Gold Market Update: Back-to-Back Weekly Declines For 2025

Table of Contents

Analyzing the Factors Contributing to the Gold Price Decline in 2025

Several interconnected factors contributed to the back-to-back weekly declines in the gold price during the early months of 2025. Understanding these elements is key to predicting future gold market trends.

Strengthening US Dollar

The US dollar and gold prices typically exhibit an inverse relationship. A strengthening dollar generally puts downward pressure on gold prices.

- Impact on Gold's Safe-Haven Appeal: A stronger dollar reduces the appeal of gold as a safe-haven asset. Investors often flock to gold during times of economic uncertainty, but a strong dollar provides a more stable alternative.

- Economic Indicators: The strength of the dollar in early 2025 can be attributed to several factors, including robust economic data from the United States, positive investor sentiment towards the US economy, and expectations of continued interest rate hikes by the Federal Reserve.

- Dollar Index Correlation: The US Dollar Index (DXY), a measure of the dollar's value against other major currencies, showed a significant increase in the weeks leading up to the gold price decline, directly correlating with the drop in gold prices. Analysis of this correlation is crucial for future gold market predictions.

Rising Interest Rates and Their Influence on Gold Investment

Higher interest rates negatively impact gold's attractiveness as an investment. Gold is a non-yielding asset; it doesn't pay interest.

- Opportunity Cost: When interest rates rise, the opportunity cost of holding gold increases. Investors can earn higher returns by investing in interest-bearing assets like bonds or savings accounts.

- Federal Reserve Policies: The Federal Reserve's monetary policy decisions play a significant role in influencing interest rates and subsequently, gold prices. Aggressive interest rate hikes, aimed at controlling inflation, typically exert downward pressure on gold prices.

- Bond Yields and Gold Demand: The relationship between bond yields and gold demand is inverse. As bond yields rise, the demand for gold as a safe haven may decline, leading to lower gold prices.

Geopolitical Stability and its Impact on Gold's Safe-Haven Status

Reduced geopolitical uncertainty can diminish the demand for gold as a safe-haven asset. When global stability increases, investors are less inclined to seek the security of gold.

- Impact of Geopolitical Events: While specific geopolitical events impacting early 2025 gold prices would need to be identified to provide specific examples, it's worth noting that periods of relative calm often lead to decreased gold demand.

- Investor Risk Appetite: Geopolitical stability generally increases investor risk appetite. This often leads investors to favor higher-return investments over safer, less-volatile assets like gold.

- Diversified Portfolios: While gold plays a crucial role in diversified investment portfolios, its significance as a safe haven decreases during periods of reduced geopolitical uncertainty.

Market Sentiment and Investor Behavior

Understanding market sentiment and investor behavior is vital in analyzing gold price movements. The recent declines reflect a shift in how investors are viewing gold.

Shifting Investor Sentiment Towards Gold

Changes in investor sentiment significantly impact trading volume and gold prices.

- Trading Volume and Open Interest: Data on gold trading volume and open interest can indicate a shift in investor sentiment. Decreased trading volume might suggest less interest in gold investments.

- Financial News Sentiment: Reports from financial news outlets on investor sentiment towards gold provide valuable insights into market trends. Analysis of news sentiment can reveal the underlying causes for gold market shifts.

- Gold ETF Holdings: Monitoring changes in gold exchange-traded fund (ETF) holdings can reflect overall investor confidence in gold as an investment.

