Goldman Sachs Pay Fight: The Debate Over CEO's True Expertise

Table of Contents

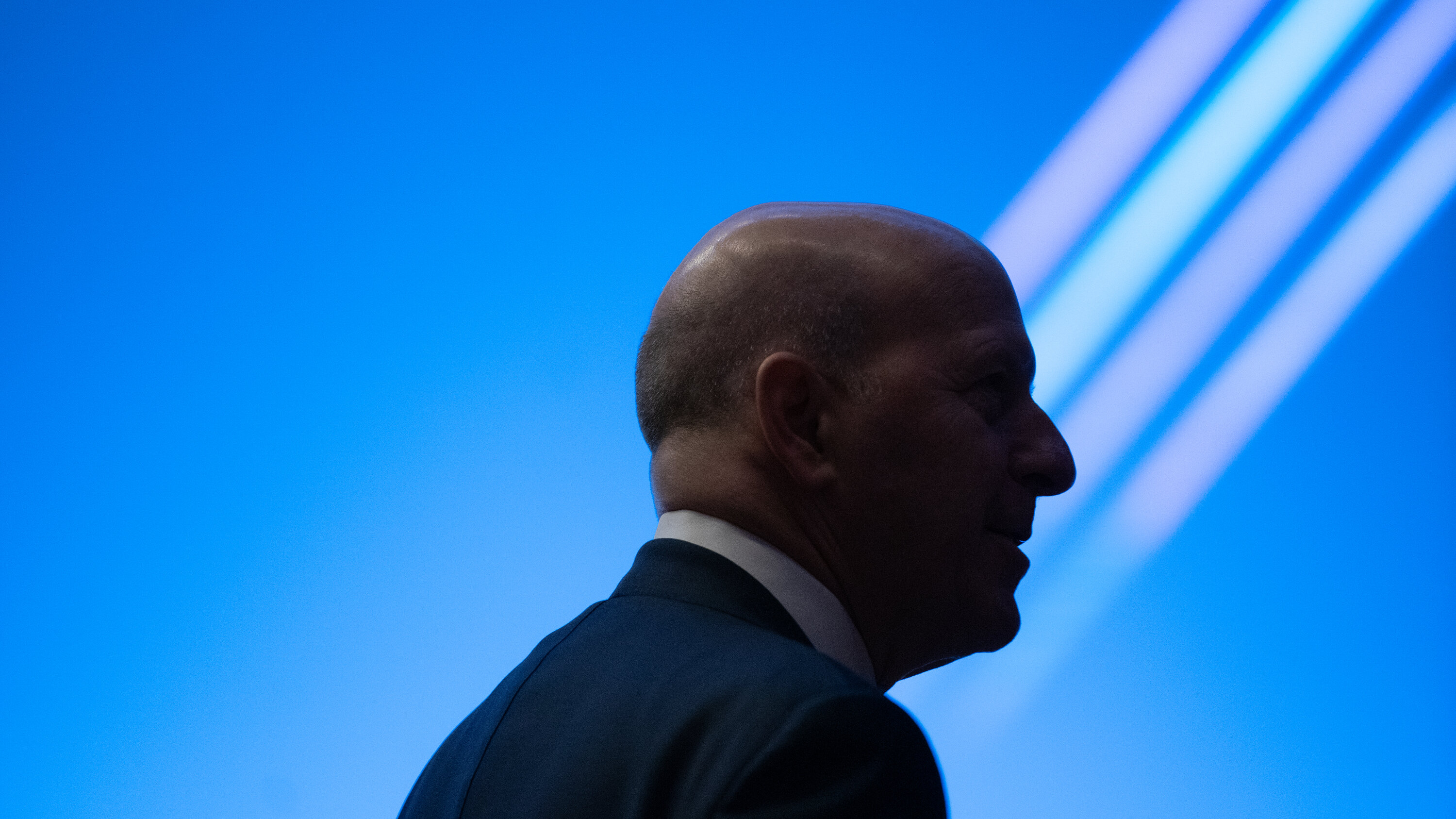

David Solomon's Compensation: A Closer Look

The Numbers and the Controversy

David Solomon's compensation package at Goldman Sachs has drawn significant criticism due to its size relative to both previous CEOs and the average Goldman Sachs employee. While precise figures fluctuate year to year and are subject to change, his total compensation consistently ranks among the highest in the financial industry. This includes a base salary, substantial bonuses heavily tied to firm performance, and significant stock options.

- Exact figures (as of [Insert most recent available data]): [Insert specific data points on salary, bonus, stock options etc. Cite source].

- Comparison with previous CEO compensation: [Comparison with the compensation of previous Goldman Sachs CEOs, highlighting percentage increases or decreases].

- Comparison with industry averages: [Comparison with CEO compensation at other major investment banks, emphasizing relative position].

Goldman Sachs justifies this compensation structure by arguing it's primarily performance-based, aiming to incentivize strong leadership and shareholder value creation. However, this rationale is central to the ongoing debate.

Performance Metrics and Justifications

Assessing David Solomon's performance requires a careful examination of Goldman Sachs's key performance indicators (KPIs) under his leadership. These metrics include profitability, return on equity (ROE), stock price, market share in various sectors (investment banking, asset management, etc.), and overall revenue growth.

