of Trump's trade policies, publishing numerous reports and statements detailing their concerns.

IMF Reports and Statements

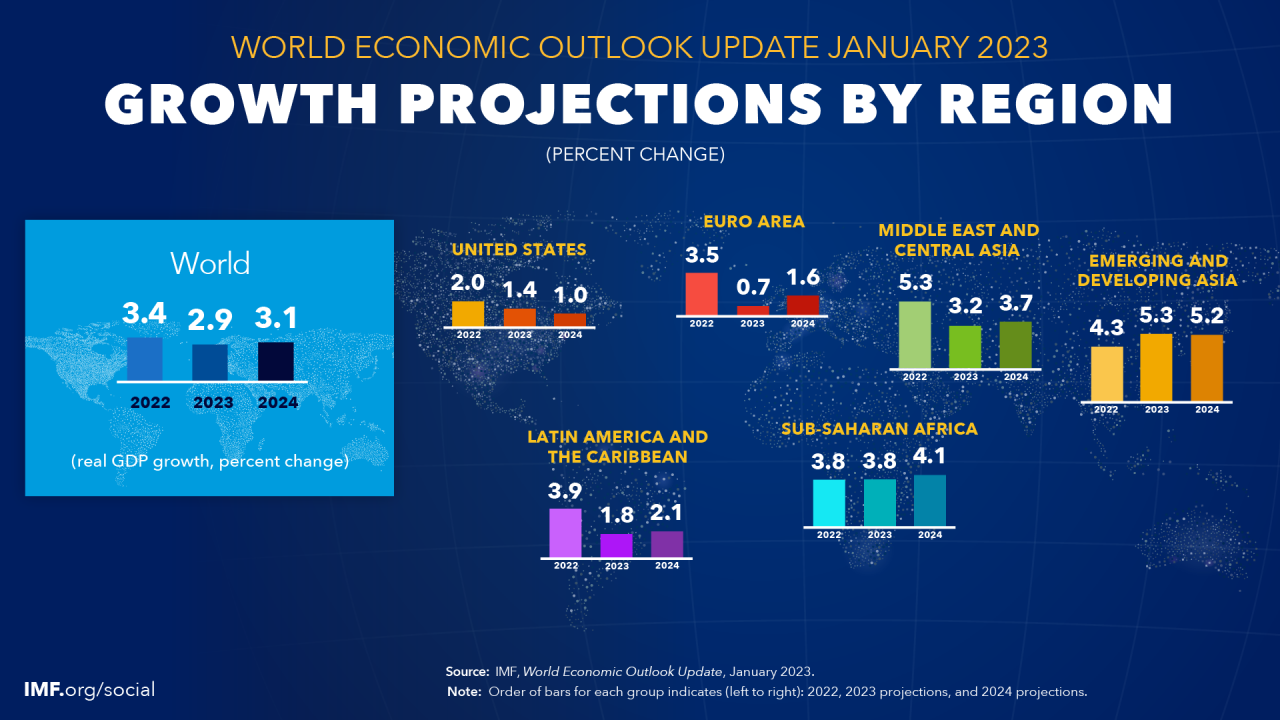

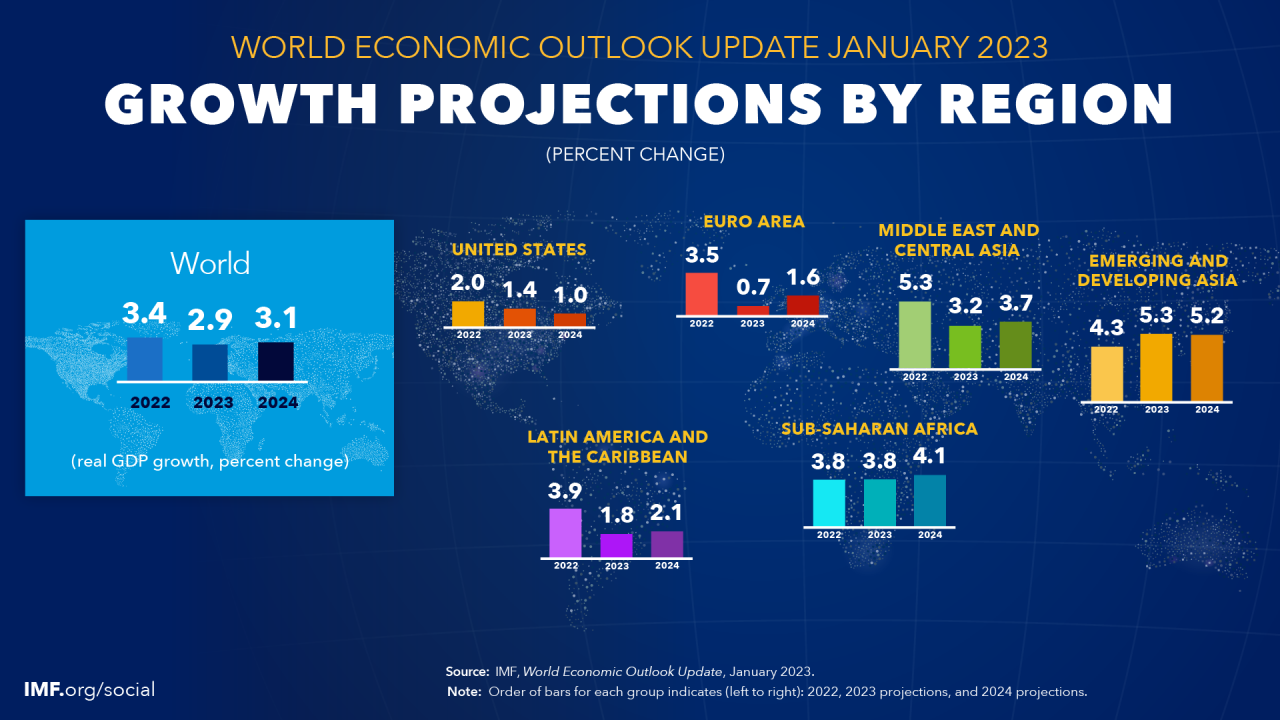

IMF reports highlighted the risks to global economic growth posed by escalating trade tensions. The organization consistently emphasized the detrimental impact on investor sentiment, business investment, and global trade flows.

- Specific Quotes/Data Points: IMF publications included specific data points illustrating the negative impact on GDP growth, both globally and in specific countries affected by the trade disputes. For instance, reports frequently cited decreased global trade volume as a direct result of the tariffs.

- Warnings about Potential Slowdown/Recession: The IMF repeatedly warned of the potential for a significant global economic slowdown or even recession if the trade tensions were not resolved. Keywords: IMF report, IMF statement, economic forecast, global economic growth, recession risk.

Impact on Emerging Markets

Emerging market economies were disproportionately affected by Trump's trade policies. Their reliance on exports and exposure to global capital flows made them particularly vulnerable.

- Increased Debt Burdens: Many emerging markets faced increased debt burdens as export revenues declined due to reduced demand for their products in the US and elsewhere.

- Reduced Export Revenues: The trade disputes led to reduced export revenues for many emerging market economies, hindering their economic growth and development.

- Capital Flight: Uncertainty led to capital flight from emerging markets as investors sought safer havens, further destabilizing these economies. Keywords: Emerging markets, developing economies, debt crisis, capital flight, export-oriented economies.

Long-Term Effects and Lingering Impacts

The consequences of Trump's trade policies extend beyond the immediate period of their implementation, leaving lasting impacts on the global economic landscape.

Structural Changes to Global Trade

The trade policies initiated a process of restructuring global trade patterns and relationships, fostering a more fragmented and regionalized trade environment.

- Shifting Alliances: Countries sought to diversify their trade relationships, forming new alliances and regional trade agreements to reduce dependence on the US market.

- Regional Trade Agreements: There was a surge in interest and activity surrounding regional trade agreements, as countries looked to strengthen ties with their neighbours.