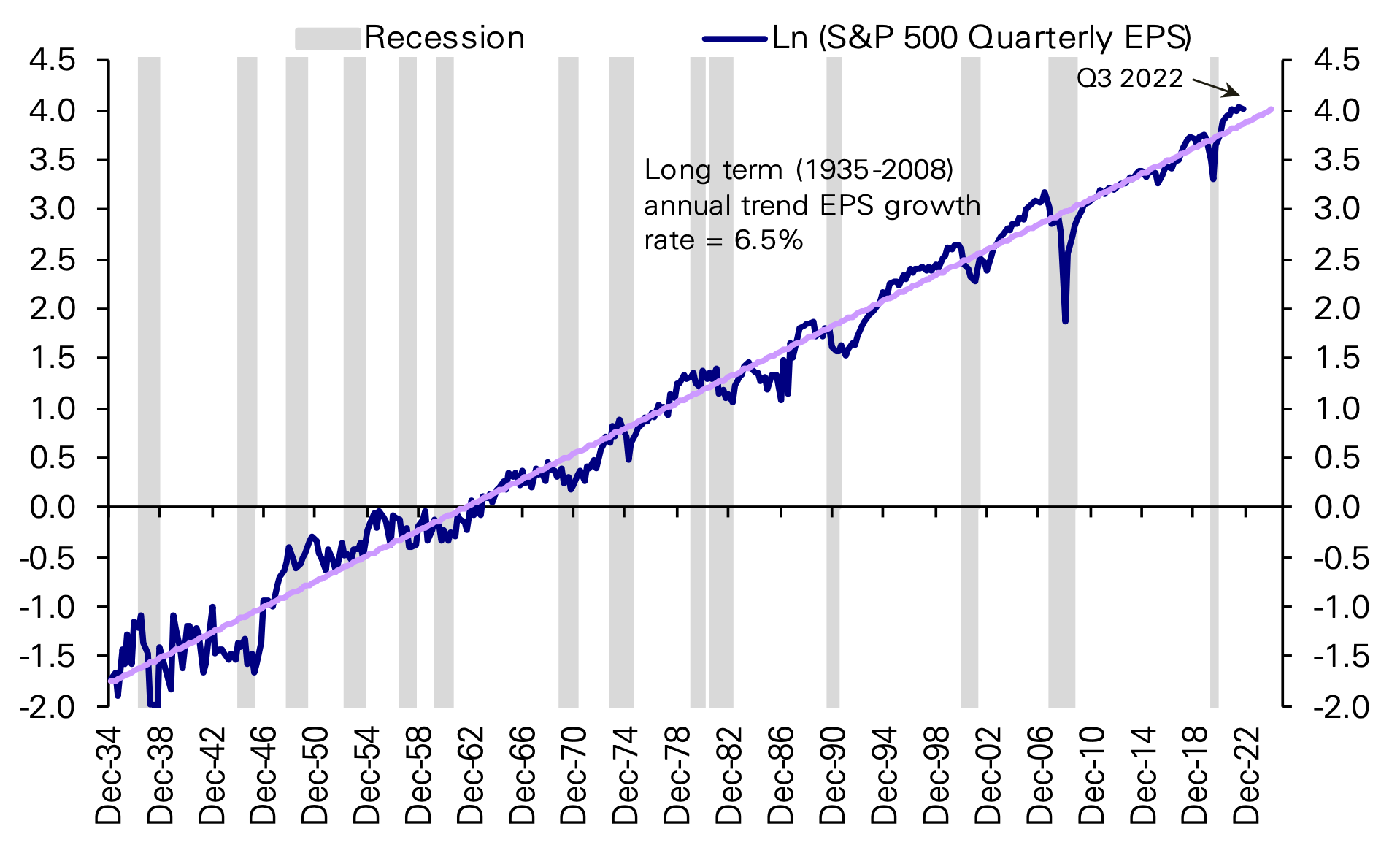

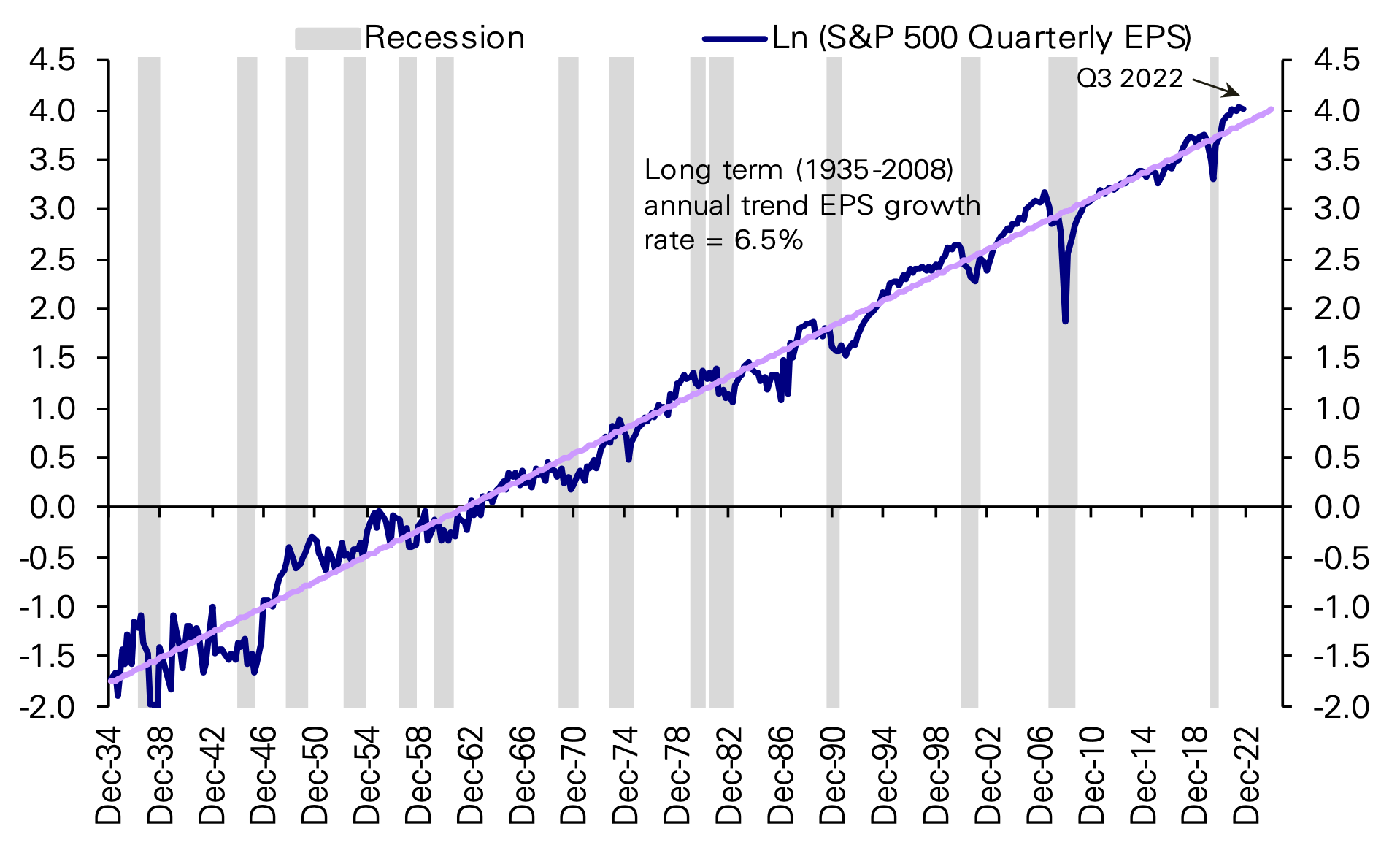

Technical Analysis of Gold Price Charts

Technical analysis helps identify trends and predict future gold price movements based on chart patterns.

- Price Charts and Graphs: Examining historical gold price charts can reveal trends, support levels, and resistance levels, providing clues about potential future price movements.

- Technical Indicators: Various technical indicators, such as moving averages and relative strength index (RSI), can signal potential changes in price direction.

- Chart Patterns: Recognizing chart patterns, such as head and shoulders or double tops/bottoms, can be used for forecasting purposes.

Outlook and Predictions for the Gold Market in 2025 and Beyond

Predicting future gold prices is challenging, yet analyzing potential catalysts and expert opinions offers a valuable perspective.

Potential Catalysts for a Gold Price Rebound

Several factors could trigger a gold price rebound:

- Economic Downturns: A significant economic downturn could renew investor interest in gold as a safe haven, increasing demand.

- Geopolitical Uncertainty: Increased geopolitical instability or unexpected global events could trigger a surge in gold prices.

- Supply Disruptions: Unexpected disruptions in gold mining or supply chains could impact the gold market positively.

Expert Opinions and Forecasts

Reputable gold market analysts offer various perspectives on the future of gold. Consulting multiple sources and considering a range of views is essential for making well-informed investment decisions. (Note: This section would ideally include citations to specific analysts and their reports.)

