Goldman Sachs On Trump's Oil Price Preferences: A Social Media Deep Dive

Table of Contents

Goldman Sachs' Public Statements on Trump's Energy Policy

Goldman Sachs, through its various communication channels, has consistently offered commentary on Trump's energy policies and their potential impact on oil prices. Analyzing these statements, both direct and implied, provides crucial context for understanding their overall stance.

Analyzing Tweets and Official Statements

Goldman Sachs utilizes its official Twitter account (@GoldmanSachs) and publishes press releases to disseminate information. A thorough review of these channels reveals several key observations:

- June 2017: A press release discussed the potential impact of Trump's proposed deregulation on the US energy sector, predicting increased domestic oil production.

- November 2018: Tweets from Goldman Sachs' energy analysts highlighted the implications of Trump's sanctions on Iranian oil exports, forecasting a potential price increase.

- December 2019: A Goldman Sachs research note explored the long-term effects of Trump's "energy dominance" strategy on global oil markets.

The tone employed by Goldman Sachs in these communications is generally analytical and data-driven, avoiding overtly partisan statements while clearly expressing their economic forecasts. Analyzing this language is essential to understanding the nuances of their perspective. Keywords like "Goldman Sachs Twitter," "Trump energy policy," and "press release analysis" help us track the evolution of their publicly available commentary.

Interpreting Goldman Sachs' Market Predictions

Goldman Sachs' market predictions surrounding Trump's oil-related decisions are a vital aspect of understanding their overall analysis. These predictions, however, are not always perfectly aligned with actual market outcomes.

- Prediction 1: Goldman Sachs accurately predicted a short-term price spike following the announcement of specific sanctions.

- Prediction 2: Their forecast regarding the long-term impact of deregulation proved partially accurate, with production increasing but at a slower rate than initially projected.

- Prediction 3: A prediction concerning the impact of a specific trade deal on oil prices proved less accurate, highlighting the complexity of influencing market forces.

Analyzing discrepancies between predictions and actual market behavior reveals important insights into the intricacies of oil price determination and the challenges of accurate forecasting in a volatile market. Keywords such as "market predictions," "oil market analysis," and "Goldman Sachs forecasts" are crucial for understanding these dynamic predictions.

Social Media Sentiment Analysis Regarding Goldman Sachs' Views

Understanding the public's reaction to Goldman Sachs' analyses provides crucial context. Social media offers a rich dataset for sentiment analysis, allowing us to gauge the broader reception of their insights.

Public Perception of Goldman Sachs' Analysis

Social media sentiment toward Goldman Sachs' commentary on Trump's oil policies is mixed.

- Positive Sentiment: Many users praised Goldman Sachs for its detailed analysis and data-driven approach. Positive sentiment often highlighted the bank's perceived expertise and objectivity.

- Negative Sentiment: Some criticized Goldman Sachs for alleged pro-establishment bias or for failing to adequately predict certain market shifts. Criticism was often linked to perceived inaccuracies in their predictions.

- Neutral Sentiment: A significant portion of the online conversation reflected neutral reactions, indicating a wait-and-see attitude before forming definitive conclusions.

Utilizing relevant hashtags like #GoldmanSachs, #Trump, #OilPrices, and #EnergyPolicy enhances our ability to track and understand the complex dynamics of online sentiment. Understanding "sentiment analysis" and "social media sentiment" provides crucial context for this assessment.

Identifying Influencers and Key Discussions

Specific individuals and organizations significantly shaped the online narrative surrounding Goldman Sachs' analysis.

- Energy analysts and commentators: Financial news websites and energy sector experts regularly cited Goldman Sachs' reports, shaping broader public perception.

- Political commentators: The political leaning of commentators heavily influenced the reception of Goldman Sachs' analyses, with those aligned with Trump's policies potentially interpreting the findings differently.

- Individual investors: Individual investors' online discussions further fueled the conversation, reflecting the diverse perspectives within the financial community.

The reach and impact of these influential voices underscore the complexity of interpreting social media sentiment accurately. Keywords such as "key influencers," "social media influence," and "online discussion" help to understand the broader social media landscape.

Correlation between Goldman Sachs' Analysis and Actual Oil Price Movements

Examining the correlation between Goldman Sachs' analysis, Trump's policies, and subsequent oil price movements is crucial for evaluating the accuracy of their assessments.

Analyzing the Impact of Trump's Policies

Trump's policies demonstrably impacted oil prices. (Charts and graphs would be inserted here visually illustrating the correlation between specific Trump policy announcements and subsequent oil price fluctuations). For example, the impact of sanctions on specific countries directly affected global supply, leading to price increases. Conversely, deregulation policies, while intended to boost domestic production, had a more complex and less immediately predictable effect. This highlights the challenges of accurately forecasting oil price changes. Using keywords such as "oil price movements," "Trump's impact on oil," and "correlation analysis" allows for a targeted analysis of this complex relationship.

Goldman Sachs' Accuracy in Forecasting

Evaluating the accuracy of Goldman Sachs' forecasts is essential for understanding their overall predictive capabilities.

- Accurate Predictions: Goldman Sachs accurately predicted short-term price spikes resulting from specific geopolitical events.

- Inaccurate Predictions: Their forecasts regarding the long-term impact of deregulation were less accurate, highlighting the inherent uncertainties in market forecasting.

