Global Tariffs Chill Tech IPO Market: A Deep Dive

Table of Contents

Increased Uncertainty and Investment Hesitation

Global tariffs create a significant amount of uncertainty, impacting the tech IPO market in several key ways. This uncertainty makes it harder for investors to accurately assess the value of tech companies preparing for an IPO.

Impact on Valuation

Global tariffs introduce uncertainty regarding future revenue streams. This makes it incredibly difficult for investors to accurately assess the value of tech companies preparing for an IPO. This leads to lower valuations and a general reluctance to invest in the tech sector.

- Reduced investor confidence translates into fewer IPOs. The risk associated with investing in a company facing potential tariff-related headwinds is significantly higher.

- Difficulty in projecting future profitability due to tariff-related cost increases. Predicting profit margins becomes a significant challenge when input costs fluctuate wildly due to tariffs.

- Increased risk aversion impacting both early-stage and late-stage funding. This uncertainty trickles down, affecting the entire funding ecosystem, not just IPOs.

Supply Chain Disruptions

Tariffs significantly disrupt global supply chains. This leads to increased production costs and delays for tech companies, further deterring IPOs.

- Increased reliance on domestic manufacturing, impacting cost structures. Shifting production can be expensive and time-consuming.

- Difficulty in sourcing components and materials, leading to production bottlenecks. Tariffs can make certain components prohibitively expensive or simply unavailable.

- Higher input costs directly impacting profit margins. These increased costs eat into the profitability of tech companies, making them less attractive to investors.

Reduced Consumer Demand and Market Volatility

The impact of global tariffs extends beyond the direct costs to businesses. They contribute to higher prices for consumer goods, potentially impacting the demand for tech products and creating further market volatility.

Impact of Tariff-Induced Inflation

Tariffs contribute to higher prices for consumer goods, including tech products. This potentially dampens consumer demand and significantly impacts the financial outlook of tech companies planning to go public.

- Reduced consumer spending on discretionary items like electronics. Consumers may postpone purchases or opt for cheaper alternatives.

- Increased competition from cheaper, non-tariff impacted alternatives. Companies in countries not subject to the same tariffs gain a competitive advantage.

- Pressure on profit margins due to decreased sales volume. Lower demand directly translates into lower revenue.

Geopolitical Instability and Market Uncertainty

The underlying geopolitical tensions fueling tariff increases often cause broader market volatility, making it an unfavorable climate for IPOs.

- Investors are more likely to seek safe haven investments during times of uncertainty. Tech IPOs are often perceived as riskier during these periods.

- Increased market fluctuations make it harder to set a stable IPO price. Volatility makes it challenging to determine a fair and accurate valuation.

- Higher risk premium demanded by investors for tech IPOs. Investors demand higher returns to compensate for the increased risk.

Alternative Funding Routes and Strategic Decisions

Facing a challenging IPO market, tech companies are exploring alternative funding strategies and strategic decisions to navigate these hurdles.

Private Equity and Venture Capital

With the IPO market cooling, tech companies may increasingly rely on private equity and venture capital for funding, delaying their public market entry.

- Private funding rounds can extend the runway for companies before an IPO is necessary. This gives them more time to weather the storm.

- Less pressure to meet the stringent requirements of a public listing. Private companies have more flexibility in their operations.

- Potential for higher valuations in private markets. Private investors may be willing to pay a premium for promising companies.

Mergers and Acquisitions

Facing a challenging IPO environment, some tech companies may opt for mergers and acquisitions as an alternative exit strategy.

- Acquisition offers a quicker liquidity option for investors. It provides a faster way to realize returns.

- Strategic consolidation within the industry. Mergers can lead to greater efficiency and market share.

- Potential for synergies and cost reduction. Combining operations can create economies of scale.

Conclusion

The chilling effect of global tariffs on the tech IPO market is undeniable. Increased uncertainty, disrupted supply chains, reduced consumer demand, and broader geopolitical instability have all contributed to a slowdown in tech IPOs. While some companies may find alternative funding routes or pursue acquisitions, the overall impact on innovation and the long-term growth of the tech sector remains a concern. Understanding the intricate interplay between global tariffs and the tech IPO market is crucial for investors, entrepreneurs, and policymakers alike. Staying informed about the evolving landscape of global tariffs and their impact on the tech IPO market is vital for making sound strategic decisions. Further research into the lasting effects of these tariffs on the tech industry is needed to better understand and mitigate the risks associated with global tariffs and their impact on the tech IPO market.