Conclusion: Navigating the Fluctuations in the Gold Market in 2025

The back-to-back weekly declines in gold prices in 2025 resulted from a confluence of factors: a strengthening US dollar, rising interest rates, and reduced geopolitical uncertainty. These factors collectively dampened investor demand for gold. However, potential catalysts for a gold price rebound exist, including economic downturns, renewed geopolitical instability, and supply-side disruptions. Staying informed about the latest developments in the gold market in 2025 and beyond is crucial to making strategic investment choices. Understanding the factors influencing gold price fluctuations is essential for navigating this dynamic market. Continue monitoring the gold price and relevant economic indicators to make informed decisions about your gold investments.

Featured Posts

-

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

May 06, 2025

Execs Office365 Accounts Breached Crook Makes Millions Feds Say

May 06, 2025 -

Tom Holland And Zendayas Surprise Baby Plans Revealed

May 06, 2025

Tom Holland And Zendayas Surprise Baby Plans Revealed

May 06, 2025 -

Colman Domingo A Ap Rocky And Pharrell Williams Cover Vogues May Issue A Fashion Powerhouse

May 06, 2025

Colman Domingo A Ap Rocky And Pharrell Williams Cover Vogues May Issue A Fashion Powerhouse

May 06, 2025 -

Nova Fotosesiya Rianni Rozkishne Rozheve Merezhivo

May 06, 2025

Nova Fotosesiya Rianni Rozkishne Rozheve Merezhivo

May 06, 2025 -

Is There A Line Of Duty Season 7 Martin Compston Weighs In

May 06, 2025

Is There A Line Of Duty Season 7 Martin Compston Weighs In

May 06, 2025