Gold Price (XAUUSD) Rises On Reduced US Interest Rate Hike Expectations

Table of Contents

Diminished Expectations of Aggressive Fed Rate Hikes

Recent economic data paints a picture of potentially slowing inflation, significantly impacting the Federal Reserve's (Fed) monetary policy and consequently, the gold price forecast. This has led to a reassessment of the likelihood of aggressive interest rate increases.

- Reduced Inflation Pressure: Softening inflation figures are lessening the pressure on the Fed to maintain its aggressive stance on interest rate hikes. This shift in economic indicators suggests a potential pivot in monetary policy.

- Revised Interest Rate Trajectory: Market analysts now predict a less steep trajectory for interest rate increases than previously anticipated. This is reflected in reduced expectations of future rate hikes, impacting the dollar index and influencing gold investment decisions.

- Weakening US Dollar: The shift towards less aggressive rate hikes has weakened the US dollar (USD). Since gold is priced in USD, a weaker dollar makes gold more attractive and affordable for international investors, thereby increasing demand and pushing up the XAUUSD price. This gold price correlation with the dollar is a key factor to consider.

- Lower Opportunity Cost: Lower interest rates generally reduce the opportunity cost of holding non-yielding assets like gold. This makes gold a more appealing investment option compared to interest-bearing assets. Understanding this dynamic is crucial for developing a robust gold investment strategy.

Safe-Haven Demand for Gold Amidst Economic Uncertainty

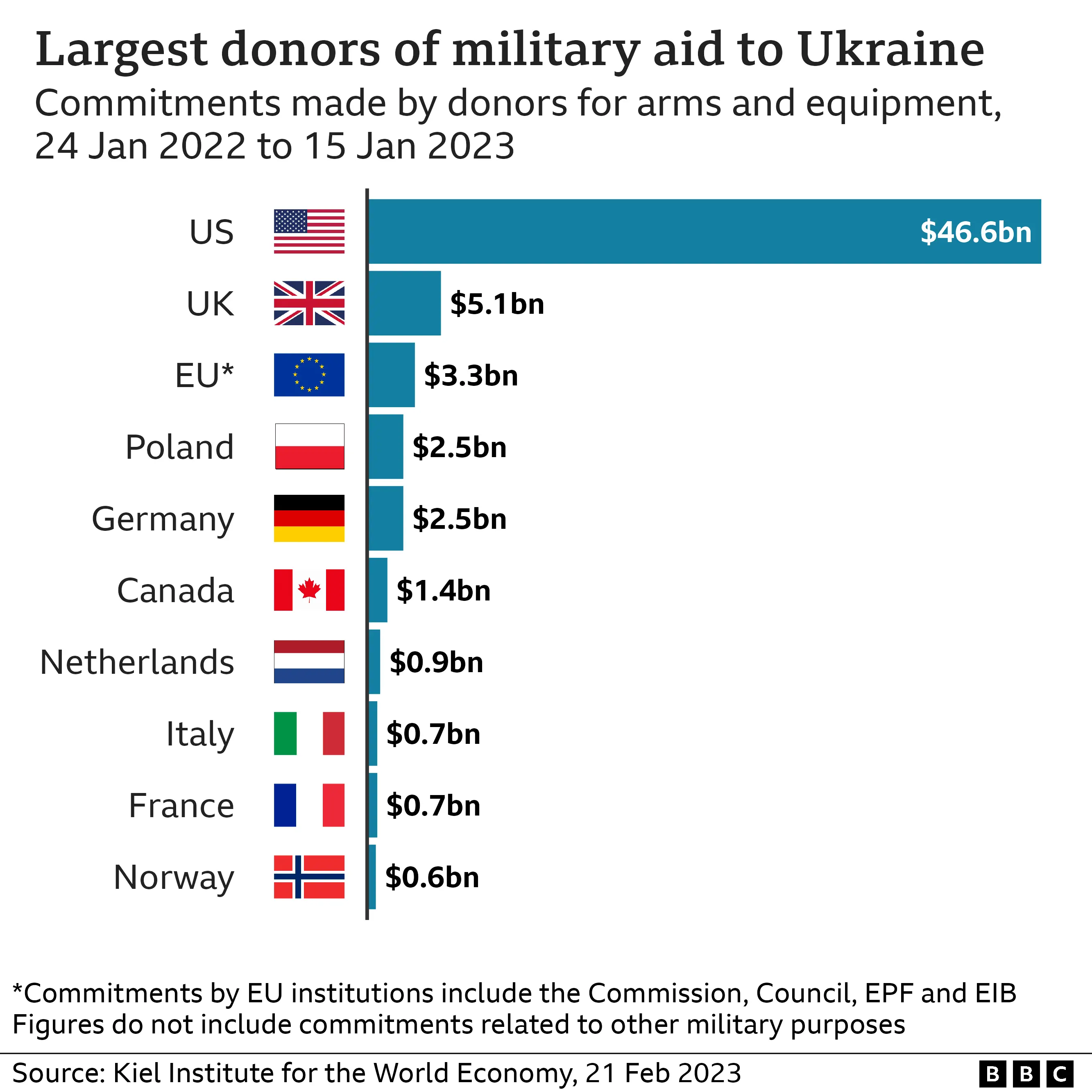

Geopolitical tensions and persistent global economic uncertainty are fueling a surge in demand for safe-haven assets, with gold emerging as a prominent beneficiary. This increased safe-haven demand is a critical driver of the recent XAUUSD price increase.