- Key Performance Indicators (KPIs): [Provide specific data points on relevant KPIs, cite source, include year-over-year comparison].

- Comparison with competitors: [Comparison with the performance of competing investment banks, such as JPMorgan Chase, Morgan Stanley, and Bank of America].

- Analysis of market conditions: [Acknowledge and account for the impact of external factors, including economic downturns, regulatory changes, and market volatility].

While Goldman Sachs has seen periods of strong profitability under Solomon, other periods have faced challenges. A comprehensive analysis must weigh these successes against the broader market context and compare them to competitor performance to accurately judge the effectiveness of his leadership.

Arguments Against Solomon's Compensation

Shareholder Dissatisfaction

A significant portion of the criticism surrounding David Solomon's compensation stems from shareholder dissatisfaction. Many shareholders believe his pay is excessive, particularly considering periods of underperformance relative to expectations and to competitor firms.

- Specific concerns raised by shareholders: [Summarize key arguments from shareholder letters, reports, or proxy statements. Include quotes if possible].

- Voting results: [Mention any votes against the compensation plan and the percentage of dissenting shareholders].

- Impact on shareholder confidence: [Analyze the effect of the controversy on investor sentiment and the company's stock price].

Shareholder activism and vocal dissent underscore a growing concern over the disconnect between executive compensation and firm performance, fueling the debate about corporate governance.

Pay Inequality and Societal Impact

The vast disparity between David Solomon's compensation and the average Goldman Sachs employee salary raises concerns about income inequality. This issue extends beyond Goldman Sachs, reflecting a broader societal concern about the widening gap between executive pay and worker compensation in the financial industry.

- Statistics on income inequality: [Include relevant statistics on CEO-to-employee pay ratios within Goldman Sachs and the broader financial industry].

- Comparison with average employee salaries: [Highlight the stark difference between the CEO's compensation and the average compensation of Goldman Sachs employees].

- Public perception of Wall Street compensation: [Discuss the negative public perception of excessive executive pay on Wall Street and its impact on public trust].

The ethical implications of such high executive pay cannot be ignored, prompting discussions about fair compensation practices and the social responsibility of corporations.

Arguments in Favor of Solomon's Compensation

Market Dynamics and Competitive Landscape

Proponents of David Solomon's compensation argue that his package is necessary to attract and retain top talent in a highly competitive environment. The investment banking industry demands individuals with exceptional skills and experience, and competitive compensation is crucial to securing and keeping the best leaders.

- Compensation of CEOs at competing firms: [Compare Solomon's compensation to that of CEOs at competing firms, demonstrating that it is within the range of market norms for similar roles].

- The need to attract and retain skilled employees: [Explain the importance of highly skilled individuals in investment banking and the need to offer competitive compensation to attract and retain them].

- Market demands: [Discuss the market forces driving high compensation for executives in the financial sector].

The argument here centers on the need to remain competitive in a talent-driven industry.

Long-Term Vision and Strategic Initiatives

Supporters of Solomon's compensation point to his long-term strategic vision for Goldman Sachs. They argue that his decisions, even if they haven't yielded immediate, dramatic results, are aimed at building a more sustainable and diversified business model for the future.

- Key strategic initiatives under Solomon's leadership: [Describe Solomon's key strategic initiatives, such as investments in technology, expansion into new markets, or diversification of revenue streams].

- Their impact on the company's financial performance: [Assess the impact of these initiatives on Goldman Sachs's financial performance, acknowledging both short-term and long-term effects].

- Long-term goals: [Explain how these initiatives align with Solomon's long-term vision for the company].

This perspective suggests that judging Solomon's performance solely on short-term metrics might be an incomplete and potentially unfair assessment.

Conclusion

The Goldman Sachs pay fight surrounding David Solomon's compensation is a multifaceted debate. While arguments exist both for and against the size of his package, several key issues remain: the effectiveness of the performance metrics used to justify it, the level of shareholder concern, and the broader societal implications of extreme income inequality. The debate underscores the ongoing challenge of aligning executive compensation with firm performance and broader societal values.

The Goldman Sachs CEO compensation debate highlights the ongoing discussion about executive pay. Understanding the various arguments is crucial for shareholders and promotes a more transparent and equitable financial industry. Continue the conversation and stay informed about further developments in the Goldman Sachs CEO compensation debate.

Featured Posts

-

Cmoc Acquires Lumina Gold For 581 Million A Major China Mining Deal

Apr 23, 2025

Cmoc Acquires Lumina Gold For 581 Million A Major China Mining Deal

Apr 23, 2025 -

Analyse Complete L Integrale Bfm Bourse Du 24 Fevrier 2024

Apr 23, 2025

Analyse Complete L Integrale Bfm Bourse Du 24 Fevrier 2024

Apr 23, 2025 -

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

Ankara 10 Mart 2025 Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025 -

The Next Pope 10 Cardinals Who Could Succeed Pope Francis

Apr 23, 2025

The Next Pope 10 Cardinals Who Could Succeed Pope Francis

Apr 23, 2025 -

Alerte Trader Seuils Techniques Incontournables Sur Les Marches Et Les Valeurs

Apr 23, 2025

Alerte Trader Seuils Techniques Incontournables Sur Les Marches Et Les Valeurs

Apr 23, 2025