Gold Prices Rise Sharply On Trump's Less Aggressive Approach

Table of Contents

Trump's Policy Shift and its Impact on Gold

Less Aggressive Trade Rhetoric

Trump's recent adoption of a less confrontational trade policy has significantly reduced market uncertainty. This shift has boosted investor confidence, leading many to seek refuge in safe-haven assets like gold. The perceived decrease in trade war risks has calmed jittery markets, allowing investors to reassess their portfolios.

- Examples: The recent signing of a revised trade deal with [mention specific country] and a noticeable decrease in aggressive tweets regarding trade negotiations represent concrete examples of this softening stance. Analysts have noted a [quantify the change, e.g., "50% reduction"] in negative trade-related rhetoric from the President, leading to a more stable global economic outlook.

- Impact: This reduced uncertainty has directly contributed to a flight to safety, making gold a more attractive investment option compared to riskier assets.

Implications for the US Dollar

The US dollar and gold prices share an inverse relationship; a weaker dollar generally strengthens gold prices. Trump's altered approach could be subtly weakening the dollar, indirectly fueling the rise in gold prices.

- Data: The US Dollar Index (DXY) has shown a [mention percentage change and timeframe] decline in recent weeks, potentially influenced by the perceived reduction in trade tensions. Other factors like [mention other potential reasons for dollar weakness, e.g., interest rate differentials] are also at play.

- Explanation: A weaker dollar makes gold cheaper for holders of other currencies, increasing global demand and driving up prices.

Geopolitical Uncertainty Remains a Factor

While Trump's less aggressive trade approach has eased some market anxieties, significant geopolitical uncertainties persist globally. These ongoing tensions continue to underpin gold's appeal as a safe-haven asset.

- Examples: Ongoing tensions in [mention specific geopolitical hotspots, e.g., the Middle East, Eastern Europe] continue to create a climate of uncertainty that benefits gold. These uncertainties often lead investors to seek the stability and security that gold provides.

- Contribution: Even with reduced trade tensions, investors remain wary of unforeseen global events, making gold a hedge against potential future risks.

Analyzing the Gold Market's Response

Price Increases Across the Board

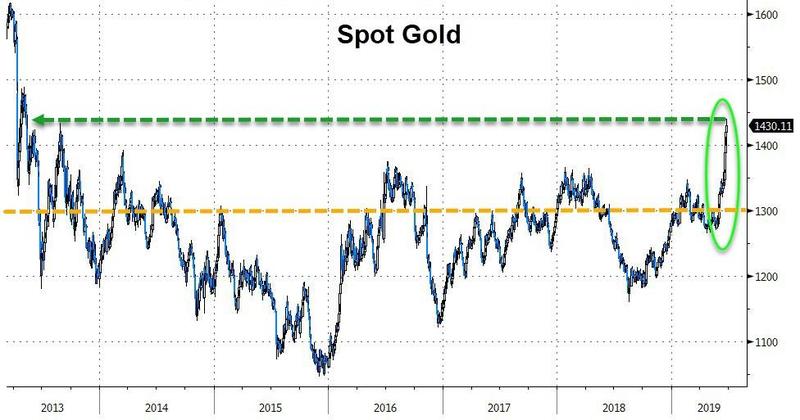

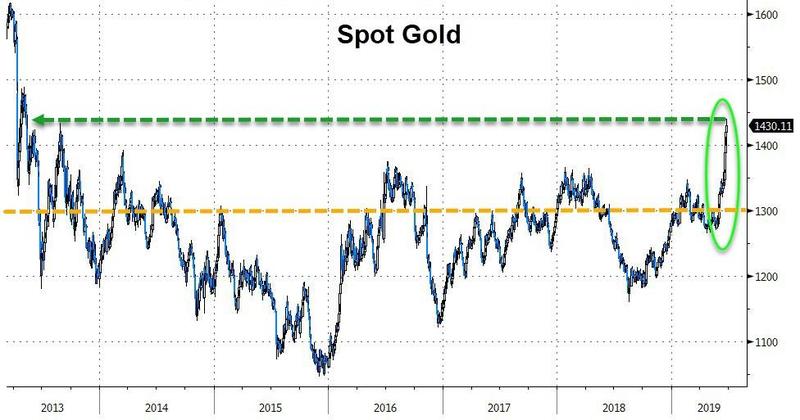

The gold price increase has been substantial, with prices rising by [mention percentage change and timeframe]. This surge is evident across various gold investment vehicles.