Featured Posts

-

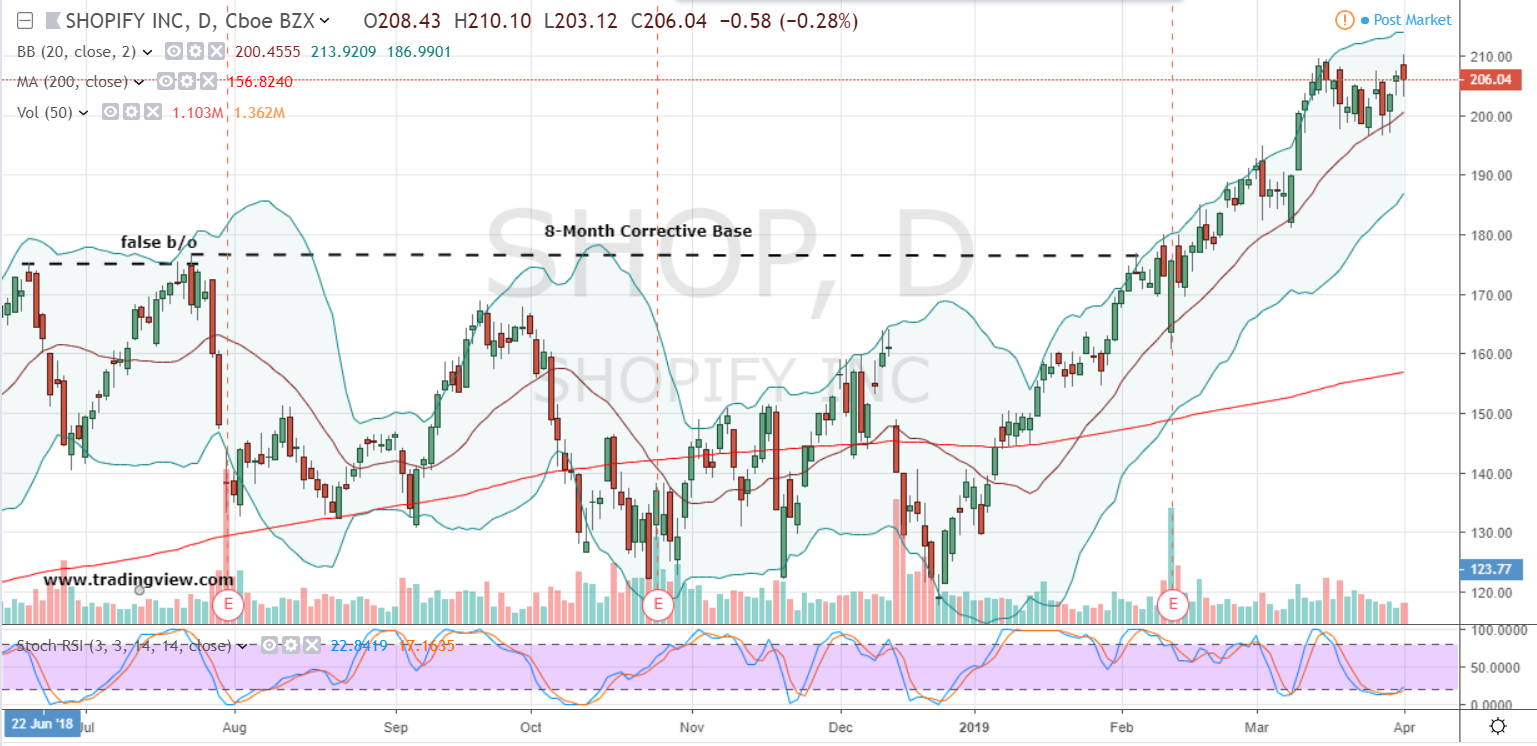

Shopify Stock Jumps Over 14 After Nasdaq 100 Listing

May 14, 2025

Shopify Stock Jumps Over 14 After Nasdaq 100 Listing

May 14, 2025 -

Trasporto Scolastico Sanremo Presentazione Domande

May 14, 2025

Trasporto Scolastico Sanremo Presentazione Domande

May 14, 2025 -

Soc Gen Names Alexis Kohler Executive Vice President

May 14, 2025

Soc Gen Names Alexis Kohler Executive Vice President

May 14, 2025 -

Resistance Grows Car Dealerships Renew Opposition To Ev Sales Mandates

May 14, 2025

Resistance Grows Car Dealerships Renew Opposition To Ev Sales Mandates

May 14, 2025 -

Consumer Alert Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025

Consumer Alert Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025