- Increased Regionalization of Trade: Global trade became increasingly regionalized as countries focused on strengthening trade within their own regions. Keywords: Global trade patterns, regional trade agreements, trade diversification, bilateral trade agreements.

Damage to Multilateralism

Trump's trade policies significantly damaged the multilateral trading system, undermining trust in international institutions and cooperation.

- Weakening of WTO: The US's actions challenged the authority and effectiveness of the World Trade Organization (WTO), hindering its ability to resolve trade disputes effectively.

- Challenges to International Cooperation: The unilateral nature of the trade policies undermined the principles of international cooperation and consensus-building in trade negotiations. Keywords: WTO, multilateralism, international cooperation, global governance.

Conclusion

The IMF's analysis consistently highlighted the significant global financial risk associated with Trump's protectionist trade policies. These policies fueled increased trade tensions, uncertainty, and negative consequences for both developed and developing economies. The lasting effects include altered global trade patterns, a more fragmented global trading system, and damage to multilateral institutions like the WTO. Understanding the global financial risk associated with protectionist trade policies is crucial for policymakers and investors alike. Further research into the IMF's analysis of Trump’s trade policies and their lasting impact on global financial risk is vital for navigating the complexities of the modern global economy. Learn more about the IMF's ongoing assessment of global financial risk and the implications of trade policy.

Featured Posts

-

Trumps Attack On Jerome Powell Calls For Fed Chairs Termination

Apr 23, 2025

Trumps Attack On Jerome Powell Calls For Fed Chairs Termination

Apr 23, 2025 -

Brewers Sweep Tigers In Series 5 1 Final Score

Apr 23, 2025

Brewers Sweep Tigers In Series 5 1 Final Score

Apr 23, 2025 -

Equifax Efx Q Quarter Earnings Beat Estimates Macroeconomic Risks Remain

Apr 23, 2025

Equifax Efx Q Quarter Earnings Beat Estimates Macroeconomic Risks Remain

Apr 23, 2025 -

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025 -

Sf Giants Defeat Brewers Thanks To Flores And Lee

Apr 23, 2025

Sf Giants Defeat Brewers Thanks To Flores And Lee

Apr 23, 2025