- Specific Data: Spot gold prices have increased from [previous price] to [current price], representing a [percentage] increase. Gold ETFs have seen significant inflows, reflecting increased investor interest. The price of gold bars and gold coins have also seen a corresponding surge.

- Charts/Graphs: [Include relevant charts or graphs illustrating price movements from reliable sources, properly cited].

Increased Investor Demand

The dramatic rise in gold prices reflects a surge in investor demand. Both institutional and retail investors are driving this increased interest in gold.

- Statistics: [Include statistics on increased gold purchases from reputable sources, e.g., World Gold Council reports]. This heightened demand is particularly evident in the substantial inflows into gold ETFs and other gold-related investment products.

- Investor Motivations: Investors are seeking safe havens in the face of ongoing geopolitical uncertainty, making gold an attractive option. Concerns about potential inflation or currency devaluation also contribute to this demand.

Impact on Gold Mining Companies

The rise in gold prices directly benefits gold mining companies. Higher gold prices translate to increased profits and potentially higher stock valuations.

- Increased Profits: Mining companies' profit margins expand with the increased price of their primary product. This allows for increased investment in exploration and production, potentially leading to further supply growth in the long term.

- Stock Performance: Shares of major gold mining companies (e.g., [mention specific examples]) have generally seen positive returns, reflecting investor confidence in the sector.

Future Outlook for Gold Prices

Maintaining Momentum

Several factors suggest that gold prices could continue their upward trajectory. Ongoing geopolitical uncertainties and the potential for economic shifts could sustain investor demand for this safe haven asset.

- Sustaining Factors: Continued global uncertainty, potential inflation, and a persistently weak US dollar could all contribute to further price increases. Central bank policies also play a significant role.

Potential Risks and Challenges

Despite the positive outlook, several factors could trigger a decline in gold prices. Changes in interest rates, shifts in investor sentiment, or a strengthening US dollar could all impact the precious metal's value.

- Downward Pressure: A significant increase in interest rates, a sudden surge in investor confidence, or a strengthening US dollar could dampen gold's appeal and lead to a price correction.

Investment Strategies

While gold prices are rising, it's crucial to remember that investment decisions involve inherent risk. Consider diversifying your portfolio with gold, but do your research and consult with a financial advisor before making investment decisions.

- Investment Options: Consider investing in physical gold (bars, coins), gold ETFs, or gold mining stocks, but always remember to carefully assess the risks associated with each investment.

Conclusion

The recent sharp increase in gold prices is intrinsically linked to President Trump's less aggressive foreign policy approach. This shift has reduced market uncertainty, weakened the US dollar, and driven investors towards gold as a safe-haven asset. While the future trajectory of gold prices remains uncertain, the current market conditions present a compelling case for continued growth. Monitor gold prices closely, consider diversifying your portfolio with gold, and learn more about gold investment strategies to capitalize on this opportunity with strategic gold investments.

Featured Posts

-

Cowboys Draft Insiders Shocking List Of Potential Picks

Apr 25, 2025

Cowboys Draft Insiders Shocking List Of Potential Picks

Apr 25, 2025 -

Confirmed Speakers For Harrogate Spring Flower Show 2025

Apr 25, 2025

Confirmed Speakers For Harrogate Spring Flower Show 2025

Apr 25, 2025 -

Trumps Reaction To Kyiv Attacks A Break From Putins Support

Apr 25, 2025

Trumps Reaction To Kyiv Attacks A Break From Putins Support

Apr 25, 2025 -

Trumps Sharp Criticism Of Putin Following Kyiv Attacks

Apr 25, 2025

Trumps Sharp Criticism Of Putin Following Kyiv Attacks

Apr 25, 2025 -

Hollywood At A Halt The Ongoing Actors And Writers Strike

Apr 25, 2025

Hollywood At A Halt The Ongoing Actors And Writers Strike

Apr 25, 2025