Discrepancies arise from numerous factors, including unexpected geopolitical events, unforeseen technological advancements, and the inherent volatility of the global energy market. Keywords like "forecast accuracy," "prediction analysis," and "Goldman Sachs accuracy" help gauge their overall track record.

Conclusion: Synthesizing Goldman Sachs' Social Media Insights on Trump's Oil Price Preferences

This analysis reveals that Goldman Sachs' public commentary on Trump's oil price preferences, as reflected in social media and official statements, is nuanced and complex. While their data-driven approach is generally well-regarded, the accuracy of their predictions varies, highlighting the inherent difficulty of accurately forecasting oil prices in a volatile geopolitical environment. The analysis also showcases the importance of considering social media sentiment when understanding the reception of their insights. However, it is crucial to acknowledge the limitations of relying solely on publicly available data. To gain a comprehensive understanding, further research should be undertaken. To stay updated on Goldman Sachs' insights into Trump's oil policies, follow their official channels and engage in ongoing discussions on relevant financial news platforms. Continue to follow Goldman Sachs' analysis of Trump's energy policy and further research into Goldman Sachs' views on oil price fluctuations under Trump for a comprehensive perspective.

Featured Posts

-

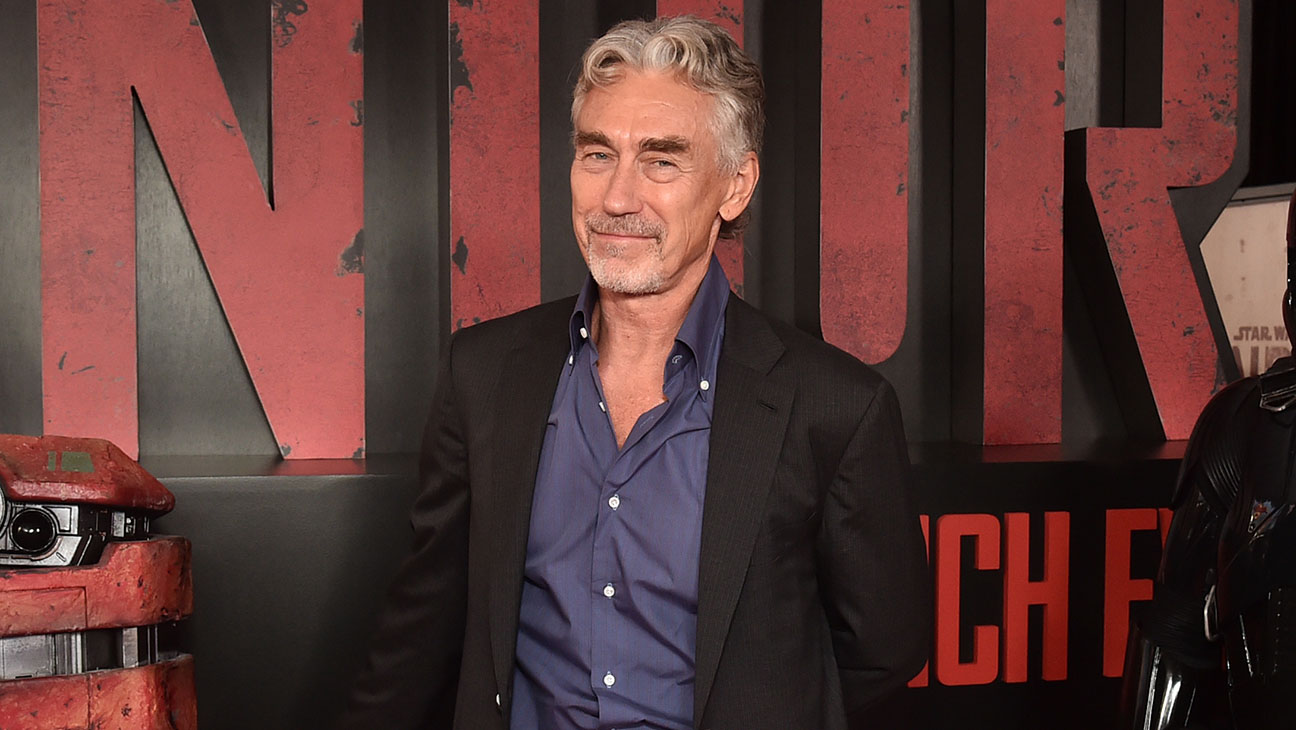

Andor Tony Gilroy Reflects On His Contributions To The Star Wars Series

May 15, 2025

Andor Tony Gilroy Reflects On His Contributions To The Star Wars Series

May 15, 2025 -

Celtics Vs Pistons Betting Odds And Winning Prediction

May 15, 2025

Celtics Vs Pistons Betting Odds And Winning Prediction

May 15, 2025 -

Ontarios Plan To Make Gas Tax Cuts Permanent And Remove Highway 407 East Tolls

May 15, 2025

Ontarios Plan To Make Gas Tax Cuts Permanent And Remove Highway 407 East Tolls

May 15, 2025 -

Apa De La Robinet In Romania Pericole Si Zone Afectate

May 15, 2025

Apa De La Robinet In Romania Pericole Si Zone Afectate

May 15, 2025 -

Tatis Returns Campusano Called Up Padres Pregame Report And Rain Delay

May 15, 2025

Tatis Returns Campusano Called Up Padres Pregame Report And Rain Delay

May 15, 2025