Gold ETFs And Cash Equivalents: The Current Market Trend

Table of Contents

The Rise of Gold ETFs as a Safe Haven

Gold ETF investment has seen a significant surge in popularity. Investors are increasingly turning to Gold ETFs as a more accessible and efficient way to gain exposure to gold compared to holding physical gold. This shift is driven by several key benefits.

-

Lower costs compared to physical gold: Purchasing and storing physical gold involves significant costs, including premiums, insurance, and secure storage facilities. Gold ETFs eliminate these expenses, making gold investment more affordable.

-

Easier to buy, sell and manage: Unlike physical gold, Gold ETFs trade like stocks on major exchanges, offering unparalleled liquidity and ease of management. Buying and selling is straightforward, making them ideal for frequent trading or adjustments to your portfolio.

-

Transparency and liquidity: The value of a Gold ETF is directly tied to the price of gold, offering complete transparency. Their high liquidity ensures you can easily buy or sell your shares without impacting the market price significantly.

-

Diversification benefits within a broader portfolio: Gold ETFs provide a convenient way to diversify your investment portfolio and reduce overall risk. Gold's low correlation with other asset classes can act as a buffer during market downturns.

-

Potential risks (market fluctuations, expense ratios): While Gold ETFs offer many advantages, it's crucial to acknowledge potential risks. Gold prices can fluctuate significantly, affecting your ETF's value. Also, expense ratios associated with the ETF should be considered.

Gold ETFs as an Inflation Hedge

Gold has historically served as a reliable inflation hedge, preserving purchasing power during inflationary periods. When the value of fiat currencies erodes due to inflation, the demand for gold, a tangible asset with inherent value, typically rises.

-

Analyzing historical data reveals a strong positive correlation between gold prices and inflation rates. During periods of high inflation, gold often outperforms other asset classes, protecting investors' wealth.

-

Compared to other inflation hedges like real estate or commodities, Gold ETFs offer a readily accessible and liquid alternative. They are easier to trade and manage compared to these alternative investments.

Cash Equivalents: Liquidity and Stability

Cash equivalents play a critical role in portfolio management by providing readily available liquidity and stability. They represent short-term, highly liquid investments that can be easily converted into cash with minimal risk of capital loss.

-

Easy access to funds: Cash equivalents, such as money market funds and short-term bonds, offer immediate or near-immediate access to your funds, making them perfect for emergency funds and short-term financial needs.

-

Minimal risk of capital loss: These are generally considered low-risk investments, meaning the chance of losing your principal is minimal. This is a crucial aspect for risk-averse investors or those with short-term investment horizons.

-

Ideal for emergency funds and short-term goals: Their liquidity makes them a perfect vehicle for building up an emergency fund, covering unexpected expenses, or funding short-term goals like a down payment or a vacation.

-

Low returns compared to other asset classes: While offering safety and liquidity, cash equivalents typically generate lower returns compared to other investment asset classes like stocks or even Gold ETFs. This trade-off between risk and return is important to consider.

Cash Equivalents and Interest Rate Sensitivity

Interest rates have a significant impact on the returns of cash equivalents. When interest rates rise, the yields on money market funds and short-term bonds generally increase, making them more attractive. Conversely, falling interest rates can lead to lower returns. Investors need to actively monitor interest rate changes to optimize their cash equivalent holdings.

Gold ETFs vs. Cash Equivalents: Finding the Right Balance

The optimal balance between Gold ETFs and cash equivalents depends on individual investor profiles, encompassing risk tolerance, investment goals, and the time horizon.

-

Consider your risk tolerance: Investors with high-risk tolerance might favor a larger allocation to Gold ETFs, accepting their volatility for the potential for higher returns. Conservative investors, however, may prefer a greater proportion of cash equivalents.

-

Define your investment goals: Short-term goals necessitate a higher allocation towards cash equivalents for immediate access to funds. Longer-term goals, such as retirement planning, may allow for a more significant investment in Gold ETFs.

-

Analyze your time horizon: Long-term investors can ride out the volatility of Gold ETFs, potentially benefiting from long-term growth. Short-term investors might prefer the stability of cash equivalents.

-

Professional advice is recommended for personalized portfolio allocation: A financial advisor can analyze your individual circumstances and help determine the most suitable asset allocation strategy involving Gold ETFs and cash equivalents.

Current Market Conditions and Their Influence

Current market conditions significantly influence the attractiveness of Gold ETFs and cash equivalents.

-

High inflation typically increases demand for Gold ETFs: As inflation erodes purchasing power, investors often seek refuge in gold, driving up demand for Gold ETFs.

-

Rising interest rates may make cash equivalents more attractive: Higher interest rates increase the returns on cash equivalents, making them a more competitive investment option.

-

Geopolitical instability can boost demand for both gold and cash: Uncertain geopolitical situations often lead investors to seek safe haven assets, benefiting both Gold ETFs and cash equivalents.