- Geopolitical Risks and Volatility: Ongoing conflicts and geopolitical instability contribute to market volatility, making gold, a traditional safe haven, an attractive hedge.

- Inflation Hedge: Gold's historical performance as a hedge against inflation makes it a compelling investment during periods of economic uncertainty and rising inflation rates. The gold price often moves inversely to inflation.

- Portfolio Diversification: Investors are increasingly incorporating gold into their portfolios as a means of diversification and risk mitigation, further boosting demand. This reflects a wider strategy of reducing overall portfolio risk and hedging against market downturns.

- Increased Demand Pushes Prices: The combined effect of these factors – geopolitical instability, inflation concerns, and portfolio diversification strategies – is resulting in increased demand and consequently, higher gold prices.

Weakening US Dollar Index (DXY)

The inverse relationship between the US Dollar Index (DXY) and the gold price (XAUUSD) is well-established. The recent weakening of the dollar has significantly contributed to the rise in gold prices.

- Inverse Correlation: A weaker dollar makes gold cheaper for those holding other currencies, leading to increased demand and upward pressure on the XAUUSD price. Understanding this correlation is paramount for successful gold trading.

- Impact of DXY Decline: The decline in the DXY is a direct contributing factor to the recent gold price surge. As the dollar weakens, the appeal of gold as an alternative investment increases.

- Ongoing Dollar Weakness: The trend towards a weaker dollar is anticipated to persist in the near future, potentially maintaining upward pressure on gold prices. This outlook influences many gold price forecasts.

- Currency Exchange Rates: Fluctuations in currency exchange rates further amplify the impact of a weaker dollar on the gold market, creating opportunities for savvy investors.

Technical Analysis of XAUUSD

Technical analysis of the XAUUSD chart provides further insights into the current market dynamics. This analysis considers various indicators to predict future price movements and inform trading strategies.

- Positive Momentum: XAUUSD charts currently display positive momentum, suggesting a continuation of the upward price trend. This provides valuable signals for traders.

- Bullish Indicators: Key technical indicators, such as moving averages and relative strength index (RSI), are pointing towards a bullish trend. These technical indicators support the observed price increase.

- Support and Resistance Levels: Support and resistance levels on the charts are providing potential price targets, guiding investment decisions and stop-loss orders.

- Trading Signals: Traders are utilizing this technical analysis to generate timely trading signals and make informed investment decisions regarding XAUUSD.

Conclusion

The recent surge in the gold price (XAUUSD) is primarily due to reduced expectations of aggressive US interest rate hikes, increased safe-haven demand amidst economic uncertainty, and the weakening US dollar. These factors have converged to create a positive environment for gold investments. Monitoring these factors and using technical analysis tools is crucial for staying informed about gold price fluctuations.

Call to Action: Stay informed about fluctuations in the gold price (XAUUSD) and consider incorporating this precious metal into your investment strategy as part of a diversified portfolio. Monitor the Federal Reserve's monetary policy announcements, global economic indicators, and XAUUSD chart analysis to make informed decisions about your gold investment. Understanding the interplay between the Federal Reserve, the US Dollar Index, and the gold market is key to navigating this dynamic asset class successfully.

Featured Posts

-

30 Million Deal Hudsons Bay Sells Key Brands To Canadian Tire

May 17, 2025

30 Million Deal Hudsons Bay Sells Key Brands To Canadian Tire

May 17, 2025 -

When Does The Alexander Skarsgard Murderbot Adaptation Premiere On Streaming

May 17, 2025

When Does The Alexander Skarsgard Murderbot Adaptation Premiere On Streaming

May 17, 2025 -

Revealed The Exclusive Vip Experience Offered To Trumps Donors At Military Events

May 17, 2025

Revealed The Exclusive Vip Experience Offered To Trumps Donors At Military Events

May 17, 2025 -

Emotional Moment Angel Reeses Message To Her Mother After Brothers Ncaa Win

May 17, 2025

Emotional Moment Angel Reeses Message To Her Mother After Brothers Ncaa Win

May 17, 2025 -

Air Traffic Controllers Exclusive Account Of Averted Midair Collision

May 17, 2025

Air Traffic Controllers Exclusive Account Of Averted Midair Collision

May 17, 2025