Conclusion

This article explored the current market trend of balancing Gold ETFs and cash equivalents, highlighting the benefits and risks of each. The optimal allocation depends on individual investment goals and risk tolerance. Understanding the dynamics between Gold ETFs and cash equivalents is crucial for navigating today's complex market. Develop a well-diversified investment strategy that incorporates both Gold ETFs and cash equivalents to meet your financial objectives. Contact a financial advisor to determine the best Gold ETF and cash equivalent allocation for your specific needs.

Featured Posts

-

Why Florida Condo Owners Are Desperate To Sell Market Analysis

Apr 23, 2025

Why Florida Condo Owners Are Desperate To Sell Market Analysis

Apr 23, 2025 -

Jumat Wage Dan Senin Legi Ramalan Perjodohan Menurut Primbon Jawa

Apr 23, 2025

Jumat Wage Dan Senin Legi Ramalan Perjodohan Menurut Primbon Jawa

Apr 23, 2025 -

Insta360 X5 More Than I Expected From A 360 Camera

Apr 23, 2025

Insta360 X5 More Than I Expected From A 360 Camera

Apr 23, 2025 -

Tensions Usa Russie Hausse Des Depenses Militaires Selon Usa Today

Apr 23, 2025

Tensions Usa Russie Hausse Des Depenses Militaires Selon Usa Today

Apr 23, 2025 -

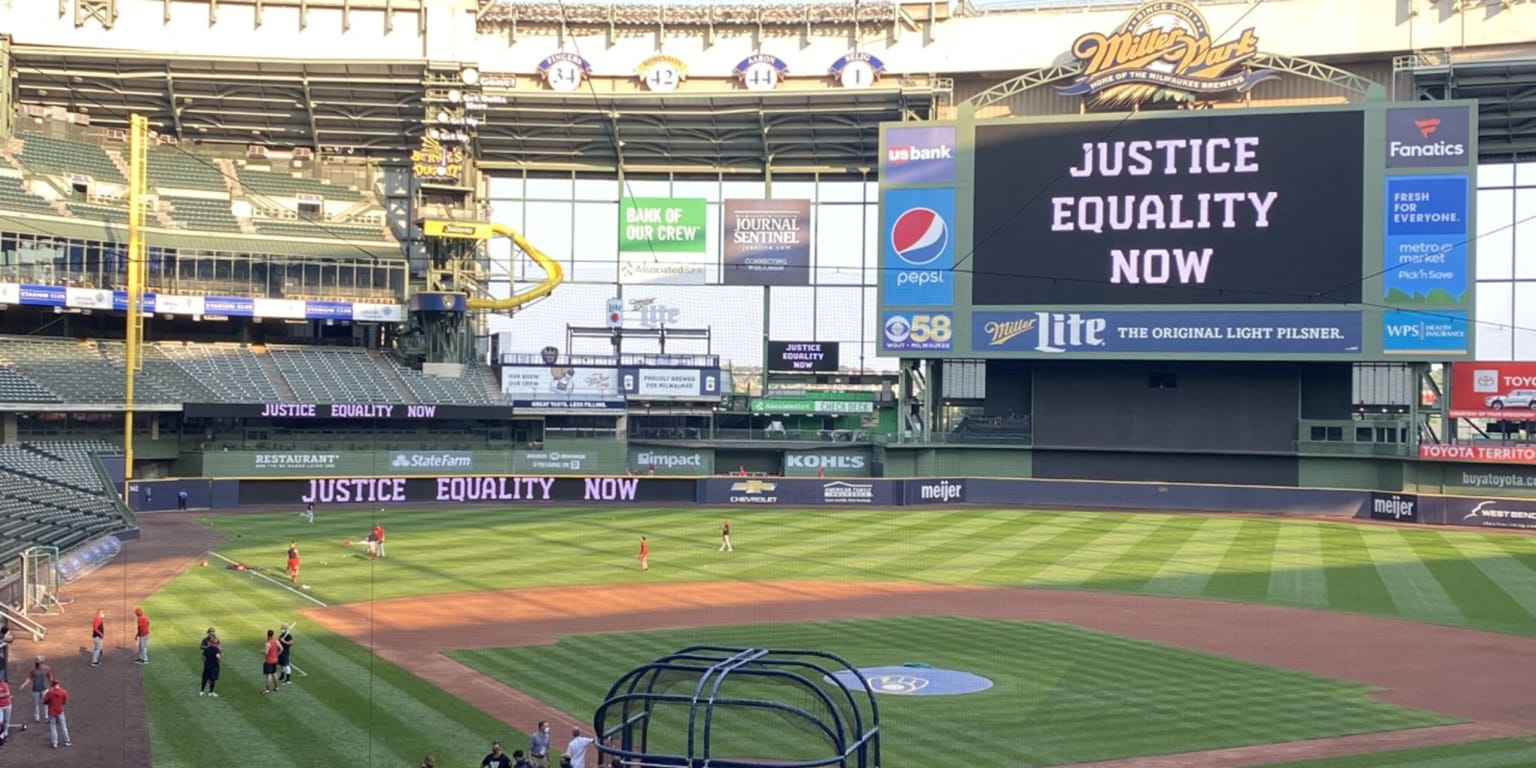

Reds Score First Runs In Loss To Brewers

Apr 23, 2025

Reds Score First Runs In Loss To Brewers

Apr 23, 2025